Peru’s international trade sector is an important contributor to its economic output, and one of the main reasons for its rapid expansion. More and more small to medium-sized companies are offering their products abroad. Still, the legal processes in order to import and export in Peru can be challenging, depending on the extent of the company’s trade requirements.

In this article, we offer valuable information about the process of obtaining licenses and special registrations, including information about obligatory taxes when you import and export in Peru. To enter the market, there are two basic options – you can set up a branch office of your established operation or you can incorporate a company in Peru.

At Biz Latin Hub, we can help with either of these two options and our full array of back office services will help you both import and export in Peru. Not only that, but we can do the same across the region, with our network of 18 dedicated local offices across Latin America and the Caribbean.

Why import and export in Peru?

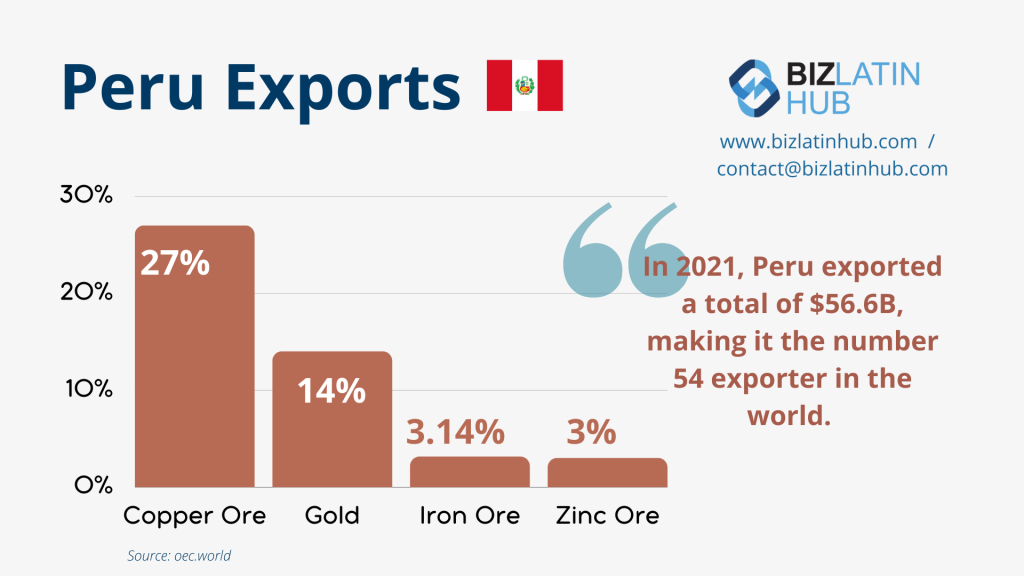

Since the beginning of the 21st century, Peru has drastically increased its trade activity. The biggest export sectors are natural resources, such as copper ore and gold, whereas the most important imports into Peru are refined petroleum and cars.

Fundamental to Peru’s international trade success are its strategic free trade agreements (FTA). Peru is a member of the World Trade Organization and has FTAs with several key Latin America economies including Mexico and Chile. In Asia, Peru has FTAs with China and Singapore, among others. Additionally, Peru fosters an important FTA with the European Union, established in 2013.

Most exporting companies in Peru are small-medium sized entities (SMEs), accounting for around 82% of all exporting companies. SMEs that engage in exporting activities are able to expand their target market immensely, enlarging it by six to seven times, which motivates more SMEs to start exporting their products.

However, before starting an international trading business, companies need to understand the legal procedures involved with exporting and importing.

Legal Import Processes

The first step of a trading company in Peru is to investigate which types of products might be competitive in the Peruvian market, which products are restricted for importation purposes and which suppliers and customs agencies might be supportive.

Importation Requirements in Peru

The following importing requirements related to Peru’s international trade must be met before one can begin operations:

- The company needs to be registered as a unique taxpayer (Registro Único de Contribuyentes – ‘RUC’).

- The company’s tax domicile stated in the RUC shouldn’t be conspicuous of non-compliance with tax regulation.

- The importing company needs to be able to exhibit the documents required for importing merchandise.

For the importation of merchandise, two scenarios exist:

- The value of the merchandise is lower than USD$2,000

- The value of the merchandise is higher than USD$2,000

Scenario 1: The ‘Simplified Dispatch Importation’, whose value shouldn’t have any significant impact on the economy of Peru, requires the ‘Declaration of Simplified Importation’ (Declaración Simplificada de Importación, DSI) that needs to be filled and presented at customs together with the invoice for the goods imported, the document of the transportation method used and the identification document.

Scenario 2: The more common case for companies importing merchandise, is the Definitive Importation (Importación Definitiva) that requires the following:

- The Customs Declaration of Merchandise (Declaración Aduanera de Mercancía DAM). This document details information about the transportation method, storage method, the customs value and the merchandise itself.

- The Certificate of Origin (Certificado de Origen, C.O.). This certificate allows an importer (or exporter) to certify the country from which the merchandise originates. It is mainly needed so that the importing company receives tariff preferences. The exporter needs to fill out and sign the Certificate of Origin and then send it to the National Superintendence of Customs and Tax Administration (Superintendencia Nacional de Aduanas y de Administración Tributaria, SUNAT).

- A food sanitary registry for processed food products issued by the Food and Environmental Health Bureau (DIGESA).

- A registry in the General Direction of Medication and Drug Supply (DIGEMID) in case of importing pharmaceuticals or medical drugs.

- Proof of a foreign trade operator, who supervises and mediates the whole import process.

Import Taxes and tariffs

To understand how to import and export in Peru we have to understand that the former is subject to the general sales tax of 16%, the municipal promotion tax of 2%, and the tariff of either 0%, 6% or 11% according to the tariff subheading of the merchandise imported.

In order to find out which product belongs to which tariff subheading, The Superintendencia Nacional de Aduanas y de Administración Tributaria (‘SUNAT‘) provides detailed information. Every merchandise is allocated a specific 10-digit number and a product heading.

REAL-LIFE EXAMPLE: Jams, jellies and marmalades from citrus fruits fall under the product section with the subheading ‘Preparation of vegetables, fruits or other fruits or other parts of plants’. The tariff for this subheading is 6% including the general sales tax (IGV) of 16% and the municipal promotion tax (IPM) of 2%. Additionally, an insurance tariff of 2.25% is applied to this subheading.

There is some relief for importing businesses; approximately 70% of the items allowed for importation and available in the tariff database fall under the 0% tariff subheading, including agricultural and intermediate goods, books or IT items, among others.

International trade: Legal Export Processes

As is the case for importation, exporting businesses should perform several investigations and above all, they need to become acquainted with the target country/target market of the products, the laws affecting the exportation process, market competition and potential clients and partners.

Requirements

Most companies need to comply with the same requirements as for importations:

- Being registered in the taxpayer register (RUC).

- Proof of compliant tax history.

- Presentation of relevant exportation documentation.

So, what documents are required for imports? Again, two scenarios exist:

- The value of the merchandise is lower than USD$5,000

- The value of the merchandise is higher than USD$5,000

For scenario 1: The company must complete the ‘Easy Export Declaration’ (Declaración Exporta Fácil, DEF) that encompasses a SUNAT copy of the invoice for the merchandise to be exported, a copy of the transportation document, the RUC of the merchandise company and proof of the client in the country of destination.

For scenario 2: The most common way for merchandisers to conduct their exportation business requires the following:

- A Customs Merchandise Declaration (DAM) exhibiting the invoice of the product and the bill of the transportation method employed.

- The Certificate of Origin (Certificado de Origen, C.O.). The process to obtain the C.O. proceeds within two steps; the exporting company fills and signs the CO and sends it to the tax and customs administration (SUNAT) who in turn validate and register the exports in the corresponding tariff subheading for the importer. The SUNAT then sends the C.O to the importer applying the tariff preference.

- For food and beverages, the importer needs to forward an application to the Food and Health Bureau in Peru (DIGESA). Additionally, the importer needs to provide the DIGESA with product information, packaging details and storage conditions.

FAQs on how to import and export in Peru

Yes, a business can be 100% foreign-owned in Peru.

This is handled by the National Superintendence of Customs and Tax Administration (Superintendencia Nacional de Aduanas y de Administración Tributaria, SUNAT).

For imports under USD$2,000, a simple form is all that is needed. For importing more valuable loads:

The Customs Declaration of Merchandise (Declaración Aduanera de Mercancía, DAM). This document details information about the transportation method, storage method, the customs value and the merchandise itself.

The Certificate of Origin (Certificado de Origen, C.O.). This certificate allows an importer (or exporter) to certify the country from which the merchandise originates. It is mainly needed so that the importing company receives tariff preferences. The exporter needs to fill out and sign the Certificate of Origin and then send it to the National Superintendence of Customs and Tax Administration (Superintendencia Nacional de Aduanas y de Administración Tributaria, SUNAT).

A food sanitary registry for processed food products issued by the Food and Environmental Health Bureau (DIGESA).

A registry in the General Direction of Medication and Drug Supply (DIGEMID) in case of importing pharmaceuticals or medical drugs.

Proof of a foreign trade operator, who supervises and mediates the whole import process.

For exports under USD$5,000, a simple form is all that is needed. For exporting more valuable loads:

A Customs Merchandise Declaration (DAM) exhibiting the invoice of the product and the bill of the transportation method employed.

The Certificate of Origin (Certificado de Origen, C.O.). The process to obtain the C.O. proceeds within two steps; the exporting company fills and signs the CO and sends it to the tax and customs administration (SUNAT) who in turn validate and register the exports in the corresponding tariff subheading for the importer. The SUNAT then sends the C.O to the importer applying the tariff preference.

For food and beverages, the importer needs to forward an application to the Food and Health Bureau in Peru (DIGESA). Additionally, the importer needs to provide the DIGESA with product information, packaging details and storage conditions.

Incoterms are developed and regulated by the International Chamber of Commerce (ICC). With 3 distinct letters, the ICC uses incoterms to define the responsibilities and obligations of the exporter and importer. It takes into account, in particular, loading and transport information, type of transportation used, insurance, risks, and place of delivery.

The biggest export sectors are natural resources, such as copper ore and gold, whereas the most important imports into Peru are refined petroleum and cars.

Biz Latin Hub can help you import and export in Peru

Peru continues growing as an attractive destination for trading companies, presenting a range of commercial opportunities for businesses small and large. We can help you both import and export in Peru.

Biz Latin Hub can provide you with professional and personalized information regarding the trade requirements in Peru and can assist you with the legal processes of exportation and importation.

Contact us today and see how our team can support you.