Bolivia’s labor laws are updated regularly, and are wide-ranging and complex. Companies need to keep in mind all the legal advice provided by experts in accordance with the law when hiring employees. The country is increasingly modernizing and part of the process involves liberalizing and smoothing the sometimes tricky bureaucracy. If you are considering company formation in Boliva, you will need to understand the labor laws here.

Key takeaways on Bolivia’s labor laws

| What are the working hours mandated by Bolivia’s labor laws? | Bolivia’s labor laws set a maximum work schedule of 8 hours per day. Men can work up to 48 hours per week and women up to 40, not including overtime. |

| What is the Bolivian minimum wage? | The Bolivian minimum wage for 2025 is Bs$2,500 (around USD$360) per month, applicable from the 17th of January. |

| Types of Employment Contracts in Bolivia | Indefinite contracts are the normal standard for most regular employees. Fixed-term contracts can only be given to workers that are not carrying out regular day-to-day activities for the company. Both contract types can be oral or written. |

| What percentage of an employee’s salary is contributed to social security in Bolivia? | Employers must cover a range of payments, totalling 16.7% of an employee’s gross salary. |

Overview of Bolivia’s labor laws

The Labor General Law of 1942 regulates labor relationships. Relationships between employers and employees are complex, and Bolivia’s regulations are regularly updated so companies can adapt to modern labor conditions. A labor relationship will be regulated by the Ministry of Labor as the entity that controls all Bolivia’s labor laws.

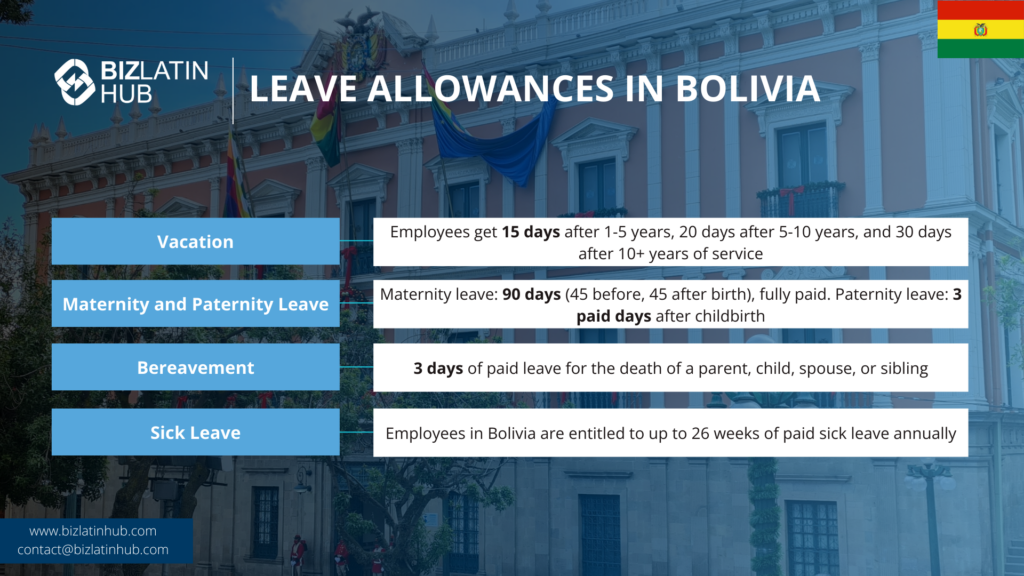

Some of the most important things to take into account in labor law are: In 2025, the national minimum wage is Bs$2,500 (approx. USD$360); There are 13 salaries to be paid in a year (12 salaries + December Christmas bonus); Standard working hours are 8 per day, 48 per week; employees are entitled to 15 days vacation each year.

What types of contracts are recognized by Bolivia’s labor laws?

In Bolivia, labor contracts can be both oral and written. According to Bolivia’s labor laws, a labor relationship contains the following requirements:

- Provision of service on a specific schedule

- Subordination and dependency

- Receiving a remuneration (salary).

If these three conditions are fulfilled, it will be automatically considered as labor relationship.

Indefinite labor contract

This type of contract is the most commonly used for labor relationships in Bolivia. Each written and oral labor contract will be considered indefinite. This is the only contract that can establish a trial period of 90 days for the employee. During the probationary period, the employer may terminate the relationship without obligation to compensate for the termination and employees can use this period to settle in to the company.

Fixed period contract

A fixed period contract is the one that due to its conditions establishes a determined period of validity. The fixed period contract must be written and must state the duration period of employment. According to Bolivia’s labor laws, this type of contract can apply in the following conditions:

- Workers with a fixed period contract cannot perform direct company activities. This type of contract can be used only for persons who support activities not related to the main activity of the company

- If a regular employee of the company is temporarily unable to work, companies can hire a temporary worker with this type of contract until the employee can return to their contracted activities. The employer cannot hire the same worker more than once using this mechanism

- If a company needs extra support and resources during a certain period of the year, it may hire fixed-term workers for that surge period to cover all company needs. If the company requires additional human resources in the long term following this period, they must hire through an indefinite labor contract

- An employee can only be hired with this type of contract two times. Otherwise, a third fixed period contract will be automatically considered as indefinite

- Each fixed period contract has a maximum length of one year

- According to Bolivia’s labor laws, a fixed period contract requires the approval of the Ministry of Labor to be validated; if this requirement is not fulfilled by the employer, the contract will be considered as indefinite.

In both types of contract, employees are entitled to the full legal rights and obligations of the employment relationship, including the contributions to social security made by the employer.

What are the labor contributions in Bolivia?

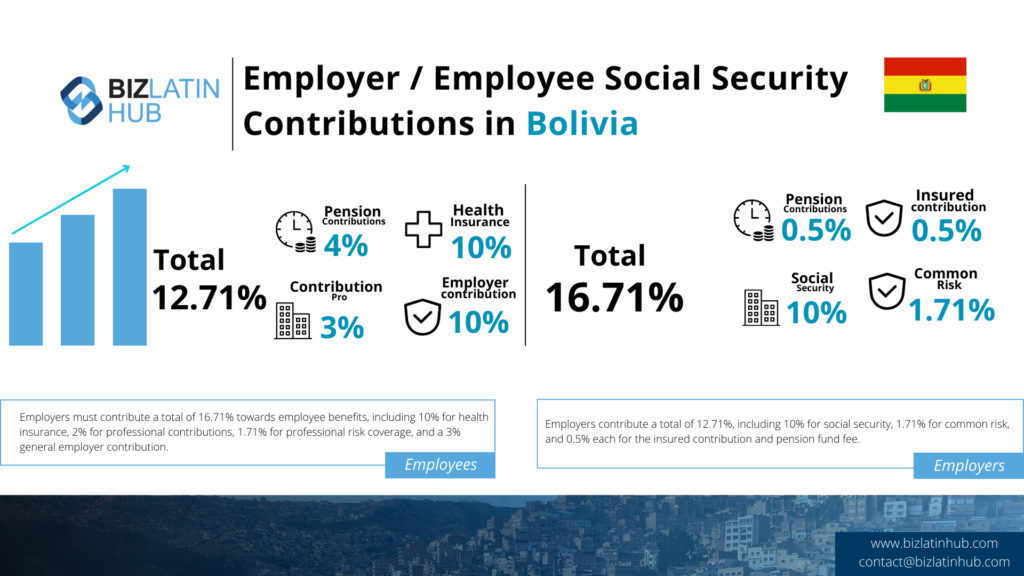

The contributions established by Bolivia’s labor laws will be calculated from each employee’s salary as follows:

| Contributions to be covered by the employer | Contributions to be covered by the employee |

| Health insurance: 10% Contribution pro: 2% Professional risk: 1.71% Employer contribution: 3% | Social security: 10% Common risk: 1.71% Insured contribution: 0.5% Pension fund fee: 0.5% |

| Total: 16.71% | Total: 12.71% |

Additionally, Bolivia applies a further tax known as the RC- IVA or RC- VAT. This is calculated by the salary amount received by the employee after the 12.71% contribution mentioned above, if the salary is higher than 4 times the national minimum wage.

Concluding the labor relationship

Bolivia’s labor laws regulate the ways to conclude a labor relationship in different scenarios and conditions. The Labor General Law of 1942 gives the following guidelines for concluding a labor relationship:

Employee voluntary resignation

If an employee decides to resign from their position, the employer must pay the pending salarIes and the indemnities for the period worked in the company until the day of the resignation. Indemnities are the equivalent of 1 month’s salary for each year worked.

Severance pay without just cause

If a company decides to fire an employee, all pending wages must be paid and be included in the time for services. Indemnification includes three extra wages as severance payment for termination without just cause.

Justified termination

Each case must be analyzed individually to determine precisely if this has been done in accordance with the law. Common reasons include illegal behaviour, violence and acting outside the terms of the contract. Justified termination must be proven to the Ministry of Labor in order for the employer to be able to pay the pending salary without severance.

FAQs about Bolivia’s labor laws

In our experience, these are the common questions and doubtful points of our clients.

Bolivia’s labor regulations define a standard workweek of 48 hours, distributed across 8 hours per day, offering flexibility through both fixed-term and indefinite employment contracts. The nation enforces a minimum wage and ensures annual paid leave for workers.

Female employees are entitled to maternity leave, and social security contributions extend coverage to health and retirement benefits. The recognition of collective bargaining underscores the importance of negotiations, and specific guidelines are in place for the employment of foreign workers.

Working conditions in Bolivia are regulated by the country’s labor laws. These laws ensure that workers are provided with fair and safe working conditions. Some of the key provisions include limits on working hours, minimum wage requirements, and the right to rest and vacation.

Additionally, employers are required to provide a healthy and safe work environment, including proper ventilation, lighting, and sanitation facilities. These labor laws aim to protect the rights and well-being of workers in Bolivia.

In Bolivia, the standard work day consists of 8 hours. However, employees are allowed to work up to 48 hours per week, with a maximum of 6 working days. It is important to note that women are only permitted to work 40 hours per week.

The minimum salary in Bolivia is Bs$2,500 per month. This is around USD$360 at current exchange rates (Jan 2025).

Overtime in Bolivia is considered as work done during emergencies or to fulfill the employer’s requirements. It is regarded as extraordinary working hours and is compensated with an additional 100% pay. However, the total overtime hours should not exceed two hours per day.

The laws regarding employment termination in Bolivia require blue collar workers with six months of service to be given 15 days’ notice, blue collar workers with 1 year of service to be given 30 days’ notice, and white collar workers with more than 3 months of service to be given 90 days’ notice.

When an employee quits in Bolivia, the employer is required to compensate the employee for their pending salaries and indemnities for the duration of their employment up until the day of resignation. These indemnities amount to one month’s salary for each year worked.

Additionally, if an employee resigns after three months of continuous work, they are entitled to severance pay equivalent to one month’s salary for each year of service, including the final, incomplete year.

Biz Latin Hub can help you comply with Bolivia’s labor laws

A PEO will help companies recruit, hire, and manage their staff in Bolivia administrating and managing payroll processes each month so companies can focus on developing their business. Through a co-employment model, PEOs will hire staff on behalf of the company and ensure all labor obligations for these employees are met.

At Biz Latin Hub, we provide bilingual PEO and payroll management services with adequate and specific contracts for each employee of a company. We ensure employers meet all relevant labor requirements, reducing the risk of non-compliance and enabling companies to expand with the right talent in accordance with Bolivia’s labor laws.

Get in touch with us now to continue your operations from abroad with PEO support.

Learn more about our team and expert authors.