If you’re an entrepreneur who wants to start a business in Australia, then there are lots of things that you need to take into consideration. Learn more about legal compliance requirements in Australia. Something that you need to take into account is company structure and ensuring that you can comply with the legal compliance requirements in Australia which are set out by the government and the Australian Securities and Investments Commission (ASIC). In this article, we summarize how you can stay above board and compliant.

Key Takeaways On Corporate Legal Compliance in Australia

| Is a physical address in Australia necessary for doing business? | A registered local fiscal address is required for all entities in Australia for the receipt of legal correspondence and governmental visits. |

| What are the annual entity legal compliance requirements? | Some of the key legal compliance requirements for a business in Australia include the following: Inform ASIC of a principal place of business Keep hold of all financial records Disclose your directors Pay fees Keep information up to date |

| What are the annual Entity fiscal Compliance Requirements? | Every year, you’ll receive an annual statement from the ASIC. It is your legal responsibility to review the statement and ensure that the details on the register are accurate and that all of your directors complete a solvency report. |

| What common statutory appointments do companies make in Australia? | An appointed local director who will be personally liable, both legally and financially for the good operation and standing of the company. More than one local director can be appointed, however at least one of them should be a local national or a foreigner with the right to live/work in the country. In case it is a public company, then a minimum of three directors must be appointed, at least two of whom must reside in the country. |

| Why Choose to Invest in Australia? | Investing in Australia offers consistent economic growth, a highly skilled workforce, strategic location, strong governance, and world-class infrastructure. |

Legal compliance requirements in Australia

One of the most obvious requirements for forming a legal entity in Australia is having a registered office within the country. As a company owner, you’ll be responsible for informing the ASIC of its location, and letting them know should you move to new premises.

This will serve as your official office and all communications will be sent to this address – whilst this address does not necessarily have to be where your main business operates, it must be a business address, rather than a home address, and it must be in mainland Australia.

Inform ASIC of your main business location

As discussed, your registered company address does not necessarily have to be your main office, so if you operate from a location that’s different from the address you provided to the ASIC, you must let them know. The same goes for any future addresses – should you open a chain, restaurants or clothing stores, for example, every address should be registered.

Keep all financial records

Not only should you keep hold of your financial records for accounting and tax purposes, but you should ensure that these records are up-to-date and easy to access. Every receipt, invoice and transaction record should be kept for up to six years so that you can provide the ASIC with information and an explanation of your day to day business operations.

Disclose your directors

Whether you’re forming a company, a trust or a partnership in Australia, you should make sure that ASIC has a copy of every director’s name, date of birth and residential address. If you have a company secretary, they must also be registered with the ASIC. It’s important to mention that every director must be registered using their home address – you cannot supply a post office box address or a principal place of business address for any of your directors.

Pay fees

When you register a company, make changes to your documents or submit your annual statements later than requested, then ASIC may impose fees or late fees. To ensure that your business is fully compliant and provides necessary information on time, refer to the ASIC website and add important dates – like tax returns – to your calendar for reference.

Keep information up to date

As a business owner in Australia, it is your responsibility to ensure that all information that the ASIC holds on your business is up to date. Whenever you make a change, whether it’s adding a new director to your company, changing the name of your business, moving to new premises or updating your email address, you must notify the ASIC as soon as you can.

Do what’s right

This point is something of a grey area, but it’s important to mention nonetheless. If you want to ensure your business remains fully compliant, you should act in the best interests of the company and its people, rather than your own personal interests.

For example, rather than taking a significant bonus that may have an impact on your company’s long-term viability, you should take a reasonable bonus or no bonus at all. Do what’s right for the good of your company, its staff, its shareholders and its creditors – if you don’t, you could be penalized.

Check your statements

Every year, you’ll receive an annual statement from the ASIC. It is your legal responsibility to review the statement and ensure that the details on the register are accurate and that all of your directors complete a solvency report, which leads us on to our next point.

Solvency

You must make sure that your company is solvent. If you cannot pay debts and when they are required, you have low levels of profits or poor cash flow, you have problems with paying creditors on time, or suppliers have taken legal action against your business, you could be insolvent.

You must notify the ASIC as soon as this happens, and take every possible step to ensure your business remains afloat. If your company goes into insolvency and the ASIC believe that your negligence was to blame, you may be required to speak before a judge.

Handle and use information correctly

Finally, you must take responsibility when handling data you obtain through a company. If you use information about staff, clients, or suppliers to gain an advantage over a person or use the information to harm a company, you may be committing an offense. Use information – and handle and encrypt it – carefully as an entrepreneur, and always do the right thing.

FAQs for legal compliance in Australia

Based on our extensive experience these are the common questions and doubts of our clients when looking to operate within the country

The following are the most common statutory appointments for Australian legal entities:

An appointed local director who will be personally liable, both legally and financially for the good operation and standing of the company. More than one local director can be appointed, however at least one of them should be a local national or a foreigner with the right to live/work in the country. In case it is a public company, then a minimum of three directors must be appointed, at least two of whom must reside in the country.

Yes, a registered office address or local fiscal address is required for all entities in Australia for the receipt of legal correspondence and governmental visits.

Some of the key legal compliance requirements for a business in Australia include the following:

Inform ASIC of a principal place of business: Your registered company address does not necessarily have to be your main office, so if you operate from a location that’s different from the address you provided to the ASIC, you must let them know. The same goes for any future addresses – should you open a chain, restaurants or clothing stores, for example, every address should be registered.

Keep hold of all financial records: Ensure that these records are up-to-date and easy to access.

Disclose your directors: You should make sure that ASIC has a copy of every director’s name, date of birth and residential address.

Pay fees: When you register a company, make changes to your documents or submit your annual statements later than requested, then ASIC may impose fees or late fees. To ensure that your business is fully compliant and provides necessary information on time, refer to the ASIC website and add important dates – like tax returns – to your calendar for reference.

Keep information up to date: Whenever you make a change, whether it’s adding a new director to your company or updating your email address, you must notify the ASIC as soon as you can.

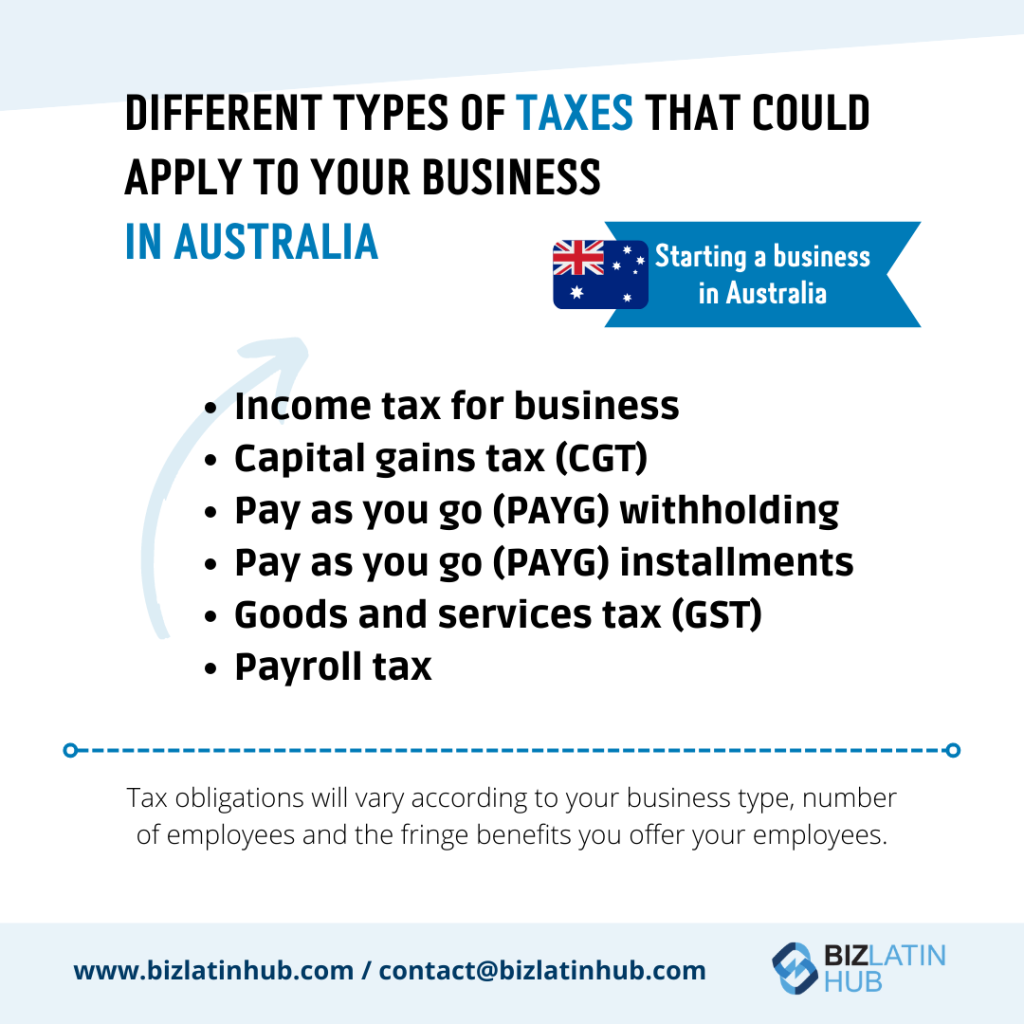

Some taxes that could apply to a business in Australia include the following:

Income tax for business

Capital gains tax (CGT)

Pay as you go (PAYG) withholding

Pay as you go (PAYG) installments

Good and services tax (GST)

Payroll tax

Every year, you’ll receive an annual statement from the ASIC. It is your legal responsibility to review the statement and ensure that the details on the register are accurate and that all of your directors complete a solvency report.

Biz Latin Hub can help you with legal compliance requirements in Australia

When forming a legal entity in Australia, you should take care to follow the necessary rules and regulations and remain fully compliant – if you do not, then you may be subject to fines or criminal proceedings. Consider working with a solicitor or lawyer to handle paperwork and ensure that everything you do as an entrepreneur and as a company is compliant.

If you’re incorporating a business in Australia and need the help of an experienced team to assist in commercial representation, formation, accounting, legal services or due diligence, get in touch with the experts at Biz Latin Hub Australia today. Reach out to our team now for personalized support.