To register a company in Panama and take advantages of the opportunities in the country you will need to follow six key steps. Following this approach ensures you meet Panama’s clear corporate laws accessing supportive government policies providing a solid foundation for your business to thrive. Compliance is key and you will deal with the Public Registry as part of the company formation process and tax authority DGI afterwards for fiscal compliance.

To open a company in Panama its advisable to work with a local partner that can keep you on track. Biz Latin Hub offers tailored support and expert back-office services to guide you through the incorporation process, ensuring compliance and positioning your business for success.

Key Takeaways On How To Register a Company in Panama

| Is There foreign-ownership availability in Panama? | Yes, 100% ownership is available. |

| Steps to Register a Company in Panama: | Step 1 – Organize the name and structure of your company. Step 2 – Company Incorporation: Draft and sign bylaws. Step 3 – Register your company in Panama. Step 4 – Obtain a Tax Identification Number (RUC). Step 5 – Open a Corporate Bank Account. Step 6 – Obtain Municipal Commercial License. |

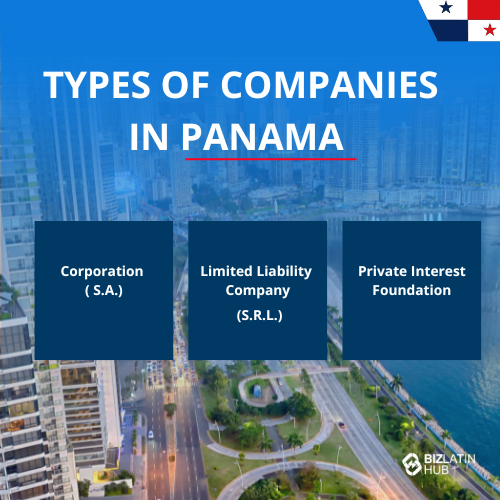

| What Are The Common Entity Types? | Corporation (Sociedad Anónima – S.A.). Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.). Private Interest Foundation (Fundación de Interés Privado). |

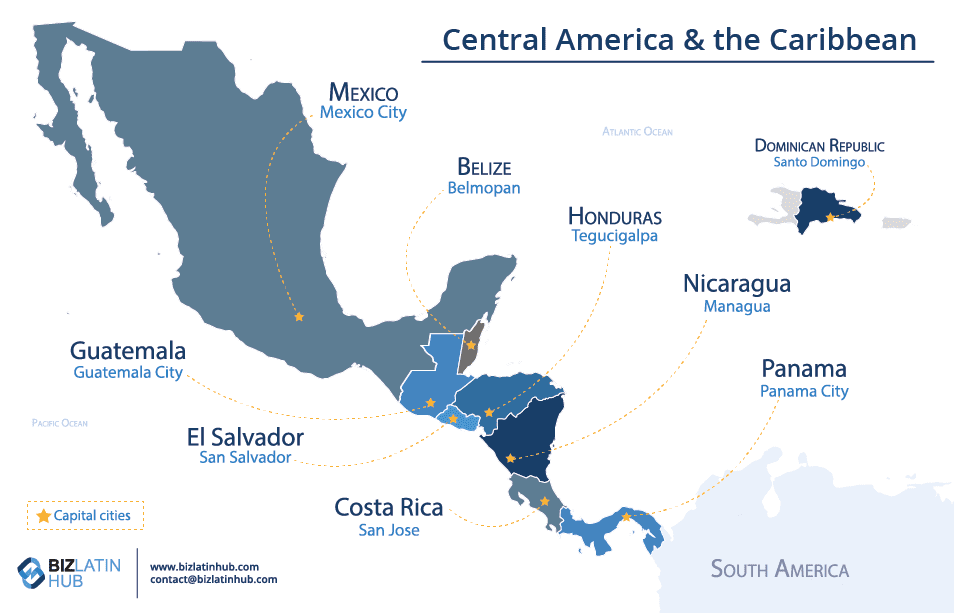

| Why Set-up a Business in Panama? | Strategically positioned, the country continues to attract a constant flow of investers looking to open a company in Panama. |

How to Incorporate a Company in Panama – Step-by-Step Guide

Please see below the 6 steps for incorporating a Sociedad Anónima (S.A.) in Panama:

- Step 1 – Organize the name and structure of your company.

- Step 2 – Company Incorporation: Draft and sign bylaws.

- Step 3 – Register your company in Panama.

- Step 4 – Obtain a Tax Identification Number (RUC).

- Step 5 – Open a Corporate Bank Account.

- Step 6 – Obtain Municipal Commercial License.

Step 1: Organize the name and structure of your company

As with most countries in Latin America, the first step to registering a business is to choose the name and legal structure of your company. The main types of company are:

- A Corporation/Joint Stock Company (Sociedad Anónima – S.A) – this is by far the most common type of company to form in Panama, which means that shareholders are only responsible for their contributions and assets.

- A Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L) – This will help provide insulation to you as an investor and will mean you are not personally liable for the debts or funds of your company.

PRO TIP: It is very important you think about this decision carefully as it can limit the type of business you can legally engage in, and once you sign your documents, amending the structure can be a very long and complicated process.

Step 2: Company Incorporation: Draft and sign bylaws

The bylaws of a company can be simply described as the ‘constitution’ of a company. These documents will contain all the crucial information about the structure and ethos of the company, including:

- Information regarding the frequency and nature of shareholder/board meetings.

- Documentation of all the details of the company (name, registered address, share capital, location, company type, Board of Directors, etc.).

- Procedure for record-keeping.

- Company’s objeto social which identifies the company’s business activities.

The bylaws will undergo notarization by a notary public in Panama, formalizing them as a public deed. This procedural step typically spans a duration of 5 to 10 business days.

Step 3: Register your company in Panama

The next process is to formally register your company in Panama. This step will ensure that the company is officially recognized in the country and that it is properly registered with the relevant tax authorities.

Remeber: Your physical presence in Panama is not required for the completion of the corporation formation process, instead this can be done through a power of attorney. So we can manage all necessary procedures efficiently without you needing to come to Panama.

Step 4: Obtain a Tax Identification Number (RUC)

Once a company is Registered, the next step is to apply for a tax identification number (Registro Único de Contribuyentes – RUC) with the Directorate General of Revenue (DGI).

Step 5: Open a Corporate Bank Account

The next step is to open a Panamanian Bank Account for your company. Here’s a general guide for opening a bank account for a Sociedad Anónima (SA):

- Match your business needs with a suitable Panama bank

- Complete all required banking documentation

Step 6: Obtain Municipal Commercial License

Acquire a commercial license from the municipal government where the company is located, which will enable you to legally commence operations.

The total time needed to complete all six steps in the process should be 5-10 business days, although may be longer if special licenses are required.

Types of Companies You Can Form in Panama

Considerations such as the nature of the business, the number of owners, liability, and tax implications should be taken into account when choosing the structure to use to register a company in Panama.

There are several different types of legal structures in Panama to choose from, but the three most commonly utilized options are:

- Corporation (Sociedad Anónima – S.A.).

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.).

- Private Interest Foundation (Fundación de Interés Privado).

1. Corporation (Sociedad Anónima – S.A.)

A corporate structure that provides limited liability to shareholders and is commonly employed for various business activities. It is crucial to note some key characteristics associated with the formation of this entity. Most notably, shareholders bear responsibility solely for their assets and contributions. Panama’s legislation does not specify a minimum social capital requirement for the company, although a recommended minimum of USD$10,000 is advised.

Recommendation: In most cases, we would recommend clients to establish a Sociedad Anonima for their business needs because:

- S.As in Panama offer operational flexibility, tax benefits for international operations, and an agile structure for management.

- They are known for privacy and structural flexibility, resembling a public limited company.

- They also offer limited liability for shareholders, protecting them from significant losses that may result from business failures, legal claims, or unforeseen events.

2. Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L.)

A company structure that offers limited liability to its members and is well-suited for small or micro-sized businesses.

3. Private Interest Foundation (Fundacion de Interes Privado)

A unique legal entity that operates similarly to a trust, providing a flexible framework for asset management, estate planning, and charitable purposes. To learn more about this type of structure please get in touch with the Biz Latin Hub team.

Main Differences Between SA and LLC in Panama

| Aspect | LLC (Limited Liability Company) | S.A. (Sociedad Anónima) |

|---|---|---|

| Shareholders | Requires at least two shareholders. | Can be incorporated with one shareholder. |

| Registration | Shareholders must be registered within the Public Registry. | Shareholder’s registration is not required within the Public Registry. |

| Incorporation Structure | Requires one administrator, two shareholders, and the appointment of an agent resident. No board of directors is necessary. | Requires the establishment of three directors (President, Secretary, and Treasurer) and the appointment of an agent resident. |

| Responsibility of Shareholders | Shareholders are jointly and severally liable for the debts of the company up to the amount of their contributions. | Shareholders are jointly and severally liable for the debts of the company up to the amount of their contributions. |

| Regulation | Regulated by Law 4 of January 9, 2009. | Regulated by the law of anonymous societies (Law N° 32 of 1927). |

Panama Company Registration Requirements for Foreign Businesses

The minimum requirements to incorporate an SA in Panama are:

- A name for your legal entity

- (1) shareholder, which can be of any nationality and reside outside of Panama and can be either a natural or legal person (i.e. an individual or a legal entity).

- Appoint at least (3) Directors for your company

- Appoint a resident agent within the bylaws of the company

- Describe the main company activities

- A minimum initial capital, although no minimum capital amount is required by law, we would strongly recommend a minimum share capital of USD$1,000 however it should be commensurate with your planned business activities.

- Register a Fiscal Address which must be within the country and is used for official correspondence

Important Tip: The founding shareholder(s) do not need to physically travel to the country as the establishment can be completed by our local Panamanian team. Resident agent (lawyer) is mandatory and must be named in the incorporation documents. All companies must maintain a legal address in Panama

Bank account setup and initial capital

Banks need proof that you are eligible to open a bank account and this applies to both personal and corporate accounts in Panama. Once you have gotten the necessary documents together (i.e valid passport, financial statements, bank and commercial references), the process for opening a bank account in Panama is relatively straightforward: filling out the paperwork and presenting the documentation to the bank.

In Panama, all documentation must be apostilled to comply with the bank’s requirements. Once all the requested paperwork and documents have been checked and approved, the bank will send a notification of the account opening. Note that there is no minimum capital requirement.

Panama has a number of banking providers that offer good services to foreign companies. The best choice for your company will depend on your business goals and which bank’s services align with them best. The options for a corporate bank account in Panama are mainly with:

- Banco General.

- BAC International Bank.

- Banistmo.

- Credicorp Bank.

- Banco Aliado.

- Banco Nacional de Panama.

- Citibank.

- Banco Davivienda.

- Santander.

- BPR Bank.

- Scotiabank.

- BBVA Panama.

- Inteligo Bank.

Tax Compliance Overview in Panama

| In Panama, the accounting standard is based on the International Financial Reporting Standards (IFRS) for publicly traded companies. Private companies can opt to follow IFRS or use the Panamanian Generally Accepted Accounting Principles (GAAP). |

| Any company looking to conduct business or trade in Panama must be granted a ‘Panama Commercial Operation Permit’. Tax on this permit for most companies is set at 2% of net worth with a maximum of USD$60,000, whilst companies within certain free trade zones (FTZs) pay a reduced rate of 1% with a maximum payment of USD$50,000. In terms of a VAT, known as the ITBMS (Impuesto de Transferencia de Bienes Muebles y Servicios) in Panama, the country offers some of the lowest rates in the world. For most goods, a meagre 7% is added to the retail price, whilst for alcoholic drinks and tobacco products, there are slightly higher rates (10% and 15% respectively). |

- Corporate tax: 25% (local-source only)

- Territorial tax system (no tax on foreign income)

- Monthly and annual filings with DGI

- RUC registration

- Employer registration with CSS for payroll and social contributions

FAQs About Company Formation in Panama

In our experience, these are the common questions we receive from potential clients.

1: What is the process to incorporate a company in Panama?

Incorporating a company in Panama involves choosing a legal structure (typically an S.A. or Corporation), reserving a company name, drafting the articles of incorporation, notarizing documents, registering with the Public Registry, and obtaining a RUC (Tax ID) from the DGI. Appointing a resident agent (licensed Panamanian lawyer) is mandatory.

2: What types of companies can foreign investors register in Panama?

The most common structures include the Sociedad Anónima (S.A.)—popular for both local and offshore purposes—and the Sociedad de Responsabilidad Limitada (SRL). The S.A. is the most flexible, offering anonymity, no minimum capital, and no nationality restrictions.

3: How long does it take to register a company in Panama?

The incorporation process in Panama generally takes 5 to 10 business days, assuming all documents are in order. Tax and bank registration may extend the total setup period to 2–4 weeks.

4: What are the requirements to start a business in Panama?

Requirements include at least three directors, a registered office, a resident agent (lawyer), and notarized articles of incorporation. Foreign shareholders need to provide valid ID, and all documents must be filed in Spanish.

5: What are the tax obligations for companies in Panama?

Panama uses a territorial tax system—only income generated within Panama is taxed. Corporate tax is 25% on local-source income. Companies must register with the DGI for a RUC, file monthly and annual tax returns, and comply with employer contributions if hiring staff.

Benefits of Incorporating in Panama

Although it is most famous for the canal, Panama has a lot more going on. The banking system is world famous, and there is a growing tourism and services sector that offers interesting opportunities to foreign investors. If you register a company in Panama, you will be in good company — with over 500,000 others, it is the second most popular place in the world to do so.

As a hub for global trade, the country is well used to international enterprises and extremely business-friendly. When you register a company in Panama, you will gain access to a well-established infrastructure, favorable tax regulations and a strategic geographic location that facilitates global business operations.

In terms of key industries, the strategic importance of the Panama Canal, an influential spot for maritime trade, has made Panama a leader in exports to the northern tip of South America whilst also providing crucial access to the Pacific and Atlantic Oceans.

Major exports include chemical products such as oxygen compounds and sulfonamides (accounting for over 18% of exports), passenger and cargo ships (9.8%), and packaged medication (8.2%). Other exciting business prospects include a growing tourism industry in a country that boasts natural beauty in abundance and retail, with the largest commercial center in Latin America, Albrook Mall.

According to research from the Banker website, 41 of the top 100 Central American banks are in Panama. The country boasts some of the best banks in the region in terms of attractiveness of investment and security for assets. Banco General, Bladex, and Bancolombia Panama are all in the top 5.

Biz Latin Hub can support you in registering a company in Panama

With Panama being such an exciting business opportunity and only seeming to be growing in terms of economic stability and buoyancy, now is the perfect time to start a venture in the country and incorporate your company. Biz Latin Hub has an office in Panama and in 17 other locations across the region.

If you have any questions about the entity incorporation process or the steps involved with the business registration, please do not hesitate to contact us here at Biz Latin Hub.