Despite the fact that Costa Rica does not maintain a fully dollarized economy, it is a country that allows the use of the dollar as commercial payment, however, does this method of payment apply to the salary of employees? Is payment in foreign currency legal? Being payed in dollars in Latin America is a trend that has been growing for a long time, and a growing question that has been going around is how does it work with cryptocurrencies? Could the payment of salaries in cryptocurrency work? If you’re thinking about registering a company in Costa Rica this might be of interest to you.

We spoke with Adriana Romero to know more about this, what are the benefits and how it could work. Adriana Salazar Romero is a trilingual (Spanish, English, and Italian) attorney and our Costa Rica’s Head of the Legal Department. In 2016 she graduated with the honorable mention Summa Cum Laude from the Foreign Affairs major and in 2022 she graduated from her second career with the honorable mention Summa Cum Laude in Law. Adriana has previously worked at top- tier law firms in Costa Rica, such as KPMG and ECIJA, as well as the Ministry of Foreign Affairs, where she developed her International Law skills. Her practices include providing legal advice in corporate law, contractual law, labor law, negotiation processes, preparation of contracts and international treaties, among others.

Biz Latin Hub: Can companies in Costa Rica legally pay their employees in foreign currency or cryptocurrency?

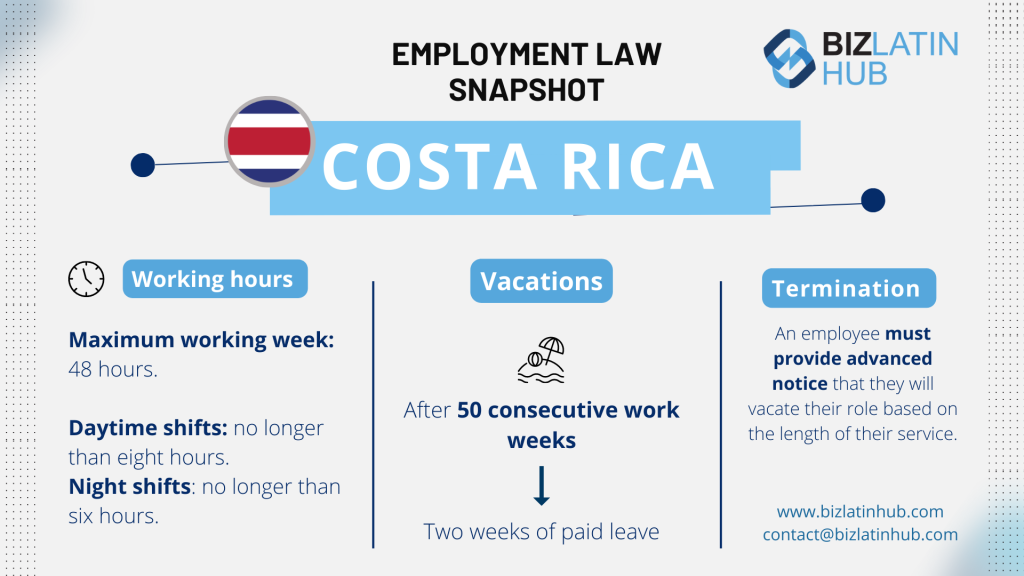

As for foreign currency salaries, the Labor Code, article 163 mentions “The salary will be freely stipulated, but it may not be less than the one that is set as a minimum.” Likewise, article 165 indicates “Salary must be paid in legal currency whenever it is stipulated in money.”, meaning that once contractually fixed, it can be maintained in the currency that the parties agree.

As for cryptocurrency, the use of this currency is allowed in Costa Rica. However it’s not legal, therefore employers can not pay their employees with cryptocurrency.

BLH: Are there any specific regulations or laws that companies must comply with when paying salaries in foreign currency or cryptocurrency in Costa Rica?

Yes, besides the Labor Code of Costa Rica, the pronouncement DAJ-AE-022-10 of February 24, 2010 of the Ministry of Labor and Social Security, mentions the regulations regarding salary payment in foreign currency.

The Organic Law of the Central Bank, number 7558, article 48 establishes the following: “The acts, contracts and obligations in foreign currency will be valid, effective and enforceable; but they may be paid at the option of the debtor, in colones computed according to the effective commercial value that, on the date of payment, had the foreign currency owed.”

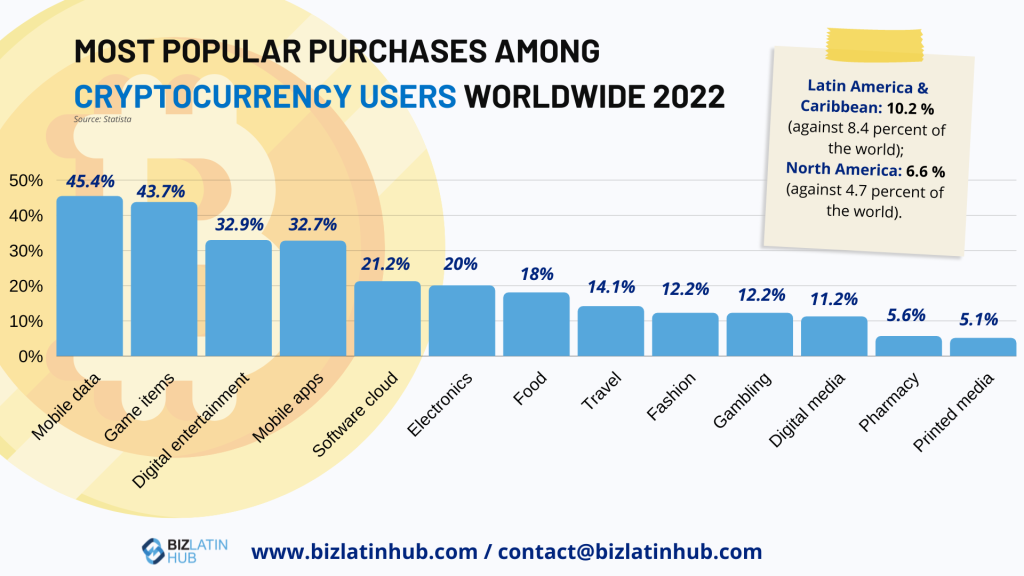

Regarding cryptocurrency there are no existing laws yet on the matter. The use of cryptocurrencies is allowed in Costa Rica, the investment in crypto assets would be protected by the principle of freedom (articles 28, 45 and 46 of the Political Constitution), however they do not represent legal currency money.

At the moment there is a legal file, number 23,415 called “Cryptoactive Market Law”, which seeks legality for the use and transfer of digital currencies in the country, promote the national territory as an investment center for providers of these and promote economic reactivation through the decentralization of the digital economy.

BLH: Are there any tax implications for employers who payment of salaries in cryptocurrency or foreign currency?

Employers must take into consideration that : the company’s labor and tax obligations must be calculated in colones, therefore they must calculate the exchange rate on each payment period, which may be a complex calculation at the end of each month.

BLH: Are there any restrictions on the types of foreign currency or cryptocurrency that can be used to pay salaries in Costa Rica?

As there are no legal prohibitions regarding the payment of salaries in foreign currency, any legal currency authorized by the Central Bank of Costa Rica will be allowed as salary if so agreed by the parties.

BLH: How does the company ensure that it is complying with all relevant laws and regulations when paying salaries in foreign currency or cryptocurrency?

For the payment of the salary in foreign currency, it must be taken into account that its value cannot be less than the minimum wage in colones.

BLH: Are there any benefits or drawbacks to payment of salaries in cryptocurrency in Costa Rica?

Among the advantages of paying your employees salary in dollars or another currency are:

- Savings: if the company receives its earnings in dollars, it would save the exchange rate on the salary payment in local currency.

- It’s easy: in Costa Rica all bank accounts can also be opened in dollars.

- Talent attraction: since more and more companies offer this payment method, it becomes a competitive option in the market.

However, companies must take into consideration the following disadvantages:

- Higher cost when canceling labor ends: settlements and layoffs must be paid to the employee in the same currency that his salary was paid.

- Complex calculation: the company’s labor and tax obligations must be calculated in colones, at the highest official rate for every payment period, showing the variances in monthly reporting to authorities.

- As payroll taxes, both income and social security, have to be paid in colones an exchange rate may occur when paying or making currency changes from dollars to colones, because commercial banks uses their lower exchange rate.

- Renegotiation of the employment contract in the event that the salary falls below the minimum due to the exchange rate.

BLH: Are there any additional procedures or paperwork required for paying employees in foreign currency or cryptocurrency?

There is no additional process in the payment of salary with foreign currency. In the case of cryptocurrencies, we will have to wait for what the bill determines and its due approval.

BLH: How does the company ensure that employees are aware of and understand the terms and conditions of being paid in foreign currency or cryptocurrency?

It is important to have stipulated in the Employment Contract the exact amount that will be paid in foreign currency, either partially or totally, and also to define if the payment of the Christmas bonus or other bonuses or benefits will also be in foreign currency.

Biz Latin Hub can help you with payment of salaries in cryptocurrency

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in San José, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about payment of salaries in cryptocurrency, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent or otherwise do business in Latin America and the Caribbean.

If this article on salaries in cryptocurrency was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.