Tax and Accounting in Peru should be a key element of your market entry strategy to set up a company in Peru and ensure compliance with its detailed regulatory framework. This guide highlights essential information to help you meet Peru’s fiscal requirements efficiently. Biz Latin Hub offers specialized support in understanding accounting standards in Peru and managing the dedicated digital platforms. These are overseen by tax authority SUNAT (Superintendencia Nacional de Administración Tributaria), which oversees all tax filings, IGV, and corporate compliance.

Key Takeaways on Tax and Accounting in Peru

| What Are The Accounting Standards in Peru? | Peruvian accounting standards mandate companies to prepare financial statements in compliance with International Financial Reporting Standards (IFRS), Officialized International Accounting Standards (NIC), and Generally Accepted Accounting Principles (PCGA). |

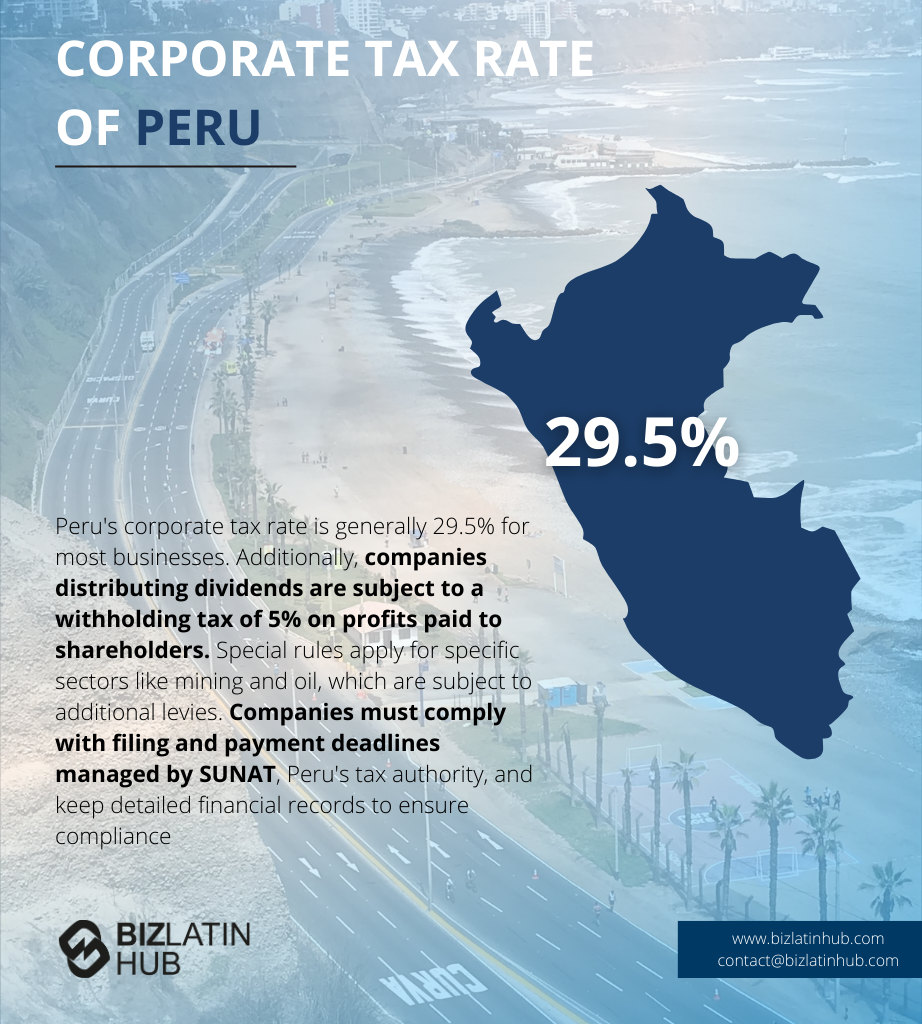

| What Is The Corporate Tax Rate in Peru? | There is a corporate tax rate of 29.5% in Peru. |

| What Is The Peruvian Value Added Tax Rate? | The standard VAT rate is 18%, consisting of 16% VAT and 2% municipal promotion tax. |

| Dividend Tax Rate in Peru | Companies must withold 5% as a dividend tax. |

Overview of Peru’s Tax and Accounting System

Generally speaking, Peru has a stable tax and financial reporting framework, which is favorable for investment since foreign companies can plan more confidently than other countries.

From a tax perspective, all companies registered in Peru are considered residents of Peru and have to pay taxes to the national tax authority, SUNAT.

They are subject to a corporation tax rate of 29.5% (2017-2023) and to meet their annual corporation tax liability, entities must make monthly advanced payments on account calculated as 1.5% of their monthly revenue. At the end of the year, the company simply deducts these advance payments on account of their total corporation tax liability to determine the balance payable.

Companies listed on the local stock exchange (SMV – Superintendencia de Mercado de Valores) must apply full IFRS whilst all other companies must follow the General Business Accounting Plan based on IFRS but less rigorous in its discloser requirements.

Peru uses the so-called “tax unit” (UIT), the amount is determined each year by the Peruvian Ministry of Economy and Finance. The applicable tax unit for 2023 is equal to PEN 4,950.

What is the business tax in Peru?

In Peru, the type of company and level of sales revenue has to be taken into account to determine the exact tax statutes of the company. Smaller companies pay a lower tax rate than larger companies. The government classifies companies based on their annual sales revenues in UIT (Tax Unit) per annum.

Taxation for companies in Peru could include:

- Corporate Tax.

- Value Added tax rate.

- Temporal Net Asset Tax.

- Financial Transaction Tax (FTT TAX).

The following table illustrates the different classifications:

Corporate Income Tax, IGV, and Payroll Contributions

Companies must pay their corporation tax and VAT annually, as well as other taxes relevant to their business to the Peruvian tax authority, the SUNAT.

Corporation Tax

In Peru, the standard corporate income tax rate is 29.5%. For companies to meet their annual income tax liability, monthly advanced payments on account should pay 1.5% of their monthly revenue.

This tax is based on the company’s net income, the taxable income is composed of all income derived from a company, including capital gains. When calculating the corporation tax liability, normal business expenses may be deducted from revenue. It is important to note that these expenses must be directly related to the company’s business objective.

However, resident corporations are taxed on their worldwide income, and nonresident corporations and branches of foreign entities are taxed solely on their Peruvian profits.

The distribution of dividends between resident companies is taxed at 5% for both local and foreign shareholders. However, foreign dividends received by a Peruvian company should be included in taxable income and are therefore subject to corporation tax which is set at 29.5% after accounting for a tax credit for foreign tax paid on the dividends.

Value Added Tax (IGV)

The general rate of VAT is 18% (2% of the municipal promotion tax and 16% of VAT itself). The IGV is the Peruvian VAT and is payable on the sale of goods, the rendering of services, construction contracts, and the sale of real estate carried out by a developer. IGV credit cash refunds are only available for exporters and some entities in a pre-operative stage under certain conditions.

All taxpayers (companies and individuals) must register with the Peruvian Tax Authorities (SUNAT) to obtain their taxpayer identification number (RUC).

Other Taxes

Temporal Net Asset Tax (ITAN): companies subject to corporation tax are obligated to pay a temporary net assets tax imposed on the total value of all assets exceeding PEN 1 million, at a rate of 0.4%. The amount paid for ITAN may be credited against the taxpayer’s income tax. If not used, the remaining ITAN may be refunded by the tax administration.

Financial Transaction Tax (FTT TAX): the FTT is applied at a rate of 0.005% on all debit and credit transactions from Peruvian bank accounts held by taxpayers. Payments of the FTT can be categorized as expenses to be deducted from income tax. The following operations, among others, are exempted from the FTT:

- Operations made between accounts of the same holder

- Credits to bank accounts for payment of salaries

Credits and debits to bank accounts of diplomatic representations and international organizations recognized in Peru.

UBO Reporting, Deadlines, and Accounting Books

Fines must be paid if tax declarations are not filed on time. Additionally, interest must be paid for late submissions of tax returns. The amounts vary depending on the total revenue of the company and whether fines are paid voluntarily or involuntarily. Furthermore, fines have to be paid when submitting incorrect information or when not paying the contribution to the ONP and withholdings on 4th and 5th category income within the established deadlines.

All fines are regulated by the UIT, and according to the sanction, they vary between 5% and 100% of their value. Companies have to use SEE (Sistema de Emisión Electrónica) for invoices. Facturas must be issued in real time and stored for 5 years.

Companies in Peru must give details on their Ultimate Beneficiary Owners (UBO) to the UBO registry via SUNAT annually or upon changes to owndership or control. Books that companies are required to keep include Diario, Mayor, Inventario y Balances. These must be in electronic format for medium/large taxpayers.

What is the Frequency of Tax Declarations in Peru?

When doing business in Peru, all companies have to declare their income and expenses on a monthly and yearly basis. The tax year for a company is its accounting year, which ends on December 31st. Therefore, companies have to make 12 monthly advanced payments of income tax based on their monthly taxable income.

Additionally, an annual tax return must be filed and the final tax has to be paid within the first three months, which follow the end of the tax year using the PDT program (Programa de Declaración Telemática). IGV is declared monthly between the 12th–20th, based on RUC. UBO registry updates are annual. Payroll reports monthly.

In addition, mining companies have to pay a royalty, ranging from 1% to 12%, calculated on the gross sale relating to the transfer of mineral resources. If taxes are not paid on time or at all, the company has to pay penalties to the national tax authority, SUNAT.

How Does Tax On Employment Income For Individuals work?

Taxation on individuals considered domiciled taxpayers is imposed on their worldwide income, however, non-residents are only taxed on income earned in Peru. In Peru, a resident is taxed whether he is Peruvian or an expat if he has lived in the country for more than 183 days within 12 months.

What is the Personal Income Tax in Peru?

Income taxes are calculated using a scale expressed in tax units, UIT equivalent to PEN 4,950. The tax on an annual income for up to 5 UIT is 8%; from 5 to 20 UIT the rate is 14%; from 20 to 35 UIT the rate is 17%; from 35 to 45 UIT the rate is 20%, and for an income over 45 UIT the rate is 30%. Such a statement is applicable for labor income of the fifth category, as well as for income arising from independent work (fourth category). Income tax on non-resident employees is imposed at 30% of their Peruvian income.

Other Employee Contributions in Peru

Other employee contributions in Peru are:

- Health Contributions.

- Pension Fund Contributions.

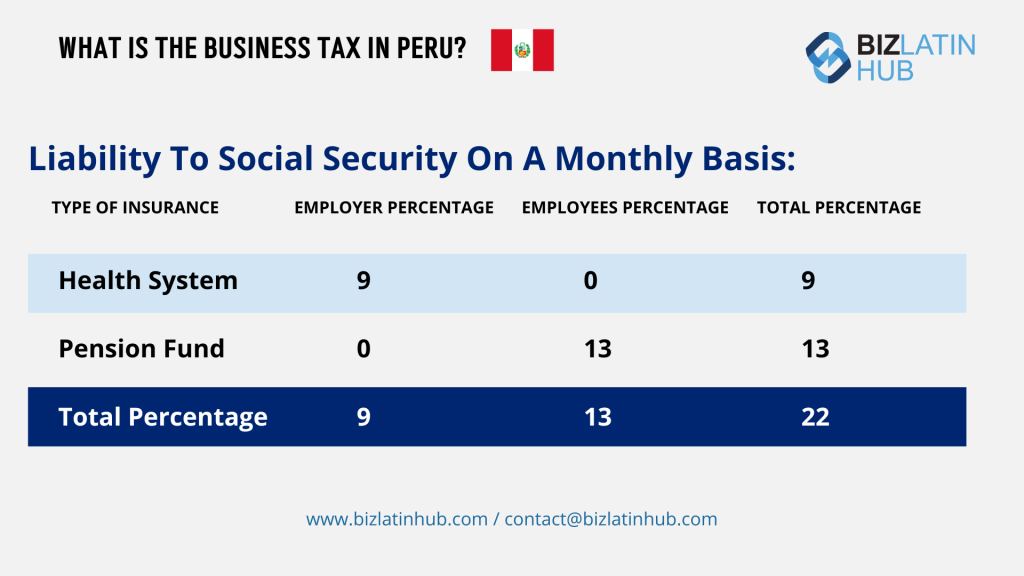

1. Health Contributions

The Peruvian health system is divided into two sectors: the public and the private sector. All employers must make mandatory monthly payments to health contributions equal to 9% of the remuneration paid to employees. Employees can be affiliated with the National Health System (6.75% – EsSalud) or the Private Health System (EPS – 9%), depending on their choice.

EsSalud is public insurance, and it is obligatory for workers both in the public and in the private sector. It provides coverage in the case of dental care, general and specialized health care, and others. EPS is for employees who are not affiliated with EsSalud. Employees who perform high-risk activities, such as mineral extractions and iron and steel melting, among others, must have complementary insurance for high-risk industries. This insurance is compulsory, crucial, and must be paid for by the employer.

2. Pension Fund Contributions

Employers shall deduct 13% from the gross salaries for pension contributions. If the employee is affiliated with the Private Pension System different rates are applied, so the 13% listed above is an average. In case of affiliation to the Private Pension System, a percentage corresponds to the personal pension account and a percentage is paid to insurance and commissions managing the fund.

Should the foreigner leave the country upon termination of his/her working contract, the respective pension funds credited to the Private Pension System may be wired to an account belonging to the employee at a foreign bank. Employees can decide whether they want the Public Pension System (ONP) or the Private Pension System.

Liability To Social Security On A Monthly Basis:

FAQs About Tax and Accounting in Peru

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Peru.

1. What is the corporate tax rate in Peru?

A1: The general corporate income tax rate is 29.5%. A 5% dividend withholding tax applies to distributions to shareholders.

2. How are businesses taxed in Peru?

Businesses in Peru are taxed according to the Tributary Code and Income Tax Law, which works based on paying corporation tax on the difference between revenue minus deductible expenses.

3. What is the IRS called in Peru?

The IRS in Peru is called the Superintendencia Nacional de Aduanas y de Administración Tributaria or SUNAT and is responsible for the administration of the taxes of the Peruvian National Government.

4. What is the accounting standard in Peru?

Peruvian accounting standards require companies to prepare their financial statements in Spanish, in SOL currency, and according to International Financial Information Standards (NIFF), Officialized International Accounting Standards (NIC), and Generally Accepted Accounting Principles (PCGA).

5. What is the CPA equivalent in Peru?

The equivalent of a CPA in Peru is the Colegio de Contadores Públicos de Lima (CPC).

6. Does Peru report in IFRS?

In Peru, all national companies whose securities are listed on a regulated market are required to use IFRS Standards issued by the IASB in their consolidated and separate financial statements, except banks, insurance companies, and pension funds, which must comply with the accounting standards issued by the Superintendence of Banking, Insurance and Pension Fund Administrators (SBS).

Non-listed companies that are not financial institutions must also follow IFRS standards approved by the Accounting Standards Council (CNC).

Foreign companies whose securities are listed on a regulated market are required to use IFRS Standards issued by the IASB and approved by the Accounting Standards Council (CNC).

7. What is IGV in Peru?

IGV (Impuesto General a las Ventas) is Peru’s VAT, set at 18%. Monthly filings are mandatory.

8. Are companies required to issue electronic invoices?

Yes. All businesses must issue electronic invoices (facturas electrónicas) and report to SUNAT using the SEE system.

9. What are the payroll tax obligations?

Employers must contribute 9% to EsSalud (health insurance) and withhold income tax and pension (AFP or ONP) from employees.

10. Is UBO registration mandatory in Peru?

Yes. All legal entities must register beneficial owners with SUNAT through the RBU (Registro de Beneficiarios Finales). Updates are required for ownership changes.

Why Invest in Peru?

Peru is an emerging investment destination, combining economic stability with vast natural and cultural wealth. As one of the fastest-growing economies in Latin America, it boasts a resilient market supported by sound fiscal policies, low inflation, and an expanding middle class.

Rich in natural resources, Peru is a global leader in mining and agriculture, producing high-demand exports like copper, gold, coffee, and superfoods such as quinoa. The government actively supports foreign investment with pro-business regulations, free trade agreements, and infrastructure development to connect Peru to global markets.

Peru’s unique advantages go beyond resources. Its diverse workforce, affordable operating costs, and thriving tourism sector—anchored by world-renowned attractions like Machu Picchu—make it a versatile hub for investors.

Additionally, the country is embracing innovation with growing investments in renewable energy and sustainable industries. With a forward-looking economy and abundant opportunities in key sectors, Peru offers a compelling case for investors seeking growth and long-term stability.

Biz Latin Hub Can Help You With Accounting and Taxation in Peru

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean. Our unrivaled reach means we can support multi-jurisdiction market entries and cross-border operations.

As well as knowledge about accounting and taxation in Peru, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to discover more about how we can assist you in finding top talent or doing business in Latin America and the Caribbean.

If this article on accounting and taxation in Peru was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.