You must open a corporate bank account in Peru for seamless financial transactions, enabling you to manage operational expenses, pay salaries, and comply with local tax obligations. With a regulatory environment that facilitates business formation, securing a corporate bank account is a crucial step in registering a company in Peru. Peru’s stable banking system and growing economy make it a preferred destination for companies seeking regional growth. Digital banking is common but onboarding remains paperwork-heavy.

Key takeaways on a corporate bank account in Peru

| What are the best banks to open a corporate bank account in Peru? | Banco de Crédito del Perú (BCP). BBVA Continental. Scotiabank. Interbancario. Banco Pichincha. Banco GNB. Banco Internacional. Banco Falabella. |

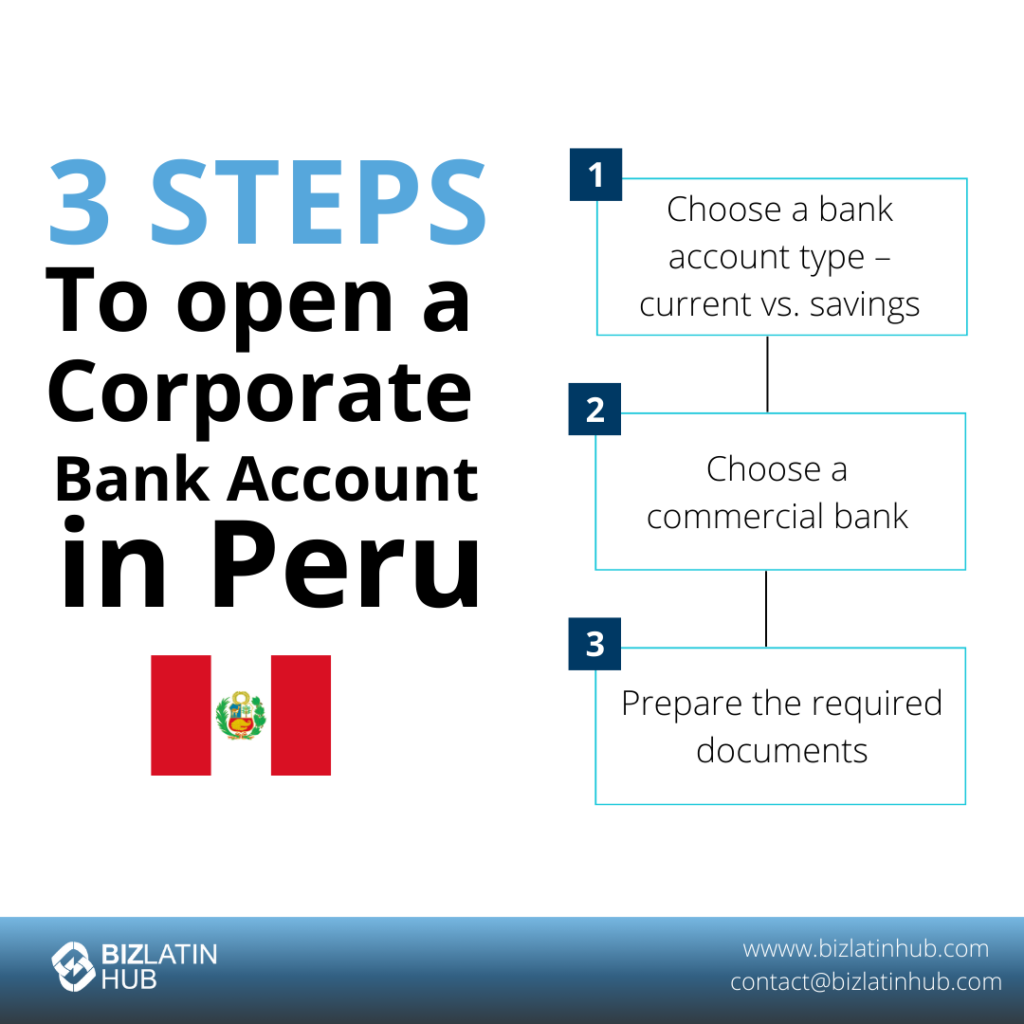

| The three step process to open a corporate bank account in Peru: | Step 1: Choose a bank account type – current vs. savings. Step 2: Choose a commercial bank. Step 3: Prepare the required documents. |

| Do all corporate bank accounts follow the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

| What documents are necessary when opening a corporate bank account in Peru? | Copy of the company’s incorporation certificate. Verbatim copy of the company’s incorporation, issued by the registry authority, not less than 30 days after it is issued (the term of issuance depends on the banking entity). RUC card, issued by the tax authority. Power of attorney of the legal representative. Identity document of the legal representative: DNI or Peruvian identity card. Opening file: signature registration form, letter of instruction. Make the minimum deposit required for local or foreign currency. |

Bank Account Setup Timeline

For opening a corporate bank account in Peru, you must follow these 3 steps:

- Step 1: Choose a bank account type – current vs. savings.

- Step 2: Choose a commercial bank.

- Step 3: Prepare the required documents.

Step 1: Choose a bank account type – current vs. savings

The two most common types of accounts in Peru are: current and savings accounts.

- The current account is one that is generated through the signing of a banking contract, whereby a financial institution is obliged to comply with its client’s payment orders up to the amount of money that the latter has deposited in it, or, if applicable, the amount of the credit that has been granted.

- The savings account is an ordinary deposit, in which the funds deposited have immediate availability and generate profitability or interest for a certain period and according to the amount saved.

When a client signs a contract to open a current account or a savings account, the bank will provide additional benefits such as access to credit, cards, etc.

Natural and juridical persons (the latter including the different types of companies such as SAA and Cerrada (SAC), Individual Limited Liability Company (EIRL), Civil Associations, etc.) may apply for both types of accounts and can do so in both domestic and foreign currency. US dollar accounts are generally available, and the ability to open an account in another foreign currency will depend on the policies of each financial institution.

Step 2: Choose a Bank in Peru

There are many options of banks in Peru where you can hold a corporate account. You should do research and choose a bank whose services will facilitate your business goals. Three popular banks in Peru among foreign companies are: Banco de Crédito del Perú, BBVA Continental, and Scotiabank.

Step 3: Prepare the Required Documents.

Once you have prepared the documents required by your bank, you may request the opening of an account. The documents provided by your company will prove the existence of the company and its recognition by the Public Register and the National Superintendency of Taxation Administration (SUNAT).

These include RUC (tax ID), company registration certificate, legal representative ID, UBO declarations, proof of business address, and possibly previous financial records. The bank will validate them and determine whether your application is successful.

You should note that even if the documents are valid, a personal or corporate account may be turned down if the applicant has a bad credit rating. If you are successful, your account will be opened and you will be sent the details to activate the online banking.

Leading Banks in Peru for Corporate Accounts

Each of these banks offers excellent options as they offer a wide variety of services adapted to the needs of international companies operating in Peru. These include BCP (Banco de Crédito del Perú), Scotiabank Perú, and BBVA Perú. These banks offer corporate services but require in-person verification.

Regulated by the Superintendencia de Banca, Seguros y AFP (SBS). Banks have to conduct mandatory KYC reviews, AML vetting, and enforce UBO declaration. This is part of tax and accounting requirements in Peru and cannot be avoided.

- Banco de Crédito del Perú (BCP).

- BBVA Continental.

- Scotiabank.

- Interbancario.

- Banco Pichincha.

- Banco GNB.

- Banco Internacional.

- Banco Falabella.

Our recommendation: We recommend that clients, as far as possible, choose a bank if they have a pre-existing relationship with it. BLH Peru works with, and recommends working with, BBVA.

Comparison Table:

| Feature | Peru | Colombia | Ecuador |

| Minimum Deposit | $500 | $500 | $500 |

| Account Opening Time | 2–3 weeks | 2–3 weeks | 2–4 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Rare | Rare |

What are the Types of Bank Account Available in Peru?

To open a bank account in Peru, you need to follow guidelines set by the bank. Each bank has its own various requirements, which change depending on the type of account you choose to open (i.e. personal or corporate, current or savings). In order to avoid problems, it is important you follow these guidelines carefully. Below you will find the main requirements for opening personal and corporate bank accounts in Peru.

Corporate Account:

- Copy of the company’s incorporation certificate.

- Verbatim copy of the company’s incorporation, issued by the registry authority, not less than 30 days after it is issued (the term of issuance depends on the banking entity).

- RUC card, issued by the tax authority.

- Power of attorney of the legal representative.

- Identity document of the legal representative: DNI or Peruvian identity card.

- Opening file: signature registration form, letter of instruction.

- Make the minimum deposit required for local or foreign currency.

Personal Account:

- Peruvian identity card (Carné de Extranjería).

- Verified home address.

- Energy or water bills.

Can foreigners open a bank account in Peru?

It is important to note that foreigners who are in Peru as tourists and who have not obtained a foreigner’s card (Carné de Extranjería) will be unable to open a bank account, regardless of what bank they choose or what type of account they are opening.

This makes sense due to it ensuring that people on tourist visas have limitations when it comes to working and setting up a business in Peru. In turn, it ensures that foreigners follow the Peruvian legal system and pay their taxes, relevant once you open a bank account in Peru.

Additional FAQs About Peru Business Banking

Based on our extensive experience, these are our clients’ most common queries on opening a company bank account in Peru.

1. Can I open a corporate bank account online in Peru?

It is possible to apply for it online. However, the document management and the verification of legal and financial information depends on the executive in charge. This information must be provided and managed by the legal representative of the company because they have to:

- a). Do a biometric test (to verify their identity).

- b). Register their signature as legal representatives.

2. What documents do I need to open a corporate bank account in Peru?

To open a corporate bank account in Peru you would need the following documents:

- Copy of the company’s incorporation certificate.

- Verbatim copy of the company’s incorporation, issued by the registry authority, not less than 30 days after it is issued (the term of issuance depends on the banking entity).

- RUC card, issued by the tax authority.

- Power of attorney of the legal representative.

- Identity document of the legal representative.

- Opening file: signature registration form, letter of instruction.

- Make the minimum deposit required for local or foreign currency.

3. Who can have access to a corporate bank account in Peru?

Access is authorized to the legal representative or proxy with sufficient power of attorney, registered in the corresponding registry.

4. Which is the best bank in Peru for foreign companies?

BLH Peru works and recommends working with BBVA.

5. Why do companies open bank accounts in Peru?

Opening a bank account in the country is mandatory for all companies operating in Peru, for fiscal and tax reasons.

6. Does Peru have banking secrecy?

Yes, in principle, it is a fundamental right, enshrined in the Political Constitution of Peru and protected by Law No. 26702, General of the Financial System and the Insurance System and Organic Law of the Superintendence of Banking and Insurance.

7. Are USD accounts available in Peru?

Yes. Most Peruvian banks offer multi-currency accounts including USD.

8. How long does the process take?

2 to 3 weeks depending on the bank and readiness of documentation.

9. Can foreign companies open bank accounts in Peru?

Yes, through a locally incorporated entity and appointment of a legal representative.

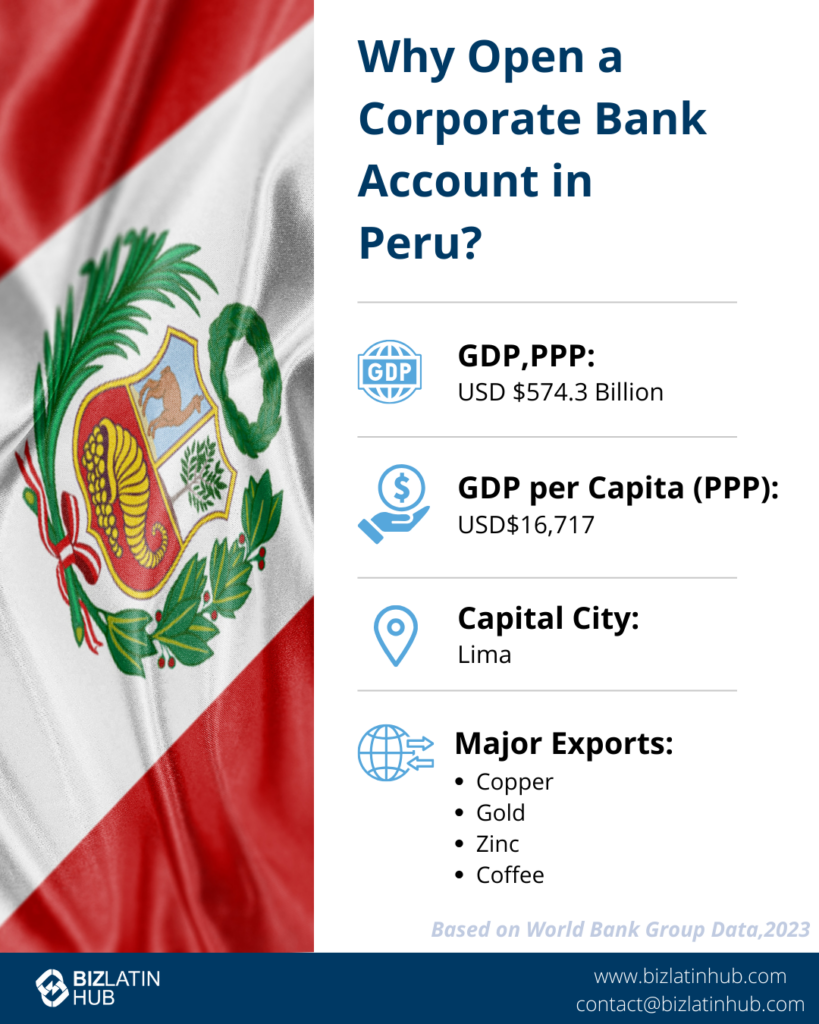

Why Open a Business Account in Peru?

Peru is a thriving destination for business ventures, making it an ideal choice for entrepreneurs and investors. One compelling reason to consider Peru is its rapidly growing economy. With a strong focus on economic stability and sustainable growth, Peru offers businesses a favorable climate where they can flourish.

Once you have opened a bank account in Peru, banking in the country is straightforward, and your business will be able to make seamless financial transactions. The country’s banking system is well-developed, secure, and accessible, with numerous international banks present. The ease of financial access simplifies capital management and investment activities.

Furthermore, Peru boasts abundant natural resources, including mining, agriculture, and renewable energy potential, which creates opportunities in various industries. The government actively promotes foreign investment, offering incentives and legal protections to attract businesses. Peru’s pro-business policies, free trade agreements, and strategic location in Latin America enhance its appeal.

In sum, Peru’s dynamic economy, accessibility, well-developed banking system, and investment-friendly environment make it a prime choice to conduct business.

Biz Latin Hub can help you open a bank account in Peru

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of how to open a corporate bank account in Peru, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean.

Or read about our team and expert authors.