Understand how to manage your business risks with due diligence in Paraguay.

Managing your business risks with due diligence in Paraguay is vital to reduce risks, as it analyzes the operations of a company and verifies compliance with local legislation and authorities.

Due diligence in Paraguay as in other Latin American countries, offers certainty about operational aspects of the company you’re managing, buying, or merging with. Undertaking due diligence activities will guarantee the good standing and reputation of your business.

The importance of due diligence in Paraguay

Due to the financial scandals of the 1990s in Paraguay, and also the discredit suffered by large audit firms after the famous Enron case, many adjustments have been made to Paraguayan law.

The Paraguayan government has strengthened its financial laws to avoid money laundering and prevent different types of transactional crimes. In this way, sanctions that were previously symbolic have become quite severe. Currently, no one can escape the fact that the management of business risks through due diligence in Paraguay is essential.

The most important aspects to be reviewed during a process of due diligence in Paraguay include:

- Corporate: Stock ownership. Statutes, partner agreements, and records of the company in question.

- Contractual: Verification of compliance with current legislation.

- Financial: Review of loans granted with and/or without real guarantees.

- Insurance: Coverage of insurance policies in which the company appears as a beneficiary.

- Real estate: Registration in the Property Registry and review of liens or domain restrictions.

- Industrial Property: Ownership and validity of distinctive signs such as trademarks, trade names, and domain names.

- Fiscal: Inspection of tax periods, tax procedures, settlement of formal tax obligations, and special tax regimes.

- Labor: Examination of employment contracts, prevention of occupational risks, compliance with collective agreements, and payment of salaries.

- Litigation: Ordinary jurisdiction and/or plaintiff/defendant.

- Environmental: Determines the environmental liabilities of the company’s operations.

Managing business risks in Paraguay

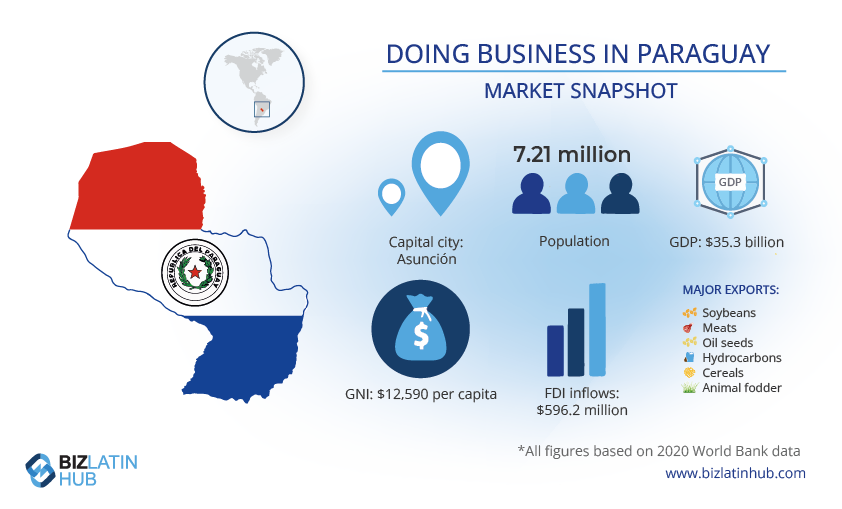

Despite the enormous investment potential in Paraguay, whether through company formation or international trade, it is necessary to be aware of the risks of doing business in the country.

In addition, the high levels of bureaucracy, the business-related regulatory framework, and the language can make establishing a company an even more challenging process for a foreign executive. Managing your business risks with due diligence in Paraguay guarantees the successful and transparent future of your business.

Manage your business risks with the help of an expert

The Paraguayan authorities are open to national and foreign businesses looking to expand in Paraguay. There are multiple benefits for executives looking to incorporate or join a pre-established company in the country, including various commercial and tax incentives.

Choosing the right partner to manage your business risks with due diligence in Paraguay is of utmost importance as it lays the foundation for your future expansion in Latin America. At Biz Latin Hub, our team of bilingual professionals has the expertise and experience in undertaking complete due diligence processes to ensure your company is protected. We can support you through the provision of tailored services ranging from company formation and due diligence to legal representation and accounting services. Contact us now to receive personalized assistance.

Learn more about our team and expert authors.