Accounting and tax requirements in Guatemala should be a fundamental part of your market entry strategy to successfully establish a company in Guatemala and ensure compliance with its complex regulatory framework. This guide outlines critical information to help you manage Guatemala’s fiscal obligations effectively with the relevant authorities. SAT (Superintendencia de Administración Tributaria) oversees tax filings and electronic invoicing. IGSS handles social security and labor contributions.

Key Takeaways On Accounting and Tax Requirements in Guatemala

| What Are The Accounting Standards in Guatemala? | Under the Code of Commerce, companies must prepare financial statements per Guatemalan GAAP, though it is undefined and not explicitly linked to IFRS. Instead, they follow Tax Legislation Decree No. 10 of 2012. |

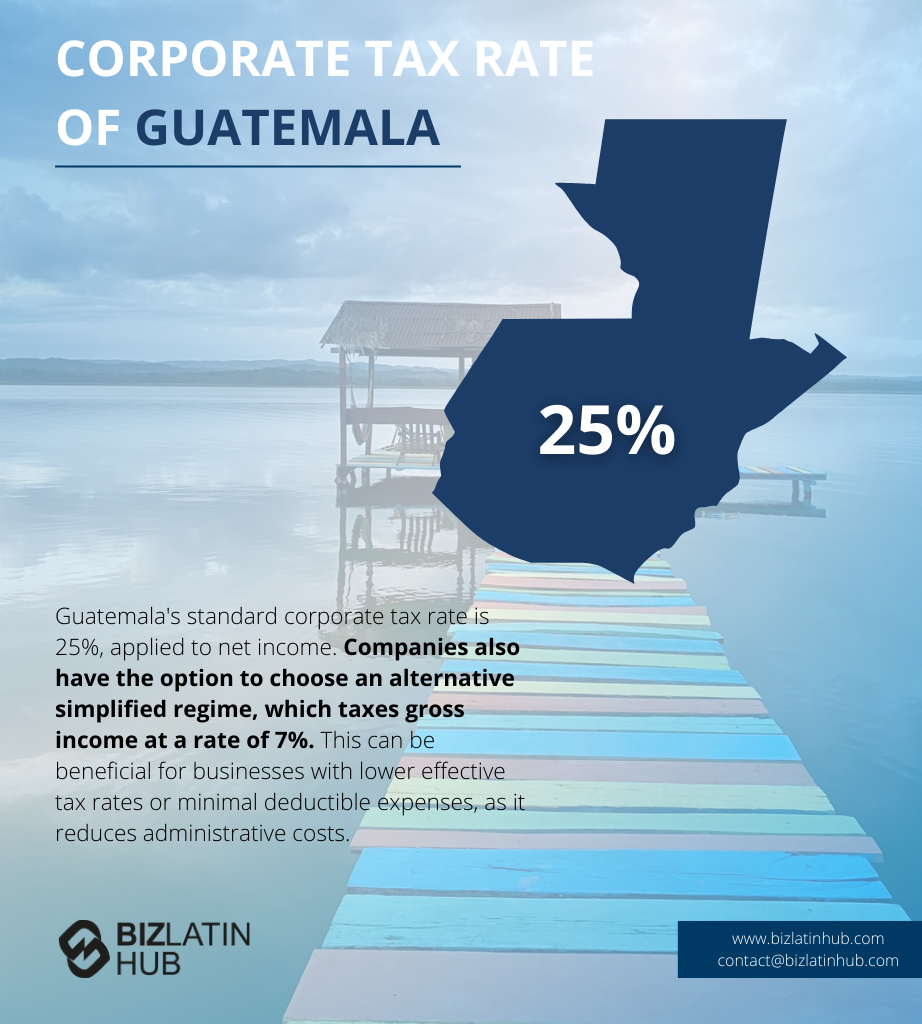

| What Is The Corporate Tax Rate in Guatemala? | The tax on earnings from lucrative activities is calculated and paid quarterly, with a final tax settlement at year-end. The rate is 25% on net income |

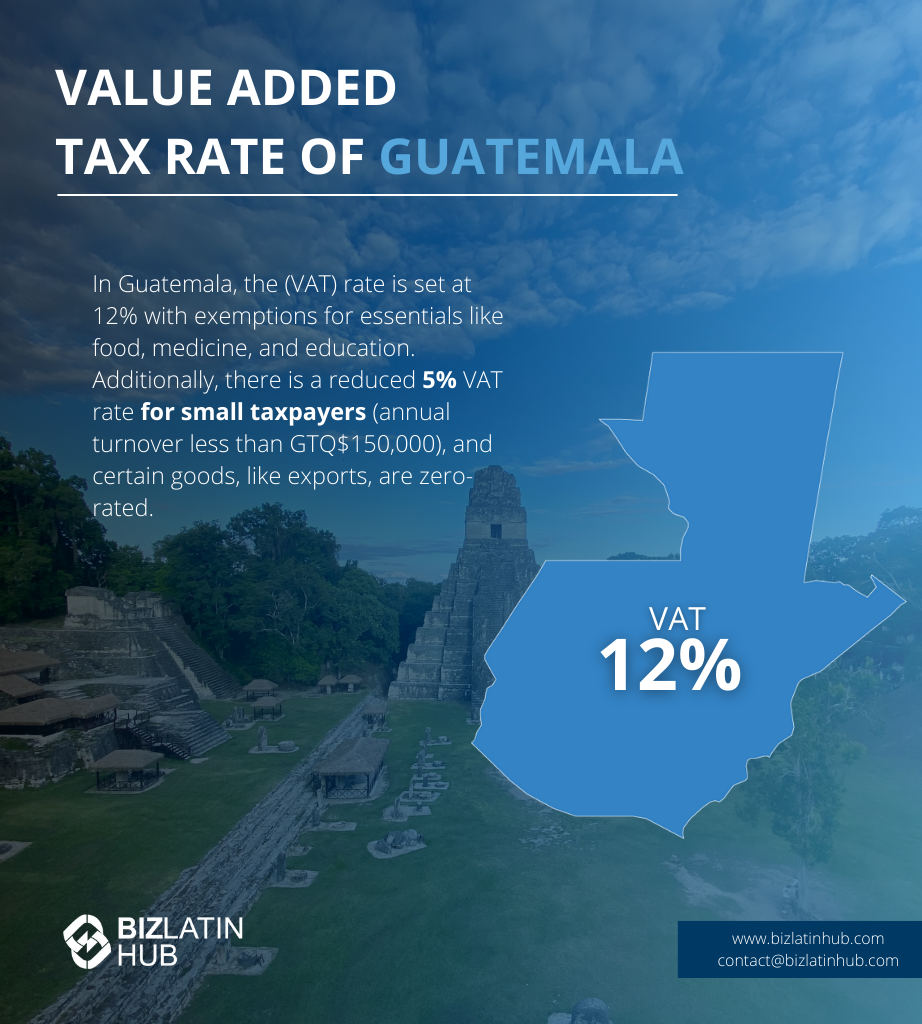

| What Is The Guatemalan Value Added Tax Rate? | The current VAT rate (IVA) is set at 13% in Guatemala. |

| Dividend Tax Rate in Guatemala | Profits and dividends earnings are subject to a 5% income tax. |

Overview of Guatemala’s Tax and Accounting System

As of January 2009, accounting tax requirements in Guatemala largely match the International Financial Reporting Standards (IFRS). Although the initial adoption period required local professionals to undergo extensive training, these standards are now mandatorily and widely applied across the country. These cover a broad spectrum of business aspects, including industry-specific regulations, operating risks, and other pertinent factors.

It’s crucial for businesses looking to invest in Guatemala to identify and understand the rules relevant to their specific sector. This understanding is vital when preparing financial statements. This task should be a collaborative effort involving the accounting or finance team and key stakeholders, such as investors or senior executives in expanding companies.

Companies must choose annually between the ISR Sobre Utilidades Regime (25% on net income) or ISR Sobre Ingresos (7% on gross income). Each regime requires separate monthly and annual returns

FEL Electronic Invoicing and SAT Filing Obligations

For those considering entering or expanding within the Guatemalan market, it’s essential to familiarize oneself with the country’s distinctive tax framework. The SAT oversees the collection of taxes from individuals and companies nationwide. All sales must be invoiced through the FEL platform run by SAT. Invoices must be issued via PACs with automatic reporting to SAT in real time.

In Guatemala, businesses must report direct and indirect taxes to the SAT. The most notable taxes include the value-added tax (VAT) and income tax, which are filed every month, as with payroll and IGSS payments. Annual income tax must be reported by March 31st of the following year. Understanding and complying with both accounting and tax requirements in Guatemala is essential for any business operating in Guatemala.

Money Laundering Regulations in Guatemala

To maintain the integrity of its financial system, Guatemala has stringent regulations against money laundering. These regulations are often referred to as Decree 67-2001. Under this law, companies and financial institutions must implement robust monitoring and reporting systems to detect and report any suspicious financial activities.

This includes the obligation to identify and verify the identity of their clients, maintain detailed records of transactions, and report any unusual or potentially illicit activities to the appropriate authorities.

Corporate Income Tax, VAT, and Monthly Reporting

Companies choose annually between the ISR Sobre Utilidades Regime (25% on net income) or ISR Sobre Ingresos (7% on gross income). Each regime requires separate monthly and annual returns.

Income tax in Guatemala applies to the profits earned by individuals and companies, whether domestic or foreign, regardless of residency status. This tax is governed by Decree 10-2012 and is applicable whenever there is taxable income. It encompasses a wide range of income sources, making it a key component of the country’s tax system.

The tax that generates the most money for the State is VAT. Decree 27-92 regulates this tax. The VAT rate is 12% of the value of each product or service and is always included in the prices of everything bought in Guatemala.

Taxpayers registered in the General Regime must report monthly VAT paid on their purchases and VAT collected on their sales. This must be done before the 10th of each month via Declaraguate and electronic payment made to the SAT.

Payroll Contributions and Labor Tax Compliance

- Employee deductions: A total of 4.83% of an employee’s salary is deducted by the employer and provided to the IGSS.

- Employer contributions: Employers must make contributions totalling 12.67% of the value of a given employee’s salary. Those contributions go to the IGSS, the Institute of Recreation of Workers of the Private Company of Guatemala (IRTRA), and the Guatemalan Technical Training Institute (Intecap), with each contribution equivalent totaling:

- IGSS: 10.67% of the employee’s salary

- IRTRA: 1% of the employee’s salary

- INTECAP: 1% of the employee’s salary

Transfer Pricing Studies in Guatemala

In Guatemala, there are specific rules for Transfer Pricing Studies to ensure that transactions between related companies follow fair market prices. This is to prevent profit shifting and tax avoidance. Companies engaged in transactions with related foreign entities have to conduct Transfer Pricing Studies and comply with the accounting tax requirements in Guatemala set out in this legislation.

These obligations include maintaining detailed documentation and records of transactions and demonstrating that prices align with those that would have been charged to independent parties under similar circumstances. Compliance with these regulations is crucial for companies to avoid penalties and ensure transparency in their financial dealings.

FAQs About Tax and Accounting in Guatemala

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting tax requirements in Guatemala.

1.What is the corporate tax rate in Guatemala?

The corporate income tax rate in Guatemala is 25% for profits or a range of 5% or 7% for gross income depending on the regime under which the company is registered.

2. How are businesses taxed in Guatemala?

In Guatemala, companies are taxed as indicated by the Guatemalan Tax Administration, which states that there are two ways of calculating income tax: the system on profits from lucrative activities and the optional simplified system on income from lucrative activities.

In the first one, the tax is determined and paid at the end of each quarter, without prejudice to the final liquidation of the tax at the end of the period. The tax rate is 25% on net income.

3. What is the tax authority called in Guatemala?

The tax authority in Guatemala is called the Superintendencia de Administración Tributaria and is responsible for implementing accounting tax requirements in Guatemala.

4. What is the accounting standard in Guatemala?

As stipulated in the Code of Commerce, all companies must prepare financial statements in accordance with generally accepted accounting principles (Guatemalan GAAP); however, this does not refer specifically to IFRS, and the code does not define Guatemalan GAAP either. Therefore, companies prepare financial statements based on the Tax Legislation Decree No. 10 of 2012.

5. What is the CPA equivalent in Guatemala?

The equivalent of a CPA in Guatemala is a Certified Public Accountant and Auditor (CPA) formally registered with the College of Public Accountants and Auditors of Guatemala (CCPAG).

6. Does Guatemala report in IFRS?

In Guatemala, companies are required to prepare financial statements following generally accepted accounting principles (Guatemalan GAAP), as per the Code of Commerce. However, it doesn’t specifically mention IFRS.

Instead, companies base their financial statements on Tax Legislation Decree No. 10 of 2012. Medium and large-sized companies must present annual audited financial statements based on income tax rules. These are considered special purpose statements. Companies can also choose to use IFRS or IFRS for SMEs with approval from the tax administration.

7. What is the VAT rate in Guatemala?

The VAT (IVA) rate is 12%. VAT returns must be filed monthly via the Declaraguate platform.

8. Are employers required to contribute to social security?

Yes. Employers contribute 12.67% of salary to IGSS, while employees contribute 4.83%.

9. Is electronic invoicing mandatory in Guatemala?

Yes. The FEL system (Factura Electrónica en Línea) is mandatory and must be used through SAT-authorized certifiers (PACs).

Why Invest in Guatemala?

Guatemala offers a strategic location in Central America, connecting North and South America. Its proximity to key markets, such as the U.S. and Mexico, provides access to global trade routes. The country has a young, growing population and a competitive labor force, making it an attractive option for companies seeking skilled workers at lower wages compared to other regions.

Guatemala also benefits from free trade agreements, including the Central America-Dominican Republic Free Trade Agreement (CAFTA-DR). The country’s diverse economy, with strengths in agriculture, manufacturing, and tourism, presents multiple investment opportunities. Favorable government policies and incentives further support foreign investment, positioning Guatemala as a rising hub for business growth in the region.

Biz Latin Hub can help with accounting and tax requirements in Guatemala

Before expansion into the country, be sure to determine the specific accounting tax requirements in Guatemala to ensure proper compliance. The professionals you work with during this process must be duly trained to perform the work necessary in a foreign environment.

For this reason, most foreign investors find themselves in need of hiring a local provider of professional accounting and tax services for their company.

In Guatemala, our Biz Latin Hub team has personnel trained in all areas related to the implementation of new businesses in different industries. We are ready to assist your company formation, hiring, commercial representation, accounting and other legal needs to ensure you can begin operations as quickly as possible and in full compliance with accounting tax requirements in Guatemala

Reach out to our team today for personalized assistance.