Banking services are an essential part of the journey to incorporate a company in Colombia. Some of the bureaucracy and administration in the process can be challenging but without one you will not be issued a business license. This guide is built from our experience that can help you prepare for this essential process. Colombia’s banking sector is modern and digital-first, with reliable services available for local and foreign companies. Understanding regulatory expectations is key.

Key takeaways on how to open a corporate bank account in Colombia

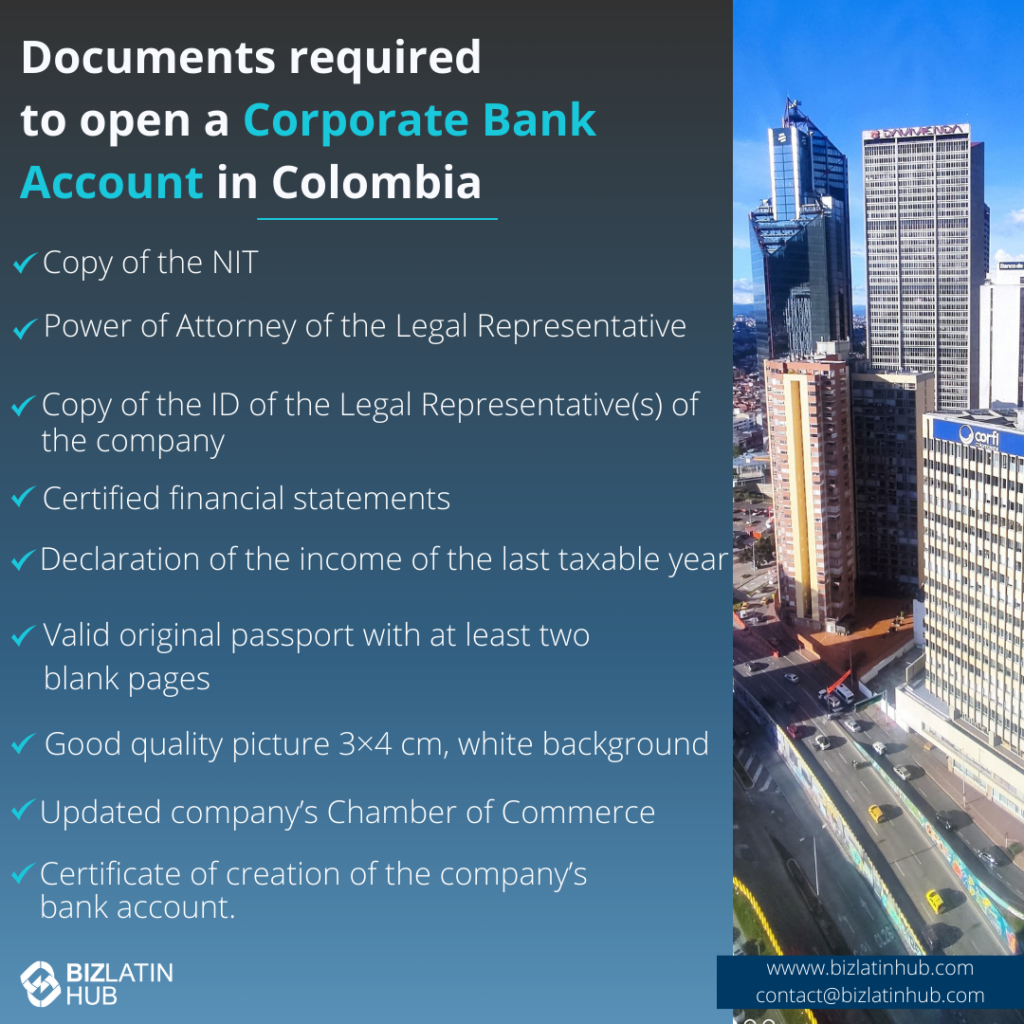

| What documents are necessary when opening a corporate bank account in Colombia? | Copy of the NIT (Número de Identificación Tributaria). Power of Attorney of the Legal Representative. Copy of the ID of the Legal Representative(s) of the company. Certified financial statements. Declaration of the income of the last taxable year. Valid original passport with at least two blank pages. Good quality picture 3×4 cm, white background. Updated company’s Chamber of Commerce showing authorized, subscribed and paid capital over 100 SMLMV (COP$100,000,000 / USD$27,000). Certificate of creation of the company’s bank account. |

| Which banks are best to open a corporate bank account in Colombia? | Banco de Bogotá Bancolombia Davivienda Banco Popular HSBC Citibank JPMorgan Chase BBVA |

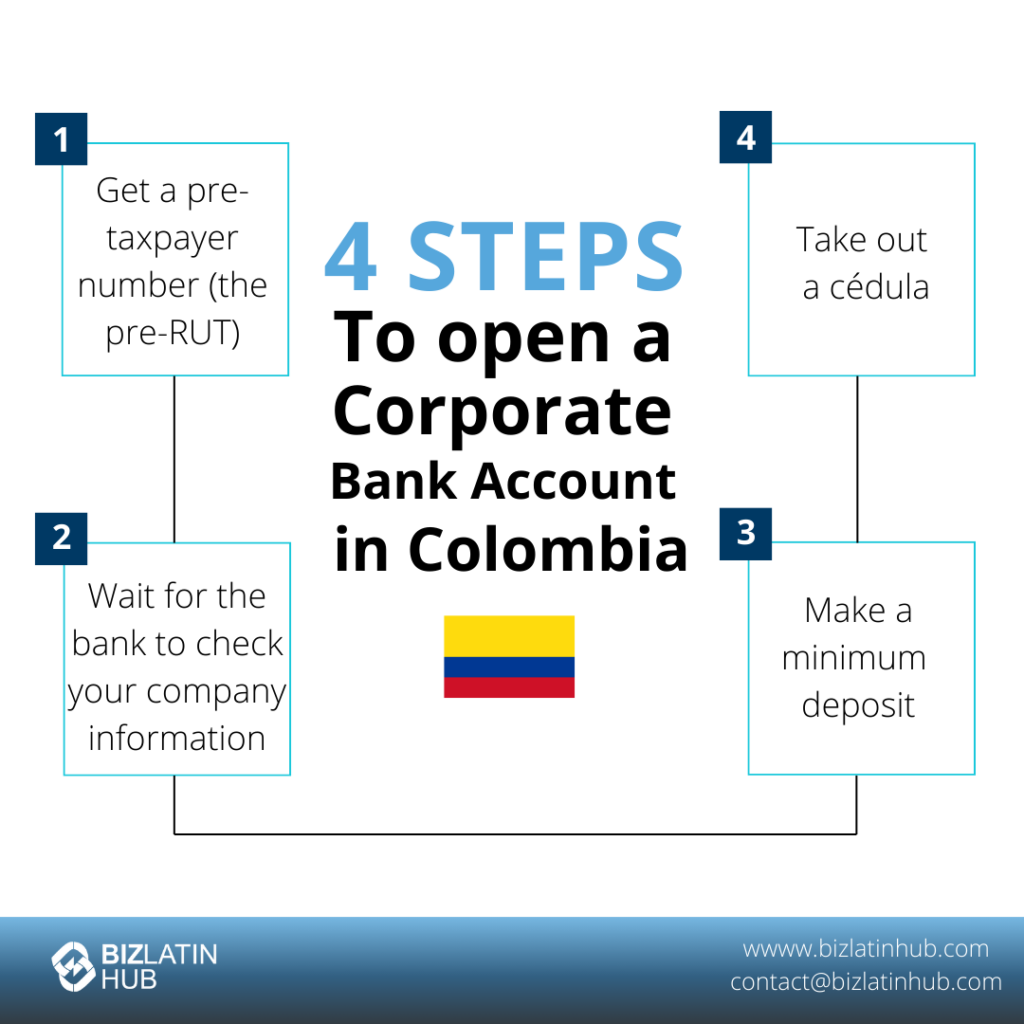

| The four step process to open a corporate bank account in Colombia: | Step 1 – Get a pre-taxpayer number (the pre-RUT). Step 2 – Wait for the bank to check your company information. Step 3 – Make a minimum deposit. Step 4 – Take out a cédula. |

| Do all banks have the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

Step-by-Step Account Opening Process

Once you have chosen a provider to bank with, you are ready to begin the process of opening a corporate account. In Colombia, this process can be summarized into five steps: get a pre-taxpayer number, wait for the bank to check your company information, make a minimum deposit, and take out a cédula.

Once you have completed each of the steps and your corporate bank account is established, the DIAN will issue the permanent tax ID for your corporation. At this point, you are ready to begin business operations.

To open a bank account in Colombia you must follow these 4 steps:

- Step 1 – Get a pre-taxpayer number (the pre-RUT).

- Step 2 – Wait for the bank to check your company information.

- Step 3 – Make a minimum deposit.

- Step 4 – Take out a cédula.

Below is more information on each of the steps outlined above.

1. Get a pre-taxpayer number (the pre-RUT)

As your first step, you will need to get a pre-taxpayer ID number (the pre-RUT) from the DIAN. (RUT stands for Registro Único Tributario.) The DIAN is the tax and customs authority in Colombia.

Once you have obtained the pre-RUT, you should present it to the provider of your choice, along with the additional required documentation and ask that they open a corporate account for your company.

2. Wait for the bank to check your company information

Once the bank has received the pre-RUT and other necessary documents, it will check your company information and verify that the funds you are depositing were acquired legally. This process can take a few days (or longer).

To avoid problems, be sure that you understand all the rules regarding wire transfers. The wire transfer process is heavily regulated in Colombia, and failing to take the proper steps could result in investigation and fines, as well as extra time, stress, and frustration.

You can also expect a background check, just like when you open a personal bank account. The bank will see that you have no outstanding warrants or unpaid bills. Certain criminal histories, such as those relating to drug trafficking, money laundering, and other financial crimes, could result in your account application being denied.

3. Make a minimum deposit

Once the bank has approved your company as a customer, you will be required to make a minimum deposit. The minimum deposit requirement will vary from bank to bank. Take this into account when choosing where to open an account.

4. Take out a cédula

In most cases, to open a company bank account in Colombia, you will need a Colombian identification card, the cédula. (This is also the case when opening a personal bank account.)

There are some exceptions to this rule, for example, if you are employed by a Colombian company and are receiving regular payments, you can open an account with a foreign passport. Using a foreign passport to open a bank account in Colombia involves complications.

If you are intending to stay in Colombia long-term to run your business, then you will need a cédula, especially if you are working. Biz Latin Hub has extensive experience in providing visas, bank accounts and cédulas. In fact, we specialize in helping businesses set up while minimizing the amount of stress they go through.

Corporate Bank Account Requirements for Foreign Companies

Opening a corporate bank account in Colombia involves navigating through various legal and financial requirements specific to the country’s banking system and the tax and accounting requirements in Colombia.

Colombian banks follow Unidad de Información y Análisis Financiero (UIAF) rules. All companies must register for tax and legal presence prior to opening an account.

In terms of documentation, you will need:

- Copy of the NIT (Número de Identificación Tributaria).

- Power of Attorney of the Legal Representative.

- Copy of the ID of the Legal Representative(s) of the company.

- Certified financial statements.

- Declaration of the income of the last taxable year.

- Valid original passport with at least two blank pages.

- Good quality picture 3×4 cm, white background.

- Updated company’s Chamber of Commerce showing authorized, subscribed and paid capital over 100 SMLMV ($100.000.000 COP / USD 27.000).

- Certificate of creation of the company’s bank account.

Please note that these requirements may vary depending on the bank.

Best Colombian Banks for Businesses

There are several local and international banks in Colombia that provide good options for foreign companies looking to open corporate accounts. Ultimately, the bank you choose will depend on your particular business needs. However, these are some popular options:

- Banco de Bogotá

- Bancolombia

- Davivienda

- Banco Popular

- HSBC

- Citibank

- JPMorgan Chase

- BBVA

Our recommendation: You should choose a bank with good international relations. Banks such as Banco de Bogota and CitiBank are excellent choices in the Colombian banking sector, known for their wide range of financial products and services tailored to the needs of both domestic and international companies.

Comparison Table:

| Feature | Colombia | Peru | Ecuador |

| Minimum Deposit | $300–$1,000 | $500 | $500 |

| Account Opening Time | 2–3 weeks | 2–3 weeks | 2–4 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Limited | Rare |

Additional FAQs About Corporate Banking in Colombia

Based on our extensive experience, these are the common questions and doubts of our clients about opening a company bank account in Colombia:

1. Can I open a corporate bank account online in Colombia?

No, you can not open a bank account online as all documentation must be signed with wet ink and delivered to the bank both digitally and physically. We always recommend appointing a legal representative based in Colombia because some of the required actions must be performed before the branch in a physical branch of the bank.

2. What documents do I need to open a company bank account in Colombia?

Normally, the bank will ask for the application form, the articles of incorporation, and the identification documents of the shareholders and legal representatives. If the bank sees it relevant, they will ask for additional documents.

3. Who can have access to a company bank account in Colombia?

Bank account access can be granted by the account owner through the virtual platform of the bank with a physical security token device. Some banks in Colombia will provide an online platform in both Spanish and English, but most are only in Spanish.

4. What is the best bank in Colombia for foreign companies?

In most cases, we recommend using one of the larger banks which have significant experience with international commerce, provide a broad service offering, and have a large number of branches and ATMs. These banks are Banco de Bogotá, Bancolombia, and BBVA.

5. Why do companies open bank accounts in Colombia?

A bank account is a must for all companies in Colombia. The bank account will allow you to complete operations, including paying taxes, payroll, local suppliers, and all domestic transactions.

6. Does Colombia have banking secrecy?

Yes. Banking secrecy is a constitutional right in Colombia.

7. Can a foreign company open a Colombian bank account without visiting?

Typically no. Banks often require in-person validation by a legal representative, though some allow local proxies.

8. Are there any currency restrictions?

No major restrictions, but all foreign currency inflows must be registered through the Central Bank system.

9. How long does it take to open an account in Colombia?

The average timeline is 2 to 3 weeks depending on completeness of documentation and the bank’s internal process.

Business Banking in Colombia – Key Advantages

Opening a bank account in Colombia is a critical step for investors, offering seamless access to one of Latin America’s fastest-growing economies. It facilitates transactions in Colombian pesos, reduces the costs of international transfers, and ensures compliance with local financial regulations, making it indispensable for investments in sectors like energy, agriculture, and technology.

A local account also boosts credibility with Colombian businesses and authorities and provides access to financial services tailored to the country’s dynamic economy. It enables investors to navigate Colombia’s regulatory landscape effectively, adapt to market conditions, and take advantage of the nation’s expanding opportunities, ensuring a solid foundation for success.

Biz Latin Hub can help you open a corporate bank account in Colombia

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge of how to open a corporate bank account in Colombia, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in Latin America and the Caribbean. Or read about our team and expert authors.