Latin America has emerged as a compelling nearshoring destination, captivating businesses around the globe. With its strategic location, vibrant business ecosystem, and abundant talent pool, the region offers many advantages that make it an attractive choice for companies seeking to optimize their operations. Read the working and vacation policies of these markets.

As the popularity of Latin America’s nearshore markets grows, its essential companies understand the working and vacation policies that exist. Regulations vary across countries, making it crucial to collaborate with knowledgeable local partners who can provide guidance and prevent potential legal and market-entry pitfalls.

In this article, we will outline the latest changes to working and vacation policies across Latin America, plus highlight the benefits of nearshoring in the region.

See also: legal requirements to start a business in Latin America.

Summary of working and vacation policies in Latin America

- Mexico

- Colombia

- Chile

- Brazil

- Argentina

Recently there have been a lot of changes in working and vacation policies across Latin America. Let’s explore the five largest markets in the region and their latest regulations.

Mexico

In late April 2023, the Mexican Congress passed a ruling to amend the Constitution, proposing a reduction of the workweek from 48 to 40 hours per week. While this labor reform has not been passed into law, all indications suggest that it will likely come into effect in September.

In December 2022, the government introduced a new regulation that improves workers’ annual leave. The amendment doubles the number of annual leave days from six to twelve, providing employees with more time for rest and leisure. In January 2023, increased its minimum wage. The previous daily rate of $172.87 experienced an increment, now amounting to $11.54 per day. Additionally, the minimum wage in the Free Zone of the Northern Border saw an increase from 260.34 pesos to 312.41 pesos, equating to $17.38 per day.

Colombia

New Colombian President Gustavo Petro has proposed significant changes to Colombian labor laws. The labor reform includes several changes.

Firstly, the weekly working hours will be reduced from 48 to a maximum of 42 hours. Secondly, any extra hours worked, including those on Saturdays, will be considered additional work and incur higher costs.

Thirdly, Sunday and holiday work will now receive a surcharge of 100% of the ordinary salary, an increase from the current 75 percent. Additionally, the reform introduces additional obligatory leaves.

Lastly, night-time work will be extended by 3 hours, starting from 6:00 pm and ending at 6:00 am, and workers performing night shifts will receive higher pay compared to those working during the daytime.

Chile

In April, Chile’s congress passed a bill reducing the country’s work week from 45 to 40 hours. The labor reforms include a five-year transition period which will reduce the working hours by one hour of work per week per year, ending in 2028.

Businesses can make this change immediately or sooner than the five-year grace period. State-owned Copper giant Codelco announced they would implement the 40-hour work week by 2026.

Alongside the reduction in the workweek, Chile’s labor reform included additional changes. The bill introduces provisions for various flexible practices that companies and employees can mutually agree upon. For example, a 4-by-3 work model involves working four 10-hour days and having three consecutive days off.

Brazil

In Brazil, the standard working hours typically consist of 44 hours per week, distributed over a maximum of 6 days. The standard daily working hours are 8 hours, with a one-hour break for lunch or mealtime. Employees are entitled to receive overtime compensation for any extra hours worked, which is calculated at a rate of 50% higher than the regular hourly wage.

After being employed for 12 months, employees are entitled to 30 paid days off a year. At least one of the vacation periods needs to be 14 days long, and two at least 5 days long. On top of the regular wage during the time off, employers must also give employees a vacation bonus, which equals one-third of their monthly salary.

Argentina

According to employment law in Argentina, a typical workweek should not exceed 48 hours, with each workday lasting eight hours. All employees have the right to a weekly break of 35 consecutive hours, usually starting at 13:00 on Saturdays, unless their job requires working on weekends.

Employees who work over 48 hours a week will receive extra pay for the additional time worked. Argentina has around 15 national holidays a year, mostly occurring on weekdays.

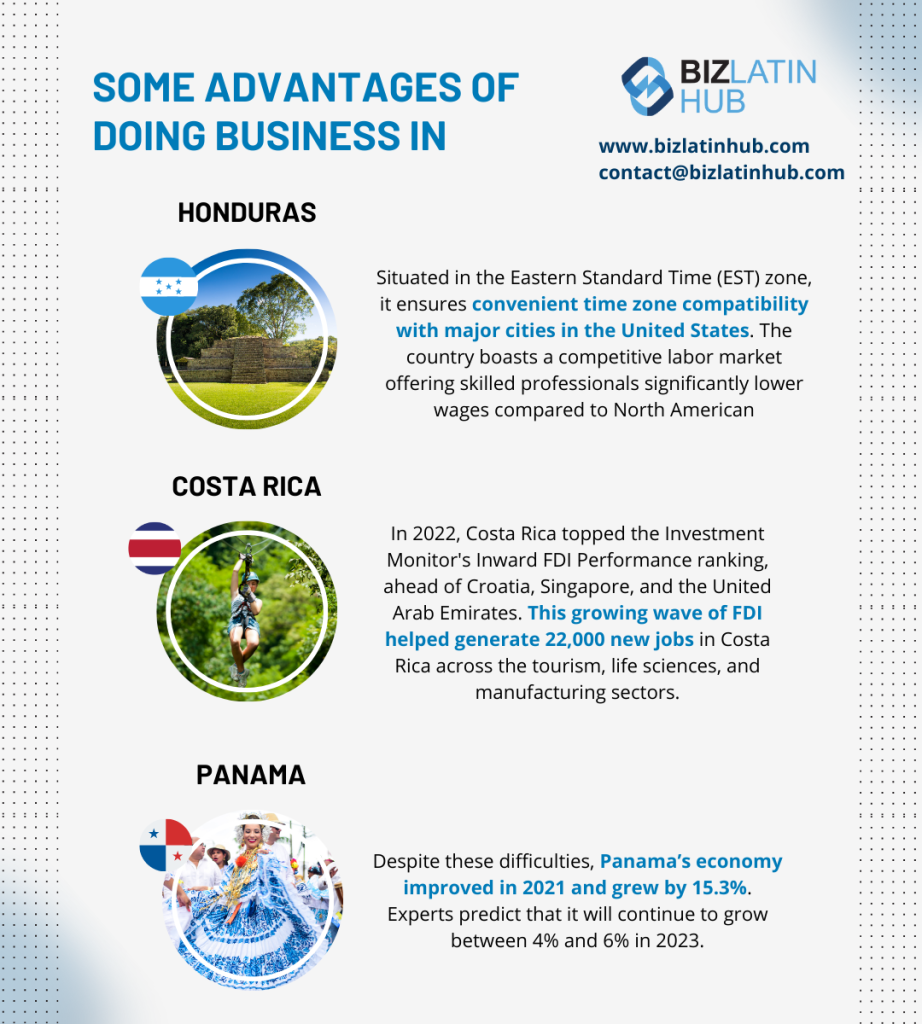

Top benefits of nearshore markets in Latin America

Embracing nearshoring in Latin America offers numerous advantages for your company. Here are five exceptional benefits that make these nearshore markets an attractive option.

- Low labor costs

- Time-zone alignment

- Skilled IT workforce

- Digital infrastructure

- Excellent return on investment

Below we will examine each of these nearshoring advantages in more detail.

1 – Low labor costs

Outsourcing presents a compelling opportunity for businesses to optimize their cost structure, streamline operations, and boost profit margins. Establishing and nurturing an internal workforce can be expensive and time-intensive, especially in regions with high labor and operational costs.

For example, an entry-level software developer in the US can expect to receive a salary of about USD 80,000 per year, while a Brazilian software developer doing the same job can expect to make around $60,000 Brazilian Reais per year (roughly USD 11,600). That equals a cost saving of around 85 percent!

In addition, nearshoring in Latin America offers a lower living cost compared to major cities in the United States or Europe.

2 – Time-zone alignment

Latin American workers have similar work hours to their counterparts in the United States and Canada.

Since the region shares a timezone overlap with North America, there is a potential for up to eight hours of synchronous work. This enables seamless team collaboration and eliminates any delays in project completion. It makes Latin America the ideal place to set up a regional hub.

3 – Skilled IT workforce

The IT industry is highly ranked globally for outsourcing software development. This makes it an ideal location for nearshoring.

Due to its excellent connectivity, including direct flights to the US, nearshoring becomes both convenient and essential.

Latin America has more than one million software developers, indicating that businesses of any size and from any sector can likely find qualified assistance to meet their specific requirements.

Beyond the developers, the estimated overall number of people working in the IT sector in the region is in the millions, widening the scope of the workforce and attracting foreign companies to invest in Latin America.

4 – Digital infrastructure

Latin America has witnessed remarkable progress in bolstering its digital infrastructure, resulting in a substantial growth spurt within its IT outsourcing sector.

The region has an extensive range of valuable resources, such as company accelerators and manufacturing parks. Science and Technology Parks (STPs) play a pivotal role in fostering innovation, research, and development, while simultaneously driving social and economic advancement.

These dynamic environments serve as hubs for cutting-edge technological advancements, positioning Latin America as a thriving destination for IT outsourcing.

5 – Excellent return on investment

Nearshoring in Latin America presents a lucrative return on investment due to significant labor savings, access to a large pool of qualified tech workers, and improved efficiency resulting from the timezone crossover.

This fantastic ROI is why the world’s leading tech giants Microsoft, SAP, Google, and IBM have offices there.

Explore nearshore markets in Latin America with Biz Latin Hub

Experience seamless market entry and reliable back-office solutions in Latin America and the Caribbean with Biz Latin Hub.

We specialize in a range of services, including expertise on working and vacation policies, along with hiring and PEO, accounting and taxation, company incorporation, and corporate legal advice.

Our offices are located in major cities throughout the region and we have strong partnerships in other markets. This wide coverage allows us to support clients with market entry and cross-border operations in multiple countries.

Get in touch with us today to learn more about our services and how we can assist you with your business endeavors in Latin America and the Caribbean.

If you found this article interesting, check out the rest of our coverage of the region or read about our team and expert authors.