Costa Rica is friendly to business and welcoming of foreign direct investment (FDI). Unlike in other nearby jurisdictions, there is little difference between obligations for national and foreign companies. Read on to learn more about corporate compliance requirements in Costa Rica.

There are many other advantages to conducting business in Costa Rica. Competency in English is well above the average in Latin America and the level of education is very high for the region. Furthermore, Costa Rica is in the same time zone as the majority of the United States, which facilitates business relations between the two countries. However you need to be aware of corporate compliance requirements in Costa Rica.

It is relatively easy to register a company in Costa Rica. This was facilitated when a decision was made to digitalize most of the institutional procedures. Presently, most of the constitutional processes can be done via a number of online platforms. Biz Latin Hub can help you with start up and our array of back office services can assist you throughout the business life cycle, including corporate compliance requirements in Costa Rica.

How does my choice of entity affect corporate compliance requirements in Costa Rica?

Costa Rica makes available a number of legal structures to accommodate the different needs and objectives of a company. Among the most popular is the Sociedad Anónima (SA) (Stock Corporation) or the Sociedad de Responsabilidad Limitada (SRL) (Limited Liability Company). For these two companies, the main difference between these two entity types is the format of administration and the person/people who carry out this role – whether it be a management board or a general manager.

To begin registering a new company, the company must have two partners and the company name must be available to avoid copyright issues. There are no requirements regarding minimum capital or even on the currency used.

Appointment of a legal representative

You company’s legal representation will depend on the legal structure that you choose. For an SA, the most important points to remember are that:

- Generally, it is the president who holds legal power.

- You must name a management board whose members can, but do not have to be, legal representatives of the company.

- As a minimum requirement, the management board must have a President, a Secretary, and a Treasurer. Other roles may be added as and when necessary.

- You must name a person who will be responsible for supervising the fiscal proceedings of the managing board.

- All of the members of the board can be foreign citizens and can reside in or outside of Costa Rica.

- If none of the legal representatives reside in Costa Rica, you must choose a resident agent who does live in Costa Rica. This person will be a lawyer, whose only function will be to receive and act upon legal developments.

Appointment of a resident agent

When the legal representative has no domicile in Costa Rica (i.e. is a non-resident legal representative), then it is mandatory to appoint a resident agent, whose function will be to receive legal communications on behalf of the corporation. This appointee must be a certified Costa Rican lawyer.

Registered fiscal address

All companies, regardless of their structure, must have a fiscal address in Costa Rica. You must present a fiscal address to the treasury that adheres to the following:

- Is able to receive notifications and messages from the CCSS (Costa Rican Social Security)

- Has you as a registered employer

- Is a real address (they may send officials to check up on your working conditions)

Entity administration

This depends on the entity type. The SRL entity type is close to an LLC in the United States and the SA is closer to a corporation. The format of the administration is arguably the biggest benefit of establishing an SRL over an SA.

The SA requires a management board, although there are cases where the legal powers granted to the representative can be sufficiently broad that you do not need a full board. Furthermore, you may need the support and agreement from the partners to act in certain situations.

For an SRL, only one manager (unless you choose to have more) leads the administration, meaning that there is no need to have a full administrative board. Even so, if it is agreed as part of the shareholder’s terms and conditions, then you will require one.

Management board: Shareholder meetings

To be in compliance with corporate requirements, you must have an annual shareholder meeting. When constituting your company, you are able to stipulate in more detail all the requirements and concessions that your company will have regarding the these meetings. This can include, for example, allowing a foreign member of the board to lead the meeting.

The meetings of the management board will be led by the President as established in the constituting documents.

Entity accounting and legal records

Every company must keep an up-to-date record of all the legal books in which they note the bylaws and their partners’ divisions. These books must be kept private but can be made available should any shareholder or public judge wish to see them.

Likewise, the company must maintain accounting records with all their transactions. There is no obligation to present these accounting records alongside your annual tax declarations; they will only be requested in the event of an inspection. But for this reason, you need to keep a copy of all your transactions in the last 10 years.

Corporate compliance requirements for taxation in Costa Rica

All persons in Costa Rica who carry out commercial activities must pay the following taxes:

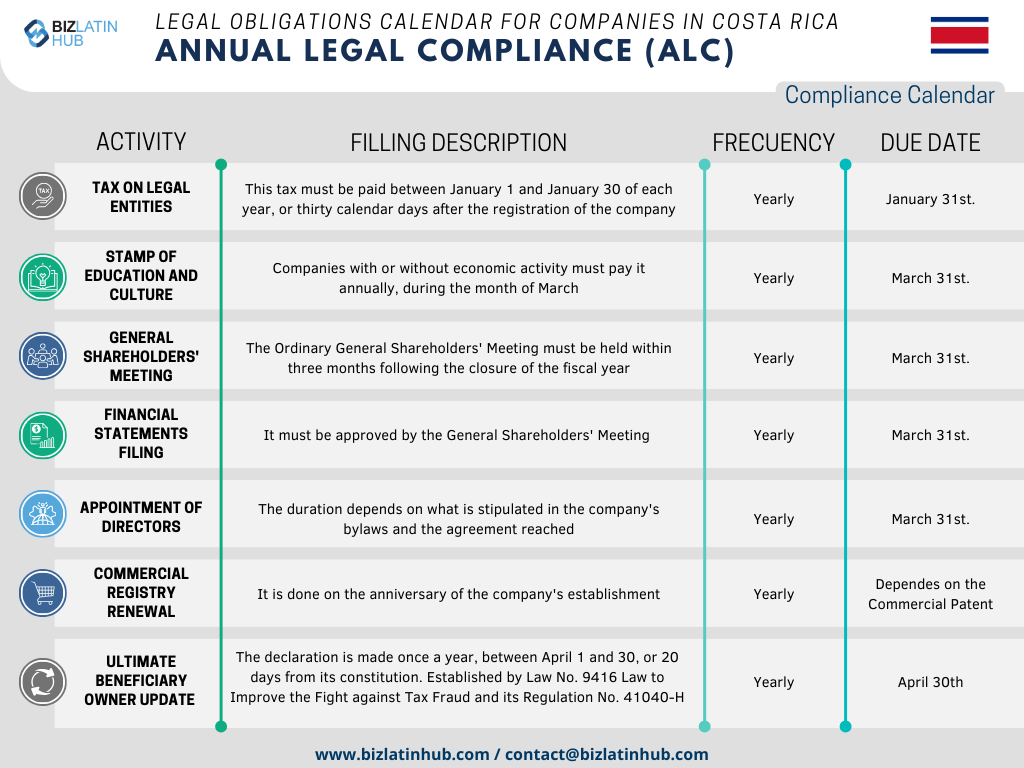

- Tax on legal entities: This is an annual tax levied on all types of societies. You make the first payment when you start the company and then at the start of every calendar year.

- Income tax: This is a tax on all the earnings that the company registers. It ranges from 10-30%, according to the income bracket that the company falls into. You declare and pay this tax annually.

- Sales tax: This tax only applies to the sale of goods and not the sale of services. You pay this tax monthly and it must be applied by the vendor on every transaction.

Depending on the type of activity that your company engages in, there may be other obligations that your company is liable for. An example is the hospitality tax that applies to companies in that sector. There are also financial benefits that can be enjoyed depending on the activity and size of the firm.

Free Trade Zone Regime compliance

The Free Trade Zone Regime (FTZR) is a set of incentives and benefits granted by the country to companies making new investments and complying with local requirements and obligations. This regime is governed by the Free Zone Regime Law, Number 7210, and its regulations.

Ultimate Beneficial Owner (UBO) filing

Since 2019, it has become mandatory to file a UBO declaration, which applies to all legal persons and legal structures domiciled in Costa Rica. This is known as the declaration of the Registry of Transparency and Beneficial Ownership (RTBF), which aims to comply with international standards and recommendations (OECD – FATF) related to transparency in taxation and financial matters.

Other entity corporate compliance requirements in Costa Rica

Once the company is registered with the Costa Rican National Register, you must do the following so you can begin business operations:

- Register as a contributor with the treasury.

- Register the company before the Board for Costa Rican Social Security.

- Register with the national insurance institute.

- Request municipal permits.

- Request specific incursion permits.

FAQs on corporate compliance requirements in Costa Rica

Based on our extensive experience these are the common questions and doubts of our clients on corporate entity compliance in Costa Rica:

The following are the most common statutory appointments for Costa Rican legal entities:

– An appointed legal representative who will be personally liable, both legally and financially, for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

– In the circumstance that the company legal representative is not domiciled in Costa Rica, a resident agent must be appointed to assume the role; this individual must be a Costa Rican lawyer domiciled in Costa Rica whose sole purpose is receiving legal and administrative notifications. As such, in the case that the client’s legal representative is not based in Costa Rica, we strongly recommend a complimentary service for which we can provide a limited power of attorney (POA). This will enable the Resident Agent through a POA to act on behalf of the legal representative to ensure the smooth functioning of the company. Based on experience, without such POA, there are often complications and problems in engaging with local authorities and carrying out the functions of the company.

Yes, a registered local fiscal address is required for all entities in Costa Rica for the receipt of legal correspondence and governmental visits.

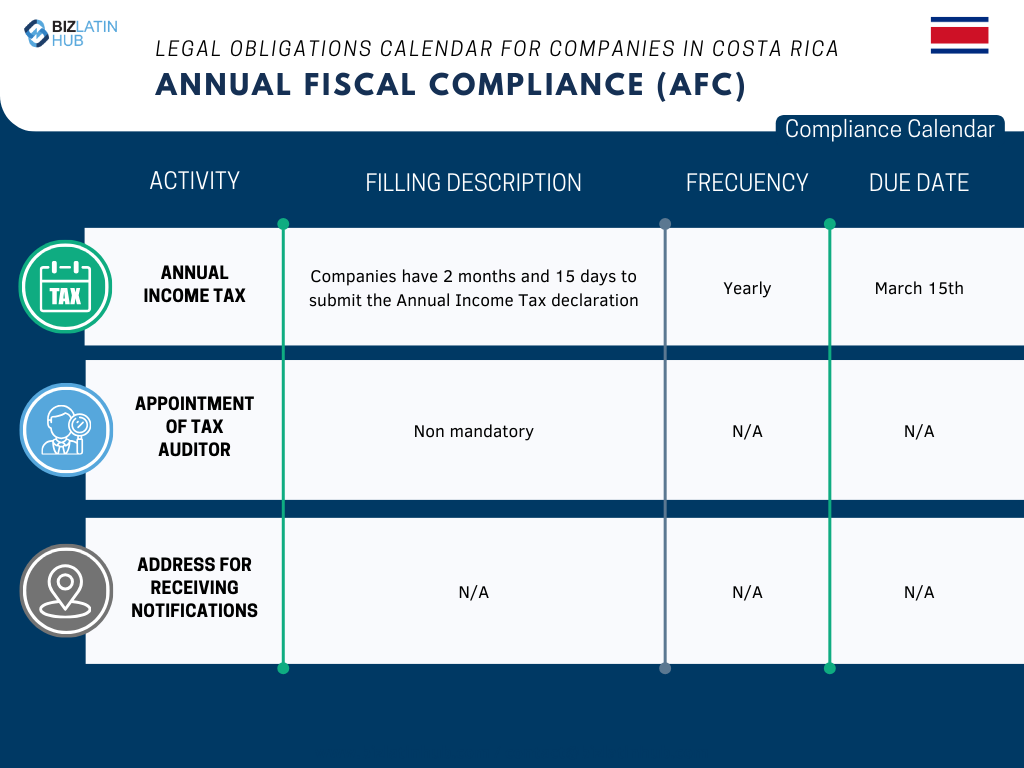

Companies in Costa Rica must submit their annual income tax declaration by the deadline of March 15th.

The Ordinary General Shareholders Meeting must be held within three months following the closure of the fiscal year and by the deadline of March 31st in Costa Rica.

This declaration was established by Law No. 9416, regulation No. 41040-H. The declaration is made once a year, between April 1st and 30th, or 20 days from its constitution.

Biz Latin Hub can help with corporate compliance requirements in Costa Rica

With the support of a local partner with good knowledge of navigating the institutional systems and experience with corporate compliance in Costa Rica, doing business in this Central American country can lead you to commercial success.

We also have dedicated offices in a further 17 countries around Latin America and the Caribbean, meaning that not only can we help with corporate compliance requirements in Costa Rica but also in most other territories within the region.

To begin your business adventure in Costa Rica, get in contact with our team here for personalized support.