Among the market entry options available to foreign investors considering doing business in Uruguay, one of the most appealing is limited liability company (LLC) formation. Because as well as being straightforward to complete, LLC formation in Uruguay offers a range of tax benefits that make it a popular option for businesses expanding into the region.

Located in the southeast of South America, and with a population of approximately 3.5 million people, Uruguay maintains a trade-friendly environment and is a member of the Southern Common Market (Mercosur), along with its two neighbors Argentina and Brazil, as well as Paraguay. Uruguay’s economy has experienced consistent annual growth in gross domestic product (GDP) since 2003, while the country has enjoyed decades of political and social stability, offering foreign businesses investment confidence.

According to the United Nation’s 2020 World Investment Report, the country saw foreign direct investment (FDI) inflows reach $189 million (all figures in USD) in 2019, marking a significant turnaround after three years of negative growth. The total stock of FDI was estimated at $28.3 billion — more than double that of ten years previous and thirteen times that at the turn of the century.

Meanwhile, in 2022, the South American country reported a gross national income (GNI) of $20,795 per capita — making it one of the most prosperous nations in Latin America. Uruguay also ranks third in the region in the Human Development Index, with an estimated 60% of its population considered ‘middle class’. Some of the country’s main export commodities include wood pulp, frozen meat, concentrated milk, and rice.

If you are serious about entering the market, you will want to find the right corporate lawyer in Uruguay to provide you with comprehensive advice and oversee the company formation process with efficiency. Or read on to understand more about LLC formation in Uruguay and why it could be the best option for you.

LLC formation in Uruguay: what is an LLC company?

An LLC company, known in Spanish as a sociedad de responsabilidad limitada (SRL), is a type of legal entity that is mainly suited to small and medium-sized enterprises and allows the development of any kind of commercial activity, with the exception of financial mediation and insurance-related operations.

This type of company requires at least two shareholders and can have a maximum of 50. If the company only has one shareholder, another must be incorporated within a period of one year. Likewise, if the maximum number of shareholders is exceeded, the LLC must become a public limited company (PLC) within two years, under penalty of dissolution.

Note that all partners of an LLC in Uruguay must actively participate in the management of the company, however, their liability is limited to the number of their contributions. On the other hand, the company’s capital cannot be represented in negotiable instruments and the transfer of shares to third parties requires the approval of all shareholders.

Furthermore, there is no maximum or minimum capital amount needed for an LLC to be established in Uruguay, with shareholders free to determine the amount of capital. During the process of LLC formation in Uruguay, each shareholder must provide at least 50% of their total contribution, and will have a maximum period of two years to provide the remaining value.

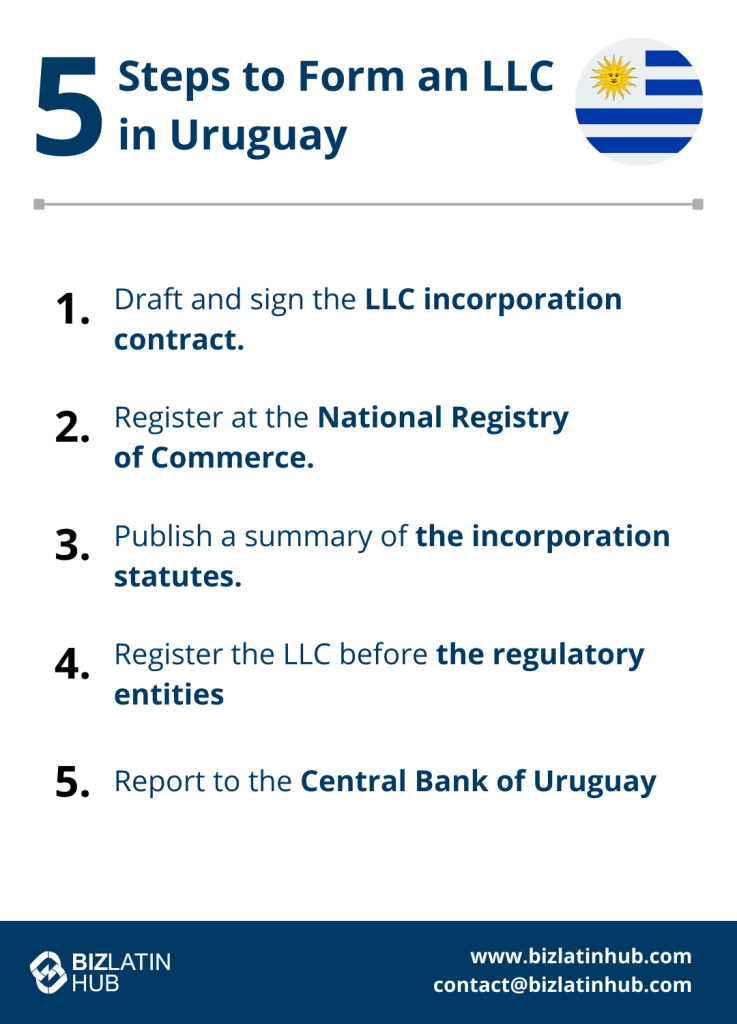

Form an LLC in Uruguay in 5 steps

LLC formation in Uruguay involves the following five steps:

- Step 1 – Draft and sign the LLC incorporation contract.

- Step 2 – Register the LLC before the National Registry of Commerce.

- Step 3 – Publish a summary of the incorporation statutes in the Official Gazette.

- Step 4 – Register the LLC before the regulatory entities in Uruguay.

- Step 5 – Report to the Central Bank of Uruguay the percentage of participation for each shareholder.

Step 1: Draft and sign the LLC incorporation contract

As a first step to form an LLC in Uruguay, all shareholders must draft and sign an incorporation contract.

Step 2: Register the LLC before the National Registry of Commerce

Once the incorporation contract is signed, there will be a 30-day period to register the LLC with the National Registry of Commerce.

Step 3: Publish a summary of the incorporation statutes in the Official Gazette

A summary of the incorporation statutes must be published in the Official Gazette (IMPO) and in another national newspaper, detailing the name of the company and partners, capital, corporate purpose, and fiscal address.

Step 4: Register the LLC before the regulatory entities in Uruguay

At least ten days before starting to operate, the company must be registered with the main regulatory entities such as the General Tax Directorate (DGI) and Ministry of Labor and Social Security (MTTS).

Step 5: Report to the Central Bank of Uruguay the percentage of participation for each shareholder

As the last step in the process of LLC formation in Uruguay, the Central Bank of Uruguay must be informed through an affidavit of the percentage of participation established for each shareholder. Note that any change related to this matter must be informed within a maximum period of 30 days.

How the LLC taxation Works in Uruguay?

One of the benefits of incorporating an LLC in Uruguay is that income earned outside of Uruguay is tax-free, which means that only income earned within the country is taxed. In addition, annual financial statements do not have to be presented to the government, as this type of legal entity is not subject to the control of the Internal Audit of the Nation (AIN). Note that foreigners can own 100% of the shares of an LLC in Uruguay.

In addition, in the event that a shareholder is foreign, no income withholding will be made when the dividends are sent abroad. However, some taxes must be paid for having earned income within the country, such as:

- Income Tax on Business Activities (IRAE) has a rate of 25% on annual taxable income.

- Personal Income Tax (IRPF) is levied on the distribution of profits to people and has a rate of 7%.

- Value Added Tax (VAT) is applied to the circulation of goods and provision of services within Uruguay. Its rate is 22%.

- Non-Resident Income Tax (IRNR) is paid at the same rate as the VAT and is only intended for non-residents.

- Asset Tax (I.P.) is applied to the equity owned at a rate of 1.5% of the total annual equity.

- Special contributions to social security must be paid based on the maximum remuneration or salary paid by the company.

Biz Latin Hub can help you form an LLC in Uruguay

At Biz Latin Hub, we offer a complete portfolio of corporate legal, accounting, and back-office services, and count on the expertise and experience needed to ensure the timely completion of your LLC formation in Uruguay. Our multilingual team of company formation agents has broad experience helping foreign companies entering the Uruguayan market and is equipped to guarantee the success of your commercial operations in Uruguay, as well as many other countries in Latin America and the Caribbean.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.