Expanding through a Professional Employer Organization, or PEO in Peru grants access to the increasingly attractive Peruvian market. The country has demonstrated positive growth for 21 consecutive years and enjoys economic stability which is key when determining risk and viability to expand into a new market.

Post pandemic, the country has rebounded well and as logistics improve, businesses will have an easier environment to carry out their operations. Investors considering using a PEO in Peru or even company formation should consider the legal ways to expand their business in the country.

Biz Latin Hub can help you in the country, regardless of whether you want to directly incorporate a company in Peru or start with PEO in Peru. Not only that, but our network of 18 dedicated local offices across Latin America and the Caribbean means that we can help you

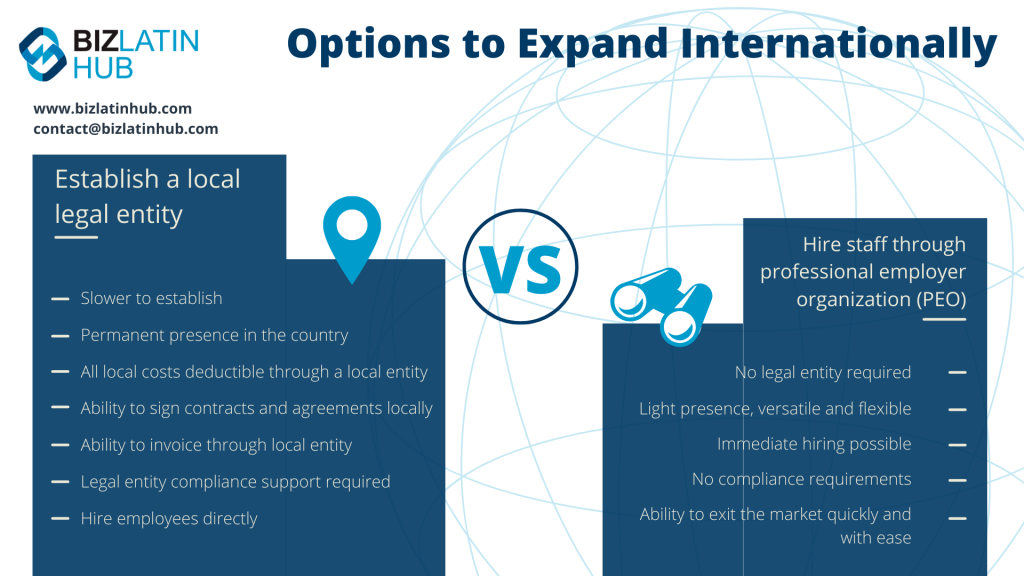

International Expansion Options: Company Incorporation vs. PEO in Peru

There are two ways in which entrepreneurs can begin operations in the country: through a PEO or to incorporate a company.

What is a Professional Employer Organization (PEO)?

A PEO, otherwise known as a proprietary company, helps businesses with their hiring needs. This organization hires local staff on behalf of a foreign parent company, through what’s called a ‘co-employment model’. When a foreign company engages with a PEO in Peru, the PEO becomes the ‘Employer of Record’, and completes administrative requirements for the company to hire local staff in Peru.

A PEO provides localized human resource management, visa services, payroll, tax administration and compliance with local labor laws. The locally hired staff member carries out work for the foreign company, but the PEO in Peru manages all employment and social security requirements under Peruvian law for that employee.

Benefits of utilizing a Peru PEO

Utilizing a Peru PEO solution is beneficial for companies seeking to test the market or companies who are expanding with limited resources.

Cost-effective solution for international expansion

Since a PEO takes charge of all non-revenue generating paperwork, including drafting employment contracts, payroll, visa management, employee benefits such as insurance, bonuses, etcetera.

Entrepreneurs save on costs and time, which they can use to focus on growing their business. In addition, business owners can have peace of mind knowing they are operating in full compliance with Peruvian labor law and taxation.

PEOs benefit from economies of scales, which means that the more employees they hire under this co-employment model, the more benefits they are able to offer them and at lower costs. In this sense, your employees will be able to get better insurance plans, bonuses and other incentives than you may not necessarily be able to offer as a smaller business

Test the market with a smaller initial investment

Utilizing a Peru PEO allows you to test the market before making large-scale investments for your international expansion. You won’t need to be physically present in the country either, which saves on travel costs.

PEOs allow investors to begin offering their products and services, and undertake market research, before formally establishing a legal entity.

As a consequence, if the response to your product(s) isn’t satisfactory, you can exit the market with limited losses. On the other hand, if the response is positive, you will have the assurance that your business is profitable and can make a larger investment in your international expansion when the timing best suits you.

Peru PEO: Downsides

While utilizing a PEO in Peru can be cost-effective, it can hinder the speed of growth. At times, paperwork regarding your employees could take longer than expected because these processes are not handled directly by your business. In addition, without an established office, it can be harder to build strong brand awareness in the initial stages of your international expansion.

Company Incorporation in Peru

Company incorporation in Peru can be a good option if it fits your business model or you have greater confidence in the market response to your product or service. Typically, multinational companies with a strong business case for expansion into Peru, and high levels of capital may prefer this option.

The main four types of legal entities in Peru are:

- The Joint Stock Company (S.A)

- Closely Held Company (S.A.C)

- Limited Liability Company (S.R.L)

- Public Held Corporation (S.A.A).

The main type of legal entity used by market entrants is S.A.C. This is because the liabilities of the associates are limited and this type of entity is constituted in a single act. Furthermore, in contrast to an S.A, it is not compulsory to form a directorate.

This type of entity requires a minimum share capital of USD$152, takes around 6-8 weeks to establish once all documentation has been submitted and requires a minimum of 2 shareholders up to 20.

Advantages of company incorporation in Peru

Speed of growth

By managing human resource paperwork directly, employment changes and transactions can be faster. You may find it easier and quicker to establish your local sales team this way.

By incorporating a company in Peru, your business is more easily recognized by local authorities, and you will have a stronger base to more easily conduct negotiations and build brand awareness.

Long-term saving costs

Hiring employees through an incorporated company in Peru from the beginning of your international expansion can save you PEO-related fees in the long-term. As your business grows, you will need to hire more employees which would ultimately increase PEO expenses. Ideally, your company would grow to a point where you can establish your own in-house human resources capability.

Downsides

Company incorporation in Peru can have high setup costs. Costs will include leasing an office, income tax, labor tax, and other industry-specific taxes under Peruvian corporate regulations.

If your business venture doesn’t work out as planned, the market exit costs will be higher compared to having utilized a PEO in Peru first. Office lease costs, employee settlements, and liquidation proceedings and paperwork will all cost a greater amount of time and money to carry out.

FAQs on PEO in Peru

Based on our extensive experience, these are the common questions and doubts of our clients on hiring in Peru:

1. How does one hire employees in Peru?

You can hire someone in Peru by either setting up your own legal entity in the country and using it for recruitment, or by utilizing the services of a PEO. An PEO, which is a third-party entity, allows you to employ individuals in Paraguay while they act as the official employer before the law. When using a PEO, you do not need a Peruvian local entity to hire employees.

2. What is in a standard employment contract in Peru?

A standard Peruvian employment contract should be written in Spanish (and can also be in English) and contain the following information:

- ID and address of the employer and employee.

- City and date.

- Location where the service will be provided.

- Payment frequency.

- Social benefits.

- Probation period.

- Work hours.

- Specific agreements or pacts.

- What are the mandatory employment benefits in Peru?

- Social Security Contributions (health, pension, and occupational risk).

- CTS (Compensation for Time of Service).

- Vacation.

- Family Allowance (if applicable).

- National Holidays Bonus.

- Christmas Bonus.

- Profit Sharing (if applicable to the sector).

3. What are the mandatory employment benefits in Peru?

- Social security contributions (health, pension, and occupational risk).

- CTS (Compensation for time of service).

- Vacation.

- Family allowance (if applicable).

- National holidays bonus.

- Christmas bonus.

- Profit sharing (if applicable to the sector).

4. What is the total cost for an employer to hire an employee in Peru?

The total cost for an employer to hire an employee in Peru varies depending on the salary. However, as an indication, the employer cost for mandatory employment benefits is 30% to 40% of the gross employee salary, on top of the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

5. Does a PERU PEO legally employ your employees?

The total cost for an employer to hire an employee in Peru varies depending on the salary. However, as it’s important to know if the provider manages local employment in Peru. Having a local employer is crucial, as they handle tasks like maintaining a local entity, registering with tax authorities, payroll processing, tax filing, benefits, and HR compliance. Additionally, the provider must maintain proper corporate governance for all their companies.

6. Does the PEO provide payroll compliance and guidance for Peru?

You do need to ensure that the PEO can provide its services in Peru. It is also worth checking which other countries they operate in. Not all providers have global advisory services. Hiring one with such services eliminates the need for multiple consultants to manage compliance in all your countries of operation.

7. How does the employment contract work?

When working with a professional employer organization (PEO), the contractual handling of the employment relationship is crucial. The PEO serves as the legal employer and needs a contract with the worker, which may or may not include your company. The agreement must be compliant with the law and aligned with your company’s practices across all locations the PEO supports.

Contracts vary across territories. Some have detailed tripartite agreements, clearly defining responsibilities, with the PEO handling payments, taxes, and local matters, while you retain policy control. Benefits and statutory requirements should be discussed. When choosing an PEO, examine their template agreements for consistency and consider how they ensure uniformity while complying with local practices.

8. Does a PEO possess in-depth payroll and HR expertise?

For effective multi-country HR and Payroll support, the Professional Employer Orgnization needs extensive international payroll and HR expertise, as well as a good understanding of local employment and tax laws. Look for evidence of robust processes and comprehensive guides to simplify information.

During the sales or onboarding process, speak to those responsible for employment compliance and assess their depth of knowledge and understanding of your challenges. Inquire about written guides for your convenience, as this shows their investment in supporting customers with local regulations.

9. What is the employment model they use in Peru?

Employers of record often keep their local employment practices in different countries undisclosed. However, understanding these practices is essential due to significant legal differences. Some countries allow unlimited PEO models, while others have time or job function limitations. Compliance with these limitations is mandatory, as violating local laws can lead to serious consequences.

Biz Latin Hub can help with company incorporation or PEO in Peru

As Peru implements its strategic public spending plans and business operations in the country, doing business in Peru becomes a more viable option for international expansion.

In addition, the country’s attractive industries such as agribusiness, cannabis, mining, and fintech are still growing, giving room for more newcomers. Investors seeking to take the opportunities present in the country can do so by utilizing a Peru PEO or company incorporation.

At Biz Latin Hub we have vast experience helping entrepreneurs from all over the world enter the Peruvian market. Our team of local lawyers and accountants is ready to assist you with PEO services, company incorporation, commercial representation, visa services and more.

Contact us now and get your venture off the ground. Learn more about our team and expert authors.

Check out our video to understand why it’s so attractive to invest in Peru.