Company Formation in Mexico: Incorporation Guide for Foreign Investors

Company formation in Mexico is appealing to foreign investors, thanks to its robust economy, growing services sector, and strategic location as a gateway to both North and Latin America. This guide will help you understand the process of setting up a company in Mexico, so your commercial activities hit the ground running. You will need to register with the Public Registry as part of company formation in Mexico.

For ongoing fiscal compliance you will have to register with the tax authority known as the Servicio de Administración Tributaria (SAT). Biz Latin Hub is here to support you every step of the way, providing our full suite of back-office services to help you register a business, maintain commercial operations, and serve as your trusted local partner in this dynamic market.

Key Takeaways On Company Formation in Mexico

| Is Foreign Ownership Permitted? | Yes 100% foreign ownership is allowed in Mexico. |

| What Are The Common Types of Companies In Mexico? | Sociedad Anónima de Capital Variable (S.A. de C.V.). Sociedad de Responsabilidad Limitada de Capital Variable (S. de R.L. de C.V.) Sociedad Anónima Promotora de Inversión de Capital Variable (S.A.P.I de C.V.)- |

| Company Formation Steps in Mexico: | Step 1 – Decide which Mexican Legal Entity to use. Step 2 – Decide on a Company Name. Step 3 – Identifying the UBO. Step 4 – Drafting the Company’s By-laws. Step 5 – Obtaining a Tax Identification Number (RFC- Registro Federal de Contribuyentes). Step 6 – Obtaining a Fiscal Address. Step 7 – Opening a Corporate Bank Account. |

| What Are The Minimum Requirements For Company Formation? | Minimum Shareholders. Share Capital. Appointing Directors. Registered Office. |

| Time to Incorporate: | Company formation in Mexico should take 10 – 12 weeks. |

How to Incorporate a Company in Mexico – Step-by-Step Guide

The steps to form a company in Mexico are:

- Step 1 – Decide which Mexican Legal Entity to use.

- Step 2 – Decide on a Company Name.

- Step 3 – Identifying the UBO.

- Step 4 – Drafting the Company’s By-laws.

- Step 5 – Obtaining a Tax Identification Number (RFC- Registro Federal de Contribuyentes).

- Step 6 – Obtaining a Fiscal Address.

- Step 7 – Opening a Corporate Bank Account.

Step 1. Decide which Mexican Legal Entity to use

The first step of company formation in Mexico is establishing a legal entity. In Mexico, there are two main types of companies: a Corporation or Sociedad Anónima (SA) and a Limited Liability Company (LLC) Sociedad de Responsabilidad Limitada (SRL). These are some of the main differences between the two:

Establishing a legal entity can be lengthy and complex. It is highly recommended you already have a legal representative in Mexico before you begin the process.

Most investors incorporating a company in Mexico choose to establish a stock corporation, which is a for-profit company, where each of its shareholders owns a part of the company through shares of stock.

Step 2. Decide on a Company Name

Finding a company name can be a tedious process since the business name you desire may not be available in Mexico. Therefore, it is important to develop 3-4 possible options and order them according to preference.

If this is the first time you are incorporating a company in Mexico and you already own a foreign company, we can request that the name of your foreign entity be registered before the Ministry of Economy.

If you wish to translate your current business name directly into Spanish, then make sure you consult with a local contact to ensure the Spanish business name reads well and is the right fit for the company.

Step 3. Identifying the UBO

Since January 1st, 2022, when the fiscal law in Mexico was updated, the controlling beneficiary (UBO) is the individual or group of individuals who:

A: Directly or by means of any legal act, obtains the benefit derived from its participation in a legal entity, a trust or any other legal figure, as well as from any other legal act, or is the one who ultimately exercises the rights of use, enjoyment, enjoyment, use or disposition of a good or service or on whose behalf a transaction is carried out, even if it is done or they do it in a contingent manner; or,

B: Directly, indirectly or contingently, exercise control of the legal entity, trust or any other legal entity.

Any entity incorporated in Mexico must identify its controlling beneficiaries on the official documentation to comply with tax provisions.

Step 4. Drafting the Company’s By-laws

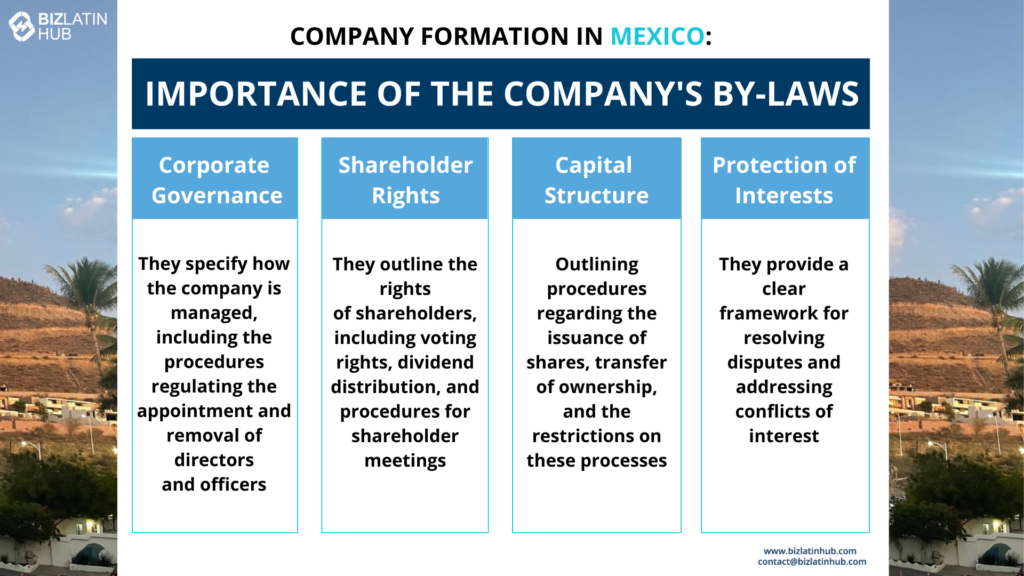

The bylaws of a company, also known as the articles of incorporation, are a set of rules and regulations that govern the internal and external operations of a company. They serve several important purposes:

- Legal Framework: the bylaws establish the company’s legal structure, with its name, purpose, and registered office. They also outline the rights and responsibilities of shareholders, directors, and officers.

- Corporate Governance: they specify how the company is managed, including the procedures regulating the appointment and removal of directors and officers, the frequency and conduct of board meetings, and the decision-making processes within the organization.

- Shareholder Rights: they outline the rights of shareholders, including voting rights, dividend distribution, and procedures for shareholder meetings. This helps ensure transparency and fairness in corporate decision-making.

- Capital Structure: they may detail the company’s capital structure, outlining procedures regarding the issuance of shares, transfer of ownership, and the restrictions on these processes.

- Protection of Interests: they provide a clear framework for resolving disputes and addressing conflicts of interest. Thus, they help protect the interests of shareholders, directors, and officers.

- Compliance: they help ensure that the company complies with relevant laws and regulations in the jurisdiction where it operates.

In summary, the bylaws of a company are a foundational document that defines the structure, operation, and governance of the organization. They provide clarity and legal certainty to all shareholders, helping to maintain order and facilitate effective corporate management. The company owners create and develop the bylaws. Developing effective company bylaws is a crucial part of company formation in Mexico.

In the bylaws, there will be specifications on who has the power to make decisions legally on behalf of the company, and potentially a breakdown of day-to-day decision-making.

It is common for foreign investors to assign a Power of Attorney (POA) in Mexico to act on behalf of the company. A POA provides safety for foreign investors who know they have a qualified local expert acting on their behalf. Having a POA also helps avoid complications during the implementation of the bylaws.

Once the by-laws have been finalized, the POA will often sign the bylaws on behalf of each shareholder with the public notary serving as a witness. Once this has been done, The Public Registry of Commerce will need to receive the company bylaws.

Step 5. Obtaining a Tax Identification Number (RFC- Registro Federal de Contribuyentes)

Your newly formed company will need a tax identification number before you can start doing business in Mexico. The tax ID can only be obtained by a local (Mexican or foreign) resident. If this is not possible, then a POA must be appointed to acquire the tax ID issued by the SAT (Servicio de Administración Tributaria) on the company’s behalf. The individual obtaining the tax ID will need to go to the tax authority with the company’s public deed.

Step 6. Obtaining a Fiscal Address

To register a company in Mexico, it is a legal requirement that you establish a fiscal address within Mexico and register it with Mexico’s equivalent of the Internal Revenue Service (IRS), the Servicio de Administracion Tributaria (SAT).

Once your company is registered, this fiscal address will be used for all business communications including tax purposes.

Step 7. Opening a Corporate Bank Account

To finish incorporating a company in Mexico, you must open a corporate bank account. The particulars of the process are regulated by bank policy. Generally, you will need to provide the bylaws of the company to the bank. You must ensure that the bank account is opened by a legal representative with the authority to open and manage the account.

The bank will review all requested documents in addition to the legal representative’s photo identification, the company’s tax ID, and the ‘Proof of Fiscal Situation’, a document that proves the tax ID is active. The bank should then process your application for a corporate account. The bank may require the legal representative to sign an anti-money laundering legal document. This helps the bank prevent any illegal activity by monitoring financial transactions.

How Long Will It Take to Successfully Incorporate a Company in Mexico?

Company formation in Mexico typically takes 4 to 6 weeks, factoring in notarization, tax registration, and bank account setup. Timelines may vary by state and complexity of documentation.

Company formation in Mexico can be overwhelming for foreign investors. Fortunately, there are experienced local corporate legal service providers that can assist foreign companies in successfully incorporating their business in compliance with Mexican law.

Important Tip: You do not need to visit the country to complete company formation in Mexico.

Do I Need a Legal Representative to Form a Company in Mexico?

Mexican law mandates that company formation in Mexico must involve a legal representative. This must be either a Mexican national or a foreign national residing in Mexico with a legal permit to work in Mexico. This individual will represent the company and act on its behalf before the law. The legal representative will also be responsible for communications between the company and any government agencies.

Company formation in Mexico can be lengthy and complex, and it requires working with multiple government agencies. Therefore, it is highly recommended that you have a legal representative in Mexico before you start the process so you can navigate it efficiently.

Types of Companies You Can Incorporate in Mexico

Before forming your company in Mexico, it’s essential to know the different entity types available. Here are the three main entity types in Mexico:

- Sociedad Anónima de Capital Variable (S.A. de C.V.): This type of company is similar to a corporation in the US. It requires at least two shareholders and has the flexibility to increase or decrease its capital over time. It is suitable for larger businesses or those planning to go public in the future.

- Sociedad de Responsabilidad Limitada de Capital Variable (S. de R.L. de C.V.): This is similar to an LLC in the US. It requires at least two partners and offers limited liability protection. It is suitable for smaller businesses or those with fewer shareholders.

- Sociedad Anónima Promotora de Inversión de Capital Variable (S.A.P.I de C.V.): This is a subtype of S.A. de C.V. It is designed for companies that promote investment and innovation. It has fewer restrictions on the transfer of shares and is suitable for companies seeking to attract foreign investment.

Differences between an S.A and S.R.L in Mexico:

| Sociedad Anónima (SA) // Corporation | Sociedad de Responsabilidad Limitada (SRL) // Limited Liability Company |

|---|---|

| The capital stock is represented by shares, which may be issued at par value or non-par value. The shares must have equal value and confer equal rights. However, it can be agreed that the capital be divided into several classes of shares with different values and rights, for each class. | The equity capital is represented by quotas, typically one per partner, which represent the partners’ overall capital contribution |

| Shares are negotiable instruments and have no restrictions on their transferability to third parties unless stated in the company bylaws | Shares are not negotiable instruments and transfer of equity quotas to third parties requires approval by the majority of partners, unless a higher threshold is stated in the company bylaws. If a partner wants to sell its equity quotas to a third party, the other partners will have a right of first refusal to acquire those equity quotas, otherwise, there must be a unanimous agreement to accept the new partner. |

| Owners of shares are referred to as shareholders (accionistas) and managers are referred to as directors (administradores). | Owners of equity quotas are referred to as partners (socios) and managers are referred to as managers (gerentes). |

| Surveillance of the company’s management by one or more statutory examiners (comisarios), who represent the shareholders, is mandatory. The statutory examiner may or may not be a shareholder. | Surveillance of the company’s management by one or more statutory examiners is optional. The statutory examiners may or may not be partners of the Company. |

Requirements to Register a Company in Mexico for Foreigners

Incorporating a company in Mexico involves several steps and requirements to ensure compliance with the country’s legal framework. Here are the minimum requirements to incorporate a company in Mexico:

- Minimum Shareholders: A minimum of two shareholders is required to incorporate a company in Mexico. However, with the new corporate reforms, it is possible to have only one shareholder if the annual sales do not exceed MX$5 million pesos, and only individuals can incorporate this type of entity, not corporations.

- Share Capital: There is no minimum share capital requirement, and the amount is decided by the shareholders. In most cases, companies in Mexico begin with a share capital of up to USD$2,500.

- Directors: Only one director is required to incorporate a Sociedad de Responsabilidad Limitada (S.R.L.) in Mexico, and there are no restrictions on the nationality or residency of the directors.

- Legal Representative: The company must have a local legal representative. This can be a national or foreign resident.

- Registered Office: All companies must have a registered office in Mexico where company documents may be legally served.

Bank account and capital requirements

Mexico offers a variety of banking options tailored to the needs of foreign companies looking to establish a presence in the country. Your ideal choice will depend on factors such as your business objectives and the specific services each bank offers. Here’s a selection of well-regarded banks in Mexico to help guide your decision-making process:

- BBVA Mexico.

- Banco Santander Mexico.

- Scotiabank Inverlat.

- Banco Mercantil del Norte (Banorte).

- HSBC Mexico.

- Banco Inbursa.

- Banco Nacional de Mexico.

Once the company is registered in the Federal Taxpayers Registry, part of the Mexican Tax Authority (SAT), it is possible to begin the bank account opening process. Minimum capital requirements vary by company type and you may need to turn up in person as well as provide documents in Spanish. You will need to have the following documents to open your bank account:

- The company’s documents of incorporation.

- Public deed related to the Legal Representative’s POAs.

- Only if applicable, public deeds related to the substantial changes in company (e.g. corporate name).

- Tax certificate (in Spanish Constancia de Situación Fiscal or CSF).

- E-signature certificate.

- Legal ID’s of shareholders (for individuals).

- The completed bank application/questionnaire.

- Certain additional documentation from the legal representative (i.e. Tax ID, certification number, ID, etc.) and current proof of domicile (utility services bills usually accepted).

- Commercial registration number for the company.

Mexico tax compliance overview

All resident companies must keep records of the company’s shareholders’ contact information, the amount of time in each shareholder meeting, and any changes in the share capital. A local registered address is required for all Mexican resident companies. All companies listed publicly must file financial reports with the Mexican Securities and National Banking Commission. Up to 10% of the annual income must be shared with the company’s employees. |

- Corporate tax: 30%

- VAT: 16%

- Monthly filings to SAT

- RFC registration

- Compliance with CFDI (digital invoicing)

- Payroll and IMSS registration for employers

FAQs on company formation in Mexico

Answers to some of the most common questions we get asked by potential clients.

1: What is the process to incorporate a company in Mexico?

The incorporation process in Mexico involves choosing a legal structure (typically an S.A. de C.V.), reserving the company name with the Ministry of Economy, drafting and notarizing the company bylaws, registering with the Public Registry of Commerce, obtaining a Tax ID (RFC) from SAT, and registering with IMSS and local municipal authorities if hiring staff.

2: What types of companies can foreign investors register in Mexico?

Common structures include the Sociedad Anónima de Capital Variable (S.A. de C.V.), ideal for medium to large operations; Sociedad de Responsabilidad Limitada (S. de R.L. de C.V.), suitable for SMEs; and Branch Offices for foreign parent companies. The S.A. de C.V. is the most widely used due to its flexibility and ability to attract investors.

3: How long does it take to register a company in Mexico?

Company formation in Mexico typically takes 4 to 6 weeks, factoring in notarization, tax registration, and bank account setup. Timelines may vary by state and complexity of documentation.

4: What are the requirements for incorporating in Mexico?

You need at least two shareholders (individuals or legal entities), a legal representative (can be foreign with a visa), a registered address in Mexico, company bylaws in Spanish, and tax registration with SAT. Foreign shareholders must provide apostilled documents and translations.

5: What are the tax obligations for companies in Mexico?

The corporate income tax rate is 30%. Companies must also register for VAT (16%), withhold payroll taxes, and make monthly filings. All entities must have an RFC and comply with SAT regulations for digital invoicing and electronic accounting.

Differences between an SA and a SRL in Mexico

| Sociedad Anónima (SA) // Corporation | Sociedad de Responsabilidad Limitada (SRL) // Limited Liability Company |

|---|---|

| The capital stock is represented by shares, which may be issued at par value or non-par value. The shares must have equal value and confer equal rights. However, it can be agreed that the capital be divided into several classes of shares with different values and rights, for each class. | The equity capital is represented by quotas, typically one per partner, which represent the partners’ overall capital contribution |

| Shares are negotiable instruments and have no restrictions on their transferability to third parties unless stated in the company bylaws | Shares are not negotiable instruments and transfer of equity quotas to third parties requires approval by the majority of partners, unless a higher threshold is stated in the company bylaws. If a partner wants to sell its equity quotas to a third party, the other partners will have a right of first refusal to acquire those equity quotas, otherwise, there must be a unanimous agreement to accept the new partner. |

| Owners of shares are referred to as shareholders (accionistas) and managers are referred to as directors (administradores). | Owners of equity quotas are referred to as partners (socios) and managers are referred to as managers (gerentes). |

| Surveillance of the company’s management by one or more statutory examiners (comisarios), who represent the shareholders, is mandatory. The statutory examiner may or may not be a shareholder. | Surveillance of the company’s management by one or more statutory examiners is optional. The statutory examiners may or may not be partners of the Company. |

Contact Biz Latin Hub for Support with Company Formation in Mexico

Company formation in Mexico is complex and requires due diligence to ensure the success of market entrants.

Biz Latin Hub ensures your company is fully compliant with local regulations and can operate with minimal delay. Offer a range of market entry and back-office services to support your commercial success in Mexico. The Biz Latin Hub team is built of well-experienced, bilingual, and knowledgeable accountants and lawyers striving to offer premium service.

The Biz Latin Hub team of local and expatriate professionals offers responsive, tailored legal and accounting solutions in Mexico where procedures tend to be lengthy and complex. If you want to set up a company, then Biz Latin Hub is your professional partner.

Reach out to our team of local experts for advice and comprehensive market services.

Learn more about our team and expert authors.