Understanding the tax and accounting requirements in Australia is essential for remaining compliant. Boasting one of the world’s most lucrative and stable economies, and a high GDP per capita, it is little wonder why so many foreign investors choose to start a company in Australia. The country is an economic powerhouse and offers entrepreneurs untapped earnings potential. Australia’s business compliance is managed by the Australian Taxation Office (ATO) and the Australian Securities and Investments Commission (ASIC), which regulate tax reporting, corporate governance, and financial disclosures.

Key takeaways on the tax and accounting requirements in Australia

| What Are The Accounting Standards in Australia? | In Australia, the accounting standards are primarily governed by the Australian Accounting Standards Board (AASB). These standards are largely based on the International Financial Reporting Standards (IFRS) set by the International Accounting Standards Board (IASB), with some additional modifications specific to Australian circumstances. |

| What Is The Corporate Tax Rate in Australia? | All legal entities are subject to a 30% rate on taxable income, with SME’s subject to a reduced rate of 25%. |

| Australian Value Added Tax Rate | Australia applies a standard goods and services tax (GST) rate of 10%. |

| What Is The Dividend Tax Rate in Australia? | Dividends to parent companies are exempt if corporate tax is paid. Interest to foreign entities incurs 10% withholding tax. |

Overview of Australia’s Tax System and Compliance Framework

If you incorporate a company in Australia, you conduct business in Australia that is managed in the country, or you conduct business in the country have Australian resident shareholders, then your company is considered to be resident in Australia.

Companies which are resident are taxed on their worldwide income – that is, income generated in Australia and by trading with other countries around the world. Non-resident companies, on the other hand, are only required to submit accounts and pay tax on their income that was generated in the country.

All companies in Australia are required to pay a corporate tax rate of 27.5%, provided their turnover is less than AU$50 million per year. For those companies with a turnover of more than AU$50 million per year, the full 30% corporate tax rate applies to all taxable income.

For companies with a turnover of more than AU$10 million per year, accounts and returns must be submitted by January 15th after the tax year ends, or February 28th for those who generate less than AU$10 million per year. Ensuring you submit your taxes on time is critical, as you may be fined or asked to appear in front of a judge if you don’t provide the necessary information on this date. Therefore, working with an experienced accountant makes sense.

It’s important to note that you may carry forward your business losses indefinitely. However, you can only carry forward capital losses by offsetting them against capital gains. Ensuring you incorporate under the right Australian business structure, and seeking the assistance of a reputable business accountant, is key to remaining compliant when carrying losses forward.

Payroll Contributions and Superannuation Obligations

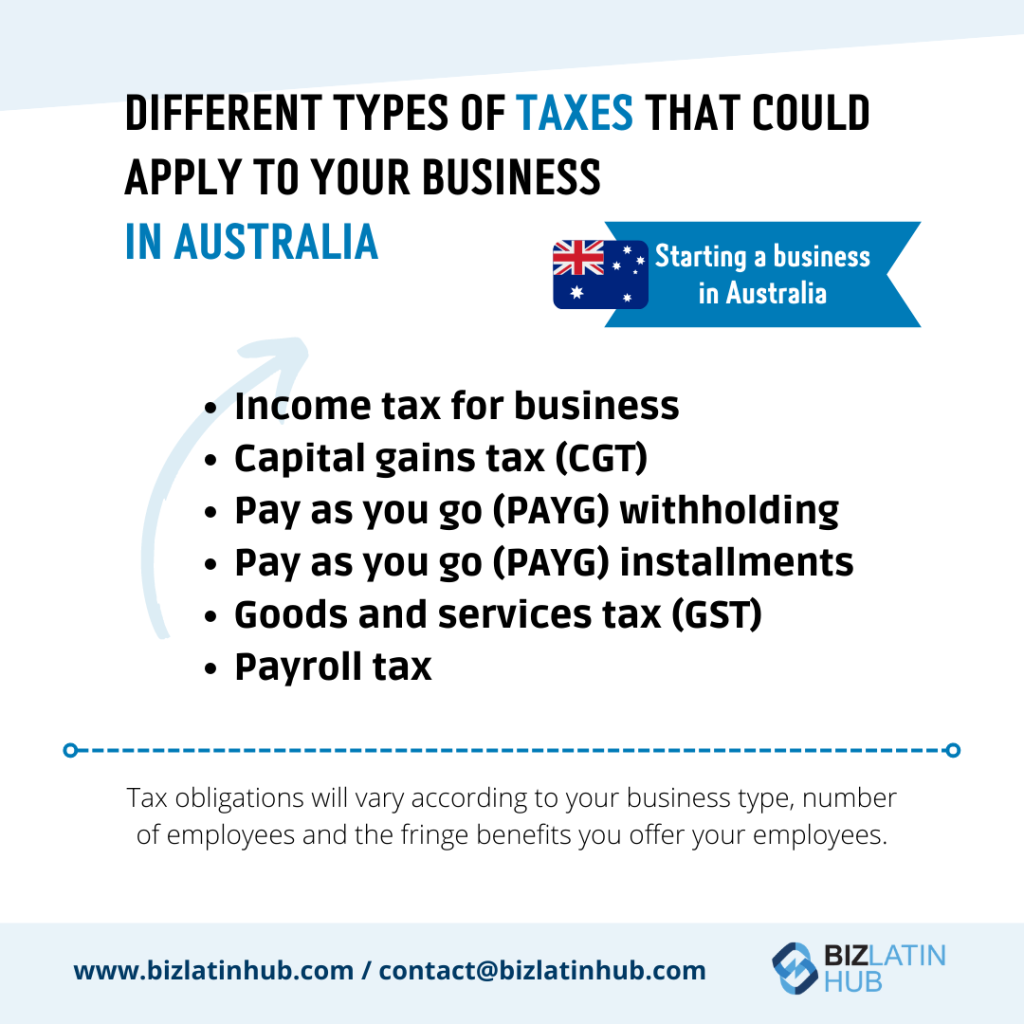

When taking on employees in Australia, you must be aware of the financial responsibilities of doing so and factor this into operating costs. Employers must register with the ATO for PAYG and with a superannuation clearing house. STP submissions are mandatory each pay cycle and must include gross pay, tax withheld, and super accrued.

Employers must pay into the Social Security and Unemployment Insurance Fund at a rate of 9.5% of an employees’ gross salary, whether setting up as a Sole Trader or a Trust, as well as paying an eye-watering 46% tax on fringe benefits provided to workers, whether that be healthcare, gym membership, or childcare. On top of that, employers are expected to withhold payroll tax that is due on all employees’ wages, which averages at around 5.5% depending on the local authority you operate within.

Withholding Tax in Australia

When operating in Australia as a foreign investor, it’s important to understand withholding tax and know how to distribute earnings to yourself, other shareholders, and businesses both in and out of Australia. If you run a subsidiary business, then you’ll be pleased to know that dividends paid to Australian and foreign parent companies are withholding tax-exempt, so long as the necessary corporate tax has been paid on profits.

The interest that is paid to foreign entities has a 10% withholding tax, and real estate sales and transfers are subject to a property tax levied by your local authority (this figure can be anything from 4% to 7%).

What is interesting to note, however, is that Australia has taxation treaties with fifty countries around the world, reducing withholding tax on payments abroad. Refer to your local government for more information before you get started.

Goods and services tax (GST)

The standard Goods and Services Tax (GST) rate in Australia is 10%. All businesses with a Goods and Services Tax turnover of AU$75,000 must register, and returns should be submitted to the government on a quarterly basis. For businesses generating a turnover of AU$20 million or more, filings should be returned monthly – keeping on top of your finances is critical here.

Corporate Tax Transparency and deadlines

In order to create a fair and transparent Australian tax system, the government offers up a lot of information about companies that operate in the country. Indeed, should you incorporate in Australia and create a successful business that generates more than AU$100 million per year, you must be prepared for an annual report to be released, that includes your company name, business number, and income figures (such as taxable income and tax payable).

In cases where confidentiality is critical, operating as a subsidiary may be a necessary step. BAS reports must include GST collected, GST paid, PAYG withholding, and PAYG installments. Filing deadlines vary—quarterly lodgers have up to 28 days post-quarter. Late lodgments may incur ATO penalties. A resident director must be appointed prior to company formation. They must reside in Australia and hold an eligible visa or citizenship. BLH can provide resident director services if required.

FAQs About Accounting and Tax in Australia

If you incorporate a company in Australia, you conduct business in Australia that is managed in the country, or you conduct business in the country have Australian resident shareholders, then your company is considered to be resident in Australia.

Companies which are resident are taxed on their worldwide income – that is, income generated in Australia and by trading with other countries around the world. Non-resident companies, on the other hand, are only required to submit accounts and pay tax on their income that was generated in the country.

All companies in Australia are required to pay a corporate tax rate of 27.5%, provided their turnover is less than AU$50 million per year. For those companies with a turnover of more than AU$50 million per year, the full 30% corporate tax rate applies to all taxable income.

GST is a 10% tax on most goods and services sold in Australia. Businesses with a turnover exceeding AUD 75,000 must register for GST and file Business Activity Statements (BAS) monthly, quarterly, or annually. BAS filings include GST, PAYG, and other obligations and are submitted electronically via the ATO portal.

Dividends paid to Australian and foreign parent companies are withholding tax-exempt, so long as the necessary corporate tax has been paid on profits. The interest that is paid to foreign entities has a 10% withholding tax.

A business that generates more than AU$100 million per year must be prepared for an annual report to be released that includes the company name, business number, and income figures (such as taxable income and tax payable).

Employers must contribute 11% (as of July 2023) of each employee’s earnings to a registered superannuation fund. Payroll tax is levied at the state level and rates vary; for example, NSW imposes 5.45% on annual payrolls above AUD 1.2 million. Employers must also comply with PAYG withholding rules and submit STP (Single Touch Payroll) reports to the ATO each pay cycle.

At least one resident director is required for Australian proprietary companies. The director must have a valid Australian address and be a permanent resident or citizen. Foreign businesses must appoint a local director before company registration. Failure to maintain a resident director can lead to deregistration.

Annual tax returns are due by 31 October (or later if using a tax agent). BAS returns are due monthly or quarterly, depending on your GST reporting cycle. Superannuation contributions must be made by 28 days after each quarter ends. Payroll tax and STP reports are submitted regularly depending on business size and payroll frequency.

Why Invest in Australia?

Australia is a global investment hotspot, with excellent trade links to many of the world’s most advanced and lucrative economies through free trade agreements, making Australia’s import and export market one that’s packed with opportunities for significant return on investment. As one of the world’s most resource-rich nations, Australia is a leader in industries like mining, energy, and agriculture, while also excelling in technology, finance, and renewable energy. Its strategic location in the Asia-Pacific region provides seamless access to booming markets, making it an ideal base for global operations. With robust infrastructure, a skilled workforce, and an open trade network, Australia is built for long-term economic growth and innovation.

What sets Australia apart is its diverse economy and commitment to sustainability. Its thriving agricultural sector is known for premium exports like beef, wine, and wheat, while renewable energy projects and clean technology investments are rapidly growing. Australia’s advanced research and development ecosystem also drives innovation across sectors. For investors looking to partner with a stable, progressive, and globally connected market, Australia offers an unmatched combination of opportunity and security.

Biz Latin hub Can Help You With Tax and Accounting in Australia

If you want to start a company in Australia, it is advisable that you have the support of a qualified account and tax specialist from the start. A well thought out business plan will not be able to evolve if your business does not remain compliant with the various accounting requirements in Australia.

Biz Latin Hub can assist you with all accounting, taxation and financial matters. Our specialist team have a comprehensive understanding of the accounting requirements in Australiaand are well equipped to work with foreign companies looking to conduct commercial activity in the region.

To learn more about the Australian economy, the business opportunities to form a company in Australia, and how you might take advantage of these political shifts, please contact us today. Or read about our team and expert authors. Interested in hiring local staff in Latin America?

See how we can support through either local company formation or through a tailored PEO solution.