Guatemala’s employment laws are governed by the Labor Code and regulate contracts, wages, work hours, social benefits, and dismissals. This 2025 guide helps employers understand key labor obligations when hiring in Guatemala, for example when starting a business in Guatemala.

Key Takeaways

| What are the working hours mandated by employment law in Guatemala? | Employment law in Guatemala sets a maximum work schedule of 8 hours per day and 44 hours per week. For shift workers, it is 36 hours. |

| What is the minimum wage in Guatemala? | The Guatemalan minimum wage depends on sector and area, varying between GTQ3,347 (USD$430) and GTQ3,973 (USD$510) in 2025. |

| Types of Employment Contracts in Guatemala | Fixed-term. Indefinite-term. Project-specific work. |

| What percentage of an employee’s salary is contributed to social security in Guatemala? | Employers must make contributions totalling 12.67% of the value of a given employee’s salary. |

Overview of Guatemalan Labor Law

Labor laws in Guatemala include a standard working week of 44 hours, with 8 hours per day. Overtime is allowed for up to 10 hours, with overtime pay at 1.5 times the normal hourly wage. Maternity leave is provided for 12 weeks, and employees are entitled to 15 working days of annual vacation leave.

There must be a minimum rest period of 12 hours between each working day, and employees are entitled to one day of paid rest after each working week. Notice periods for terminating a contract vary based on length of service. Additionally, employees are entitled to receive both a 13th and 14th-month bonus, known as aguinaldo and bono 14 respectively.

Work Hours, Overtime, and Holidays

Statutory working hours under employment law in Guatemala differ based on whether an employee is a daytime, nighttime, or mixed-shift worker.

For daytime workers, who are defined as those whose regular working hours fall between 06:00 and 18:00 on a given day, the working week is a maximum of 44 hours long, based on eight-hour working days, meaning that a standard working week consists of five and a half working days.

For nighttime workers, who are defined as those whose regular working hours fall between 18:00 and 06:00 the next day, the working week is a maximum of 36 hours long, based on 6-hour working days, meaning that a standard working week consists of five working days.

Mixed-shift workers have a regular schedule that involves both daytime and nighttime working hours as earlier defined. Usually, a given shift should include no more than three hours of nighttime hours and should be a maximum of seven hours long. A mixed-shift worker should work no more than 42 hours per week, meaning that a standard working week consists of a maximum of six working days.

Note that, there are generally between eight and ten public holidays that fall on weekdays each year, as well as an additional public holiday observed in capital Guatemala City which can fall on a weekday.

Employment law in Guatemala establishes that employees who have served at least one year with the same employer are entitled to a vacation period that must last at least 15 working days. This should be taken in a single block and not split up throughout the year.

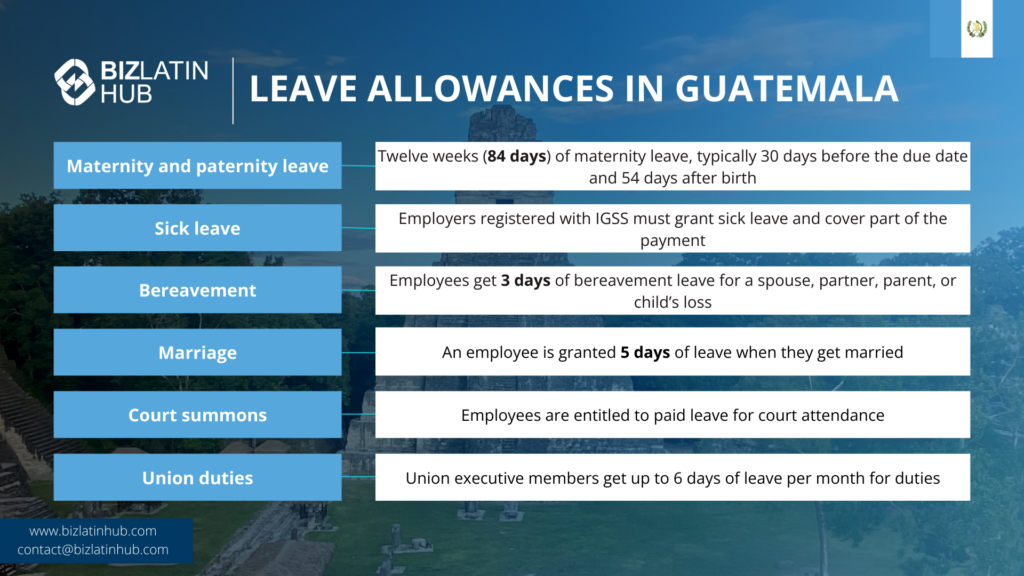

- Maternity and paternity leave: Guatemalan employment law dictates that expectant mothers are entitled to a maximum of twelve weeks (84 consecutive days) of maternity leave. That is generally made up of 30 days before the due date and 54 days after the birth. New fathers are entitled to a total of two days of paternity leave.

- Sick leave: Any employer registered with the National Social Security Program (IGSS) must provide sick leave permission to employees and will be liable for a portion of their payment, based on factors including:

- type of sickness.

- length of service with the company.

- Internal Social Security regulations.

If the employer is not registered with the IGSS is obliged to provide sick leave permission to the employee until they make a full recovery, as well as a portion of their salary during the first three months of their leave, with that portion based on their length of service.

Note that an employer is obliged to register with the IGSS if the company employs three or more permanent employees.

- Bereavement: In the event of the death of an employee’s spouse or common-law partner, parent, or child, they are entitled to three days of bereavement leave.

- Marriage: An employee is granted five days of leave when they get married.

- Court summons: Any employee summoned to court is entitled to paid leave for the duration of the period that they must attend the court.

- Union duties: Any employee who is a member of the executive committee of a union is entitled to up to six days of leave per calendar month in order to carry out their duties.

Employment Contracts in Guatemala

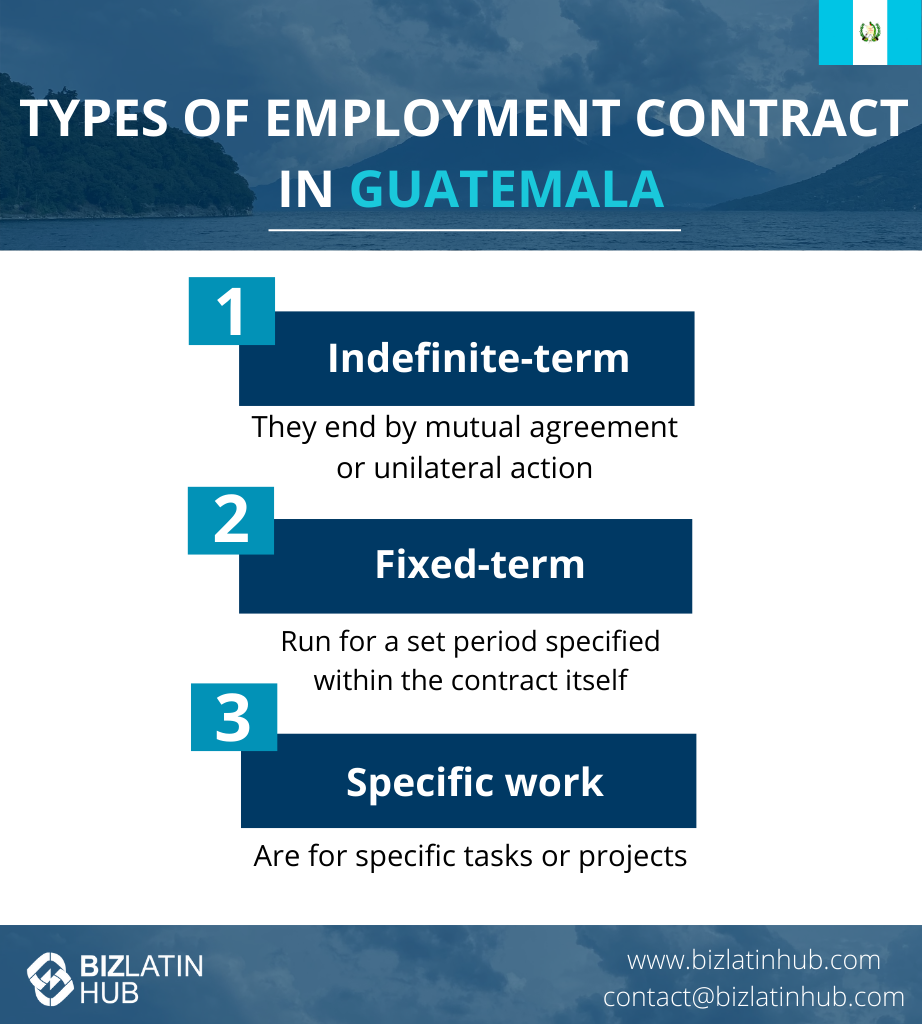

There are two types of individual labor contracts used under employment law in Guatemala, consisting of:

Indefinite contracts

Indefinite-term contracts are the most widely used type of contract in Guatemala. They have no set termination date and end only through mutual agreement between the employer and employee or when one party can act unilaterally. Such instances include an employee resigning from their role, or an employer terminating the contract due to the employee’s malpractice, following the legal procedure for dismissal.

Fixed-term and part-time contracts

These run for a set period specified within the contract itself. Specific work contracts are used for the completion of a particular task or project, for which parameters and benchmarks, including what the conclusion of the task entails, must be clearly stated within the contract.

Dismissals and Severance Pay in Guatemala

Under employment law in Guatemala, employees are obliged to provide notice of their decision to terminate a contract based on their length of service with the employer, set out as follows:

- Less than six weeks of service = one week of notice.

- Between six and 12 months of service = 10 days of notice.

- Between one and five years of service = two weeks of notice.

- More than five years of service = one month of notice.

If the employer wishes to unilaterally terminate an employee’s contract without just cause, the employee will be entitled to:

- Any payment owed for the days worked.

- Compensation for unused vacation and public holiday allowance.

- A proportion of the two annual bonuses (the thirteenth and fourteenth salary) is based on the proportion of the time they have worked.

- A severance payment equal to one month of salary for each year of service.

An employee can only have their contract terminated without the right to compensation when they are found guilty of misconduct, as laid out in Article 77 of the Guatemalan Labor Code.

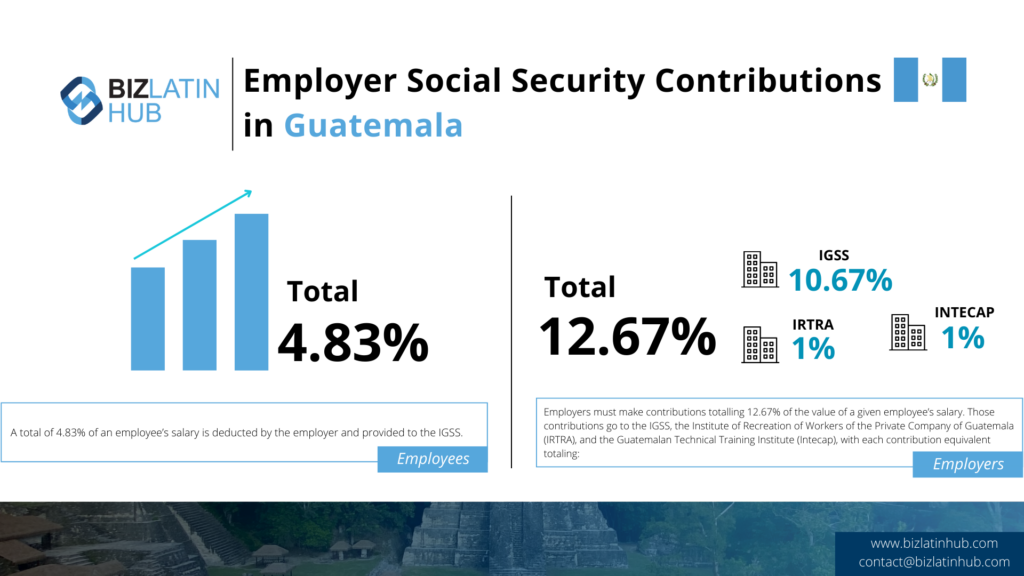

- Employee deductions: A total of 4.83% of an employee’s salary is deducted by the employer and provided to the IGSS.

- Employer contributions: Employers must make contributions totalling 12.67% of the value of a given employee’s salary. Those contributions go to the IGSS, the Institute of Recreation of Workers of the Private Company of Guatemala (IRTRA), and the Guatemalan Technical Training Institute (Intecap), with each contribution equivalent totaling:

- IGSS: 10.67% of the employee’s salary

- IRTRA: 1% of the employee’s salary

- INTECAP: 1% of the employee’s salary

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Working Hours | Max 44 hours/week (day), 36 hours/week (night) | Overtime and mandatory rest days |

| Employment Contracts | Must be in writing and filed with authorities | Legal protection under Labor Code |

| Social Security (IGSS) | Register employee and pay monthly contributions | Access to public healthcare and pension |

| Paid Leave | 15 days/year after 150 days of work | Paid vacation and national holidays |

| Termination | Provide justification or severance if without cause | Indemnity and benefits on termination |

How does employee termination work in Guatemala?

Employees in Guatemala can generally be terminated in one of two ways: with or without just cause. Conditions for just cause include illegal activity such as theft or violence, failure to comply with the stipulations of the contract or inadequate performance. In the latter case, warnings and written procedure must be followed in order to allow for due process.

For dismissal without just cause, notice must be given and compensation paid which includes all bonuses pro rata and leave not taken. The laws regarding employment termination in Guatemala state that the notice period for termination varies based on the requirements for terminating an employee in Guatemala are as follows:

- Less than six weeks of service: one week of notice.

- Between six and 12 months of service: 10 days of notice.

- Between one and five years of service: two weeks of notice.

- More than five years of service: one month of notice.

FAQs about employment law in Guatemala

In our experience, these are the common questions we receive from potential new clients.

Labor laws in Guatemala include a standard working week of 44 hours, with 8 hours per day. Overtime is allowed for up to 10 hours, with overtime pay at 1.5 times the normal hourly wage. Maternity leave is provided for 12 weeks, and employees are entitled to 15 working days of annual vacation leave.

There must be a minimum rest period of 12 hours between each working day, and employees are entitled to one day of paid rest after each working week. Notice periods for terminating a contract vary based on length of service. Additionally, employees are entitled to receive both a 13th and 14th-month bonus, known as aguinaldo and bono 14 respectively.

The working conditions in Guatemala include a maximum of 8 hours per day and a total of 44 hours per week. Daytime work is defined as the period between 6 and 18 hours on the same day.

The Labor Code allows for a maximum of 44 hours per week for daytime work, and 36 hours for night shifts. Overtime is paid at 150%.

The minimum wage in Guatemala varies depending on both sector and location. Wages are higher in the department of Guatemala, which includes the capital, than elsewhere. Exporters and agricultural workers receive lower wages than other workers.

Department of Guatemala:

Agricultural: GTQ3,843 per month.

Non-Agricultural: GTQ3,973 per month.

Exporter and Maquila: GTQ3,528 per month.

Other departments of Guatemala:

Agricultural: GTQ3,686 per month.

Non-Agricultural: GTQ3,800 per month.

Exporter and Maquila: GTQ3,347 per month.

Overtime in Guatemala is paid as an additional payment of 50% of the employee’s contracted hourly rate of pay for any work carried out beyond the standard working time restrictions.

If terminated without just cause, employees are entitled to severance pay equivalent to one month’s salary per year of service, plus any unpaid benefits.

When an employee quits in Guatemala, they must receive their final wages in their last day of work. However, severance pay does not apply if the employee voluntarily terminates the employment contract. The employee’s settlement must include proportional payments of salary, 13th and 14th salary and vacations if he or she has not enjoyed them.

No. Hiring employees requires a registered Guatemalan legal entity or the use of a local Employer of Record (EOR).

Yes. All employment relationships must be covered by a written contract, registered with the Ministry of Labor.

Employees are entitled to 15 paid working days of vacation annually after completing 150 days of continuous work.

Employers must contribute to the IGSS (Instituto Guatemalteco de Seguridad Social), which provides health, maternity, and pension benefits.

Biz Latin Hub can help with employment law in Guatemala

Biz Latin Hub is a professional services company providing integrated market entry and back office services throughout Latin America and the Caribbean.

As well as in Guatemala City, we have offices in 15 other jurisdictions in the region, meaning we are ideally placed to support multi-jurisdiction market entries and cross-border operations.

Our portfolio includes accounting & taxation, company formation, due diligence, legal services, and hiring & PEO, among others.

We are committed to compliance everywhere we operate, so working with us comes with the guarantee that your company will fully adhere to employment law in Guatemala or any other market where we assist you.

Contact us today to find out more about how we can support you doing business in Guatemala.

Or learn more about our team and expert authors.