Learn what makes Bolivia an emerging market to watch in 2025, with insights into key sectors, legal setup, and what foreign investors should know before starting operations.

Doing business in Bolivia in 2025 offers opportunities in a resource-rich but often underexplored economy that continues to develop its business infrastructure and trade ties. The country has shown during this last decade an impressive economic recovery through important economic programs put in place. Now, it is one of the fastest-growing economies in Latin America, foreign investors are looking to start their business in Bolivia. The country is showing interest in partnerships in strategic sectors such as hydrocarbons, mining, natural resources exploitation, transport, and communication. Companies doing business in Bolivia must understand local corporate regulations, licensing requirements, and the practical steps involved in market entry.

Key takeaways on doing business in Bolivia

| Is foreign ownership allowed? | 100% ownership is possible and can be done from overseas. |

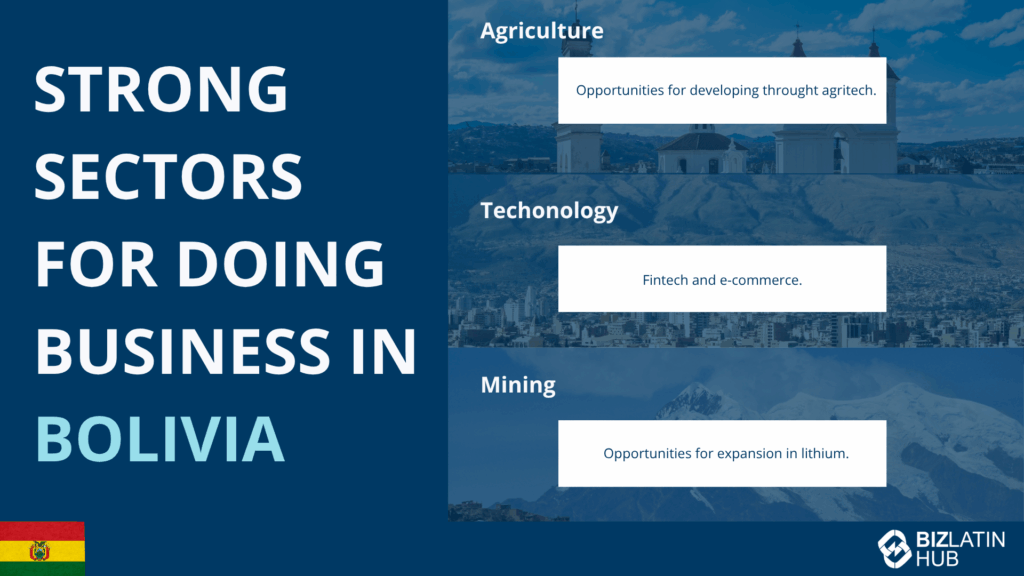

| Strong sectors in Bolivia | Agriculture remains strong and has opportunities for developing through agritech. Tech is starting to growing, especially fintech and e-commerce. Mining is strong with opportunities for expansion in lithium. |

| Are there Free Trade Zones in Bolivia? | There are now Free Trade Zones (FTZs) in El Alto, Patacamaya, Oruro, Puerto Suarez, Cobija, and Warnes. |

| Are there any incentives for Foreign Direct Investment in Bolivia? | IBCE helps improve production, investment and business opportunities and inward investment. There are the FTZs and foreign companies have the same rights as local ones. |

| What international links does the country have? | Bolivia is a member of the World Trade Organization and the Andean Community and an associate member of MERCOSUR. |

How easy is doing business in Bolivia?

Despite frequent political rhetoric about protecting local interests, the country is actually relatively open to inwards investment. This is based on Law N°1182 which promotes national and foreign investment aimed at improving social and economic development. This law gives foreign and national investors the same rights.

Foreign investors doing business in Bolivia are targeting sectors like lithium mining, agriculture, renewable energy, transportation infrastructure, and telecommunications.

The Bolivian Foreign Trade Institute (IBCE – Instituto Boliviano de Comercio Exterior) was established to promote the economic and social development of Bolivia. It focuses on bringing awareness to foreign trade and Bolivian culture. For example, in July 2024, the government revised its Value Added Tax (VAT) Zero Rate regime to include international road transport services, aiming to support strategic sectors like logistics and transportation.

IBCE also helps improve production, investment and business opportunities. Additionally, it promotes efficiency, competitiveness, productivity and business quality by creating statistical reports, consultancies and market research. IBCE supports new importers and exporters. The association reviews all requirements and documents needed to operate.

There are now Free Trade Zones (FTZs) in El Alto, Patacamaya, Oruro, Puerto Suarez, Cobija, and Warnes. Operating licenses in the FTZs last for 15 years and give exemption from customs duties and VAT (known locally as IVA). It is worth noting that the zones have had a turbulent history, already having been opened, shut down and reopened this century.

On May 26, 1969, five South American countries (Bolivia, Colombia, Chile, Ecuador, and Peru) signed the Cartagena Agreement, with the purpose of improving the standard of living of its population through integration and economic and social corporation. The Cartagena Agreement eventually resulted in creating the Andean Community of Nations (CAN).

Bolivia has been a member of the WTO since it was created in January 1995. The World Trade Organization deals with the rules and organization of commerce between countries. The goal of the WTO is to help countries work with each other to grow the world economy.

According to the Political Constitution of the Plurinational State of Bolivia, the government will register and protect the intellectual property rights of an individual or collective over the works and discoveries of authors, artists, composers, inventors and scientists, under the conditions laid down by law.

Each of these legal frameworks impose their own laws that must be taken into account when importing and exporting in Bolivia.

Five opportunities for doing business in Bolivia

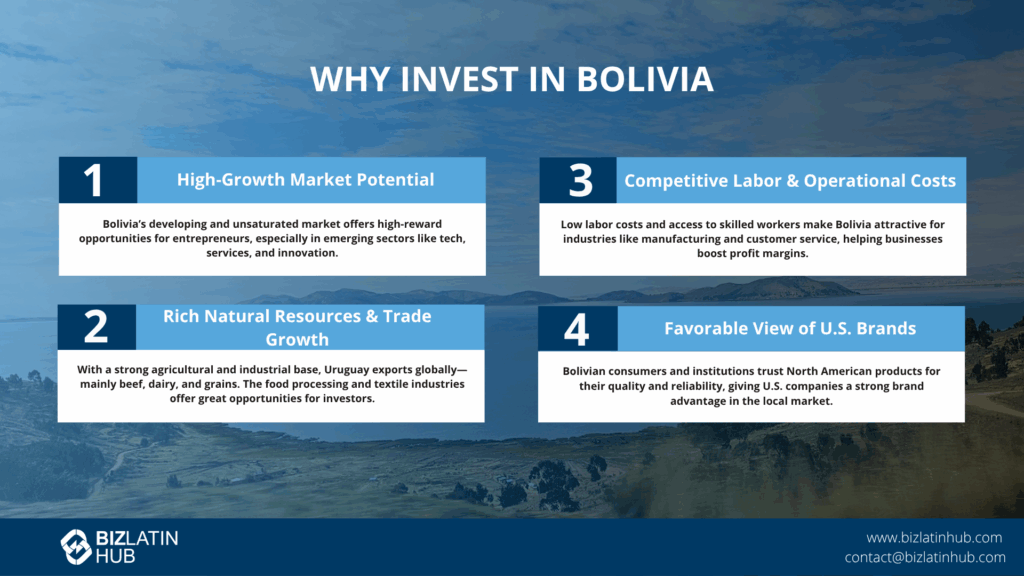

1. Unsaturated market offers opportunity for entrepreneurs to do business in Bolivia

Bolivia currently lags behind some neighboring countries in terms of development and entrepreneurship. However, there is great potential for foreign entrepreneurs to step into the gaps in this developing country’s unsaturated market. This isn’t a country for people who need well-developed chances, but doing business in Bolivia is perfect for those who are searching for high-reward opportunities with some risk.

Bolivia is demonstrating its willingness to become a more entrepreneurial and innovative nation in the business world. There is a growing community of young entrepreneurs helped and formed by different organizations. Young Bolivians are determined to have a positive impact on their country, or ideally on the world.

2. Exporting and importing in Bolivia

Since the Bolivian government is initiating the reduction of exportation restrictions, Bolivia is going to become more present in the trade market, specifically in the agricultural industry. This would allow the country to generate increased revenues which will contribute to economic growth and also present an opportunity for the government to invest back into certain sectors.

The main export product of Bolivia is petroleum gas, contributing to 32% of total exports. Zinc ore follows, with a total amount of 17% of the total Bolivian exports. Bolivia’s imports are mainly cars with a percentage of 5.7% of their total imports. These are followed by the import of refined petroleum, which accounts for 4.4%.

Bolivia’s mining market feeds a significant demand for large construction vehicles. This demand can be a great opportunity for investors to invest in.

Bolivia is rich in non-renewable natural resources. Bolivia’s largest export sectors are mining and hydrocarbons. There is still a lot of potential in this market to grow. Next to the already mined minerals such as silver, lead, zinc, natural gas, and tin, Bolivia possesses the largest lithium reserve in the world, which is not currently being used to its maximum benefit.

3. Preference for Northern American brands

Doing business in Bolivia is made easier for Northern American companies as Bolivian consumer perceptions of North American products are generally high-quality and innovative. The American brand therefore carries a lot of influence in the Bolivian market. Local governments use products and services from the United States because they are viewed as reliable due to warranties, high customer service standards, and maintenance plans.

4. Agricultural sector will continue to grow

The growing agricultural sector is the most important sector in Bolivia’s economy, contributing about 13% of GDP and accounting for just under 30% of total employment.

The need for new technology in the agricultural sector will also increase. As technological expertise is lacking in Bolivia, the growth of the agricultural sector in Bolivia is driving demand for greater international knowledge and technological sophistication.

Such technologies can be applied to the Bolivian market to improve productivity, efficiency, and even food security. As such, investors with expertise in such technologiy can find considerable opportunities for doing business in Bolivia.

5. Low costs of labor

Doing business in Bolivia is made particularly attractive by the low cost of labor. Bolivia’s workforce maintains an average salary of Bs2,500 (around USD$350). Bolivia’s main labor cost advantages can be found in sectors such as manufacturing and customer service.

High-value employees are available on the market. Foreign companies looking to do business in Bolivia, therefore, have greater access to experienced staff at lower prices, keeping overheads low and improving chances of establishing higher profit margins.

Why Bolivia Presents Unique Investment Potential in 2025

Bolivia may not yet be a mainstream destination for foreign direct investment, but in 2025 it presents a compelling case for companies seeking long-term growth in an untapped market. Its vast natural resources, evolving legal framework, and growing internal market are gaining attention from investors with a strategic, long-term view.

Top reasons to consider doing business in Bolivia:

- Lithium reserves – Bolivia is estimated to hold over 20% of the world’s lithium resources, positioning it as a future leader in battery supply chains.

- Hydroelectric and solar potential – The government is investing in clean energy infrastructure, creating space for public-private partnerships.

- Growing domestic consumption – A young, urbanizing population is creating new demand in retail, logistics, telecommunications, and digital services.

- Gateway to Southern Cone – Bolivia shares borders with Brazil, Chile, Peru, and Argentina, offering multi-market access for regional trade.

- Government incentives – Strategic sectors benefit from investment incentives, though regulations can vary by region and industry.

Local Tip:

La Paz and Santa Cruz are the most common cities for company incorporation, with Santa Cruz being the preferred hub for agribusiness and logistics companies.

Why Choose to Incorporate a Company in Bolivia?

The country is a member of the World Trade Organization and the Andean Community and an associate member of MERCOSUR, making company formation in Bolivia attractive. According to data from the Bolivian Institute of Foreign Trade (IBCE), in 2023, Bolivia’s total trade volume reached $US 10.5 billion. The country’s main trading partners are Brazil, Argentina and China.

Doing business in Bolivia requires proper company registration with FUNDEMPRESA, tax registration with SIN, and ongoing compliance with the Bolivian Commercial Code.

To form a company in Bolivia, foreign investors must choose a legal entity (usually Sociedad de Responsabilidad Limitada or Sociedad Anónima), register with FUNDEMPRESA, obtain a tax number from SIN, and open a corporate bank account. The incorporation process typically takes 4–6 weeks. Businesses in regulated sectors may require additional licenses or permits from local or national authorities.

Bolivia does not require you to travel to the country to complete the incorporation process. This means you can set up from anywhere and begin to recruit staff, saving you time and money. CEOs and investors who want to expand into multiple markets quickly will find this particularly attractive.

Since Bolivia is near other Latin American markets like Peru, Chile, Paraguay, and Brazil, company formation in Bolivia allows you to reach various nearby markets for trade. Once you have incorporated your company, you can apply for a corporate business account and begin trading freely in the market.

Local Insight for 2025:

While Bolivia has historically been cautious toward foreign capital, recent efforts to modernize its legal and financial systems are improving conditions for international business — especially in clean energy, lithium, and agri-logistics.

Will Bolivia’s lithium market open up to foreign business?

At the moment, lithium exploration remains highly regulated. It’s important to keep an eye on mining developments and reform in the country, however, as the opening of this market will pose significant, multi-million dollar opportunities for companies and see more keen on doing business in Bolivia.

With the growing demand for electric cars, the need for batteries is likewise increasing. Given that lithium is the key element in electric cars, the potential growth for the lithium market is very big.

While Bolivia’s lithium market has stagnated, its importance to economies like the US might yet improve due to the instability of the other triangle members Argentina and Chile.

FAQs on doing business in Bolivia

Answers to some of the most common questions we get asked by our clients who are thinking of doing business in Bolivia.

1. Can a foreigner own a business in Bolivia?

Yes, a business in Bolivia can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. What opportunities stand out for doing business in Bolivia?

At the moment, lithium exploration remains highly regulated. It’s important to keep an eye on mining developments and reform in the country, however, as the opening of this market will pose significant, multi-million dollar opportunities for companies and see more keen on doing business in Bolivia.

With the growing demand for electric cars, the need for batteries is likewise increasing. Given that lithium is the key element in electric cars, the potential growth for the lithium market is very big.

Bolivia is not a country for risk-averse investors who are seeking guaranteed rewards, but for those looking to get in at the start, the economy has an enormous amount of room in which to grow over the coming years. There is plenty of demand for North American products, meaning that importing and exporting is a potential growth area.

3. How long does it take to register a company in Bolivia?

Company formation in Bolivia can take 5 to 6 weeks after the required documentation has been provided by the client.

4. Are there Free Trade Zones in Bolivia?

There are now Free Trade Zones (FTZs) in El Alto, Patacamaya, Oruro, Puerto Suarez, Cobija, and Warnes.

5. Does Bolivia have trade agreements with other countries?

The country is a member of the World Trade Organization and the Andean Community and an associate member of MERCOSUR.

6. What entity types offer Limited Liability in Bolivia?

The Sociedad de Responsabilidad Limitada (S.R.L.) is the limited liability entity type.

7. Is Bolivia a good place to do business in 2025?

Yes — especially for companies in mining, energy, agriculture, or logistics. Bolivia offers cost advantages and untapped potential in key strategic sectors.

8. Can foreigners fully own a company in Bolivia?

Yes. Foreign investors can fully own companies and repatriate profits, although some sectors may require local licensing or approvals.

9. What is the average time to incorporate a company in Bolivia?

With legal guidance, most companies can be established in 4 to 6 weeks, depending on the industry and required permits.

Take advantage of the opportunities for doing business in Bolivia

Entrepreneurs considering doing business in Bolivia should work experienced, leading market entry and back-office specialists to start their expansion successfully. If you’re considering doing business in Bolivia in 2025, Biz Latin Hub provides end-to-end support for company incorporation, legal compliance, and local representation.

At Biz Latin Hub, our team of seasoned expatriate and local professionals provide market-leading support across a whole host of sectors, like company incorporation and recruitment.

Contact us today and we’ll get back to you with a personalized business strategy.

Or learn more about our team and expert authors.