Uruguay’s stable economy and investor-friendly environment make it an attractive destination for foreign companies. However, managing employment and compliance can be complex without local expertise. A Professional Employer Organization (PEO) or Employer of Record (EOR) allows companies to quickly and legally hire employees without opening a legal entity. Biz Latin Hub provides expert PEO and EOR services tailored for seamless market entry into Uruguay from market entry to company formation in Uruguay.

Key Takeaways

| Is it legal to hire in Uruguay through PEO payroll services? | Yes it is legal to hire employees through a professional employer organization in Uruguay. |

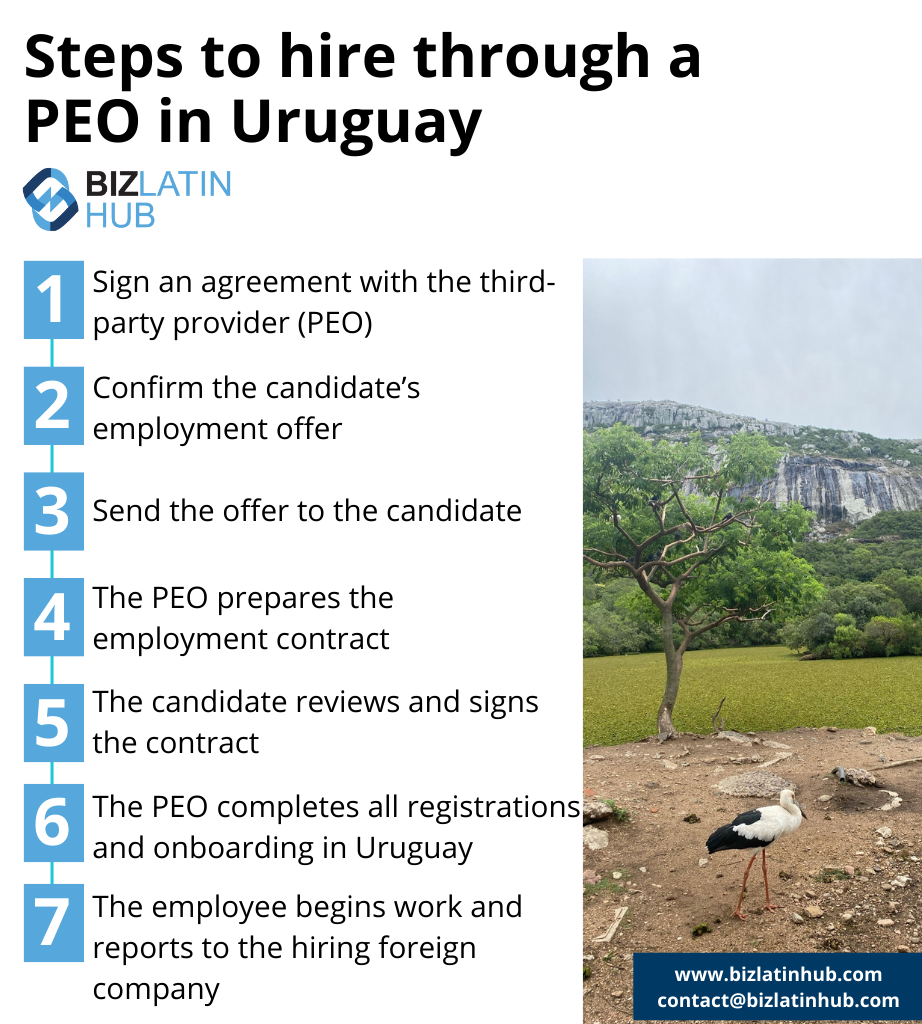

| Steps to hire through a PEO in Uruguay | Sign a service agreement with the third-party PEO. Confirm the employment offer for the candidate. Share the employment offer with the candidate. After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the employer. The candidate reviews and signs the employment contract. The PEO completes all required employee registrations with Uruguayan authorities. The employee starts work and reports to the hiring foreign company. |

| What are the working hours in Uruguay? | The Uruguayan Employment Act sets the standard workweek at 44 hours, distributed over five days. |

| What are the benefits of hiring through a PEO in Uruguay? | Outsourcing payroll to Uruguay and working with a trusted local providor takes away the hassle and ensures employees can be onboarded in days and not months. |

What Is a Professional Employer Organization (PEO) in Uruguay?

A professional employer organization (PEO) provides comprehensive assistance to companies with HR requirements, including recruitment, tax, and benefits payment. By using a PEO/EOR, the company outsources local staff recruitment, social security management, and payroll Uruguay, allowing you to concentrate on growing your business activities.

PEOs can help by hiring staff on behalf of your business, creating a ‘co-employment’ relationship. This makes the PEO/EOR the employer of record in the eyes of the government.

Key Advantages of PEO and EOR Services for Expanding into Uruguay

Expanding into the region with an existing PEO in Uruguay enables companies to make a smaller-scale investment in their market entry process. Hiring one or two employees in Uruguay is cheaper than setting up a permanent location through company incorporation.

Other benefits of hiring through a PEO/EOR in Uruguay include:

- Hiring the right people according to the profile required by the client.

- Apply and implement institutional policies in employment contracts.

- Pay staff in accordance with local law.

- Payment of national taxes and taking out compulsory employment insurance.

- Perform due diligence.

Simply put, a PEO in Uruguay can help foreign businesses navigate the complexities of hiring and managing staff in a new market, removing the burden of legal obligations and procedures that may be unfamiliar to them.

Benefits of Using PEO & EOR Services in Uruguay:

- Rapid hiring of skilled workers

- Full labor law and social security compliance

- No need to incorporate a company

- Streamlined HR and payroll processing

- Local expertise to reduce risk

- Flexible business scaling and exit options

- Support from bilingual legal and tax professionals

How to Partner With an Professional Employer Organization in Uruguay?

To partner with a PEO payroll providor in Uruguay, the hiring company enters into a contract with a third-party organization, appointing them as the professional employer Organization (PEO) for the staff they wish to hire in Panama. This arrangement ensures that, on official documentation in Uruguay, the third-party company (the PEO/EOR) is legally responsible for complying with all employment regulations for the employees.

This relieves the foreign company of the complexities of navigating Uruguyan labor laws independently. By reducing the risk of non-compliance, the foreign company can concentrate on business development and market growth.

The process of hiring an employee through an employer of record in Uruguay is simple and involves the following steps:

- Sign a service agreement with the third-party PEO.

- Confirm the employment offer for the candidate.

- Share the employment offer with the candidate.

- After the candidate accepts the offer, the PEO drafts the employment contract and assumes the role of the employer.

- The candidate reviews and signs the employment contract.

- The PEO completes all required employee registrations with Uruguayan authorities.

- The employee starts work and reports to the hiring foreign company.

What labor laws will a PEO/EOR in Uruguay cover?

In 2016, the International Trade Union Confederation (ITUC) rated Uruguay as one of the best countries in terms of workers’ rights. Uruguay was the only country in Latin America to receive the best possible rating by ITUC, and is in the same category as Germany, Finland, Iceland, or the Netherlands.

Even if you hire staff through a PEO in Uruguay, you should be informed about the key aspects of Uruguayan labor legislation, such as:

Employment contracts

- Indefinite duration contracts: There is no legal requirement to have a written agreement. However, we recommend signing a contract in order to clarify the terms and conditions of the employment relationship.

- Term contracts: It is mandatory to have a written contract when engaging in an indefinite employment relationship.

- Temporary or seasonal contracts: The law requires a written employment contract.

Termination of the Employment Relationship

In Uruguay, if an employer terminates an employee’s contract without a valid reason, it is called ‘dismissal,’ and compensation must be paid to the employee. There is no formal requirement for prior notice of dismissal under Uruguayan labor law. Generally, the employer is required to compensate the employee for dismissal unless the employee has engaged in notorious misconduct. A PEO in Uruguay can help your company conduct dismissals within compliance standards.

Resignation is the expressed wish of an employee to end the contractual relationship. The employer must pay liquidation pay. On the other hand, abandonment is the tacit wish of the worker not to continue with the labor relationship. Similar to what was mentioned above, a PEO in Uruguay will be able to effectively handle employee terminations and within legal frameworks to maintain compliance.

When expanding your company and hiring local employees through a PEO in Uruguay, it’s important to consider the benefits and rights entitled to employees in the country, including:

Working hours: Employees may work no longer than 8 hours a day. Employees may work between 44-48 hours a week,

Overtime in Uruguay refers to work exceeding the legal or conventional limit set for the employee’s activity and category. Payment for overtime is 100% of the regular hourly rate on working days and 150% on holidays. Less than 30 minutes of work is counted as half an hour, while more than 30 minutes is counted as one full hour.

Additionally, decree 611/80 establishes the cases in which overtime is exempted, e.g. “senior personnel of commercial, industrial and service establishments. Senior personnel are considered to be employees who hold positions above that of a section chief”.

Holidays and bonuses

Paid holidays/leave of absence: All employees working for private individuals or private companies of any kind, including domestic service, are entitled to at least 20 days’ paid annual leave.

Vacation Salary: All workers engaging in a private commercial activity receive a sum equivalent to 100% of the liquid vacation day. The employer must pay this before the beginning of the leave and in proportion to the corresponding days. A PEO in Uruguay can make sure your company compensates employees correctly and mitigates potential issues related to salary concerns.

Bonuses: Employees receive two installments of an annual bonus, known as the Annual Complementary Salary (SAC) or Aguinaldo, which is paid twice a year, in June and in December, and corresponds to the sum of the last 6 months of work divided by 12.

PEO vs. EOR: Which Is Right for Your Business?

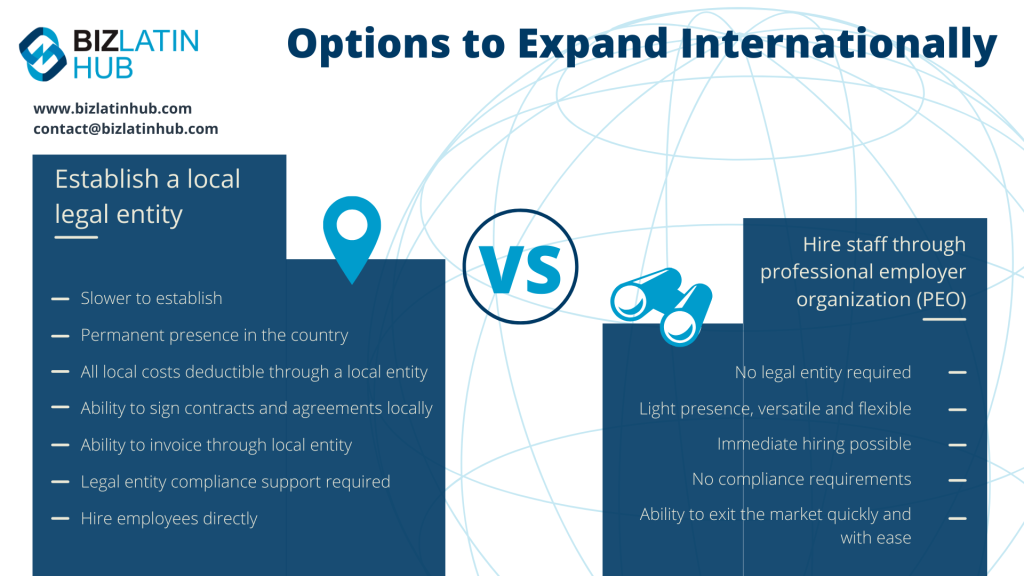

When expanding into Uruguay, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EOR arrangements are fully legal in Uruguay, which has been rated by the International Trade Union Confederation as one of the best countries for workers’ rights.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Uruguay. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Uruguay’s regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence, we can guide you through the process.

| Feature | PEO Uruguay | EOR Uruguay |

|---|---|---|

| Legal Employer | Client (entity required) | Biz Latin Hub (acts as legal employer) |

| Hiring Speed | Moderate | Fast |

| Compliance Responsibility | Shared | Fully handled by EOR provider |

| Best For | Companies with a local presence | Fast entry or short-term hiring |

| Contract Ownership | Company-employee | EOR-employee |

This overview makes it easy to evaluate whether a PEO or EOR suits your Uruguay expansion strategy.

How to Use a Payroll Calculator

If you are keen to get an idea of the possible costs involved in payroll outsourcing in Uruguay, using a payroll calculator is one way to get a very good estimate.

Because while a payroll calculator won’t be completely accurate, it will give you the opportunity to search according to the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our Hiring & PEO Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, based on that which is most convenient to you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Uruguay would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs when using a PEO/EOR in Uruguay

Based on our experience these are the common questions and doubts of our clients.

You can hire an employee by incorporating your own legal entity in Uruguay, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Uruguay by acting as the legal employer. This means you do not need an Uruguayan legal entity to hire local employees.

A standard Uruguayan employment contract should be written in Spanish (and can also be in English) and contain the following information:

-ID and address of the employer and employee

-City and date

-The location where the service will be provided.

-Employee position and responsibilities

-Payment frequency.

-Social benefits.

-Probation period

-Work hours

-Specific agreements or pacts.

The mandatory employment benefits in Uruguay are the following:

-Social Security Contributions (health, pension, reconversion fund, and IRPF)

-Vacation

-Holidays Bonus

-Christmas Bonus

The total cost for an employer to hire an employee in Uruguay can vary based on the salary; however, indicatively the employer cost for mandatory employment benefits is 12.7% of the gross employee salary, which is additional to the employee’s gross salary.

Please use our Payroll Calculator to calculate employment costs.

A PEO supports businesses with HR, payroll, and benefits management — but requires you to have a Uruguayan entity.

An EOR hires and manages employees on your behalf under local law — no local entity required.

EOR is best for fast market entry without legal setup. PEOs work for companies that already have a presence in Uruguay.While a PEO functions as co-employer, an EOR assumes the role of the formal employer for your staff. Typically, an EOR provides a wider array of services compared to a PEO.

Yes. Biz Latin Hub can help you transition your team as you grow and incorporate locally.

Yes. Biz Latin Hub ensures full compliance with Uruguay’s labor code, BPS (social security), and tax authority (DGI) obligations.

Why invest in Uruguay?

Uruguay’s impressive and sustained GDP growth since the turn of the millennium is noteworthy. The country achieved growth of 4.4% in 2022 and has maintained positive growth since 2003, reaching peaks of over 7% in 2005 and between 2008-2010 despite the global recession.

Additionally, Uruguay boasts a very high level of human development compared to other countries in the region. This not only provides investors with an abundance of excellent human capital but also offers residents a pleasant, flourishing society to live in. A quality PEO/EOR in Uruguay can assist your company in taking advantage of the highly skilled talent pool in the country and ensure your market expansion is a great success.

Biz Latin Hub can be your PEO/EOR in Uruguay

Understanding local laws, regulations, processes, and requirements is at the core of what we do at Biz Latin Hub. We help you reduce risk, simplify operations, and ensure a smooth launch into the Uruguayan market.

Working with a Professional Employer Organization (PEO) in Uruguay can be the perfect solution to hiring local staff when expanding your company.

Our team of professionals will help you to keep up to date with the new labor regulations that the government has recently implemented in Uruguay. We help our clients to comply with labor and social security regulations, determine payroll taxes and benefits, and perform labor due diligence among other services.

Contact us today to discuss how we can support you.

Learn more about our team and expert authors.