If you are interested in starting a business in Ecuador, or are already operating in the market, comprehending and steering your way through employment law in Ecuador will be critical to establishing and maintaining a strong reputation with local authorities and ensuring the success of your business. Ecuador has a strong minimum wage and a short work week by regional standards, for example.

Key Takeaways

| Working hours in Ecuador | Employment law in Ecuador sets a maximum work schedule of 8 hours per day and 40 hours per week, not including overtime. |

| Ecuadorian Minimum Wage | The current minimum wage as of January 2025 is USD$470. However, there are exceptions in certain sectors. |

| Types of Employment Contracts in Ecuador | Indefinite-term. Temporary Contracts. Occasional Work Contracts. |

| % of an employee’s salary contributed to social security in Ecuador | Employers must contribute the equivalent of 11.5% of an employee’s salary towards social security. |

Working hours under Ecuadorian employment law

Employment law in Ecuador stipulates that employees should work no more than 40 hours as part of a standard working week, with each working day lasting no longer than eight hours.

Supplementary hours are permitted, however, they must be additionally remunerated in proportion to the time worked.

Note that there are generally between 11 and 12 national holidays that fall on weekdays per calendar year in Ecuador.

What types of contract are used in Ecuador?

While there are at least 16 different types of contracts that can be used in different circumstances under employment law in Ecuador, there are three main ones that companies and foreign investors tend to use when operating in the market.

- Indefinite contracts are the most commonly used type of employment agreement in Ecuador, continuing until both parties mutually agree to terminate the contract. If an employer wishes to unilaterally terminate such a contract, they must either demonstrate just cause to the relevant authorities or provide the employee with compensation. These contracts must be documented in writing and, as of 2023, must offer a minimum wage of USD$450 per month. Additionally, any trial period specified in the contract cannot exceed 90 days.

- Temporary contracts may be issued in situations that justify their use, such as covering for maternity leave or extended sick leave. These contracts can last for a maximum of 180 days within 365 days. If the employee continues to work beyond this period, the contract is automatically converted into an indefinite contract. Employers must provide documentation to demonstrate the necessity of hiring someone temporarily according to Ecuadorian employment law. Termination of the contract occurs when the specified period of employment ends. Temporary contracts must be in writing and, as of 2023, must include a minimum salary of $450 per month. Additionally, these contracts are subject to a 35% surcharge on the contribution base.

- Occasional contracts are available to address emerging or extraordinary needs that are not related to a company’s core business activities. These contracts are limited to a maximum duration of 30 days within a 365-day period. If the employee continues to work beyond this timeframe, the contract is automatically converted into an indefinite contract. Employers must provide evidence to justify the need for employing someone on an occasional basis. The contract terminates when the specified period of employment ends. Occasional contracts must be in writing and, as of 2023, must include a minimum salary of $450 per month.

How much vacation time do Ecuadorian employees receive?

According to employment law in Ecuador, workers who have completed one year of work for the same employer are entitled to 15 consecutive calendar days of leave. After five years of service, employees accrue one additional day of leave and continue to accrue an additional day for each subsequent year they work.

If an employee leaves a company before completing a year of service, they are entitled to payment for the proportionate number of vacation days accrued during their time worked.

For example, an employee who has completed eight months of service will be entitled to payment for two-thirds of a year’s leave allowance, meaning 10 days of pay, protected by the employment law in Ecuador.

- Sick leave: An employer must grant an employee any leave required to recover from sickness, if it has been authorized by a registered doctor.

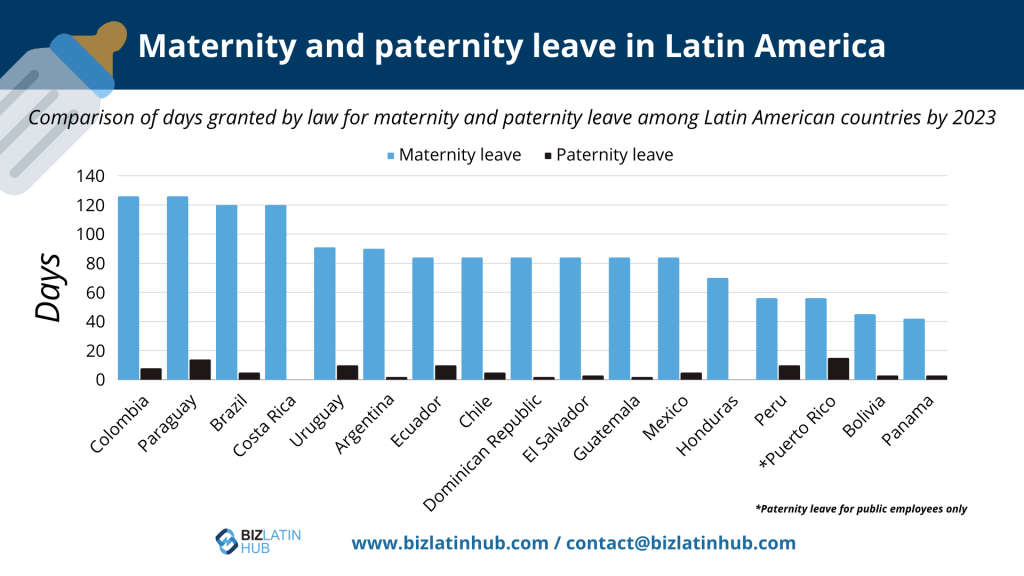

- Maternity and paternity leave: Under employment law in Ecuador, women are entitled to 12 weeks of paid maternity leave when they have a child. In the event of multiple births, the period is extended by an additional 10 working days, meaning a total of 14 weeks of paid leave.

For fathers, 10 days of paid paternity leave are granted, which is extended by an additional five days in the event of multiple births or a birth by cesarean section. - Bereavement leave: Employees are entitled to three days of paid bereavement leave in the event of the death of any relative to the first or second degree. That includes spouses and common-law partners, parents, siblings, children, grandparents, grandchildren, aunts, uncles, nieces, nephews, and half-siblings.

Statutory contributions under Ecuadorian employment law

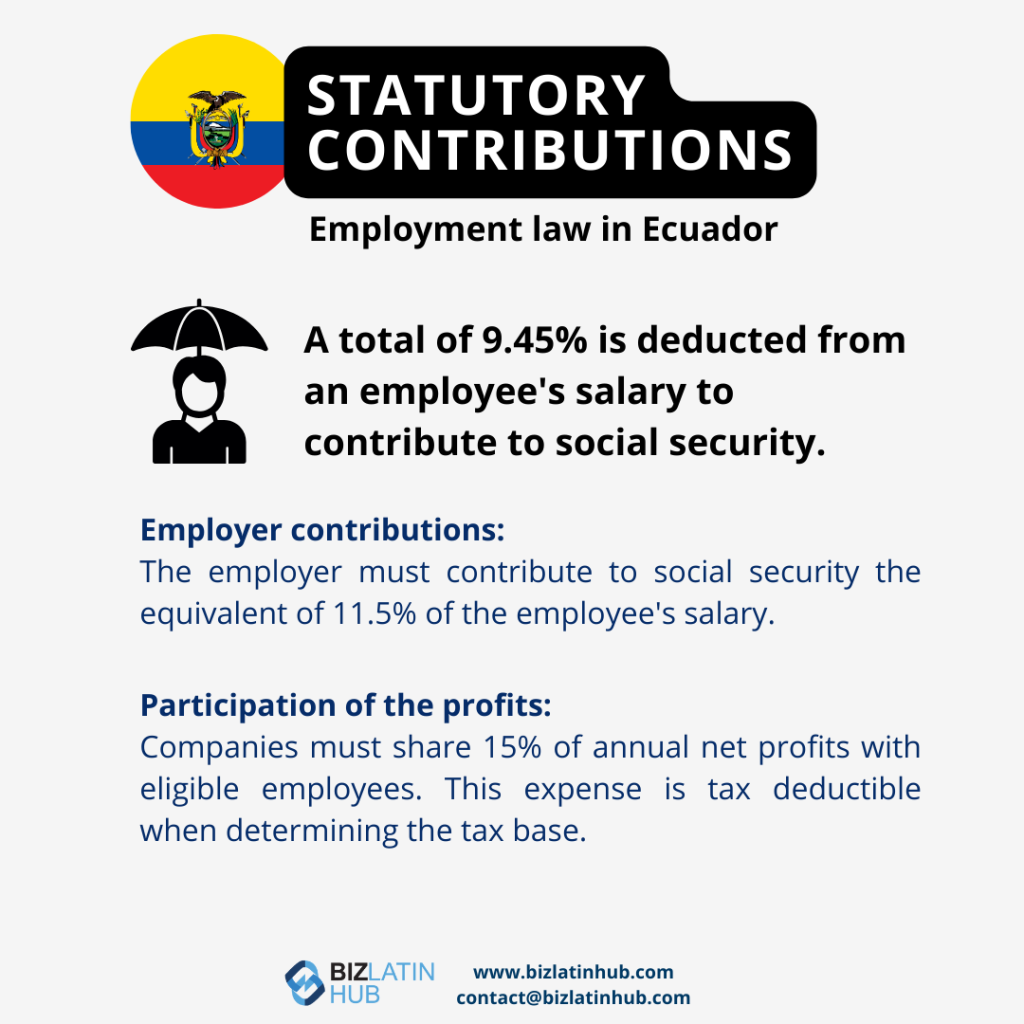

- Employee deductions: Under employment law in Ecuador, a total of 9.45% of an employee’s salary is deducted to contribute towards social security. Income tax is applied progressively, with salaries up to $11,722 per year incurring no income tax. The top band of income tax is 37% and applied to salaries over $105,580 per year.

- Employer contributions: Employers must contribute the equivalent of 11.5% of an employee’s salary towards social security.

- Profit sharing: Under Ecuadorian employment law, companies must share 15% of net annual profits with their employees. This expense is tax deductible when calculating the company’s taxable base.

Terminating employees in Ecuador

To terminate an employee in Ecuador, the employer must meet certain requirements. These include demonstrating just cause to the relevant authorities or providing compensation to the employee. Just cause can be based on reasons such as dishonesty, negligence, fraud, or other work-related offenses.

If the employee has a fixed-term contract, the employer must give a 30-day notice before termination. Severance pay is also required, which is equivalent to one month’s salary for each year of service, pro-rated for any part-year worked. Sudden dismissal does not need justification but does require the payment of severance.

When an employee resigns in Ecuador, they are entitled to a severance payment of 25% of their last monthly salary for each year of service. This severance payment is given in every case of termination of the employment relationship, including employee resignation and termination with a fair cause.

Additionally, employees who quit must receive their final paycheck within 72 hours of giving notice. If an employee gives notice more than 72 hours before their final shift, they must receive their paycheck on that day. If no notice is given, the paycheck must be sent within 72 hours of their last day.

FAQs about employment law in Ecuador

In our experience, these are the common questions and doubtful points of our clients.

The labor laws in Ecuador include the Labor Code as the primary rule on labor provisions, ministry agreements, and different types of secondary norms issued by regulatory entities.

Working conditions in Ecuador include a 40-hour work week, 15 calendar days of annual paid vacation, restrictions and sanctions against child labor, protection of worker health and safety, minimum wages and bonuses, maternity leave, and employer-provided benefits.

A standard workday in Ecuador typically consists of 8 hours.

The base minimum monthly wage in Ecuador is currently USD$470. However, there are a range of particular exceptions to this depending on sector and position, so you should consult an expert to make sure you stay compliant.

Overtime in Ecuador is paid at a rate of either 150% or 200% of the employee’s regular salary. The specific rate depends on the work performed during overtime and the time when the overtime was worked. It is important to note that all overtime hours must be approved by the local labor inspector.

Employment termination laws in Ecuador do not require prior notice. It is permissible to dismiss an employee without justification, but this would necessitate the payment of severance. However, if an employee is dismissed for just cause, there is no obligation to provide severance payment.

To terminate an employee in Ecuador, the employer must meet certain requirements. These include demonstrating just cause to the relevant authorities or providing compensation to the employee. Just cause can be based on reasons such as dishonesty, negligence, fraud, or other work-related offenses.

If the employee has a fixed-term contract, the employer must give a 30-day notice before termination. Severance pay is also required, which is equivalent to one month’s salary for each year of service, pro-rated for any part-year worked. Sudden dismissal does not need justification but does require the payment of severance.

When an employee resigns in Ecuador, they are entitled to a severance payment of 25% of their last monthly salary for each year of service. This severance payment is given in every case of termination of the employment relationship, including employee resignation and termination with a fair cause.

Additionally, employees who quit must receive their final paycheck within 72 hours of giving notice. If an employee gives notice more than 72 hours before their final shift, they must receive their paycheck on that day. If no notice is given, the paycheck must be sent within 72 hours of their last day.

Biz Latin Hub can assist you with employment law in Ecuador

At Biz Latin Hub, our multilingual team of corporate support experts has the experience and expertise to assist you in navigating employment law in Ecuador.

Our portfolio of services includes company formation, accounting, legal services, and tax advisory, among others, and we provide tailored packages of integrated back-office solutions to our clients, acting as a single point of contact for doing business in Ecuador, or any of the other 17 markets around Latin America and the Caribbean where we are able to offer our services.

Contact us now to discuss how we can support your business.

Or learn more about our team and expert authors.