Barbados is a beautiful island. Businesses find more than sun and sand here. Company formation in Barbados offers stable government. Its legal system is dependable. Its workforce is skilled. These qualities make Barbados a prime spot for business. The financial services sector is strong. Barbados gives businesses key advantages. Its tax laws and international agreements create these benefits. International companies operate well here. This guide details the primary advantages that make Barbados an attractive and competitive destination for foreign investment and international business operations.

Key Takeaways: Doing Business in Barbados

| What are the main advantages of doing business in Barbados? | The country has a stable political system and a well-developed infrastructure and Barbados offers a low corporate tax rate for international business. |

| What is the most common legal entity for foreign investors? | An IBC, or International Business Company. |

| Does Barbados have a network of double taxation treaties? | Yes, most notably with Canada. |

Key Advantages for Doing Business in Barbados

1. A Favorable Tax Environment

Barbados offers a competitive, low-tax regime for international businesses, with corporate tax rates ranging from 1% to 5.5%. This allows companies to maximize their global profits.

Expert Tip: Leveraging the Double Taxation Treaty Network

From our experience, a key but often underutilized advantage of Barbados is its extensive network of double taxation treaties (DTTs), including a prominent treaty with Canada. These treaties prevent income from being taxed twice (once in Barbados and again in the investor’s home country).

For international corporations, structuring investments through a Barbadian IBC can be a highly effective way to reduce the overall tax burden on cross-border transactions like dividends, interest, and royalties. We advise clients to seek professional tax advice to see how Barbados’s treaty network can be leveraged for their specific international structure.

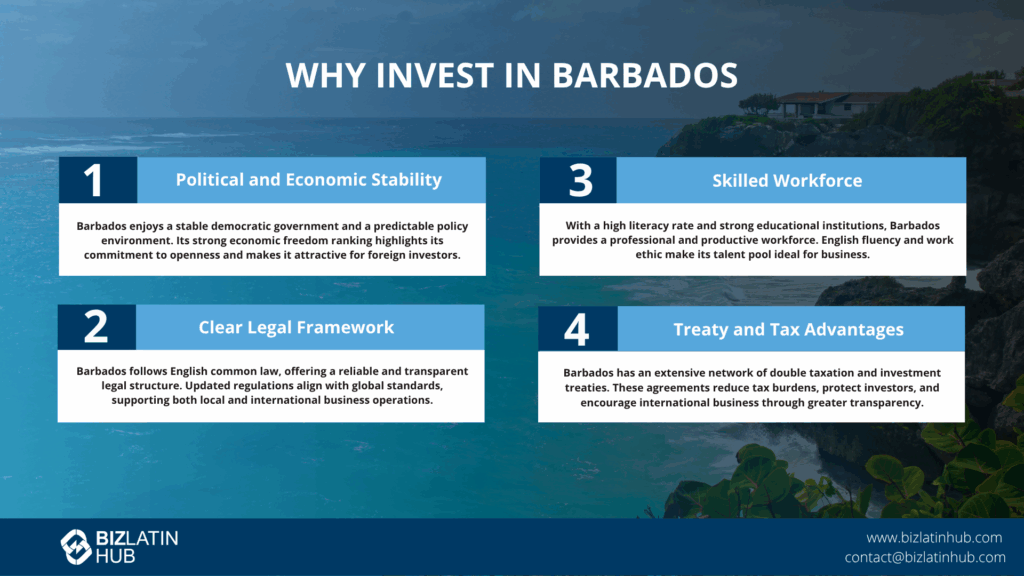

2. A Stable and Well-Regulated Jurisdiction

The country has a long tradition of political stability and a respected regulatory framework. It is not considered a “tax haven” and complies with international transparency standards set by the OECD.

3. A Skilled Workforce

Barbados boasts one of the highest literacy rates in the region and has a well-educated, English-speaking workforce, particularly in the areas of finance, law, and tourism management.

4. Gateway to International Markets

The country has a strong network of double taxation treaties and bilateral investment treaties. This, combined with its good infrastructure, makes it an effective hub for managing international business operations.

Barbados Business Environment: An Overview

Barbados presents a welcoming scene for businesses. It attracts both local and international companies. Foreigners can start companies in Barbados. They can do this with a visa or a residence permit. Digital platforms make business registration simple. New businesses can establish quickly. Key industries grow well in Barbados. These include:

- Financial services

- Tourism

- Technology

- Renewable energy

The Barbados International Business Association (BIBA) is important. It helps promote international trade and investment. Invest Barbados is an economic development agency. It plays a big part in attracting and keeping international investment. It gives useful information and support to investors.

Stable Politics and Economy

Barbados benefits from a stable political climate. Its democratic government ensures this stability. This creates a predictable setting for policy decisions. Businesses find this setting helpful for their operations. Barbados’s legal system follows English common law. This system provides a dependable base for business activities. The 2025 Index of Economic Freedom reports Barbados’s economic score as 68.9. This score places its economy 36th globally for freedom. This improved ranking shows a strong commitment to economic openness. Foreign investors notice this positive feature. Barbados serves as a key link to the Americas. This location boosts its appeal for companies looking to expand. All these factors make Barbados an excellent choice for business.

Clear Legal System

Barbados has a well-defined legal and regulatory system. This system supports business activities. The country has laws that help businesses, like the Firms Act. The International Business Companies Act was once central. Now, the laws for international business have changed. Newer laws and changes, like the Companies (Amendment) Act, have replaced much of the old IBC Act. These new laws meet current international standards. However, specific licenses and rules for international business are still very important. The legal system is like the British common law system. Barbados offers a clear legal structure. This structure meets international standards. It covers rules for tax, labor, environment, health, and safety. Both foreign and local investors get clear instructions for following rules. This builds a trustworthy setting for business. This clear legal structure helps business growth and investor belief.

Skilled Workers Available

Barbados has a very skilled workforce. Its literacy rate is historically high. The 2020 UN Human Development Report stated it was 99.6%. You should check the latest figures. The education system is strong. Institutions like the University of the West Indies produce many graduates each year. English is the official language. Everyone speaks it. People are learning other languages like Spanish and French. This is common in the tourism industry. However, English is the main language for business. The workforce is known for a strong work ethic and professionalism. This leads to high productivity. Many students graduate from secondary school each year. You should check official sources for exact numbers. This ensures a steady supply of new talent. Businesses can find capable and fresh workers.

Key Areas for Investment

Barbados offers exciting investment areas. The Government of Barbados promotes the island as a top investment spot. Invest Barbados leads this effort. Key investment areas include:

- Financial services

- Renewable energy

- Tourism

Political stability and a dependable legal system make Barbados more attractive. The country has many skilled workers. These workers are vital for the technology and renewable energy fields. The Barbados International Business Association (BIBA) also plays a big part. It helps increase international trade. This trade supports corporate, financial, and insurance services.

Financial Services

Barbados provides a structured setting for international banks. These banks must meet certain official rules. Banks must form under the Companies Act. They also need licenses under current financial services laws. Examples include the Financial Institutions Act or the International Financial Services Act. Always note new law updates. Following these rules is very important. Not following them can lead to serious penalties. Penalties can include losing licenses or work permits. The island follows international financial and auditing standards. It has strict rules against money laundering. To start an international business entity, you must give detailed information. This includes facts about business activities and shareholders. This information is filed under the Companies Act and related license rules. The Central Bank of Barbados helps the government with economic plans. This strengthens Barbados’s financial services sector.

Real Estate Potential

Real estate in Barbados is a good investment. The tax system is favorable. Here are typical parts of the real estate tax system. (Important: Tax rates and rules can change. Always check with official government sources for the latest information.)

- Transfer Tax: Historically about 2.5% on property sales.

- Stamp Duty: Historically about 1%.

- Capital Gains Tax: Usually, individuals do not pay capital gains tax on property.

- Gift, Inheritance, or Estate Taxes: Usually, none.

- VAT on real estate services: The standard VAT rate (like 17.5%) might apply to some services.

This tax system has historically drawn investors to property. Good quality of life also makes investing in Barbados real estate attractive. Incentives, like duty-free options for reducing manufacturing costs, add to the appeal.

International Business Companies (IBCs)

The idea of International Business Companies (IBCs) in Barbados has changed. In the past, IBCs were main tools for global business. They formed under the Companies Act. They got licenses under the International Business Companies Act. They had to do business only internationally. They could not trade locally. They needed an International Business Licence. This system has changed a lot. The changes help Barbados meet international standards. Companies doing international business still need the right licenses. They must follow the Companies Act and specific financial services laws. But the “IBC” name and its old specific law are mostly gone. They are now part of a wider, compliant company structure. Barbados’s rule system still supports international business entities. It helps them operate effectively in global trade. It also ensures they follow current local and international laws.

Barbados’s Treaty Network Advantages

Barbados offers a strong treaty network. This network benefits international businesses and foreign investors. The country’s business-friendly system includes double taxation treaties. It also includes investment treaties and a competitive tax system. Barbados has many double taxation agreements (DTAs). These DTAs make tax treatment clear. They help investors avoid paying taxes twice on international income. Bilateral investment treaties (BITs) offer protection. They guard against unfair government seizure of property for cross-border investments. Barbados’s tax and investment treaties allow lower withholding taxes on some types of income. This makes international investments more attractive. The island nation also shows its commitment to transparency. It does this by joining tax information exchange agreements.

Bilateral Investment Treaties

Bilateral investment treaties in Barbados help protect foreign investments. The country has BITs with several important nations. These treaties promote and safeguard investments across borders. They give legal safety and protection to foreign investors. BITs make Barbados a more appealing business center in the Caribbean. They work with double taxation agreements. They simplify investing. They do this by lowering risks of cross-border business. BITs, a competitive tax system, and many double taxation agreements make Barbados a special place for international investment.

Taxation Treaties

Barbados has many treaties. These treaties support a good tax environment. Barbados signed the Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI). This action aligns Barbados with global standards. The country’s double taxation agreements (DTAs) clarify tax rules. They reduce the chance of paying taxes twice on income. These agreements also help lower withholding taxes. This makes business across borders more efficient. Barbados’s bilateral investment treaties add to its taxation treaties. They give more protection for investments across borders. The large network of DTAs and BITs, plus a competitive tax system, makes Barbados an attractive place for foreign investment in the Caribbean. Barbados also shows its dedication to financial transparency through tax information exchange agreements.

Tax System for Global Business

Barbados has appealing corporate tax rates. These rates attract global businesses. The system for specific incentives and exemptions has changed. It now aligns with global standards against harmful tax practices, like OECD BEPS projects. The current corporate income tax uses a sliding scale. It starts at very low rates for all companies. The system focuses on transparency and following rules. These rates encourage international business and foreign investment.

Key Tax Features

- Competitive Corporate Tax Rates: A main feature is the low, tiered corporate income tax rate. This rate applies to all companies.

- Industry-Neutral Approach: The changed system treats industries more equally with taxes. It moves away from specific past exemptions.

- Double Taxation Agreements (DTAs): Many DTAs exist. These agreements stop double taxation. They help cross-border investments.

- Bilateral Investment Treaties (BITs): Barbados is part of various BITs. These treaties promote and protect foreign investments.

Taxation Overview

| Tax Aspect | Description |

|---|---|

| Global Income Tax | Companies based in Barbados usually pay taxes on their worldwide income. However, methods exist to prevent double taxation on international income. |

These tax advantages make Barbados a strategic location for international companies. They create a good environment for business growth.

Establishing a Business in Barbados

To start a business, foreign investors typically form an International Business Company (IBC). This structure is designed for international activities and benefits from the low-tax regime. The incorporation process is efficient and involves registering the entity with the Corporate Affairs and Intellectual Property Office (CAIPO).

Starting a company in Barbados involves clear steps. These steps are for both local and foreign investors. Barbados usually does not require a minimum amount of capital for many company types. This makes the country good for new businesses and established ones. The first steps to start a company include:

- Choosing a unique company name.

- Preparing the required documents.

- Filing these documents with the Corporate Affairs and Intellectual Property Office (CAIPO).

This simple process helps establish Barbadian companies. It also promotes international business projects. (Important: Company start-up fees can change. Check CAIPO’s current list for exact costs. Basic fees have usually been affordable.)

Efficient Legal and Regulatory System

Barbados has a dependable legal and regulatory system. It is based on British common law. This system creates a clear and open environment for businesses. It meets international standards. This ensures rules are followed. It also protects the interests of foreign and local investors. Key laws like the Firms Act and the Companies Act (with its updates) make business dealings simpler. They also help economic growth. As stated before, the specific laws for international business have changed. They now meet current global standards. Government bodies like the Ministry of Finance and Invest Barbados are important. They help keep this system efficient. They offer a reliable legal setting for foreign investments and international companies.

Steps to Start a Business

Starting a business in Barbados follows a set order. This order ensures legal and procedural correctness:

- Request Name: First, file a Request for Name Search and Name Reservation form with CAIPO. This secures your company name.

- Foreigner Eligibility: Foreigners can start a company. They can do this even with a Barbados visa or residence permit.

- Prepare Documents: You must prepare the Articles of Incorporation. Other needed documents are also essential. This applies when forming a Limited Liability Company (LLC) or other company types.

- File with CAIPO: Filing these documents with CAIPO finishes the process.

The cost to start a company usually includes basic registration fees. (Check with CAIPO for current specific fees.) This allows both residents and international businesses to set up efficiently in the Barbadian market.

Infrastructure and Support Institutions

Barbados has good infrastructure. This infrastructure supports business operations. Key features are:

- Modern Telecommunications: A fibre-optic network and high-speed 4G LTE data services provide vital, smooth connections.

- Efficient Transport Network: An international airport offers direct flights to big destinations. These include the USA, Canada, UK, and Europe.

- Stable Utilities: Businesses can rely on essential utilities. These include 110v/50 cycle electricity and dependable service facilities. This ensures smooth operations.

The country is known for its competitive tax system. Helpful international tax treaties with countries like the U.S., Canada, and the U.K. support this. The Barbados government works to improve business infrastructure. This includes updating the Corporate Registry. It also ensures tax benefits meet international standards.

Role of the Barbados Chamber of Commerce

The Barbados Chamber of Commerce and Industry is very important for local business. This private group represents its members and the wider business community. It offers key resources like company lists and networking events. These resources help businesses operate. The chamber actively improves the business environment. It creates more trade opportunities in the area. Members get good handling rates at a special airport facility. This is through work with the Customs Department at Grantley Adams International Airport. The chamber also acts as an information center. It gives insights into the business climate. It connects with others to help Barbados’s economy grow.

Services of Invest Barbados

Invest Barbados helps international businesses start and grow. It gives advice and support to investors. It is a key government agency for economic development. Its job is to attract and keep international investment. It does this by promoting Barbados as a top business spot. The agency offers support specific to each investor’s needs. This ensures initial investments last and grow. Invest Barbados also acts as the main link between the government and investors. This simplifies the company start-up process. Invest Barbados helps foreign and local businesses succeed by creating a good business environment.

Barbados Stock Exchange

The Barbados Stock Exchange (BSE) is important. It helps create wealth efficiently in the Caribbean. It started under the Securities Exchange Act of 1982. It became the BSE again in 2001. The stock exchange is a privately owned nonprofit group. It has a two-part electronic trading system. This system includes a regular market and a market for innovation and growth.

To list on the regular market, companies must meet certain rules. Historically, this included having assets of a minimum value (around 500,000 USD). (You should check current specific rules with the BSE.) The BSE also educates investors. It shares trading reports and market news. This helps people make informed investment choices and supports economic growth.

Strategic Location

Barbados has a key strategic location in the Caribbean. Its position provides excellent connections to major world markets. This makes it an appealing place for business expansion. The island is a gateway to North America, South America, and Europe. This gives companies a good base to reach international markets. This geographic benefit helps businesses find growth and export chances. It makes the country more attractive as a strategic center in the Americas.

Access to Major Markets

Barbados has good connections to big markets. These markets are in North America, South America, and Europe. This geographic benefit makes the island a natural link to the Americas. It attracts businesses that want to grow internationally. As a central point, Barbados lets companies reach a wide network of profitable markets.

Access to these key markets makes Barbados more appealing. This is true for new businesses and large companies. Businesses can grow their operations efficiently. They can reach global customers from a strategically good base. This helps international business run smoothly.

The strategic location of Barbados makes it a top choice. Foreign investors and international businesses prefer it. Its market access is a big factor for companies. These companies want a strong presence in the Americas and other regions.

Focus on Sustainable Economic Development

Barbados is dedicated to sustainable economic development. The Barbados Investment Development Corporation (BIDC) historically helped local companies. It helped them increase exports. (Its role may have changed. Export promotion is often now part of Invest Barbados or other agencies.) This help included market development aid. Through such work, Barbados encourages investment from the Caribbean. This approach uses chances within the Caribbean Community (CARICOM) and the Caribbean Single Market and Economy (CSME).

Barbados also draws international businesses through Invest Barbados (IB). IB is an economic development agency. It encourages international investment. This work drives economic growth and sustainability. The government offers a competitive tax system. It also offers business support services to international companies. These actions make Barbados a good place for business operations.

Strong governance improves Barbados’s economic stability. The country’s legal framework uses English common law. This system ensures dependable and clear business conditions.

Barbados Economic Sectors:

- Tourism

- Renewable Energy

- Traditional Agriculture (with more focus on unique, high-value items)

Supportive Structures:

- Agencies like Invest Barbados for local business growth and international investment.

- Industry groups and the Chamber of Commerce.

In short, Barbados successfully mixes local and foreign investment. This creates a lively and varied economy. The country’s strategic plans and support systems continue to advance sustainable economic development.

Consumer Behavior and Market Trends

Barbados has a stable political and economic climate. This creates a market environment that attracts local and international goods. Consumers in Barbados prefer high-quality, sustainable, and new products. This preference shows the country’s high living standard and educated workforce. Businesses should match their products and services with these consumer values. This will help them stay competitive. Barbados is a mature business location. It ensures open transactions. This builds consumer trust and keeps the market stable.

Local Buying Habits

Barbadian buying habits mix local customs and global trends. Consumers often choose products and services that offer high quality and sustainability. A desire for environmentally friendly products shows the need for sustainable options. Value-added tax (VAT) on online buys also shapes consumer choices. Sellers from other countries must handle VAT collection for goods and services sold in Barbados. A higher VAT rate on some services, like certain telecommunication services, can affect consumer costs. (For example, mobile services historically had a 22% VAT. You should check current specific rates.) The cost of living is higher than the world average. Still, the market shows these clear buying habits. Affordability is a factor in consumer choices.

New Business Opportunities

Barbados is a promising place for business growth. This is especially true in technology and renewable energy. The country’s business-friendly climate and stable economic policies make it a strategic link to the Americas. In this setting, agencies like Invest Barbados help local companies increase their export sales. They do this by using opportunities in the Caribbean Community (CARICOM) and the Caribbean Single Market and Economy (CSME). The Barbados International Business Association (BIBA) also plays a key part. It helps with trade and investment in corporate, financial, and insurance services. The country’s GDP is a factor. (You should confirm current GDP figures for 2023 or later with official sources like the Central Bank of Barbados or the Barbados Statistical Service. A GDP around $6.72 billion was noted for 2023, but this needs current verification.) A high education level also makes Barbados more attractive to investors. It offers a strong base for business projects.

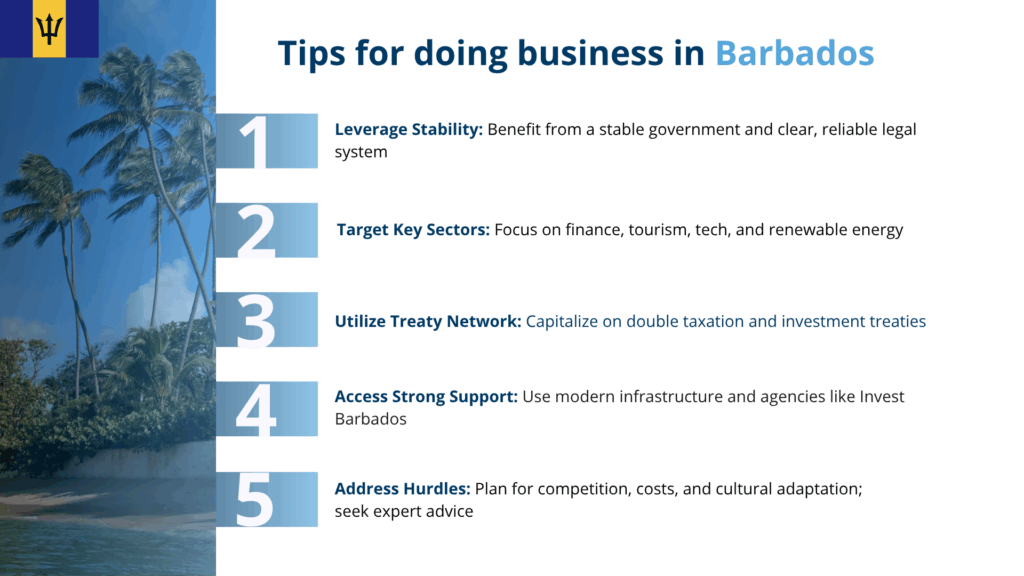

Facing Market Entry Hurdles

Facing Market Entry Hurdles in Barbados

Starting a business in Barbados means you must understand its rules. New businesses compete with existing ones. Good preparation is important to overcome this. High living costs and transport fees are financial difficulties. Business owners must plan budgets with care.

Following rules is vital. Businesses must obey local labor laws and registration rules. Expert advice can help with these requirements. Adapting to the culture is also important. Understanding and respecting local customs can make business operations smoother.

Here are key things to think about for market entry:

- Understand official requirements.

- Prepare to compete with established businesses.

- Plan for high living costs and fees.

- Follow labor laws and registration rules.

- Get expert advice.

- Adapt to local culture.

This table summarizes these hurdles to help your planning:

| Hurdle | Key Action |

|---|---|

| Official requirements | Get expert advice |

| Established competition | Prepare thoroughly |

| Financial difficulties | Budget carefully |

| Following laws | Obey regulations |

| Cultural differences | Adapt to local ways |

Dealing with these points effectively will help you enter the Barbados market.

Important Note: Financial figures, tax rates, fees, and statistics in this guide can change. Always check with official Barbados government sources. Or, check with relevant Barbados institutions. Get the latest information before making business decisions.

Frequently Asked Questions: Business in Barbados

For international businesses (IBCs), Barbados has a very low, tiered corporate tax rate that starts at 5.5% and decreases to as low as 1% on high profits. This makes it highly competitive.

Yes, Barbados is known for its long history of political stability as an independent parliamentary democracy. Its legal system is based on English common law, providing a secure and predictable environment for business.

While tourism is a major pillar of the economy, Barbados also has a strong international business and financial services sector. There is a skilled workforce with expertise in areas like accounting, law, and wealth management.

An IBC is a legal entity designed for international trade and investment. It must conduct its business exclusively outside of Barbados. In return, it qualifies for the country’s low-tax regime and other benefits.

Biz Latin Hub can help you with opportunities in Barbados

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.