Accounting in Brazil must be part of your market entry strategy to successfully register a company in Brazil and remain compliant in a complex business landscape. This guide provides essential information to equip you with the knowledge you need to effectively navigate Brazil’s fiscal intricacies and stay on the right side of the Receita Federal.

This is the federal tax authority responsible for income tax, CSLL, and corporate oversight. However, there will also be local rules to follow, with SEFAZ operating at the state level and overseeing ICMS (VAT). Companies must also interact with eSocial (labor filings) and the Municipal Tax Authorities for service tax (ISS).

Key Takeaways On Accounting in Brazil

| What Are The Accounting Standards in Brazil? | Companies prepare financial statements in Portuguese, adhering to Brazilian Accounting Norms (NBC), previously referred to as Generally Accepted Accounting Principles (GAAP), with all accounting records and statements documented in Portuguese. |

| What Is The Corporate Tax Rate in Brazil? | Corporate income tax (IRPJ) applies to an entity’s taxable profits at a 15% rate. However, including the surtax and the social contribution on net profits the total nominal rate reaches 34%. |

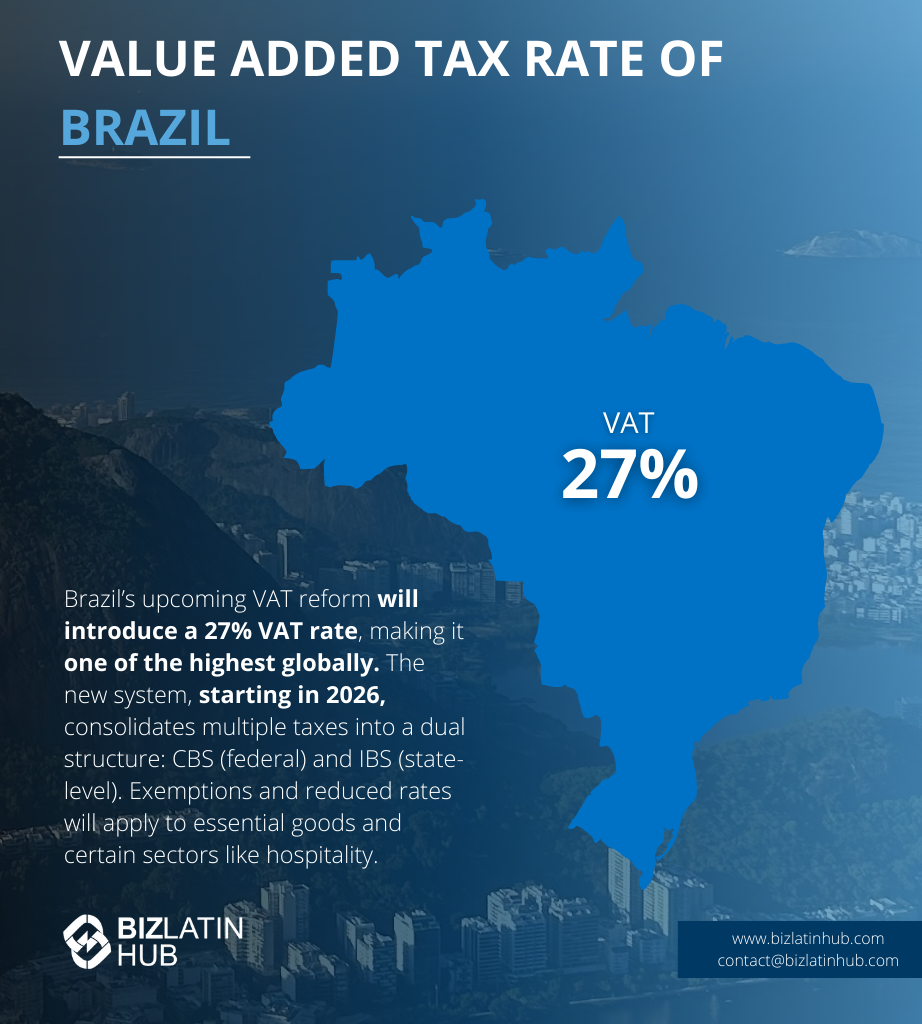

| What Is The Brazilian Value Added Tax Rate? | The current standard VAT rate (ICMS) is set at 17%, but in some states it can be as high as 25%. |

| Dividend Tax Rate in Brazil | Dividends are subject to a “withholding tax” of 15%. |

Overview of Brazil’s Corporate Accounting and Tax System

When incorporating a company in Brazil, several crucial tax considerations must be kept in mind:

- Tax return extensions are not possible.

- An annual paper tax return must be filed before the last working day of April each year.

- Corporate income tax rate averages at 34%, contingent on turnover.

- Federal tax on domestic and foreign products is levied at 1.65%.

- Mandatory social security contribution stands at 7.6%.

- Federal and state VAT taxes apply to various products and services, with rates varying between 7% to 25% depending on the state. This will change in 2026.

- NF-e must be issued for all taxable sales.

- Invoices are tied to the CNPJ and state registration.

- Service providers must issue NFS-e through municipal platforms.

- All invoices must be transmitted in real-time and stored for five years.

What accounting standards are used in Brazil?

Key annual accounting obligations for companies in Brazil include:

- Documenting and implementing accounting procedures.

- Implementing financial accounting software.

- Preparation of financial accounting records.

- Preparing forecasts, budgets, and sensitivity analyses to better manage financial obligations and ease the process of reporting to Brazil’s accounting authorities.

You need to be aware of personal and corporate tax obligations in your country of residence as well. You must fulfill those obligations annually.

Corporate Tax, Simples Nacional, and ICMS in Brazil

Before starting a business in Brazil, familiarize yourself with various laws, including those related to the different regimes for companies of different sizes. The tax regimes are broken into three parts, essentially related to the size of the company.

These are: Simples Nacional (for companies with annual revenue up to BRL$4.8 million, simplified tax and filings); Lucro Presumido (presumes margin for calculating IRPJ and CSLL); Lucro Real (actual profit, required for financial companies, companies with revenue over BRL$78 million, or operating internationally).

In Brazil, providing additional benefits for employees is essential, depending on the professional category of your business. These benefits may include meal allowances, transportation allowances, and health plans and may vary according to the state in which you are working.

As in many other Latin American countries, there is a mandatory 13th month bonus to pay. Payroll must be reported monthly via eSocial, and all employment contracts must comply with the CLT (Consolidação das Leis do Trabalho).

- Employee deductions: Income tax deductions vary from 0% to 27.5% based on salary. Social security deductions similarly vary from 7.5% to 14%, limited to BRL$876.97 per month.

- Employer contributions: Under employment law in Brazil, employers must make two monthly contributions:

- An amount between 26.7% and 31.8% of the employee’s salary to the INSS.

- 8% of the employee’s salary to the government compensation fund (FGTS).

Under certain circumstances, the employer is also required to provide transport and meal allowances, while for some jobs employees are entitled to have certain benefits covered, such as health and life insurance.

Financial Reporting, SPED, and ECD Requirements

Adhering to the following laws is crucial for maintaining business success in Brazil:

- Public companies must publish annual financial statements in a national newspaper.

- For company de-registration, maintaining a resident company secretary and a legal registered office in Brazil is mandatory.

- At least one individual representative must be a resident of Brazil.

For instance, public companies that annually publish financial statements must prioritize compliance with the regulations set forth by the National Financial and Capital Markets Association (Anbima).

The key SPED (Sistema Público de Escrituração Digital) system covers a number of fields connected to fiscal compliance. This is aimed at promoting transparency and avoiding irregularity.

This includes ECD (accounting bookkeeping), ECF (fiscal bookkeeping), NF-e (electronic invoicing), and others. ECD is due annually by the last business day of May; ECF follows by July. Other deadlines include: IRPJ and CSLL (quarterly or annual with estimates); PGDAS-D Simples declaration (monthly); DIRF (Feb); DCTFWeb (monthly); RAIS (March). Missing deadlines leads to automatic fines and potential suspension of services for repeated failures.

Are foreign investors protected in Brazil?

The specific organizations listed below are the ones that protect your business as a foreign investor. Foreign investors also have several outlets that protect their business:

- The Brazilian Export and Investment Promotion Agency (Apex).

- The National Financial and Capital Markets Association (Anbima).

- Cetip.

- Market Information Organization Board (Codim).

- Brazilian Institute for Investor Relations (IBRI).

FAQs About Tax and Legal Compliance in Brazil

Based on our extensive experience these are the common questions and doubts from our clients when looking to understand accounting and taxation in Brazil.

The corporate income tax is 15%, with a 10% surtax on income over BRL 240,000/year, plus a social contribution (CSLL) of 9%, totaling 34% for most companies.

Companies in Brazil follow the tax laws in force in the country and can be calculated based on a presumed percentage of gross revenue or, even, based on net profit.

The RFB (Receita Federal do Brasil), which is responsible for the implementation and regulation of tax and customs legislation in Brazil.

Brazilian accounting standards require companies to prepare their financial statements in Portuguese and accordance with Brazilian Accounting Norms (NBC), formerly known as Generally Accepted Accounting Principles (GAAP). Accounting records and statements must be made in Portuguese.

The equivalent of the CPA in Brazil is the Conselho Federal de Contabilidade (CFC). All accountants must be qualified and registered before the regional accounting council in their region.

In Brazil, all companies must follow the Brazilian Accounting Norms (NBC TG; NBC TG 1000; ITG 1000), within the IFRS standards, according to the size of the company.

Companies may choose between Simples Nacional (for SMEs), Lucro Presumido (presumed profit), and Lucro Real (actual profit). Each has different thresholds, rates, and compliance requirements.

SPED is the Public Digital Bookkeeping System for tax and accounting reporting. ECD is the Digital Accounting Bookkeeping (Escrituração Contábil Digital), mandatory for many entities.

ICMS is a state-level VAT charged on goods and services, with rates varying by state (typically 7%–18%). Companies must register with SEFAZ.

Employers must contribute around 28% of salary to INSS, FGTS, and other funds. The eSocial system is mandatory for digital payroll submissions.

Why Invest in Brazil?

Now is an ideal time to invest in Brazil due to its vast natural resources, diversified economy, and strategic global position. The country is a leading producer of commodities such as soybeans, iron ore, and coffee, with growing opportunities in renewable energy, technology, and agribusiness.

Brazil’s membership in Mercosur and trade agreements with global markets enhance its role as a key player in international trade.

Ongoing economic reforms and infrastructure development are improving Brazil’s investment climate. Currently, the country is negotiating a new taxation system coming into effect in 2026. Efforts to simplify taxes, modernize industries, and attract foreign capital are driving growth across sectors.

With a large domestic market, competitive labor costs, and expanding international partnerships, Brazil offers significant opportunities for businesses seeking to establish or grow operations.

Biz Latin Hub can assist you with accounting in Brazil

Once you understand the accounting process, laws, and legal requirements in Brazil, you are ready to do business there.

Biz Latin Hub is the market leader in helping both local and foreign companies to successfully expand their business in Brazil, by providing a full suite of multi-lingual commercial representation and back-office services.

Contact us today to find out more about how we can support you doing business or read about our team and expert authors.