In our latest Q&A, Biz Latin Hub’s Luis Durán Jiménez, senior accountant in Costa Rica, discusses Outsourcing payroll in Costa Rica and what are the benefits of this service for your company.

Luis Rolando Durán Jiménez is a bilingual accountant (Spanish/English) with more than eighteen years of experience and a specialization in taxes from the Association of Private Accountants of Costa Rica. Throughout his career he has worked in various types of economic activities, mainly in the branch of professional, financial, administrative services and the rental of movable and real estate assets.

Since 2018, he has been notoriously involved in expanding the knowledge and scope of his profession and specialty, publishing in Blogs, advising and training colleagues, giving courses and talks within the Association itself and other institutions, as well as participating in Commissions for the Association and attending meetings with tax authorities of the country.

SEE ALSO: Register a Company in Costa Rica

Biz Latin Hub: What does outsourcing payroll mean?

- Processing only, in which the supplier is limited to receive the information of the employees on the payroll, the salary components to be included in the calculation, calculate both gross and net salary, generate or process the corresponding payment and finally report to the social security and tax authorities the gross wages earned. Additionally, it calculates the file for future liquidations or terminations, but does not legally assume any type of commitment to the employee regarding his or her labor rights.

- Taking the employee as one’s own: In this case, all the operational tasks of the previous point are carried out, but all the legal responsibilities of the employer are assumed, in the event of termination or labor conflicts.

Biz Latin Hub: What are the things a company should consider when choosing a payroll provider?

The most important aspects are in the field of experience and knowledge: a provider of this service with a team versed in labor matters, calculation of wages and other rights, will be of great support. Other desirable characteristics will be the handling of adequate programs for processing, banking contacts and depth of the team itself.

Biz Latin Hub: Why should companies consider outsourcing payroll in Costa Rica?

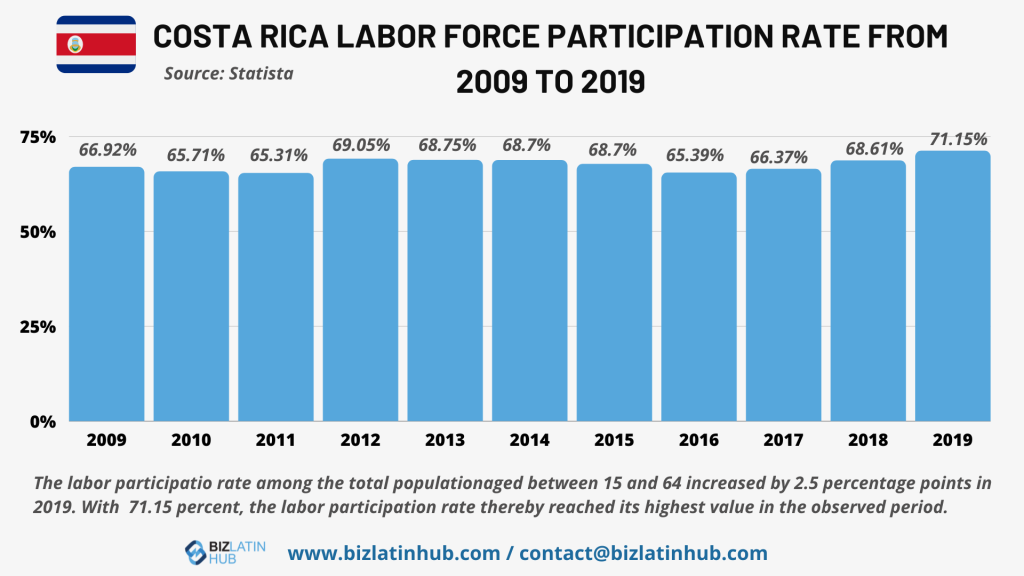

For foreign investors, knowledge of local matters is key and this can be provided by local specialists. Knowing the Costa Rican particularities in labor matters can take several months or even a couple of years, so it is advisable to use this service in any of the options mentioned above, to avoid future contingencies.

Biz Latin Hub: Is outsourcing payroll cost-effective?

Of course, hiring a competent payroll processing team can cost at least 3 times as much as outsourcing payroll processing. Hiring a competent payroll processing team can cost at least 3 times more than outsourcing this service. If, in addition to payroll processing, employees will also be hired under this same scheme, the protection guaranteed by the knowledge, avoids contingencies, not only legal but also cash flow, by providing the calculation of the corresponding labor provisions. For local companies, the reduction of the workload of their departments will allow resources and objectives to be focused entirely on the growth of the company and not on logistical issues.

Biz Latin Hub: What are the advantages of outsourcing your payroll in Costa Rica?

The main advantages of this scheme would be a greater knowledge of the labor market by having personnel with sufficient and proven experience in payroll, processing according to the legislation, both in time and in the application and reporting of deductions and other tax issues, prevention of labor and tax contingencies, banking relationships that facilitate interaction for account opening and other banking procedures (including payment) and labor with “local terminology”, support in the representation for records and consultations with labor, social security and tax authorities.

Biz Latin Hub: What are the risks associated with payroll outsourcing in Costa Rica?

Some of the appreciable risks are:

- The proper agreement is not made, being a legal risk and a detriment to the company that payments or hiring are not canceled in due time.

- The external agent lacks control or supervision over the contractor’s personnel.

- Vulnerability and loss of control when sharing sensitive business information with an external agent with no experience in handling confidential data.

Biz Latin Hub can help you outsource your payroll in Costa Rica

At Biz Latin Hub, we offer corporate legal services throughout Latin America, and have a lawyer in Costa Rica ready to assist you.

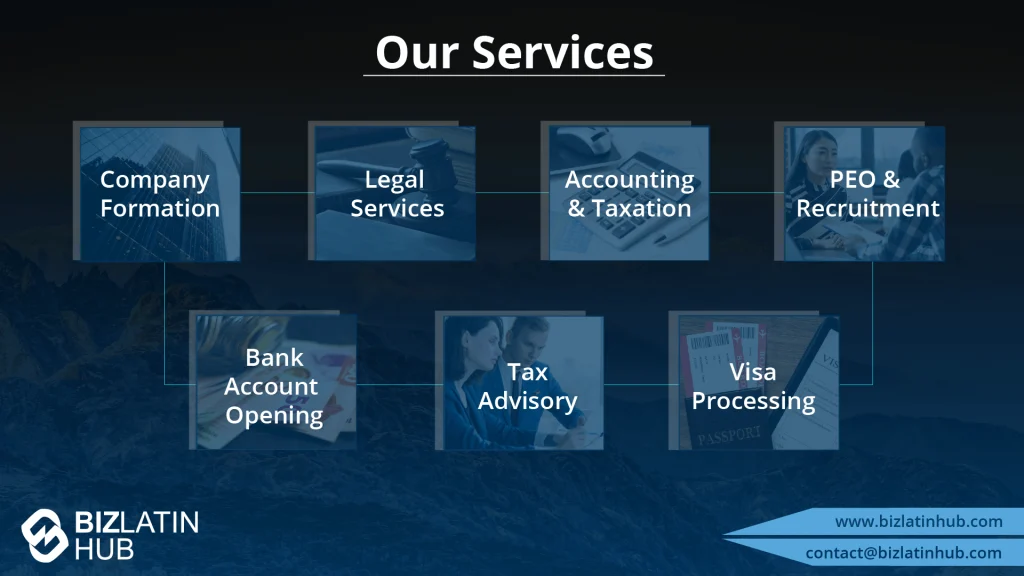

We are a professional services provider with a comprehensive portfolio of back-office services that also includes company formation, accounting & taxation, hiring & PEO, and visa processing, meaning we can tailor a services agreement to suit any need.

As well as in Costa Rica’s capital San José, we have teams in over 16 other key cities around Latin America and the Caribbean, and trusted partners in many others, meaning that we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Contact us today to find out more about how we can assist you.

Or read about our team and expert authors.