Understanding Colombian employment and labor law is essential for companies hiring locally. This guide outlines key legal obligations under the Colombian Labor Code, including employee rights, employment contracts, working hours, severance pay, and social security contributions. If you want to register a company in Colombia, this guide will make sure you stay compliant.

Key Takeaways On Labor Laws In Colombia

| What are the working hours mandated by labor laws in Colombia? | Colombian labor law sets a maximum work schedule of 8 hours per day and 46 hours per week, not including overtime. |

| What is the Colombian minimum wage? | The current minimum wage as of January 2025 is COP$1,423,500 (aprox USD$330). |

| Types of Employment Contracts in Colombia | Fixed-term. Indefinite-term. Contracts for a set task. Occasional, accidental, or transitory contracts. Provision of services agreements. |

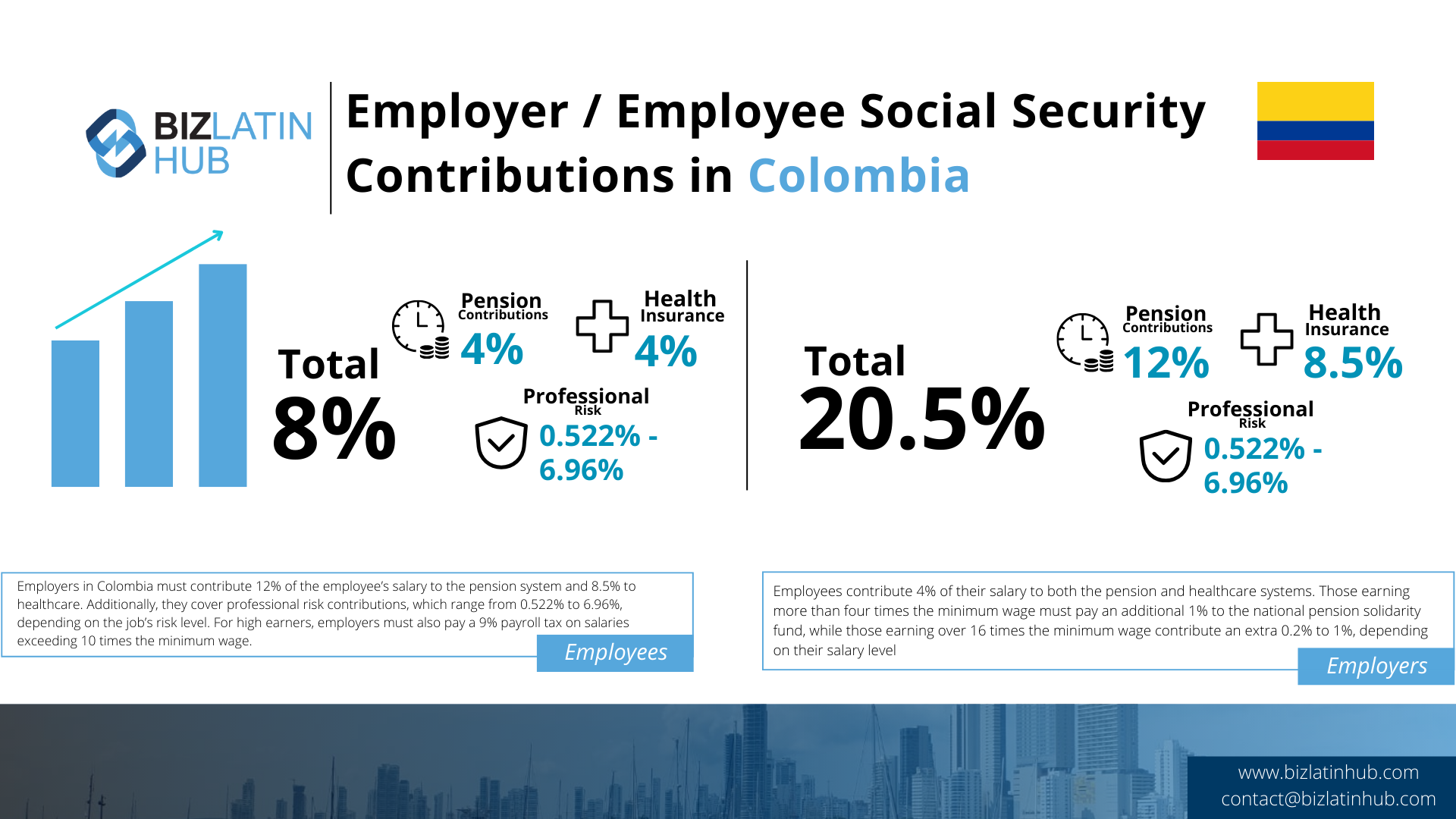

| What percentage of an employee’s salary is contributed to social security in Colombia? | Total contributions is roughly 28.5% of an employee’s salary, with employers covering 20.5% and employees contributing 8%. |

Who Is Protected by Colombian Labor Laws?

Colombian labor laws protect all resident employees, whether they work for local or international companies. Overseen by the Ministry of Labor, the regulations include specific requirements, such as adherence to work visa and reporting obligations through platforms like SIRE and RUTEC. Foreign nationals employed by Colombian-registered companies have the same rights as local employees, with exceptions only applying when a Colombian citizen is hired by an international company under a contract executed outside the country.

Employers must also comply with workforce composition rules, limiting foreign workers to 10% of general staff and 20% of specialized roles in companies with more than 10 employees. Foreign entities hiring in Colombia typically need to establish a local branch or subsidiary to meet payroll and social security obligations, ensuring compliance with labor laws and fair treatment of all employees.

Types of Employment Contracts in Colombia

There are five main types of contract that are used in Colombia, depending on the nature of the business and job someone is being employed for.

Fixed-term contracts

They can last for up to three years and extended for as long as needed. If the original contract lasts less than one year, it can be renewed for the same period of time, however any subsequent renewal must be for at least one year.

Under employment law in Colombia, fixed-term contracts include a trial period, which cannot last for more than two months. For contracts of less than one year, the trial period cannot last for more than one fifth of the contract.

Indefinite-term contracts

These run for an unspecified amount of time, either because of the nature of the role being undertaken, or because of an agreement between the employer and employee. Such a contract can only be terminated when both parties agree, or under circumstances established in the contract that allow one party to act unilaterally.

The trial period for an indefinite-term contract cannot last for more than two months and must be specified in the contract.

Temporary and occasional contracts

These are given for the fulfilment of a specific project. Such a contract must have markers or thresholds written in, or a specified endpoint, to clearly establish when the task will be completed and therefore when the contract ends.

The trial period can be agreed upon by the parties but cannot last for more than two months and must be specified in the contract.

Occasional, accidental, or transitory contracts

These are used when the work due to be completed falls outside the scope of the company’s standard activities and is generally provided for work that will be completed in less than one month. The intricacies of these contracts need to be fully understood in order to maintain compliance with employment law in Colombia.

Provision of services agreements

Commonly referred to as ‘prestaciones’ contracts, these can be established between a company and an individual contractor, and must involve the contractor working with a degree of technical and administrative autonomy.

A prestaciones contract has a civil character and therefore is not considered a labor contract subject to the same provisions under labor and employment law in Colombia. All risks associated with the role being undertaken are therefore assumed by the contractor.

Under such contracts, the employer is not responsible for managing employee deductions, while common benefits such as annual bonuses, paid vacations, and severance pay are also not included.

Note: For all contracts that last at least one year, other than prestaciones contracts, the employee is entitled to a ‘13th salary’ bonus, which totals one full month of salary and is distributed in two parts, one being mid-year and the other in December. A PEO firm in Colombia can help you navigate the Colombia labor laws and maintain compliance for various types of employment contracts.

Under Colombian employment law, all employees with labor contracts must be enrolled in the integral social security system, which includes the general pension system, health and social security systems, and the general system of professional risks. Contributions are based on the employee’s monthly salary and are capped at 25 times the monthly minimum wage. For 2025, the minimum monthly wage is set at COP$1,423,500, making the maximum contributory salary COP$35,587,500.

Contributions total approximately 28.5% of an employee’s salary, with employers bearing around 20.5% and employees contributing about 8%. These contributions are broken down as follows:

- Pension system contributions: 16% of the employee’s salary (12% employer, 4% employee).

- Health system contributions: 12.5% of the employee’s salary (8.5% employer, 4% employee).

- Professional risk contributions: Vary between 0.522% and 6.96% of the salary depending on job risk level, fully covered by the employer.

Additionally, employees earning more than four times the minimum wage (COP$5,694,000) must contribute an extra 1% to the national pension solidarity fund. Higher earners (those making more than 16 times the minimum wage, or COP 22,776,000) must contribute an additional 0.2% to 1% based on their salary. Employers must also pay a 9% payroll tax for employees earning over 10 times the minimum wage (COP$14,235,000), applied exclusively to salary items.

Employers operating in Colombia must fully understand and comply with these obligations to ensure adherence to local employment laws.

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Minimum Wage | Must pay at least COP 1,300,000 in 2025 | Right to legal minimum salary |

| Social Security | Register for pension, health, ARL, family compensation | Access to healthcare, pension, and insurance |

| Work Hours | Max 44 hours/week from July 2025 | Protected from excessive working hours |

| Paid Leave | 15 working days after one year of service | Entitled to use accrued vacation leave |

| Severance | Pay severance and legal benefits if dismissed | Protection from unfair dismissal |

Integral Salaries

An integral salary in Colombia is a comprehensive compensation package that includes base salary and mandatory benefits, such as fringe benefits and overtime payments, but excludes paid vacation allowance and the 13th salary bonus. For 2024, the minimum integral salary is set at COP$18,505,500, which is 13 times the monthly minimum wage of COP 1,423,500.

When calculating pension system contributions for employees with an integral salary, the contribution base is the lesser of 70% of the integral salary or 25 times the minimum monthly wage. This means that for 2024, the maximum contribution base is COP$35,587,500.

Therefore, employees earning an integral salary above approximately COP$46,428,571 per month in 2024 will have their pension contributions capped at the maximum contribution base of COP$35,587,500. Employers and employees should be aware of these thresholds to ensure accurate contributions to the social security system.

Working Hours and Overtime in Colombia

According to employment law in Colombia, the maximum a person should work is 46 hours per week and will drop to 44 in July 2025. Regular working hours consist of eight hours per day, for a maximum of six days per week.

For employees, employers are required to provide the “Día de Familia” and Recreational Days Off. Also, every Sunday is a mandatory rest day in Colombia, so those working six days per week will generally work on a Monday to Saturday schedule, however an employer can negotiate with their employees to elect a different rest day.

Note that in Colombia there are 18 national holidays per calendar year, with February and September being the only months of the year in which at least one national holiday is not observed. In general, those holidays fall on a Monday.

Paid Leave and Public Holidays

After one full year of service with the same employer, employees are entitled to 15 consecutive working days of paid vacation. Under employment law in Colombia, employees must take at least six of those days, but can only carry over any untaken vacation to the following year. Carrying over vacation must be done with the agreement of the company and can be altered at the discretion of both the employee and employer.

Maternity and Paternity Leave

Female employees are entitled to a total of 18 weeks of paid maternity leave, with the week before the due date being a mandatory leave period, guaranteed by employment law in Colombia. In the case of a premature birth, maternity leave will last for 18 weeks plus the difference between the due date and the day of birth. For example, in the event a baby is born one week early, maternity leave will last for 19 weeks. For multiple births, maternity leave is extended to 20 weeks.

For new fathers, eight days of paid paternity leave are provided, as long as the employee has been contributing to the Social Security System, which will reimburse paternity leave pay to the employer.

Bereavement

Under employment law in Colombia, employees are entitled to five days of bereavement leave in the event of the death of a parent, in-law, grandparent, sibling, child, spouse, or partner. With regards to kinship through adoption, this provision only applies to an adopted parent or child.

The employee’s company assumes all costs related to bereavement leave.

Voting Leave

Under employment law in Colombia, employees are entitled to half a day of personal leave to vote in local and national elections. Upon returning to their place of work, the employee must show their voting card to the employer to demonstrate they voted, and failure to do so will result in the time missed being docked from their salary.

Military Service Leave

In the event that an employee is called up for military service, their employment contract is deemed suspended. Under employment law in Colombia, the employee is obliged to allow the employee to resume the same job within 30 days of that service being completed.

Note that military service in Colombia can last either one or two years, depending on the type of service chosen by the employee.

Trade Union Leave

Colombian labor law dictates that employees are entitled to personal leave in order to serve on a trade union committee. They are also entitled to leave for other trade union purposes, but they must provide adequate notice to the employer, and their absence should not adversely affect the business.

How can an EOR Strategy Keep you Compliant?

For anyone planning a short-term market entry, or who only needs a small number of local employees, and therefore seeks to hire via an employer of record in Colombia, one of the key advantages of the service beyond avoiding the need to form a local entity is the fact that compliance with local employment law will be guaranteed as part of your services agreement. An Employer of Record, also known as a EOR, can help your company remain compliant and up-to-date with reforms and regulations within the company.

Common FAQs about Employment Law in Colombia

In our experience, these are the common questions and doubtful points of our clients.

1. What are the labor laws in Colombia?

In Colombia, labor laws dictate a 46-hour workweek, overtime regulations, minimum wage, paid vacations, sick leave, maternity and paternity leave, workplace safety, and union rights. Termination requires a valid reason, possibly including severance pay.

2. What are the working conditions in Colombia?

Working conditions in Colombia include a 46-hour workweek, one day off per week, paid vacations, social security, and healthcare benefits. Adherence to these regulations may vary across industries.

3. What is the legal working week in Colombia?

As of July 2025, Colombia’s legal working week is 44 hours, reduced from 48 under Law 2101 of 2021. It will drop to 42 hours in 2026. Overtime must be paid for excess hours.

4. What is the minimum salary in Colombia?

As of January 2025, the minimum wage in Colombia is COP1,423,000, approximately USD$330/month.

5. How is overtime paid in Colombia?

Overtime is paid at 125% of the regular wage. Night overtime (9:00 p.m. to 6:00 a.m.) and work on Sundays and public holidays are paid at 175%. Overtime is capped at 2 hours per day, or 12 hours a week.

6. How are dismissals regulated under Colombian law?

Dismissals must be based on just cause (Article 62, Labor Code) or else require payment of legal indemnities. Termination processes must be documented, and some require Ministry of Labor approval.

7. How is severance pay calculated in Colombia?

If terminated without just cause, the employee is entitled to:

- Severance pay

- Interest on severance

- Pro-rated vacation and bonuses

- Legal indemnities (based on tenure and salary)

In both scenarios, adherence to legal procedures and proper documentation are essential to ensuring compliance with Colombian labor laws. Consulting with a legal expert or labor attorney is often advisable to navigate the complexities of employment termination in Colombia.

8. What happens when an employee quits in Colombia?

An employee can quit without a notice period. The employer must pay outstanding wages, accrued vacation, and other legally required benefits.

9. Can foreign companies hire Colombian workers directly?

No. Companies must set up a legal entity or use an Employer of Record (EOR) to legally hire and pay Colombian employees.

10. What social security payments are required in Colombia?

Employers must contribute to:

Pension (12%)

Health (8.5%)

Occupational risk (ARL)

Family welfare entities (SENA, ICBF, Family Compensation Fund)

These payments are in addition to gross salary and are compulsory.

11. Is a written employment contract mandatory?

Yes. Written contracts are required for fixed-term and temporary jobs. While indefinite-term contracts may be verbal, a written agreement is highly recommended to clarify terms and meet compliance under the Labor Code.

12. Are 13th-month bonuses required by law?

Yes. Employees must receive a prima de servicios, equal to one month’s salary annually, paid in two equal parts in June and December.

13. How much paid vacation are workers entitled to?

After 12 months of service, employees receive 15 working days of paid annual leave. Unused leave may be carried forward within limits.

Why Choose to Hire Employees in Colombia?

Hiring local employees in Colombia offers international investors a strategic advantage due to the country’s skilled and cost-competitive workforce. Colombia boasts a growing pool of professionals with expertise in sectors like technology, finance, and manufacturing, supported by strong university programs and vocational training. Employing local talent also enables businesses to navigate the cultural and linguistic nuances of the Colombian market, fostering stronger connections with clients and partners while improving operational efficiency.

Additionally, hiring locally ensures compliance with Colombian labor laws, mitigating legal risks and enhancing a company’s reputation as a responsible employer. By contributing to the local economy through job creation and tax payments, international investors can also benefit from incentives such as tax breaks and government-backed workforce development programs. These factors make Colombia an attractive destination for businesses seeking growth in Latin America.

At Biz Latin Hub, our multilingual team of corporate support specialists has the knowledge and expertise to support you in doing business in Colombia. Our comprehensive portfolio of services, including company formation, accounting, tax advisory, and hiring & PEO, means we can provide tailored packages of integrated back-office solutions and be your single point of contact for doing business in Colombia, or any of the other 17 markets around Latin America and the Caribbean where we have local teams in place.

Contact us now to discuss how we can support your business.

Or learn more about our team and expert authors.