Explore how to successfully do business in Guatemala in 2025 — from legal requirements and company formation to sector opportunities and regulatory tips.

Doing business in Guatemala in 2025 offers growing potential for foreign investors thanks to its strategic location, low labor costs, and pro-business government incentives. If you want to register a company in Guatemala, read on to find out more information and tips about the country. Entrepreneurs and companies doing business in Guatemala must understand the country’s corporate structures, tax regime, and requirements for foreign ownership.

Key takeaways on doing business in Guatemala

| Is foreign ownership allowed in Guatemala? | 100% foreign ownership is not an issue in the country, with no restrictions on how foreigners can operate in the economy when doing business in Guatemala. |

| Most important sectors in Guatemala | Guatemala has a famously large agricultural sector, which generates almost 10% of GDP. Manufacturing is even more important. With a massive garment producing industry at its center, it contributes 22% of the GDP. The country’s fastest-growing sector is services, and it is responsible for 60% of GDP. |

| Are there Free Trade Zones in Guatemala? | There are both public and private FTZs in Guatemala, as well as Special Economic Zones (SEZs). In total, there are ten now, after some were closed by a previous government. |

| Are there incentives for Foreign Direct Investment in Guatemala? | There are very few barriers for foreigners who are thinking of doing business in Guatemala. It’s an open, free-market economy, and almost all sectors of its economy are open to foreign investment. The Free Trade Zones offer exemption from some taxes under certain conditions in order to help promote FDI in the country. |

| What international links does the country have? | The country benefits from a range of agreements, most notably with the USA, all its neighbors, the EU and Mexico. |

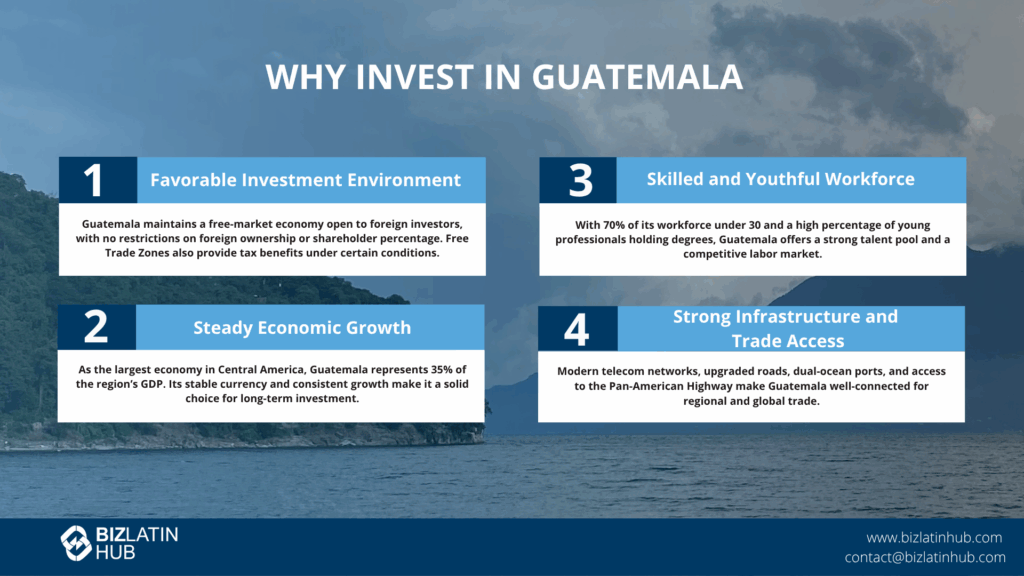

What are the advantages of doing business in Guatemala?

Guatemala has a famously large agricultural sector, which generates almost 10% of GDP. Coffee, bananas, and sugar are some of the key agricultural exports. Manufacturing is even more important. With a massive garment producing industry at its center, it contributes 22% of the GDP. Key sectors for doing business in Guatemala include textiles, agribusiness, logistics, BPO, and light manufacturing — particularly for export to the U.S. under CAFTA-DR.

The country’s fast-growing sector is services, and it is responsible for 60% of GDP. Some positives to doing business in Guatemala include the following:

- Guatemala is welcoming of foreign investment

- It boasts consistently strong economic growth

- Possesses a skilled labor force

- Is home to modern telecommunications infrastructure

- Has free trade agreements with the US, Central America

1. Open to foreign investment

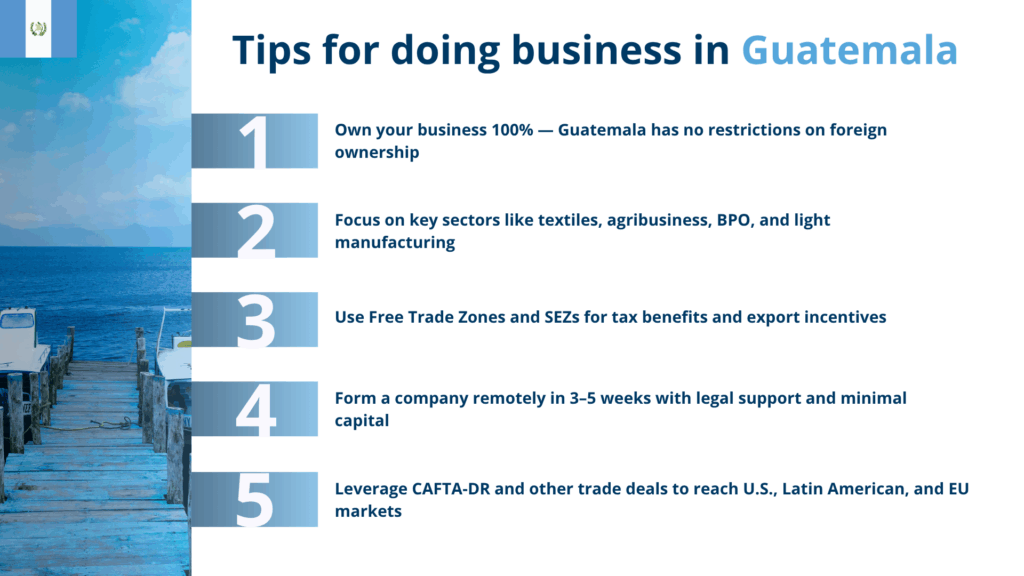

There are very few barriers for foreigners who are thinking of doing business in Guatemala. It’s an open, free-market economy, and almost all sectors of its economy are open to foreign investment. Foreigners can own property such as vehicles and real estate free of any need for local co-signers, partners, or stakeholders, and there is no limit to how much of a company a foreigner owns.

There are also no restrictions concerning the maximum proportion of foreign shareholders in a business. In order to help promote FDI in the country, there are also Free Trade Zones that offer exemption from some taxes under certain conditions.

2. A consistently growing economy

The Central American country’s economy dwarfs its neighbors in terms of size. Guatemala represents 35 percent of the region’s GDP and has seen foreign direct investment grow by 376 percent since 2013. The principal sectors of the Guatemalan economy are manufacturing, services, and retail commerce.

Guatemala’s currency, the Quetzal, has been stable against the US dollar for the last decade – this alone might be reason enough to consider doing business in Guatemala. The country might not be spectacular in terms of growth spurts, but consistently matches or exceeds expectations on a strong and steady progression.

3. A skilled labor force

There is a large segment of the workforce that is well-educated and highly skilled – particularly among the young. Roughly 86 percent of young Guatemalan workers hold diplomas or degrees from colleges or universities. This is classed as any form of further education and means that the labor market is generally high quality.

Furthermore, Guatemala’s workforce is made up of about 6.7 million people, 70 percent of whom are under the age of 30. There are fewer local graduate vacancies than candidates, so for people or companies thinking of doing business in Guatemala, there is high supply in the labor market.

4. Modern infrastructure

Companies that are doing business in Guatemala have access to the robust telecommunications infrastructure of a highly privatized sector. Pretty much everyone has a smartphone in Guatemala – there are more than 20 million in the country, which is equivalent to 110 percent of the population.

In terms of logistics, there are ports on both the Pacific and Atlantic coasts, as well as connection to the Pan American Highway, meaning that goods can easily reach Asia, Europe, Africa and both the Americas. The road network has received upgrades in recent years, speeding up cross-country movement.

5. Free trade agreements with the US and Latin America

Those doing business in Guatemala will be able to take advantage of the free trade agreements that the government has negotiated. Among the countries with which Guatemala has free trade agreements are the entirety of Central America, the United States, Mexico, the Dominican Republic, Colombia, Panama, Chile, and the European Union.

Company formation in Guatemala

To incorporate a company in Guatemala, foreign investors must select a legal structure (commonly Sociedad Anónima), draft the articles of incorporation, register with the Commercial Registry, obtain a tax ID (NIT) from SAT, and open a corporate bank account. With legal support, the process can take 3–5 weeks. For companies operating in free trade zones, additional permits from ZOLIC (Zona Libre) are required.

Doing business in Guatemala requires proper registration with the Mercantile Registry, SAT (tax authority), and compliance with Guatemala’s Commercial Code.

Local Insight for 2025:

Guatemala is increasingly being used as a nearshoring base for U.S. supply chains due to its CAFTA-DR access, skilled labor, and low operational costs — especially in manufacturing and business process outsourcing.

Why Guatemala Is an Emerging Investment Destination in 2025

As the largest economy in Central America by population, Guatemala is gaining increased attention from investors seeking low-cost production and nearshoring opportunities. With free trade access to the United States and a government focused on economic development, Guatemala offers an attractive business climate for 2025.

Top advantages include:

- Access to the U.S. market – Via the CAFTA-DR agreement, Guatemalan exports enjoy reduced tariffs and customs advantages for North American buyers.

- Low labor costs – Guatemala offers one of the most affordable workforces in the region, ideal for manufacturing, BPO, and agribusiness.

- Stable currency – The Guatemalan quetzal has shown long-term stability, creating predictability for foreign investors.

- Growing industrial base – Free zones and industrial parks in cities like Guatemala City and Escuintla are attracting light manufacturing and assembly operations.

- Rising tech and BPO sectors – With a young population and expanding internet access, Guatemala is developing a competitive outsourcing market.

Local Tip:

Guatemala City is the most common incorporation location due to infrastructure, access to government institutions, and availability of skilled legal and accounting professionals.

What are some of the challenges of doing business in Guatemala?

Here’s a breakdown of the challenges that you should consider before doing business in Guatemala:

Bureaucracy is alive and well

Latin Americans seem to have a love affair with bureaucracy, and Guatemala is no different. When setting up a business there, be prepared for red tape – the country is rife with it. The relatively straightforward act of setting up a business in Guatemala can take up to 40 days to complete.

Notarized documents are required at various stages of the process and the business must be registered with several government and business entities. Legal representation is required for any business, so anyone doing business in Guatemala will have to hire a lawyer.

Corruption is widespread

The political situation in Guatemala is marked by continuing allegations of corruption and widespread calls for reform. As a consequence, in Guatemala many commercial successes are hard fought. A growing number of US stakeholders in the country have complained of rampant corruption in Guatemala and say that transparency is non-existent.

However, corruption tends to be industry specific, so people doing business in Guatemala may or may not encounter this, depending on the industry within which they operate. It’s also the case that a number of foreign owned companies are largely disconnected from this.

Internal security risk

While Guatemala is relatively stable economically, growth is distributed unequally, and rates of poverty remain high. Those doing business in Guatemala are probably well aware that the country has one of the highest violent crime rates in Latin America.

However, this is regional and relatively easy to avoid. Also, those crime rates remain high but they are falling and have been steadily reducing over the century to date. While this is not a thing that can be simply brushed aside, it’s also a manageable issue.

FAQs on doing business in Guatemala

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Guatemala?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Guatemala?

| There are both public and private FTZs in Guatemala, as well as Special Economic Zones (SEZs). In total, there are ten now, after some were closed by a previous government. |

3. How long does it take to register a company in Guatemala?

lt takes between 8 to 10 weeks to form a company in Guatemala after all required information and documentation have been provided.

4. Which sectors are important in Guatemala?

Guatemala has a famously large agricultural sector, which generates almost 10% of GDP. Coffee, bananas, and sugar are some of the key agricultural exports. Manufacturing is even more important. With a massive garment producing industry at its center, it contributes 22% of the GDP. The country’s fast-growing sector is services, and it is responsible for 60% of GDP.

5. Does Guatemala have trade agreements with other countries?

Those doing business in Guatemala will be able to take advantage of the free trade agreements that the government has negotiated. Among the countries with which Guatemala has free trade agreements are the entirety of Central America, the United States, Mexico, the Dominican Republic, Colombia, Panama, Chile, and the European Union.

6. What entity types offer Limited Liability in Guatemala?

Both the S.A and S.R.L offer limited liability in Guatemala.

7. Is Guatemala a good place for foreign business in 2025?

Yes. With access to major markets, a competitive labor force, and investment incentives, Guatemala is increasingly attractive for exporters, manufacturers, and service providers.

8. How long does it take to form a company in Guatemala?

| The process typically takes 3 to 5 weeks, depending on the company structure and whether free zone approvals are required. |

9. What types of businesses do well in Guatemala?

Textile and apparel manufacturing, food processing, logistics, agricultural exports, and BPO services are among the strongest performers in the Guatemalan market.

Biz Latin Hub Can Help You With Doing Business in Guatemala

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in major cities across the region. We also have trusted partners in many other markets.

Our unrivalled reach means we are ideally placed to support multi-jurisdiction market entries and cross-border operations. If you’re planning on doing business in Guatemala in 2025, Biz Latin Hub can support you with legal entity formation, compliance, and back-office operations.

As well as knowledge of doing business in Guatemala, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you finding top talent or otherwise doing business in Latin America and the Caribbean.

If this article on the advantages and challenges of doing business in Guatemala was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors.