Starting a business in Costa Rica is a popular choice among foreign investors seeking to enter Latin America, thanks to a number of factors that make it a favorable investment destination. Those include a stable economy, low levels of crime, a sizable expat community, and an investment-friendly environment.

For anyone looking to register a company in Costa Rica, a step-by-step guide to starting a business in Costa Rica is included below, while some key requirements associated with doing business in the country are also considered. Biz Latin Hub can help you with all this and more, not only in the country but elsewhere in the region as well.

Table of Contents

Starting a business in Costa Rica: a favorable market for investors

Costa Rica is well-known for having no standing army, instead relying on the support of the United States — its close ally and number one trade partner — to guarantee national security.

The Central American nation is able to adopt such a policy because of the long-standing political and economic stability the country has enjoyed, as well as the strong political and cultural ties it has with its regional neighbour.

That includes a large population of expats, including investors, remote workers, and retirees, attracted by low violent crime levels and one of the highest levels of English proficiency in the region. Recently the government has been making significant efforts to rejuvenate the economy.

Recently, starting a business in Costa Rica was made even more attractive when the government announced new measures to encourage FDI by slashing taxes and easing residency requirements for investors. That same month, a law was also introduced to attract more foreign remote workers to the country. The Costa Rican government has also introduced a scheme, known as the Green Protocol, offering more credit for environmentally-friendly businesses.

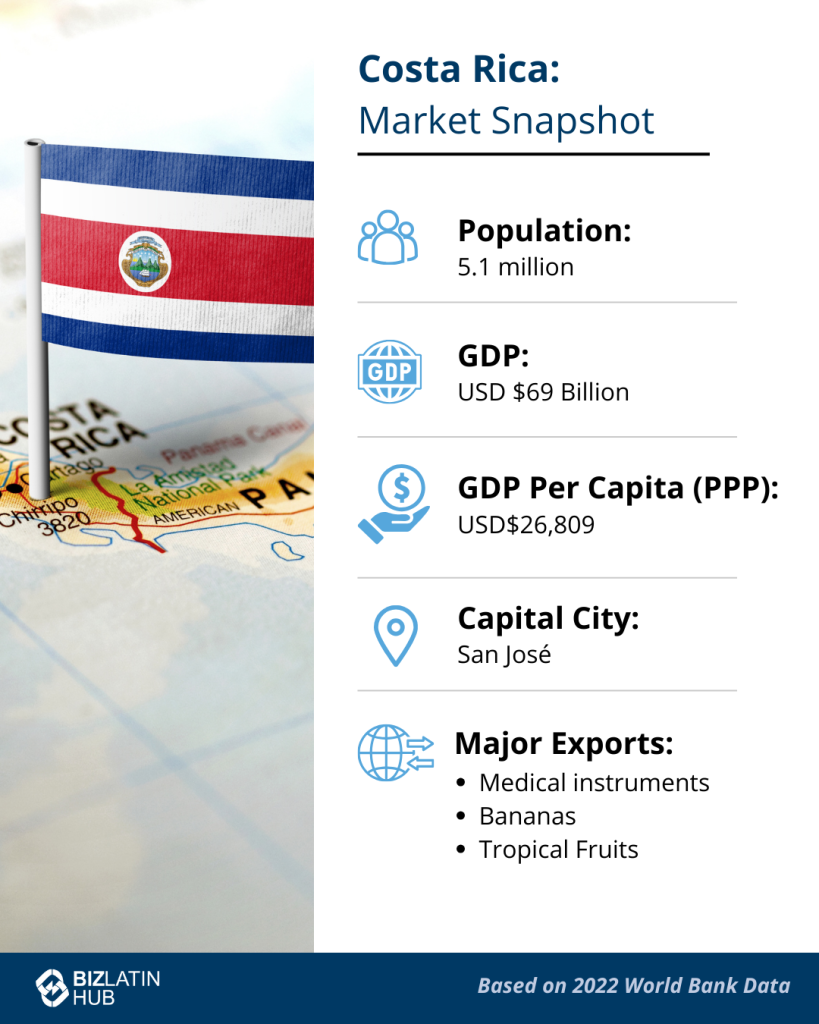

All of these factors combine to make starting a business in Costa Rica an attractive prospect for foreigners and there has never been a better time to do it. The future is bright for this small but well-positioned nation, currently boasting an economy worth more than USD$65bn despite only having 5 million residents.

Starting a business in Costa Rica: steps to company formation

When starting a business in Costa Rica, you will need to go through the following company formation process:

1. Choose the company structure

There are a number of entity types in Costa Rica to choose from, and you will need to select the one that most suits your business needs. This is something that your corporate legal counsel in Costa Rica will be able to advise you on.

2. Sign-off on proper documentation

You will need to prepare powers of attorney (POAs) and articles of incorporation for the entity, and documentation will need to be notarized. Once more, your legal counsel will be able to assist you with all of this.

3. Submit the articles of incorporation to the National Registry

This step takes between 24 and 48 hours to complete in order to have the entity legally registered.

4. Register as a taxpayer in Costa Rica

When starting a business in Costa Rica, you will need to register as a taxpayer in the country, which involves filing a D-140 form, which will provide details such as the economic activity, company name, and the fiscal address.

5. File the Ultimate Beneficial Owner (UBO) Declaration

Having been accepted as a new member of the Organisation for Economic Co-operation and Development (OECD) in May, it is required for all legal entities to file a UBO, with the information kept on a registry that is not publicly available.

6. Register with Costa Rican social security agency

Once your entity has been incorporated, you will need to register yourself as an employer with the Costa Rican social security agency — Caja Costarricense de Seguro Social (CCSS).

7. Complete the process of starting a business in Costa Rica by applying for insurance

With all of the above completed, the final step to starting a business in Costa Rica is to apply for insurance, both national insurance and occupational risk insurance.

FAQs on starting a business in Costa Rica

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in Costa Rica:

1. Can a foreigner own a business in Costa Rica?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals)

2. How long does it take to register a company in Costa Rica?

Once all the required documentation is submitted in Costa Rica, reviewed, and presented to the National Registry, the process of registering a branch can typically be completed within 2 weeks.

3. What does an S.A. company name mean in Costa Rica?

The S.A. in a company name in Costa Rica refers to a Sociedad Anónima, which is similar to a Joint Stock Company. This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure is famous in Costa Rica for its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

4. What does the SRL company name mean in Costa Rica?

In Costa Rica, SRL stands for Sociedad de Responsabilidad Limitada, which is roughly similar to a Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

5. What entity types offer Limited Liability in Costa Rica?

In Costa Rica, both S.A (Sociedad Anónima) and S.R.L (Sociedad de Responsabilidad Limitada) are limited liability entity types.

Biz Latin Hub can assist you with starting a business in Costa Rica

At Biz Latin Hub, our team of corporate support professionals is available to assist you starting a business in Costa Rica.

We offer a comprehensive portfolio of back-office services including company formation, accounting & taxation, legal services, visa processing, and hiring & PEO, meaning that we can provide tailored packages of services to suit every need.

As well as supporting investors entering and doing business in Costa Rica, we also have teams in place in 15 other markets around Latin America and the Caribbean, and specialise in multi-jurisdiction market entries.

Contact us today to discuss how we can help you reach your commercial goals.

Or read about our team and expert authors.