Latin American economies continue to perform strongly despite rising inflation, ongoing logistic issues, and Russia’s invasion of Ukraine. But there are significant challenges for companies looking to enter this developing market. One is understanding the complex issue of withholding taxes in Latin America.

To help you gain better insight into tax advisory in Latin America, and simplify this important issue, we have created this short guide below to understand withholding taxes in Latin America. This will make sure you do not accidentally infringe local law.

Biz Latin Hub can help you avoid these pitfalls and make sure that you stay fully compliant with withholding taxes in Latin America. Our array of market leading back-office services are designed to do just this and allow you to focus on what you do best – growing your business. And with a network of 18 offices across the region, we can help you anywhere in Latin America and the Caribbean.

What are withholding taxes in Latin America?

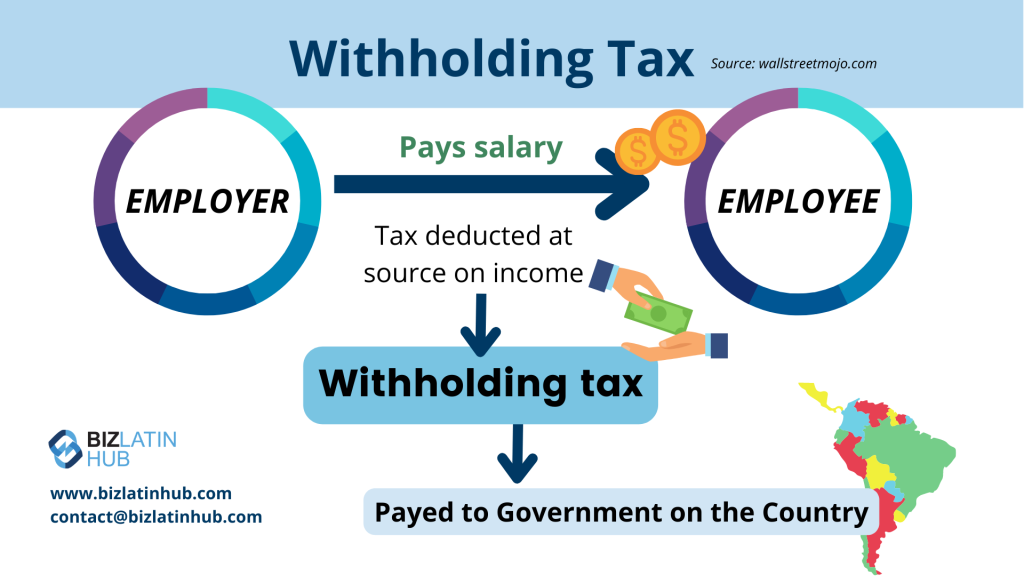

Put simply, withholding tax is a government requirement for the buyer of goods or services to deduct a specific amount from the payment made to the supplier. The withholding amount is then submitted to the tax authority.

Withholding tax is usually calculated as a percentage of the net amount of the sale. When it comes to value-added tax (VAT) withholding, it can also be calculated as a percentage of the VAT amount. It should be noted that other calculation methodologies exist. Unfortunately, while simple in theory, some countries in Latin America have multiple forms of withholding taxes, tares, and procedures.

Effectively managing withholding taxes in Latin America demands a firm, high-level comprehension of various country-specific withholding tax regulations. You must also understand the challenges and risks of not following the rules, which could lead to significant fines.

Withholding taxes in Latin America: A close-up on 5 countries

Let’s focus on five large countries in the region, some of which have the most complex withholding taxes in Latin America.

- Argentina.

- Brazil.

- Mexico.

- Colombia.

- Chile.

1. Argentina

Argentina has one of the most complicated tax systems in the world.

It levies withholding (WHT) and collection taxes across various levels of government, including federal, provincial, and municipal. Moreover, these taxes are imposed across nearly all tax categories, such as income tax, VAT, and turnover tax.

Almost all goods and services are subject to the federal income tax withholding regime. Interestingly, nearly all registered taxpayers are required to serve as withholding tax agents. The tax is due at the time of payment.

The rates for VAT withholding differ depending on the type of goods or services being provided, with percentages ranging from 50 percent for the sale of goods and certain construction services, up to 100 percent for “blacklisted” taxpayers identified by the authority as high risk.

The penalties for non-compliance are significant, as they can be up to ten times the unpaid tax amount owed to the tax authority.

2. Brazil

The tax system in Brazil remains one of the world’s most complex while also constantly changing. For instance, it is home to over 80 different taxes. It is important to understand that indirect taxes and VAT withholding taxes are only applied to services. In Brazil’s withholding tax framework, the location of the transaction and the parties involved are crucial factors.

In general tax systems, the responsibility for paying taxes associated with a business fall on the seller or service provider. However, in the case of withholding taxes, it is the buyer or service acquirer’s responsibility to calculate, retain, and pay taxes imposed on the transaction on behalf of the seller or service provider.

3. Mexico

In contrast to Argentina and Brazil, Mexico has a more straightforward approach to its tax system. Income tax withholding generally applies to payments made by entities to individuals for professional services. Like Argentina and Brazil, local entities serve as the withholding tax agent, and withholding is triggered upon payment. The WHT rate is 10 percent, and it applies to the net amount of the transaction.

4. Colombia

The Colombian tax system provides for withholding tax as a general mechanism of advanced tax collection. According to the law, all corporate entities are typically required to withhold or collect taxes from payments made to third parties.

The collection agents for WHT must collect the applicable amounts, deposit the withheld funds with the authority, file monthly WHT returns, and provide WHT certificates to the payees. Payees who file corporate income tax (CIT) returns can credit the withheld taxes against their annual CIT liability calculated on their returns.

Foreign non-resident persons are taxed on their Colombian-source income only. Generally, the full tax liability accruing on payments made to foreign non-resident persons is satisfied via the collection of the applicable WHT. The WHT rate on payments made to foreign non-resident persons for royalties and taxable interest is 20%, while administrative expenses are taxed at 33%.

5. Chile

The withholding tax is an annual tax that impacts individuals or companies that are not residents of Chile and is levied on their entire taxable income. In most cases, non-resident taxpayers are only subject to tax on their income sourced in Chile. Income is considered to have its origin in Chile when it is generated from assets situated in Chile or from activities carried out within Chilean borders.

Income derived from Chilean sources includes the capital gains acquired from selling shares or rights in a foreign non-resident entity that owns shares or rights in a Chilean entity. In addition, the profits distributed from Chilean companies or branches to non-resident shareholders, partners, or parent companies are subject to a 35% withholding tax.

Nevertheless, non-residents are entitled to a tax credit against the withholding tax that they must pay, which is equal to the corporate tax paid by the company. The tax credit can be either 65% (Partially Integrated System) or 100% (Small and Medium Enterprises System) depending on the tax regime the company has chosen.

Biz Latin Hub can assist you with withholding taxes in Latin America

Biz Latin Hub can give you peace of mind regarding withholding taxes in Latin America.

We offer a fully integrated, multilingual team of legal, accounting, and company formation services for your business plans in Latin America, and the Caribbean.

With wholly-owned subsidiary offices located throughout the region, we have the expertise to answer your questions and help you achieve your business goals.

To learn more about how we can help you with withholding taxes in Latin America and more, talk to our experienced team today.