What to expect: If you wish to withdraw your consent and stop hearing from us, simply click the unsubscribe link at the bottom of every email we send or contact us at social@bizlatinhub.com. We value and respect your personal data and privacy. To view our privacy policy, please visit our website. By submitting this form, you agree that we may process your information in accordance with these terms.

Company Formation in Guatemala: Guide for Foreign Businesses

To register a company in Guatemala you will be required to follow a five-step process to take advantage of the opportunities in the country. When supported by the right expertise, company formation in Guatemala is a straightforward process, ensuring compliance with the country’s well-defined rules and procedures. This involves getting a Registro Único de Contribuyentes (RUC) from the tax authority (SAT) and opening a bank account. Biz Latin Hub offers a full suite of back-office services to streamline incorporation and ongoing operations.

Key takeaways on how to register a company in Guatemala

| Is foreign ownership permitted? | This is permitted in Guatemala, including 100% ownership. You will need local representatives. |

| Steps to register a company in Guatemala | Step 1 – Choose the Type of Entity. Step 2 – Register a Company in Guatemala with an appropriate name. Step 3 – Determine the Amount of Initial Share Capital and Open a Corporate Bank Account. Step 4 – Notarize and Establish the Bylaws of Your Company. Step 5 – Registration of the Company Before Guatemalan State Entities. |

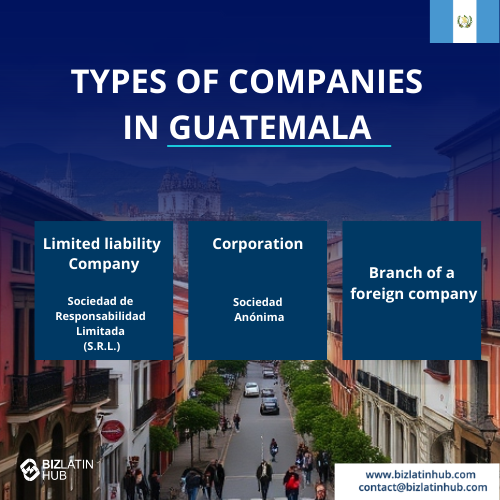

| What are the most common entity types in Guatemala? | Corporation (Sociedad Anónima S.A.) Limited liability company (Sociedad de Responsabilidad Límitada S.R.L.) Local branch. |

| What reasons are there to register a company in Guatemala? | The country has taken great strides forward in recent years and is now the biggest economy in Central America. However, there is also still plenty of room for growth. |

| Why use a company formation agent to register a company in Guatemala? | A local professional can help you enter the market and leverage their knowledge and expertise to guide you through market entry |

How to Incorporate in Guatemala – Step-by-Step

When you register a company in Guatemala, whether you are supported by a company formation agent or otherwise, you must complete the following 5 steps:

- Step 1 – Choose the Type of Entity.

- Step 2 – Register a Company in Guatemala with an appropriate name.

- Step 3 – Determine the Amount of Initial Share Capital and Open a Corporate Bank Account.

- Step 4 – Notarize and Establish the Bylaws of Your Company.

- Step 5 – Registration of the Company Before Guatemalan State Entities.

Step 1 – Choose the Type of Entity

Based on your needs and the way you intend to structure your business, you will first need to choose which type of entity to register.

Step 2 – Register a Company in Guatemala with an appropriate name

To ensure the availability of the chosen company name and compliance with legal requirements, it is essential to conduct thorough research. This includes verifying that the chosen name is not already in use and that it sufficiently distinguishes itself from existing company names. Additionally, it is crucial to incorporate the appropriate entity type into the name where mandated by legal requirements.

Step 3 – Determine the Amount of Initial Share Capital and Open a Corporate Bank Account

To establish the company, an initial capital investment will be necessary. It can be deposited in the company’s provisional corporate bank at the start of the incorporation process.

Step 4 – Notarize and Establish the Bylaws of Your Company

All of the internal regulations that will govern the operation of the company must be determined and laid out in a document signed by all shareholders. This must be done at a public notary, either in person or through a power of attorney (POA). It is one of the most important steps to complete when registering a company in Guatemala.

Step 5 – Registration of the Company Before Guatemalan State Entities

In order to comply with the law and complete the formalization of the company, your legal entity must be registered at the Mercantile Registry and the Superintendency of Tax Administration.

Business Entities Available to Foreign Investors

One of the first choices you will need to make when you register a company in Guatemala – and which a company formation agent will be able to assist you with – is the type of entity to establish.

There are two basic forms with which most foreign companies enter the market, the SRL and the SA.

Then there is the option to open a local branch of your already established company within Guatemala. This is most popular with large organizations and/or those that which to capitalize on an existening brand name or reputation.

Depending on the nature of your business and how you plan to structure it, some of the most likely options include:

Limited liability company (Sociedad de Responsabilidad Limitada (S.R.L.)

With a limited liability company (LLC), participation is not measured in shares, but in contributions from partners, with each partner’s liability limited to the capital they have contributed to the company. Partners are not personally liable for the debts that the company may face.

Other requirements to register an LLC in Guatemala are:

- A minimum of two (2) and a maximum of 20 partners are allowed, and they can be individuals or legal entities.

- The company must have an original name to trade under, which by law must also include the words ‘limited company’ (which may be abbreviated).

- The company cannot have an industrial partner (article 82 of the Commercial Code).

Small companies often choose to incorporate as an LLC. However, another option for small and big companies alike is a corporation.

Corporation (Sociedad Anónima)

In a corporation, participation is based on shares, with shareholder liability limited to the number of shares an individual holds. A corporation’s overall liability is limited to the assets it holds. Forming a corporation in Guatemala is done via execution of a public deed, which must be registered at the country’s Commercial Registry and at the Superintendency of Tax Administration.

Some characteristics of a corporation in Guatemala:

- They provide high levels of privacy for shareholders and their meetings.

- A legal representative in Guatemala (local or foreign, with a Guatemalan Tax ID) needs to be appointed.

- Contributions for capital formation can be in cash.

- The name of the company must include the word corporation (which can be abbreviated as “S.A.”).

- Shareholders can be nationals or foreigners, individuals, or legal entities.

Branch of a foreign company

If you already have a business elsewhere, and you are looking to register a company in Guatemala, you might consider forming a foreign branch.

In order to do so, you will need to appoint a legal representative in Guatemala, who must be a citizen or legal resident based in the country, and who will have the legal authority to act on the company’s behalf.

Forming a branch of a foreign company in Guatemala involves submitting documents from the parent company that have been properly legalized (apostilled or equivalent), as well as registering the local branch with various state entities.

It is worth taking into account that these requirements mean the process can often take longer than is the case for other entity types.

Comparison Table – Guatemala Company Types

| Legal Structure | Ideal For | Shareholder Requirements | Advantages |

|---|---|---|---|

| Sociedad Anónima (S.A.) | Scalable or investment ventures | Minimum 2 | Preferred by investors, publicly tradable shares |

| Sociedad Limitada | Small partnerships | Minimum 2 | Simpler to manage, lower compliance burden |

| Branch Office | Foreign expansions | Foreign parent needed | Operates directly under the foreign entity |

Register a Company With the Help of a Company Formation Agent in Guatemala

For many foreign investors looking to set up a company in Guatemala, a lack of familiarity with the local market is a big obstacle. For those who do not speak Spanish, the language barrier may also create difficulties.

A company formation agent in Guatemala can help you overcome both of these issues and guide you through the process of establishing a business. With their help, you can register a company in Guatemala in the most efficient way.

When you contract a provider to act as a company formation agent, they may also offer other back office services such as accounting, recruitment, and ongoing legal support beyond what is necessary to get your business off the ground.

Legal Requirements for Business Registration

The Minimum requirements to incorporate an S.R.L in Guatemala are:

- Two (2) shareholders, which can be either natural (i.e. persons) or legal persons (i.e. entities)

- Three possible names for the legal entity,

- Business activity,

- Initial capital at the time of incorporation

- Approximate monthly amount invoiced by the entity

All companies in [Country] must obtain a Registro Único de Contribuyentes (RUC) or equivalent tax identification number from the national tax authority (e.g., SAT, SUNAT, DGI).

This number is essential for:

- Issuing legal invoices

- Opening a business bank account

- Paying corporate income tax and VAT

- Registering employees for payroll

Maintaining tax compliance is critical to avoid fines, suspensions, or delays in future filings. Biz Latin Hub assists with monthly filings, annual declarations, and payroll processing.

If a company’s shareholders or directors are all foreign, most countries in Latin America require the appointment of a local legal representative.

This representative:

- Must reside in the country (either as a citizen or resident visa holder)

- Is responsible for representing the company before tax authorities and public institutions

- Signs official documents and ensures legal compliance

Biz Latin Hub can serve as or appoint a trusted legal representative, and also offers Power of Attorney (POA) solutions for remote setup.

After incorporation and tax registration, most companies must obtain a municipal or commercial operating license from the local city hall or municipal authority.

This license:

- Authorizes the business to legally operate in its designated location

- May involve inspections, zoning approvals, or a small annual fee

- Needs to be renewed annually

Biz Latin Hub helps manage this process to ensure your business stays compliant at both the national and local levels.

Important Tip(s): The founding shareholders do not need to physically travel to the country as the establishment can be completed via a power of attorney

FAQs About Company Formation in Guatemala

Based on our extensive experience these are the common questions and doubts of our clients on company registration in Guatemala:

1. Why is Guatemala good for doing business?

Guatemala is considered good for business due to its strategic location, natural resources, young and growing population, and efforts to improve the business environment.

2. What is the Guatemala Company Tax ID?

In Guatemala, Tax IDs are known as “Número de Identificación Tributaria” (NIT) and are required for a variety of financial transactions.

3. How long does it take to form a business in Guatemala?

Expect 3–4 weeks for the full process, including document preparation, notary work, registry approvals, and tax registration.

4. Can a foreigner own a business in Guatemala?

Yes, a foreigner is eligible to own a business in Guatemala.

5. What is an SA in Guatemala?

In Guatemala, “SA” stands for “Sociedad Anónima,” which is similar to a joint-stock company.

6. How many shareholders does it need to form a company in Guatemala?

It requires a minimum of two (2) shareholders to form a company in Guatemala. Which can be either natural (i.e. persons) or legal persons (i.e. entities).

7. What is the process to incorporate in Guatemala?

Incorporation starts with reserving a company name, drafting and notarizing the articles of incorporation, registering with the Mercantile Registry, and obtaining a RUC (tax ID) from SAT. Once registered, the company must open a bank account, register for VAT, and comply with monthly filings. All official documents must be in Spanish and notarized.

8. What types of companies can you form in Guatemala?

A: The most common types are the Sociedad Anónima (S.A.), Sociedad Limitada (Ltda.), and Branch Office. The S.A. is ideal for scalable ventures and foreign investment.

9. What are the legal requirements?

Minimum 2 shareholders, Guatemalan legal representative, company bylaws in Spanish, a fiscal address, and a RUC issued by SAT.

10. What are the tax obligations?

Guatemala has a 25% corporate income tax and 12% VAT. Companies must also comply with monthly filings and social contributions.

Benefits of Company Formation in Guatemala

Guatemala is the largest economy in Central America, and among the top ten economies in Latin America, with a GDP (PPP) that hit $247 billion in 2023 (all figures in USD).

The country’s strong economic performance over recent years has made it an increasingly attractive destination for foreign direct investment (FDI). FDI has continued to grow, consistently making up a significant portion of GDP. Over the past two decades, FDI has represented between 1.3% and 2.9% of GDP.

One of the reasons for Guatemala’s success in attracting investment is the government’s success in reducing its once notoriously high levels of violence – with intentional homicides more than halving since 2009.

The country also benefits from its highly strategic location. By dominating Mexico’s southern border, Guatemala forms a gateway between the three major economies of North America and the rest of Central America.

Guatemala has high-volume ports serving both the Pacific Ocean and the Caribbean Sea, offering easy freight access to the rest of the Americas, as well as Asia-Pacific and Europe.

Guatemala has a famously large agricultural sector, which generates almost 10% of GDP. Coffee, bananas, and sugar are some of the key agricultural exports. Manufacturing is even more important. With a massive garment producing industry at its center, it contributes 22% of the GDP. The country’s fast-growing sector is services, and it is responsible for 60% of GDP.

Biz Latin Hub Can Help You Register a Company in Guatemala

At Biz Latin Hub, we provide market entry and back office services throughout Latin America and the Caribbean, with more than a dozen offices around the region, including in Guatemala City.

Our portfolio of services includes company formation, accounting & taxation, legal services, bank account opening, and hiring & PEO, and our unrivaled regional presence means we are ideally placed to support multi-jurisdiction market entries.

Contact us today to find out more about how we can support you in doing business.

If you found this article on how to register a company in Guatemala useful, check out the rest of our coverage of Central America. Or read about our team and expert authors.