Barbados has a dynamic business environment. This environment attracts local entrepreneurs and international investors. The island nation provides several types of legal entities. Each entity type meets different business requirements and goals. Understanding the legal entity types in Barbados is important for anyone starting a business there. Regular Barbados Companies (RBCs) and Societies with Restricted Liability (SRLs) are primary choices. Former structures like International Business Companies (IBCs) are no longer available for new registrations. This guide details the characteristics of the primary corporate structures to help foreign investors select the most suitable entity for their business objectives.

Key Takeaways: Legal Entity Types in Barbados

| What are the three main types of legal entities in Barbados? | |

| What is a Regular Barbados Company (RBC) used for? | |

| What is a Society with Restricted Liability used for? | A Society with Restricted Liability (SRL) combines features of a company and a partnership. |

| Which government body registers companies in Barbados? | The Corporate Affairs and Intellectual Property Office (CAIPO). |

Key Business Structures in Barbados

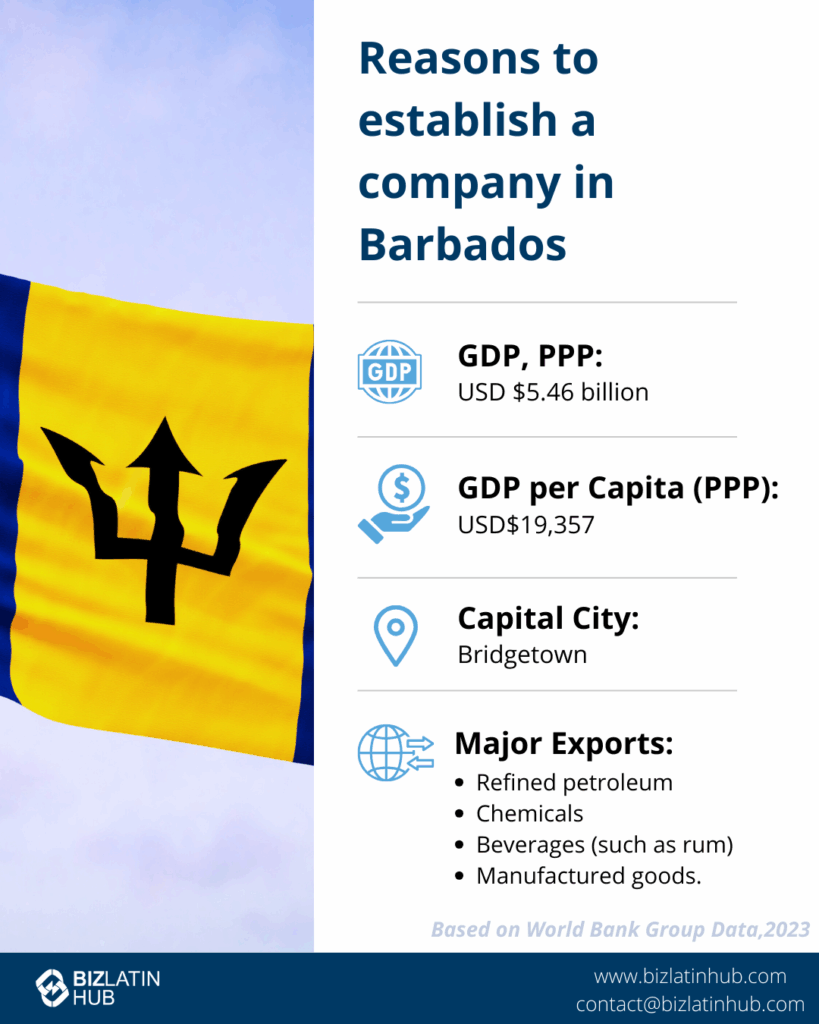

Barbados provides a stable and well-managed business setting. Its legal system features the Companies Act and the Societies with Restricted Liability Act. These laws, along with recent tax reforms (effective January 1, 2024, and further clarifications in 2025), create organized business operations.

Businesses in Barbados can select between two primary entities: the Regular Business Company (RBC) and the Society with Restricted Liability (SRL). An SRL generally requires at least one member (though historically some structures required two) and can have an unlimited duration, though specific articles or older formations might have set periods.

The concept of International Business Companies (IBCs) offering broad tax exemptions on international profits is outdated. Entities engaging in international business now typically operate as RBCs or SRLs, potentially with a Foreign Currency Permit (FCP) if earning 100% of their income in foreign currency. Such FCP holders can benefit from a 5.5% corporate tax rate.

Economic substance regulations exist. Companies must perform their main income-generating work in Barbados to follow these rules. Amendments to reduce some reporting obligations under these rules are anticipated in 2025.

Investors benefit from asset protection. They also benefit from many double tax treaties. These treaties help lower taxes on international income. A general corporate income tax rate of 9% applies, with a 15% minimum effective tax rate for qualifying Multinational Enterprise (MNE) groups.

Here is a simple comparison of key entity types:

| Entity Type | Minimum Members (General) | General Corporate Tax Rate | Tax Rate for 100% Foreign Income Earners (with FCP) |

|---|---|---|---|

| Regular Business Company | No Minimum | 9% | 5.5% |

| Society with Restricted Liability | 1 | 9% | 5.5% |

Barbados gives legal and financial advantages to businesses and investors, adapting to global standards.

Regular Barbados Companies (RBCs)

Regular Barbados Companies (RBCs) operate under the Companies Act of Barbados. These companies may need Central Bank approval for certain international business activities, unless holding a Foreign Currency Permit (FCP). RBCs must have at least one shareholder. They also need one local resident director. Unlike other structures, RBCs do not need a minimum stated capital for incorporation.

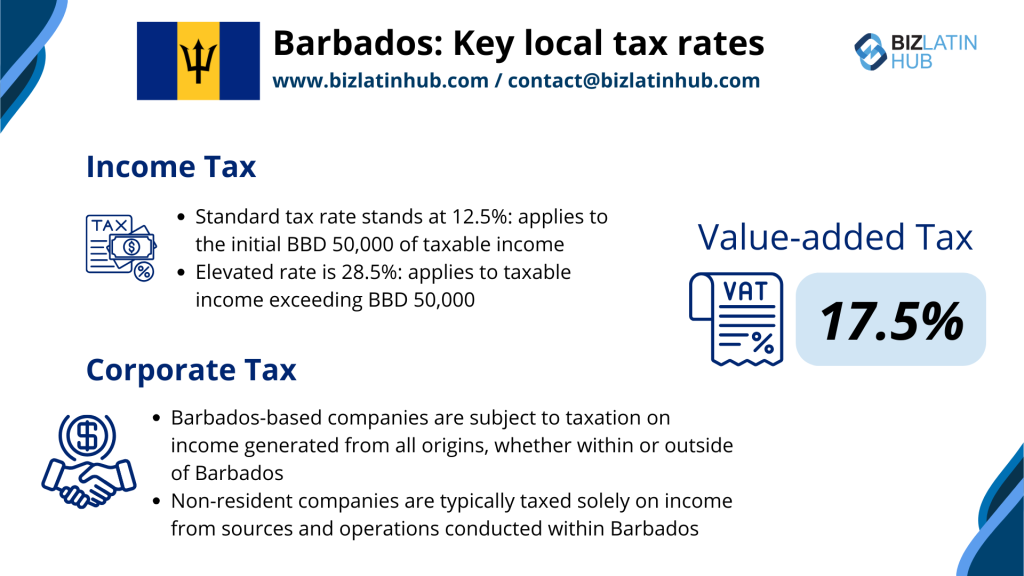

RBCs are subject to a general corporate tax rate of 9%. If an RBC is part of an MNE group with annual consolidated revenue of EUR 750 million or more, it may be subject to a top-up tax to ensure a 15% minimum effective tax rate. Companies holding an FCP and earning 100% of their income in foreign currency qualify for a 5.5% tax rate. Income from qualifying intellectual property is taxed at 4.5%. To follow regulations, RBCs must have a registered office in Barbados. RBCs are good for businesses that plan to operate in the local market or internationally under the current tax framework. Most companies are required to prepay corporation tax monthly, effective from income year 2025.

Key Features of RBCs:

- Approval Needed: Central Bank approval for some international business (unless FCP holder).

- Shareholder Requirement: Minimum of one shareholder.

- Director Requirement: One local resident director.

- Capital Requirement: No minimum stated capital.

- Tax Rate: General 9%; 5.5% for FCP holders (100% foreign income); 4.5% for qualifying IP income; 15% minimum for qualifying MNEs.

| Requirement | Details |

|---|---|

| Shareholders | At least one |

| Local Resident Director | Required |

| Capital | No minimum requirement |

| Office | Must maintain a registered office |

| Tax Rate | 9% (general); 5.5% (FCP/100% foreign income); 4.5% (IP); 15% (MNE min.) |

RBCs are suitable for businesses concentrating on the Barbadian market or conducting international operations under the revised tax laws.

Societies with Restricted Liability (SRLs)

In Barbados, a Society with Restricted Liability (SRL) is similar to a company but has key differences. SRLs use distinct terms. For example, they use “managers” instead of directors. They use “quota holders” instead of shareholders. An SRL must have at least one member (shareholder) and a local resident director/manager. SRLs have no minimum capital requirement. SRLs holding an FCP and earning 100% foreign income are exempt from exchange controls and benefit from a 5.5% tax rate. However, SRLs must generally have an annual audit and file returns if their assets or revenue are more than BDS500,000(thisthresholdcanvary,e.g.,US1 million for some SRLs). SRLs focusing on international dealings (often with an FCP) typically cannot own land for business (but can lease) or deal with CARICOM residents in certain capacities. The duration of an SRL is generally unlimited, though older articles of organization or specific types might have stated lifespans (e.g., 50 years was common for former “Exempt SRLs”).

Key Features of SRLs

SRLs in Barbados are separate legal entities. They give limited liability protection to their members. This protection means owners are liable only for their investment amount. SRLs are organized under the Societies with Restricted Liability Act. They must follow specific rules. The terms used are different from other companies: managers replace directors; quota holders replace shareholders. SRLs are subject to a general corporate tax rate of 9%. However, SRLs holding an FCP (earning 100% of income in foreign currency) or meeting other specific criteria (e.g., certain holding companies, approved small businesses under specific conditions) can qualify for a 5.5% tax rate. Income from qualifying IP is taxed at 4.5%. If an SRL is part of a qualifying MNE group, a 15% minimum effective tax rate applies. Additionally, SRLs must keep meeting minutes. Most companies, including SRLs, must prepay corporation tax monthly from income year 2025.

Advantages and Disadvantages of SRLs

Choosing an SRL in Barbados provides limited liability. These entities are separate from their owners. This structure protects personal assets from the SRL’s debts. The applicable tax rates (9% general, or 5.5%/4.5% for qualifying income/entities) can be competitive. Foreign investment is encouraged, especially through the FCP regime which offers exemptions from exchange controls for entities earning 100% foreign currency. Also, SRLs can raise funds by selling quotas.

However, SRLs have mandatory annual audits and must file returns if their financials exceed certain thresholds. This adds compliance duties. Despite these, the SRL is a popular choice due to its flexibility and protective structure under the current tax system.

International Business Companies (IBCs) – Historical Context

The International Business Company (IBC) was historically a popular business structure in Barbados for foreign investors, offering very low tax rates or exemptions on international profits. However, the IBC Act was repealed, and new IBCs can no longer be incorporated since December 31, 2018. Grandfathering provisions for existing IBCs ended in June 2021.

Entities that previously operated as IBCs or would have sought IBC status now typically register as Regular Barbados Companies (RBCs) or Societies with Restricted Liability (SRLs).

Current Approach for International Business: RBCs/SRLs with Foreign Currency Permit (FCP)

Businesses engaging in international trade and earning 100% of their income in foreign currency should now consider forming an RBC or SRL and applying for a Foreign Currency Permit (FCP).

Benefits of an FCP (under the FCP Act, 2025-5, effective March 2025):

- Eligibility for a 5.5% corporate tax rate on income.

- Exemption from exchange controls under the Exchange Control Act.

- Reduced stamp duty rates under the Stamp Duty Act.

- Exemption from certain property transfer taxes under the Property Transfer Tax Act.

- Import duty relief (customs duty, VAT, ad valorem stamp duty) on specified items (plant, machinery, equipment, etc.) for FCP holders exclusively engaged in the trade of services, subject to conditions.

- The FCP regime has expanded to include external companies and trustees.

This FCP framework is designed to maintain Barbados’s competitiveness in international business while complying with global tax standards.

International Societies with Restricted Liability (ISRLs) – Historical Context

Similar to IBCs, the specific regime for International Societies with Restricted Liability (ISRLs), which catered mainly to global transactions with significant tax benefits, is also part of the legacy system. New ISRLs with the old tax benefits can no longer be formed.

Entities seeking to conduct international business as an SRL would now form a standard SRL and, if qualifying (e.g., earning 100% income in foreign currency), apply for an FCP to access benefits like the 5.5% tax rate and exchange control exemptions. These SRLs (with an FCP) typically cannot conduct business with Barbados residents or own land outright (but may lease property).

Structure and Operation (General SRLs / former ISRL-type activity)

The structure of an SRL in Barbados is like a company with limited liability. Under the Societies with Restricted Liability Act, an SRL is a separate legal entity, providing members with limited liability protection. An SRL can operate for an unlimited duration. These entities are governed by Barbados’s Societies with Restricted Liability Act and the Companies Act for certain aspects, which provide guidelines for their formation, registration, and daily operations.

Foreign companies aiming to conduct business or seek a local presence in Barbados must register as external entities under the Companies Act. Companies must maintain comprehensive accounting records and submit annual financial statements and tax returns.

Benefits for International Trade (via FCPs)

Barbados offers a strong platform for international trade through its network of double tax treaties and the FCP regime. The FCP allows companies earning all their income in foreign currency to bypass capital controls and benefit from a lower tax rate (5.5%) and import duty concessions for service traders. This enhances tax planning and international market position. The stable business environment ensures investor confidence and asset protection.

Limited Liability Companies (LLCs)

In Barbados, the Limited Liability Company (LLC) is legally termed a Society with Restricted Liability (SRL). The Corporate Affairs and Intellectual Property Office (CAIPO) handles the registration. An SRL is a separate legal entity, distinct from its owners, providing limited liability protection. This shields owners from personal responsibility for company debts. As detailed in the SRL section, SRLs use “managers” (not directors) and “quota holders” (not shareholders). Managing an SRL involves formalities like maintaining minutes and adopting resolutions.

Flexibility and Protection

Barbados has adaptable company laws. The Companies Act and Societies with Restricted Liability Act create a positive setting for business, offering asset protection. Foreign companies can re-register as Barbados entities and vice-versa (continuance). The SRL structure offers flexibility with the potential for favorable tax treatment if qualifying for an FCP or other specific rates. Confidentiality is important; financial statements of private companies are not generally public.

Comparison with Other Company Types

Barbados offers different legal entities. SRLs give owners limited liability. The former IBC structure is no longer available for new entities. Public Limited Companies (PLCs) require a minimum capital (stated as BBD $50,000, subject to verification for current accuracy) and pay corporate tax generally at 9% (or specific rates like 5.5% or 4.5% if qualifying, and subject to the 15% MNE minimum tax if applicable). Unlike some older SRL structures that might have had a 50-year lifespan, PLCs can exist indefinitely. PLCs can have many shareholders.

Partnerships in Barbados

Partnerships in Barbados offer flexible structures. Barbados regulates partnerships under local laws. Key sectors like financial services and tourism often use partnerships. Businesses must follow CAIPO-managed registration procedures. The English Common Law-based legal system influences partnership structures.

Types of Partnerships

Barbados recognizes several partnership types, including Limited Partnerships which require national registration. An SRL is distinct from a partnership. RBCs are common for local business. Former IBCs are now RBCs/SRLs.

Legal Obligations and Protection

Foreign businesses operating in Barbados must register under the Companies Act. Compliance avoids fines. Entities must follow all laws and industry rules, including annual reports and license maintenance. The Companies Act and Partnership Act guide entity formation. Registering a business name with CAIPO is essential.

Sole Proprietorship

A sole proprietorship is Barbados’s simplest business structure. One person owns, operates, and is liable for all business debts. Its simplicity is preferred. Barbados supports sole proprietorships with good infrastructure.

Process of Establishment

Setting up a sole proprietorship is simple. The proprietor registers a trade name with CAIPO, submitting the name and possibly identity/address proof. CAIPO registration protects the business name.

Pros and Cons for Entrepreneurs

Starting a legal entity in Barbados offers benefits. The tax environment can be favorable (e.g., 9% general corporate rate, 5.5% for qualifying FCP holders). Structures like SRLs provide protection against personal liabilities. The Companies Act supports asset protection. However, sole proprietors have personal liability for all business debts.

Public Companies in Barbados

Public Companies (Public Limited Companies – PLCs) in Barbados can list shares on the stock exchange to raise capital. The cost to incorporate was historically stated as BBD $1,500-$5,000, and minimum share capital as BBD $50,000 (these figures should be verified for current accuracy). The corporate tax rate for PLCs is generally 9%. If the PLC qualifies for specific conditions (e.g., as an FCP holder earning 100% foreign income, or income from qualifying IP), rates of 5.5% or 4.5% may apply. If part of a qualifying MNE group, a 15% minimum effective tax rate is applicable. PLCs must follow local laws. Listing offers credibility.

Governance and Compliance Requirements

Compliance for Barbadian businesses includes annual reports and license maintenance. Governance ensures adherence to rules. Companies need complete accounting records and must submit annual financial statements and tax returns. Most companies must prepay corporation tax monthly from income year 2025. Small private companies may not need to make financial statements public.

Benefits for Large-Scale Operations

Large-scale operations in Barbados can benefit from the current corporate tax structure (9% general, or lower specific rates if qualifying). The legal framework protects assets and minimizes shareholder liability. The efficient tax and business environment can reduce compliance tasks.

Incorporation of External Companies

External company incorporation is for foreign companies doing business locally. An external company operates in Barbados if it holds land titles or maintains a local office/business place. Companies Act registration is required. They also need licenses under relevant laws. The Registrar of Companies prevents name confusion.

Requirements and Process

CAIPO oversees company registration. A registered local address is needed. The process: choose a structure, reserve a unique name with CAIPO, prepare documents (Memorandum, Articles of Association). Registration can take about six weeks.

Strategic Advantages

Barbados offers strategic benefits: a business-friendly environment with policies attracting foreign investment (e.g., FCP regime); double taxation agreements; a skilled workforce; political/social stability. The Companies Act provides asset protection. Modern infrastructure supports operations.

Choosing the Right Legal Entity

Choosing the correct legal entity in Barbados is very important, especially with the recent tax reforms. Each type influences tax, liabilities, and operations. An RBC or SRL offers limited liability and a clear organizational structure.

For international commerce, forming an RBC or SRL and obtaining an FCP (if earning 100% foreign income) is the current route, offering a 5.5% tax rate and other benefits. The former IBC regime is not available for new businesses. Entities under the Companies Act and Societies with Restricted Liability Act are separate from their owners, providing asset protection.

Key Legal Entities in Barbados (for new formations):

- Regular Business Company (RBC)

- Society with Restricted Liability (SRL)

Key Considerations for International Business:

- Foreign Currency Permit (FCP) for entities earning 100% foreign income.

Benefits (General):

- Limited Liability (RBCs, SRLs)

- Asset Protection

- Structured for Various Business Activities under Current Tax Laws

Professional guidance is highly recommended for registering and meeting legal obligations due to the evolving nature of tax laws and regulations. This ensures you select the right structure for your business goals.

Additional Resources and Support for Businesses

Barbados provides a strong system for business registration and operation. The government gives support to make company registration easier.

Businesses in Barbados can use various services for company formation, structuring, and compliance help. These ensure businesses meet legal requirements.

Barbados also gives access to a skilled, cost-effective workforce. Its strategic location helps businesses access North American, Latin American, and European markets.

Here are some resources for businesses in Barbados:

- Government Assistance: Simplifies company registration (e.g., via CAIPO).

- Professional Services: Offer legal, tax, and compliance support.

- Strategic Location: Access to major global markets.

- Workforce: Skilled and cost-effective local labor.

These resources support a thriving Barbadian business environment.

Governing Body: CAIPO

The Corporate Affairs and Intellectual Property Office (CAIPO) is the government agency responsible for the incorporation and registration of all business entities in Barbados. All formation documents and annual returns are filed with CAIPO.

Frequently Asked Questions

What are the main types of legal business entities in Barbados?

The main legal business entities in Barbados include Regular Barbados Companies (RBCs), Societies with Restricted Liability (SRLs), Partnerships, Sole Proprietorships, and Public Limited Companies (PLCs). Each structure has different legal and tax obligations suited to specific business needs.

What is a Regular Barbados Company (RBC)?

An RBC is a company incorporated under the Companies Act of Barbados. It requires at least one shareholder and one local resident director. RBCs are subject to a 9% corporate tax rate, but can qualify for 5.5% or 4.5% rates if they meet specific criteria such as holding a Foreign Currency Permit (FCP) or earning income from intellectual property.

What is a Society with Restricted Liability (SRL)?

An SRL is a type of limited liability company under Barbadian law. It uses “managers” and “quota holders” instead of directors and shareholders. SRLs must have at least one member and one local manager. They offer liability protection, no minimum capital requirement, and are eligible for tax benefits if they qualify for an FCP.

Can these entities be 100% foreign-owned?

Yes, all three major entity types—the RBC, IBC, and SRL—can be fully owned by foreign individuals or corporations. There is no requirement for local shareholders.

Are International Business Companies (IBCs) still available in Barbados?

No. The IBC regime in Barbados ended in 2018, and grandfathering provisions expired in 2021. Businesses seeking similar benefits now form RBCs or SRLs and apply for an FCP if eligible.

What is an annual return?

An annual return is a document filed each year with CAIPO. It confirms the company’s key details, such as its registered office address, directors, and shareholders, are up-to-date. Filing this return is mandatory for a company to remain in good standing.

Companies must maintain accounting records, file annual tax returns, and most must prepay corporate tax monthly starting in 2025. SRLs may require audits and must file returns if revenue or assets exceed specific thresholds. External companies must also register with CAIPO and fulfill local requirements.

What type of business structure is best for foreign investors in Barbados?

Foreign investors typically form an RBC or SRL and apply for an FCP to benefit from tax advantages and exchange control exemptions. These structures provide liability protection, asset security, and access to double taxation treaties.