Corporate Entity Regulatory Compliance in Peru is designed to foster economic growth, protect workers, and sustain a competitive business environment. Understanding these regulations is vital for registering a business in Peru and avoiding penalties. Biz Latin Hub provides comprehensive assistance with its full suite of back-office services, addressing all your compliance needs under a single service agreement. This guide details the annual legal and fiscal obligations required to keep a Peruvian entity in good standing with SUNAT and the Public Registry.

Key Takeaways On Corporate Entity Regulatory Compliance in Peru

| Fiscal Address Requirements: | A registered office address or local fiscal address is required for all entities in Peru for the receipt of legal correspondence and Governmental visits. |

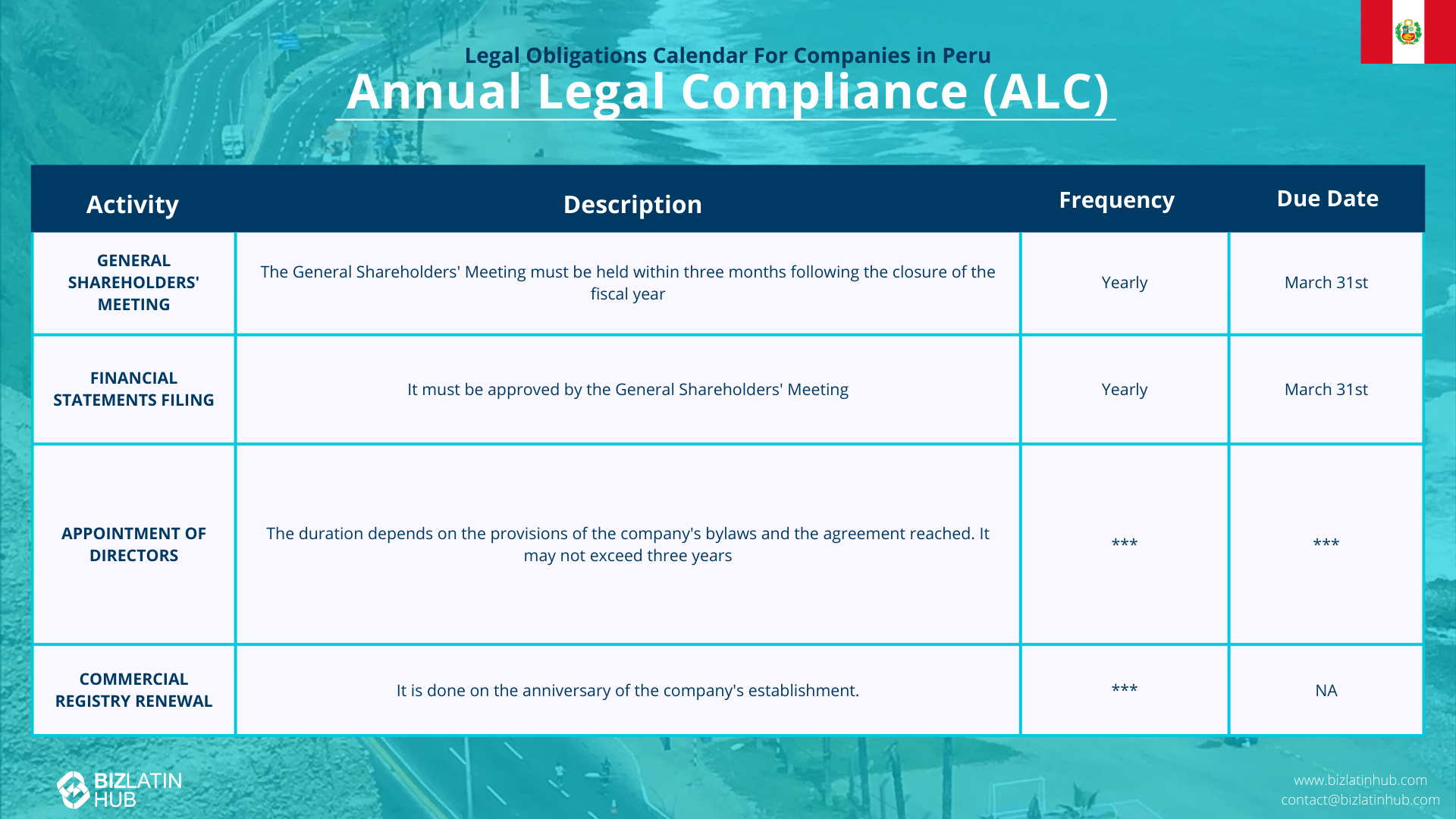

| What Are The Annual Legal Compliance Steps? | General Shareholders Meeting Financial Statements Filing Appointment of Directors Commercial Registry Renewal |

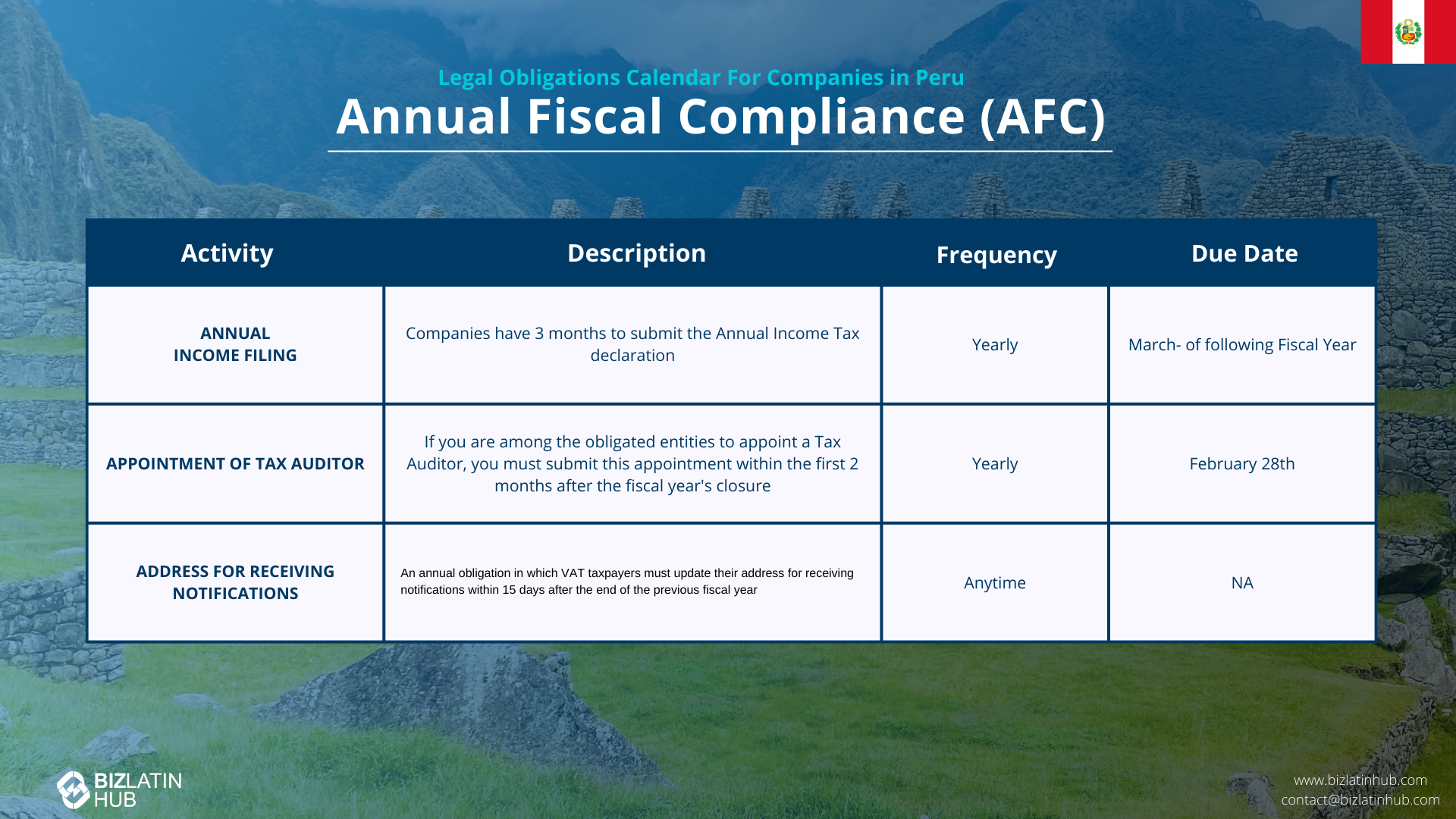

| What Are The Annual Fiscal Compliance Steps? | Annual Income Filing Appointment of Tax Auditor Address for Receiving Notifications |

| Why Invest in Peru? | Successive governments have upheld prudent economic and regulatory management, ensuring solid macroeconomic foundations. |

Legal Entity Regulatory Compliance in Peru: Key Responsibilities

While regulatory compliance in Peru may vary based on the type of entity you have, the following requirements are usually applicable:

- An annual tax declaration must be made, usually within three months of the end of each fiscal year, which in Peru runs from 1 January to 31 December.

Note that the actual date on which the declaration should be submitted is dictated by the last digit of the company’s tax ID number, and the tax authority (SUNAT) publishes a calendar each year with information on this date. - An annual shareholders meeting (AGM) must be held within three months of the close of the fiscal year, meaning that the AGM must take place by March 31st.

The AGM will include discussion of the financial statements of the previous year, which must have been approved by the company and submitted to the SUNAT. Minutes from the AGM must be properly recorded. - Circulation of those minutes, usually via a board of directors meeting, is a prerequisite of legal regulatory compliance in Peru.

- Updating the corporate books, which include the minutes from AGMs and the shareholder registry, among other details, must be done to adhere to legal regulatory compliance in Peru.

Expert Tip: Legalizing Books Before Use

From our experience, a common compliance error is using corporate books (Minutes Book, Shareholder Register) before they are legalized. In Peru, physical books must be stamped (“legalized”) by a Notary Public before the first entry is made. Electronic books must be affiliated with SUNAT. Ideally, this is done immediately upon incorporation. Recording minutes in a book that hasn’t been legalized nullifies the validity of those decisions vis-à-vis third parties.

In Peru, a legal representative acts as the legal face of the company before government authorities. The legal representative must make all the decisions on behalf of your company on legal matters. As such, the person appointed as legal representative holds certain legal liabilities.

The legal representative must be a local national or a foreigner with the right to live and work in Peru and is responsible for the company’s legal and tax compliance.

Key Annual Filing Obligations

Annual income tax declarations must be submitted within three months after the fiscal year-end. The exact filing date is determined by the last digit of the company’s tax ID number, as per the calendar published annually by SUNAT. VAT must be declared monthly.

Electronic Books (PLE & SIRE)

Peru has migrated almost entirely to digital accounting. The Program of Electronic Books (PLE) and the Integrated System of Electronic Records (SIRE) require companies to submit their Purchase and Sales Registers and other accounting books digitally to SUNAT. Failure to upload these XML files on time results in fines.

UBO registration and updating

Companies must identify and register their UBOs with SUNAT. An individual is deemed a UBO if they hold at least 10% of an entity’s capital, have the power to designate or remove the majority of the administrative bodies, or have decision-making power in financial, operational, or commercial agreements.

Penalties for Non-Compliance in Peru

Non-compliance with corporate legal obligations in Peru can result in significant legal and operational consequences. Common penalties include:

- Suspension of Tax Identification Number (RUC): Businesses cannot operate legally if their RUC is suspended.

- Fines from Regulatory Authorities: SUNAT may impose fines for late or incorrect filings.

- Legal Actions Against Administrators: Company administrators may face personal liability for non-compliance, leading to legal actions and potential disqualification from holding management positions.

- Restriction on Business Operations: Companies failing to comply with regulations may face restrictions on their business activities.

- Negative Impact on Creditworthiness: Non-compliance can adversely affect the company’s credit rating, making it difficult to secure financing or conduct business with partners.

FAQs on Financial Regulatory Compliance in Peru

Based on our extensive experience these are the common questions and doubts of our clients on regulatory compliance in Peru:

The following are the most common statutory appointments for Peruvian legal entities:

– An appointed legal representative who will be personally liable, both legally and financially for the good operation and standing of the company. This should be a local national or a foreigner with the right to live/work in the country.

Yes, a registered office address or local fiscal address is required for all entities in Peru for the receipt of legal correspondence and Governmental visits.

If you are among the obligated entities to appoint a tax auditor, you must submit this appointment within the first 2 months after the fiscal year’s closure and by the deadline of February 28th in Peru.

The general shareholders meeting must be held within three months following the closure of the fiscal year and by the deadline of March 31st in Peru.

Companies have 3 months to submit their annual income tax declaration by the deadline of March 31st in Peru.

Companies must hold an Annual General Meeting (AGM) of shareholders by March 31st, submit annual income tax declarations within three months after the fiscal year-end, appoint a tax auditor if revenues exceed 3,000 UITs, and update corporate books, including minutes from AGMs and the shareholder registry.

Companies must submit annual income tax declarations within three months after the fiscal year-end. The exact filing date is determined by the last digit of the company’s tax ID number, as per the calendar published annually by SUNAT.

The legal representative is responsible for ensuring the company’s compliance with local laws, representing the company in legal matters, and signing official documents. This individual must be a local national or a foreigner with the right to live and work in Peru.

If a company is among the obligated entities to appoint a tax auditor, the appointment must be submitted within the first two months after the fiscal year’s closure, by the deadline of February 28th.

Companies must identify and register their UBOs with SUNAT. An individual is deemed a UBO if they hold at least 10% of an entity’s capital, have the power to designate or remove the majority of the administrative bodies, or have decision-making power in financial, operational, or commercial agreements.

Non-compliance can lead to penalties, including fines, suspension of the company’s tax identification number, and potential legal actions against the company’s administrators.

Why invest in Peru?

Peru is one of the most popular destinations in Latin America and the Caribbean for foreign investors, illustrated by its high levels of foreign direct investment (FDI). FDI as a percentage of GDP has followed a general upward trajectory over recent years — rising from $2 billion in 2021 to $5.1 billion in 2022 — highlighting increasing interest from international capital. The World Bank has predicted that in 2024, the economy will grow by 2.3%.

Peru is famous for being a significant producer of gold, copper, and agricultural products, with fruits, nuts, and animal fodder among its key exports. The fishing industry is also very important, with seafood another key export. Meanwhile, the services sector is becoming increasingly important to the economy. In 2022, services made up 49% of GDP. This sector includes providers of financial regulatory compliance in Peru.

Peru is also a member of the Andean Community of Nations (CAN) — a regional integration initiative with Bolivia, Colombia, and Ecuador. All of this contributes to the Peruvian market’s popularity as an investment destination. To take full advantage of it, you must understand and be in line with regulatory compliance in Peru.

Biz Latin Hub can help with legal regulatory compliance in Peru

At Biz Latin Hub, we have the people and expertise to be able to assist you with financial regulatory compliance in Peru. Our comprehensive portfolio of professional solutions includes company formation, accounting & taxation, legal services, visa processing, and hiring & PEO, and we offer tailored packages of integrated back-office services to suit every need.

As well as Peru, we have teams in 17 other markets around Latin America and the Caribbean, and trusted partners who extend our coverage to almost every corner of the region, and we specialize in multi-jurisdiction market entry.

Contact us now to find out more about how we can assist you in doing business in Peru.

Or read about our team and expert authors.