Barbados attracts many executives. It offers beautiful beaches and good business opportunities. Those looking at company formation in Barbados must understand its compliance and governance rules. These checks and processes are essential for a thorough Entity Health Check in Barbados. This assessment makes sure a business operates legally and well. This guide explains the value of a proactive compliance review and details the main areas that must be assessed to ensure a company in Barbados is in good legal and financial standing.

Key Takeaways: Entity Health Check in Barbados

| What is a corporate entity health check? | An entity health check is a preventative audit of a company’s statutory records and filings. |

| What are the key areas reviewed for a Barbadian company? | It verifies compliance with CAIPO, the BRA, and the NIS. |

| Will a health check look at your accounting? | A health check ensures the annual return has been filed correctly. |

| Why is a health check crucial for good corporate governance? | The objective is to identify any compliance issues before they can result in penalties or legal challenges. |

The Importance of a Corporate Health Check

An entity health check is a preventative audit of a company’s statutory records and filings. The objective is to identify any compliance issues, such as an unfiled annual return or unpaid NIS contributions, and correct them before they can result in penalties or legal challenges.

Key Areas of a Barbadian Entity Health Check

Expert Tip: Verifying the Annual Return Filing

From our experience, the most common compliance lapse in Barbados is the failure to file the annual return with the Corporate Affairs and Intellectual Property Office (CAIPO) on time. Every company must file this return each year on the anniversary of its incorporation.

The return confirms the company’s directors, shareholders, and registered office. Failure to file can lead to the company being struck from the register. A key part of any health check is not just confirming if the return was filed, but what information was filed, to ensure it accurately reflects the current state of the company.

1. Corporate Compliance with CAIPO

This audit verifies that the company’s annual returns have been filed correctly and on time, and that the information on the public register regarding directors and addresses is accurate.

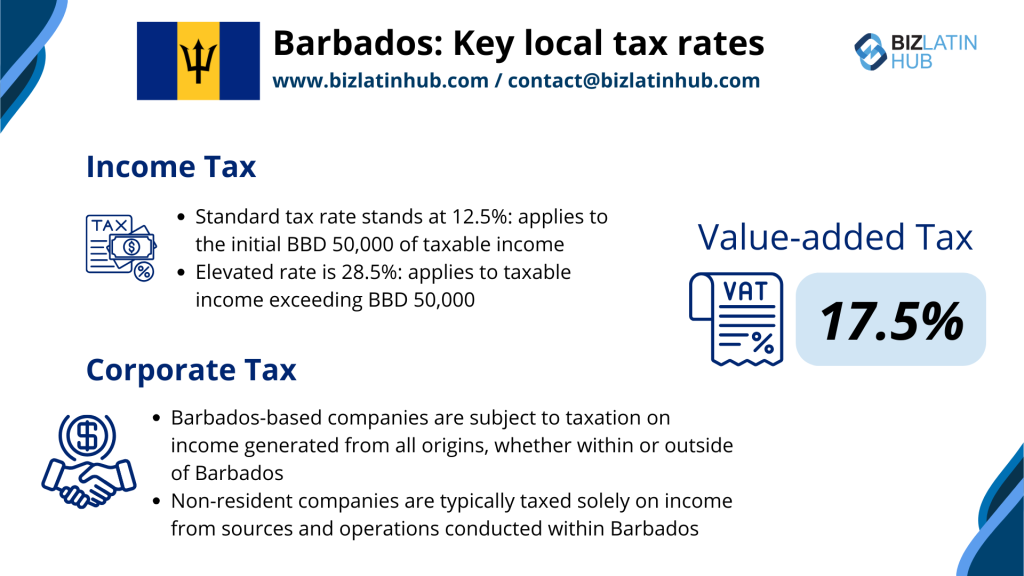

2. Tax Compliance with the BRA

This involves a review of the company’s annual corporate income tax return and its bi-monthly VAT filings to ensure they are accurate and have been submitted on schedule.

3. Social Security Compliance with the NIS

This check verifies that the company is correctly registered with the National Insurance Scheme and that all required monthly contributions for its employees have been paid.

Entity Health Considerations for Common Business Types in Barbados

Barbados is a good place to start a business. It has many business structures for different needs. The Barbadian government helps foreign investors. It allows 100% foreign ownership. Invest Barbados (IB) is a government agency. It helps businesses start and grow. Business types include sole proprietorships, partnerships, and companies. These serve local and foreign investors. Each business type has clear features and compliance needs. Businesses must follow these for legal operation. Choosing the correct business type and understanding its specific rules are the first steps for a successful Entity Health Check in Barbados and ensuring long-term business well-being.

Regular Barbados Companies (RBCs)

Regular Barbados Companies (RBCs) use the Companies Act of Barbados. They offer a reliable way to do business locally. RBCs need clearance from the Central Bank of Barbados for international business. This step makes sure the company follows financial rules important for its health and its entity health check results in Barbados. An RBC needs at least one shareholder. This shows the need for clear company structures for good management and compliance, contributing to overall entity health. RBCs follow strict compliance and governance rules. They operate openly and efficiently. They meet local legal standards. This business type is good for businesses that will work directly with the Barbadian market.

Societies with Restricted Liability (SRLs)

Societies with Restricted Liability (SRLs) in Barbados are a unique business type. They suit certain professional activities. Specific details about SRLs are not in this information. Generally, SRLs give limited liability to their members. This is like other company types. This structure can be good for partnerships. Partners can limit personal liability but share ownership. People interested in SRLs should talk to local legal advisors or authorities in Barbados. They can get full details on compliance and rules relevant to the health and entity health check requirements for SRLs in Barbados.

International Business Companies (IBCs)

International Business Companies (IBCs) in Barbados suit businesses in international trade. They also suit businesses that make goods for export. IBCs have several benefits. They are exempt from exchange control rules. They are also exempt from withholding taxes on payments to non-residents. These payments include dividends, interest, and royalties. To start an IBC, a company must incorporate in Barbados. It must also get a license from the Minister of Industry and International Business. An IBC needs at least one director. The director does not need to be a local resident. However, the company must appoint a registered local resident agent. IBCs need an annual audit if their assets or gross revenue are over BDS$500,000. This audit is a key part of an entity health check for IBCs in Barbados. These companies must also file annual returns. They must pay an ongoing license fee. This makes sure of openness and following rules, which are signs of good entity health in Barbados.

Entity Health: Key Compliance Rules for Barbados

Operating a company in Barbados means following several regulatory compliance needs. This makes sure of legal operation and good standing. These are key signs of an entity’s health. Not following these needs can harm a company’s status, operational efficiency, and overall health, negatively impacting any Entity Health Check in Barbados.

Key needs for maintaining entity health in Barbados include:

- Getting licenses and permits: This includes a general Business License. It also includes any industry-specific permits for the company’s work. These are foundational for a healthy legal status and a positive Entity Health Check in Barbados.

- Following employment rules: Companies must understand and follow local labor laws. Employers of Record (EORs) can help with these rules, ensuring the health of employment practices, a factor in an Entity Health Check in Barbados.

- Filing annual returns: All registered companies must file annual returns. They file with the Corporate Affairs and Intellectual Property Office (CAIPO). This is a critical part of regular entity health checks in Barbados.

- Keeping proper documents: For example, companies need a Certificate of Incorporation to open a business bank account. Organized documentation reflects good corporate health and preparedness for an Entity Health Check in Barbados.

- Using import duty exemptions (if they apply): Companies that make or process goods may get these exemptions.

Filing Annual Returns: A Key Entity Health Check in Barbados

All registered companies in Barbados must file annual returns. They file with the Corporate Affairs and Intellectual Property Office (CAIPO). This filing updates financial information. It also details company activities to follow local laws. Specific deadlines can differ. They often relate to the company’s incorporation month. Companies must prepare financial statements on time for this required annual filing with CAIPO. Careful record-keeping of all transactions is important for compliance. Companies must also report any changes in their structure with the annual returns. This makes sure they continue to operate legally in Barbados. Timely and correct filings are basic for a good entity health assessment in Barbados.

Entity Health: Accurate Record-Keeping in Barbados

Careful record-keeping is important for compliance. It is also important for good standing in Barbados. This is a key part of an entity’s health. An EOR can help by managing employee records and performance information. This helps companies follow local labor laws. Businesses must file annual returns. They must also get business licenses and permits to operate legally. Good record-keeping makes sure needed documents are ready. These include a Certificate of Incorporation and proof of business address for banks. Healthcare organizations in Barbados can use special platforms. These platforms monitor and check professional licenses. This helps with full record-keeping and compliance, supporting overall entity health and forming part of an Entity Health Check in Barbados.

Entity Health: Reporting Company Changes in Barbados

Companies in Barbados must report structural changes to CAIPO. These changes include appointing new directors or changing the business address. These updates are needed to meet the rules of the Barbados Corporate Affairs and Intellectual Property Office. Correct documents and quick reporting are important. They make sure of compliance and up-to-date registration. Telling CAIPO quickly about company structure changes helps keep the company’s good standing and legal status in Barbados. Keeping registration records current helps companies avoid penalties. It also avoids interruptions in business activities. This helps give the entity a clean bill of health, crucial for any Entity Health Check in Barbados.

Legal System: Supporting Entity Health in Barbados

Barbados is a good place for businesses because its regulatory system is strong. The island nation’s rules match international best practices. This protects the reputation of its regulatory systems and anti-money laundering measures. Companies in Barbados must meet local compliance needs to keep good standing. These needs include filing annual returns and getting licenses and permits. The flexible Companies Law supports many business operations. This stable legal system is important for maintaining long-term entity health and successful Entity Health Checks in Barbados.

Frequently Asked Questions: Entity Health Check in Barbados

CAIPO stands for the Corporate Affairs and Intellectual Property Office. It is the government agency responsible for the registration of companies and the filing of annual returns.

The BRA is the Barbados Revenue Authority, the main tax authority responsible for collecting corporate income tax and Value-Added Tax (VAT).

A Certificate of Good Standing is issued by CAIPO and confirms that a company has filed all its annual returns and is in compliance with the Companies Act. This document is essential for many business transactions.

The NIS is the National Insurance Scheme, the social security system in Barbados. A health check verifies that the company has made all mandatory monthly contributions for its employees.

Biz Latin Hub can help you with an entity health check in Barbados

At Biz Latin Hub, our multilingual team of company formation specialists has extensive experience in supporting foreign executives when starting a business in Latin America. We offer a complete set of services for your business needs, such as legal, accounting, and recruitment support.

You can rely on us as your main contact for entering and doing business in any of the 18 markets in Latin America and the Caribbean where we operate.

Contact us now for personalized assistance or a free quote on company formation in Latin America.

Learn more about our team and expert authors.