Understanding invoicing requirements for a foreign company in Ecuador means your billing will be in accordance with local legal norms, which will help you maintain healthy working relationships with clients and local tax authorities. This is important to make sure you stay compliant with the law and avoid sanction.

Invoices indicate outstanding payment due for goods or services, and represent a type of legal protection to both parties involved in a business transaction, promising the client the service and the contractor their payment. Invoicing requirements for a foreign company in Ecuador are largely in line with international standards, but there are some local differences to be aware of.

Invoices are also a critical component of tax and invoicing requirements for a foreign company in Ecuador. Especially when entering a new market, it makes sense to partner with an experienced operator in the field such as Biz Latin Hub. With 18 dedicated offices across the region, we can help with invoicing requirements for a foreign company in Ecuador or elsewhere in Latin America and the Caribbean.

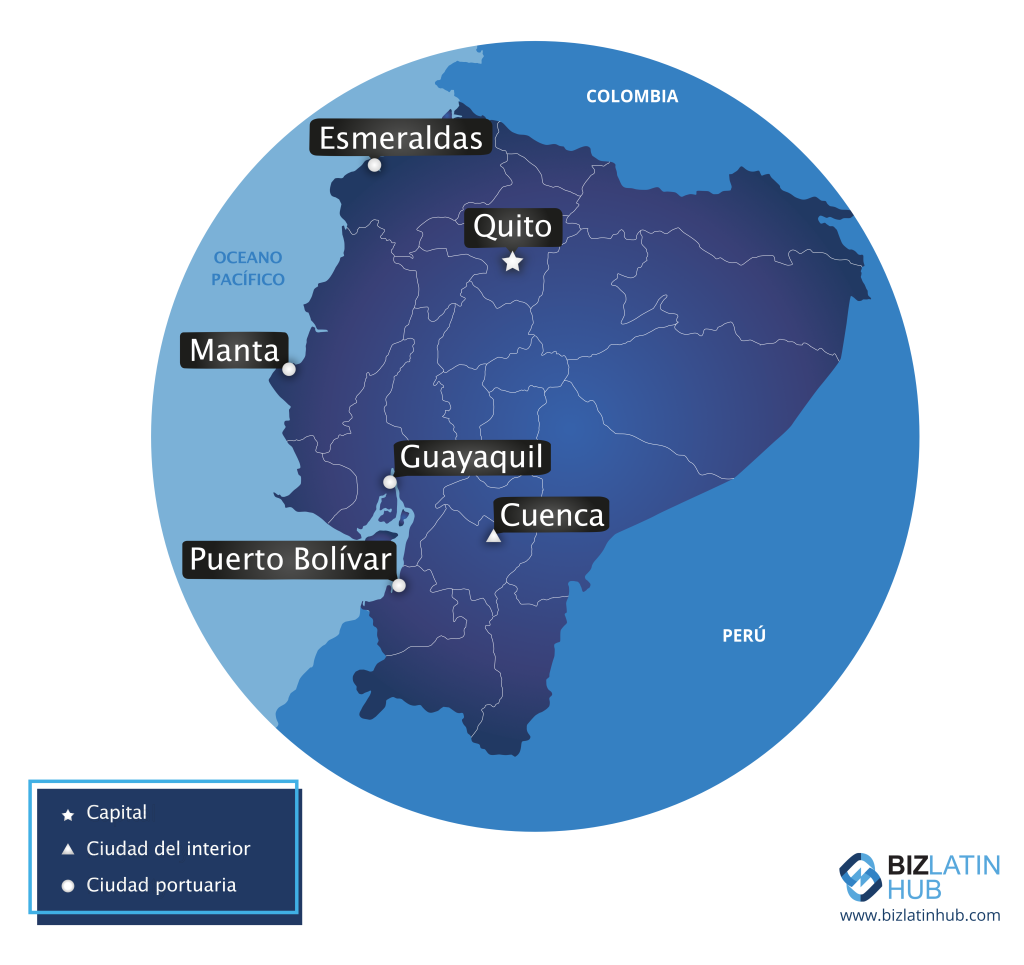

Why invest in Ecuador?

The country is well positioned for growth, especially with the rising interest in nearshoring. Ecuador is strategically well located for this trend, with easy and quick access to the United States and a friendly time zone for North American businesses. There is also a similar business culture to those countries, which reduces friction between borders considerably.

Compared to some other countries in the region, corporate law is relatively simple, making it easy to set up a company in Ecuador. With due diligence and proper strategic thinking, companies in many different commercial sectors can succeed. The internal market is small, but has room to grow and a bright future.

In 2024, Ecuador’s Gross Domestic Product (GDP) is valued at approximately US$115.05 billion. This represents an increase from the $109.167 billion reported in 2022. In terms of Foreign Direct Investment (FDI), the latest available data is from September 2023, which shows that Ecuador received an increase of USD$155 million in FDI.

Invoicing requirements for a foreign company in Ecuador: who issues an invoice?

An invoice provides valuable information that describes a commercial agreement between a seller and a buyer. Likewise, invoices are crucial for accounting activities and can also be useful to identify individuals involved in a transaction between two entities.

Who issues an invoive can depend on the type of company involved. If the company has a permanent legal presence, anyone legally authorised to sign documents on behalf of that company will be able to issue an invoice.

Where the company does not have a legal entity constituted in Ecuador, but instead has an appointed legal representative in the country, that representative can manage invoices on the company’s behalf.

What should companies include in an invoice?

In line with invoicing requirements for a foreign company in Ecuador, companies doing business in the country must issue invoices that include the following information:

- Date of the authorization to issue invoices, granted by the Internal Revenue Service (SRI), expressed in “day/month/year” format

- Unique Taxpayer Registry number (RUC)

- Full names and surnames of people involved, denomination or company name of the issuer

- The invoice may include the commercial name

- Address of issuing establishment, only if applicable

- Expiration date of the document, expressed in “day/month/year” format

- Number of the unique registry of taxpayers, denomination or company name and authorization number granted by the SRI

- A 15-digit unique invoice number (see below)

Unique invoice number: Invoices in Ecuador must include a fifteen-digit number, in which the first three digits represent the number of the establishment as recorded in the single taxpayer registry. The following three digits must correspond to a code assigned by the taxpayer. Finally, a nine-digit invoice ID number must be included.

FAQs on invoicing requirements for a foreign company in Ecuador

Date of the authorization to issue invoices, granted by the Internal Revenue Service (SRI), expressed in “day/month/year” format

Unique Taxpayer Registry number (RUC)

Full names and surnames of people involved, denomination or company name of the issuer

The invoice may include the commercial name

Address of issuing establishment, only if applicable

Expiration date of the document, expressed in “day/month/year” format

Number of the unique registry of taxpayers, denomination or company name and authorization number granted by the SRI

A 15-digit unique invoice number (see below)

Invoices in Ecuador must include a fifteen-digit number, in which the first three digits represent the number of the establishment as recorded in the single taxpayer registry. The following three digits must correspond to a code assigned by the taxpayer. Finally, a nine-digit invoice ID number must be included.

If the company has a permanent legal presence, anyone legally authorised to sign documents on behalf of that company will be able to issue an invoice. Where the company does not have a legal entity constituted in Ecuador, but instead has an appointed legal representative in the country, that representative can manage invoices on the company’s behalf.

Invoices indicate outstanding payment due for goods or services, and represent a type of legal protection to both parties involved in a business transaction, promising the client the service and the contractor their payment.

Biz Latin Hub can help you with invoicing requirements for a foreign company in Ecuador

At Biz Latin Hub, we offer a full suite of customized back-office services, including company formation in Ecuador, accounting and taxation services. Our team of multilingual specialists can assist you with invoice management, bookkeeping services, audit and tax filing while you focus on growing your core business.

Reach out to us now for personalized assistance.

Learn more about our team and expert authors.