Before entering the territory, it’s crucial to have a good grasp of the annual entity compliance in Honduras and the broader regulatory framework. Investors should be aware of these financial regulations before company formation in Honduras, as non-compliance could lead to legal challenges and financial penalties. Financial regulatory compliance is a significant aspect of overall corporate compliance. This overview is designed to assist you in navigating the legal landscape. This guide details the statutory maintenance required to keep a Honduran company active with the Chamber of Commerce and Municipality.

Key Takeaways: Annual Corporate Compliance in Honduras

| Is a physical address in Honduras necessary for doing business? | Yes, a registered office address or local fiscal address is required for all Honduran entities to receive legal correspondence and governmental visits. |

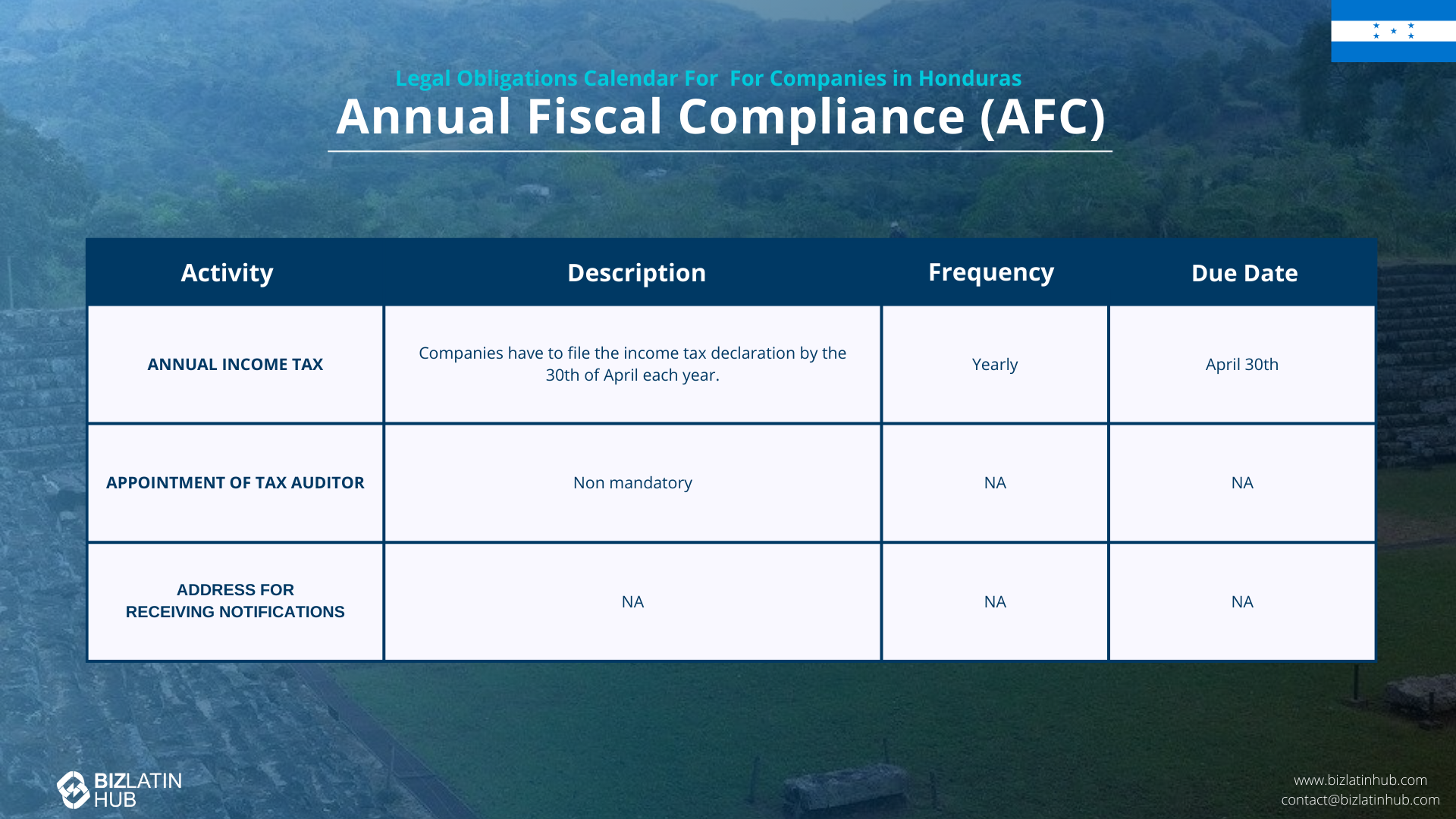

| What are the annual entity fiscal compliance requirements? | Yearly submission of financial statements and tax returns |

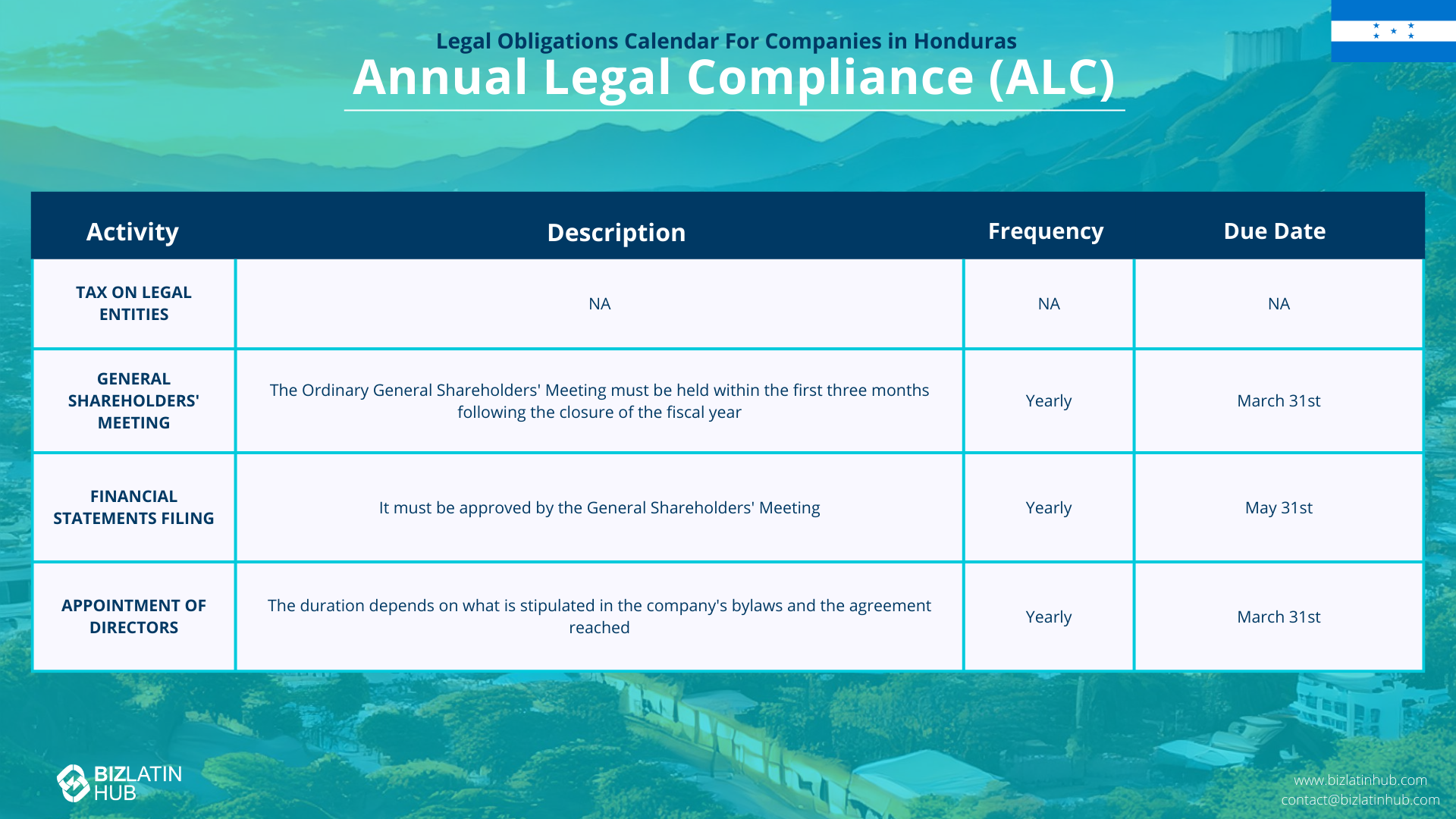

| What are the annual Entity Legal Compliance Requirements? | Meticulous upkeep of current corporate records Organization of regular shareholder meetings, usually conducted on an annual basis. Furthermore, board meetings and annual shareholder meetings that involve the following aspects must be disclosed to financial authorities as part of entity annual compliance |

| What common statutory appointments do companies make in Honduras? | An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country. |

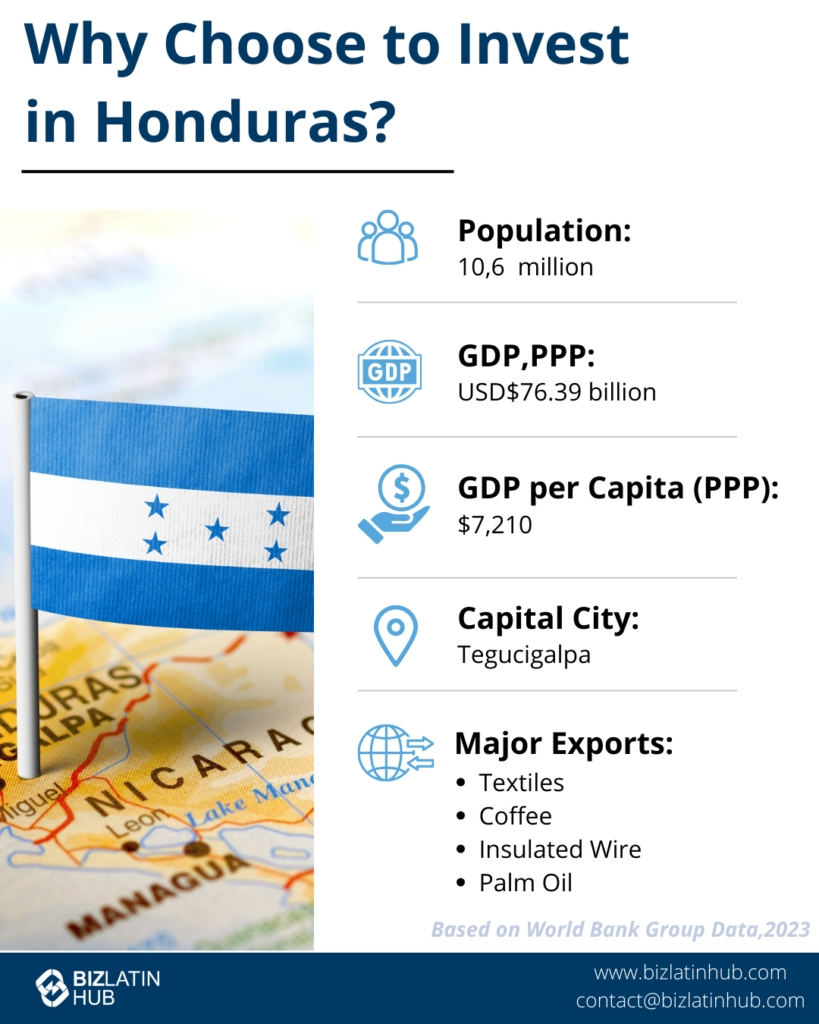

| Why Choose to Invest in Honduras? | There is a wide array of opportunities for investors in industries like textiles, agricultural productions and call centers. |

| When is the deadline for filing the annual income tax return? | Companies in Honduras have to file their income tax declaration by the 30th April each year. |

| Are any permits necessary? | An annual municipal operating permit is required to conduct business. |

Key Corporate Compliance Requirements in Honduras

In Honduras, businesses are have a number of regulations pertaining to operations, aiming to guarantee both legal adherence. These requisites include:

- Yearly submission of financial statements and tax returns

- Meticulous upkeep of current corporate records

- Organization of regular shareholder meetings, usually conducted on an annual basis.

Additionally, companies must conform to the stipulations outlined in the Honduran commercial code concerning corporate governance. The stipulations mandate tasks such as appointing a legal representative, and, depending on the company’s scale and nature, constituting a board of directors.

1. Holding Shareholder Meetings

There are two types of shareholder meetings required by law:

- Ordinary Shareholder Meeting: This meeting must be held at least once a year, within the first three months following the close of the fiscal year. Its purpose is to approve the financial statements, appoint or ratify the management body, and address other routine matters.

- Extraordinary Shareholder Meeting: This meeting is convened to make decisions on specific matters that are outside the scope of the ordinary meeting. This includes modifications to the company’s deed of incorporation, a change of legal representative, or the dissolution of the company.

Furthermore, board meetings and annual shareholder meetings that involve the following aspects must be disclosed to financial authorities as part of entity annual compliance:

- Presentations are given

- Job appointments are made

- The company’s financial status is reported

- Profits or losses are discussed

- Other similar activities

Expert Tip: Documenting Shareholder Meetings

From our experience, inadequate documentation of shareholder meetings is a common compliance issue. It is not enough to simply hold the meeting; you must create detailed minutes in Spanish that are recorded in the official, sealed corporate books. These minutes serve as legal proof of corporate decisions. We recommend having a legal professional review the minutes before they are officially recorded to ensure they meet all requirements of the Honduran Commercial Code and will be accepted by the Mercantile Registry without issue.

2. Maintaining Corporate and Accounting Books

Your legal representative will be tasked with maintaining corporate and accounting dates in good order. Honduran accounting standards mandate that companies prepare their financial statements in Spanish, following International Financial Reporting Standards. Accounting records and books must also be maintained in Spanish.

The Impuesto Sobre Ventas (ISV) or VAT is 15%, with a increased rate of 18% on certain luxury goods. ISV returns must be filed monthly through the SAR’s online portal by the 10th. Electronic invoicing is mandatory for large taxpayers and is being extended to other categories. Corporate tax returns are due by April 30 annually. Payroll contributions must be submitted monthly, and the 13th salary is due in December.

3. Fulfilling Tax Obligations

In Honduras, the fiscal year runs from January 1st to December 31st. To start commercial operations, companies must have a unique taxpayer registry, which is obtained via the ATV portal of the Ministry of Finance.

The main taxes that must be declared and paid are:

| TAX | DETAILS |

| Income Tax | This annual tax is levied on income from capital, labor or a combination of both |

| Sales Tax | Applied in a non-cumulative manner on imports and the sale of goods and services |

| Municipal Taxes | This local tax is levied on income from capital, labor, or a combination of both |

4. Renewing the Municipal Operating Permit

An annual municipal operating permit is required to conduct business. This must be applied for and renewed on an annual basis. To renew the municipal operating permit, a company must present its certificate of good standing from the tax authority (constancia de solvencia fiscal) and proof of up-to-date payment of municipal taxes. This permit must be renewed annually in the municipality where the company operates.

Expert Tip: Aligning Renewals

From our experience, the renewal of the Mercantile Registry often gets blocked because the Municipal Solvency hasn’t been obtained yet. There is a sequence: 1) Pay Municipal Taxes (January), 2) Obtain Municipal Solvency, 3) Renew Mercantile Registry (deadline usually within first few months). We advise clients to prioritize municipal payments in January to ensure the chain of renewals proceeds smoothly.

Types of companies in Honduras

In Honduras there are a variety of company types, but the most commonly used are the following:

- Corporations – A corporation exists under a name and has capital divided into shares. The partners are responsible for the payment of what they have subscribed.

- Limited Liability Companies – A limited liability company exists under a corporate name. The partners are only required to pay their contributions, and are not responsible for the financial liabilities or the debt of the company as a whole.

- Branch of foreign company – The foreign parent company regulates the rules and assumes the responsibilities before third parties.

Requirements for corporation formation in Honduras

If you have not yet set up a corporation in Honduras, you must complete the following steps:

- Obtain a certificate of registration of the foreign company in its place of origin.

- Agree on the appointment of a permanent legal representative in Honduras.

- Ensure that the documents confirming the above are of recent date, duly notarized, and where appropriate, translated into Spanish.

The Role of the Mercantile Registry

The Mercantile Registry in Honduras, managed by the local Chamber of Commerce, is the official body where companies are registered. All significant corporate actions, such as the appointment of a new legal representative or changes to the company bylaws approved in a shareholder meeting, must be officially registered here to be legally valid.

What labor regulations are there in Honduras?

Foreign companies doing business in Honduras must comply with labor regulations, which include:

- Providing employees with a trial or probationary period that cannot exceed 60 days and must be paid

- Payment to employees of at least USD$305 per month, which is Honduras’ national minimum wage

- Payment to employees of fourteen monthly salaries (12 regular monthly salaries, plus the June bonus payment and Christmas bonus paid in December)

- A standard workday of eight hours

- Entitlement of 10 days of paid vacation per year

To meet entity annual compliance in Honduras, companies must also provide their employees with social security. The employer/employee contributions are as follows:

- The employer covers 10.66 percent of the employee’s salary to monthly social security payments

- The employee must contribute 6.5 percent of their salary to monthly social security payments

Municipal Solvency

In Honduras, the “Solvencia Municipal” is a critical document. It proves the company has paid its local taxes. Without a valid Solvencia, the company cannot clear goods at customs, renew its Mercantile Registry, or bid on government contracts. It is the key that unlocks other administrative processes.

FAQs on entity legal compliance in Honduras

Based on our extensive experience these are the common questions and doubts of our clients on entity legal compliance in Honduras:

The following are the most common statutory appointments for Honduran legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or local fiscal address is required for all Honduras entities to receive legal correspondence and governmental visits.

Companies in Honduras have to file their income tax declaration by the 30th April each year.

The Ordinary General Shareholders Meeting must be held within the first three months following the closure of the fiscal year in Honduras and by the deadline of March 31st.

The main taxes that a company must declare and pay in Honduras are the following:

Income tax: This annual tax is levied on income from capital, labor, or a combination of both.

Sales tax: Applied in a non-cumulative manner on imports and the sale of goods and services.

Municipal taxes: This local tax is levied on income from capital, labor, or a combination of both.

To renew the municipal operating permit, a company must present its certificate of good standing from the tax authority (constancia de solvencia fiscal) and proof of up-to-date payment of municipal taxes. This permit must be renewed annually in the municipality where the company operates.

The main taxes include the corporate income tax, which is a flat rate of 25% on net profits, and a sales tax (ISV) of 15% on most goods and services. Companies may also be subject to an asset tax if it exceeds their income tax liability.

An Ordinary Shareholder Meeting is held annually to approve the previous year’s financial statements, review the general manager’s report, and appoint auditors. An Extraordinary Shareholder Meeting is called only to address specific, urgent matters such as modifying company bylaws, appointing a new legal representative, or increasing company capital.

Yes, a foreigner can be the legal representative of a Honduran company. However, the foreigner must obtain legal residency in Honduras to fulfill this role. This is a key consideration for foreign investors when structuring their management team.

The company enters a status of non-compliance. While it may not be immediately dissolved, it will be blocked from registering any new acts (like a change of director) and cannot obtain certificates of good standing.

Biz Latin Hub can help you with entity annual compliance in Honduras

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about entity annual compliance, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise doing business in Latin America and the Caribbean.

If this article about entity annual compliance in Honduras was of interest to you, read about our team and expert authors.