Good things come in small packages, which is why many Latin-based companies are considering company formation in New Zealand. The country ranks highly for ease of doing business and punches well above its weight on the international stage. It is well connected to global trade and has a common market agreement with Australia. Agriculture is the traditional sector for doing business in New Zealand, but construction and services are ripe for development in coming years.

Key takeaways on doing business in New Zealand

| Is foreign ownership allowed in New Zealand? | Yes, a business can be 100% foreign-owned in New Zealand. |

| Most important sectors in New Zealand | Key sectors in New Zealand include: Agriculture and Agritech Construction Services Tourism |

| Are there Free Trade Zones in New Zealand? | No, there are no free trade zones or special economic areas. However, there is the common market with Australia. |

| Incentives for Foreign Direct Investment in New Zealand | The Overseas Investment Act (OIA) governs FDI in New Zealand and regulates it tightly. There are no special incentives due to the common market. |

| International links | The country has a wide-ranging agreement with neighboring Australia that allows the two to function as a common market. On top of that, there is the Trans Pacific Partnership, the ASEAN agreement and a range of other free trade agreements with countries around the world. |

An overview of New Zealand’s economy

Incorporating two main islands and a string of smaller outlying islands, New Zealand is the best country in the world to start and run a business, according to The World Bank. The country is of a similar physical size to Japan or Great Britain and benefits from being culturally diverse, with high levels of immigration from countries around the world, specifically from Australia and Asia, who come to do business in New Zealand.

As stated in their latest report, the World Bank considers New Zealand to be more attractive from a business standpoint than Singapore, Denmark, and Hong Kong, thanks to its ease of entry, and relaxed attitudes towards foreign investment and international expansion. As an entrepreneur looking to take your business to new heights, New Zealand could be an option to consider in your strategy.

With a population of 5 million people, all of whom speak English, the country is accessible to investors who want to enter into a new country with fewer cultural, language, and legislative barriers. On top of that, the local ‘can do’ attitude helps to enable growth and innovation in new businesses. Below, we share some of the reasons why you should consider incorporating a business in New Zealand in 2024, and offer guidance on how to maximize your return on investment.

New Zealand has been named the least corrupt nation in the world, making it a firm favorite for businesses looking for an Australasian base. The country follows the British Westminster parliamentary democracy and constitutional monarchy set-up, with the government led by a Prime Minister who is elected by citizens. The country also has His Majesty King Charles III as its official head of state, though he has no role in the running of the country.

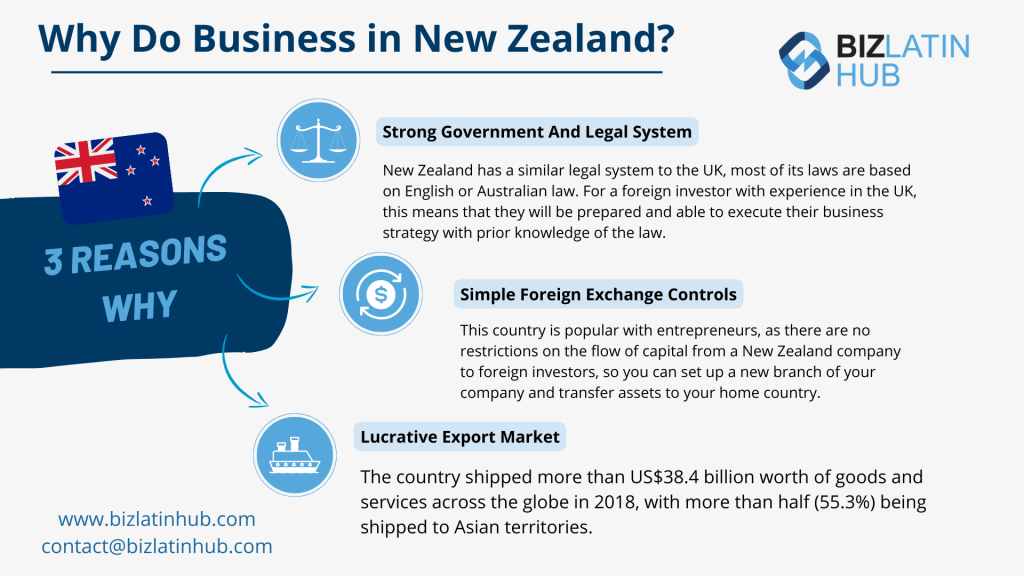

New Zealand’s legal system is similar to the British system, with the majority of the country’s statutes based on English or Australian law. For a foreign investor with a background in the United Kingdom, navigating to a country like New Zealand means you will be forearmed and will be able to execute your business strategy with a prior understanding of the law and your responsibilities as an employer. Of course, there are differences between UK law and NZ law, but the basic principles are the same.

Foreign investment in the country is monitored by the Overseas Investment Office, The Financial Markets Authority, and the Reserve Bank of New Zealand. These institutions regulate the country’s financial markets, investments, and insurance.

New Zealand is home to a lucrative export market, with exported goods making up around 30% of the country’s GDP. The country shipped more than USD$39.8 billion worth of goods and services across the globe in 2023, with more than half (58%) being shipped to Asian territories.

According to World’s Top Exports, current export sales translate to around USD$7,700 per resident in the country, demonstrating just how lucrative the country’s export market is.

The most popular commodities exported in the country are dairy products as well as meat, wood, fruits, nuts, beverages, cereal, fish, machinery, aluminium, and food preparation products.

Vehicles, machinery, minerals, electricals, and plastics were the biggest imported product categories, each representing a trade deficit, which unlocks unique opportunities for foreign investors looking to enter into the import and export market.

International agreements for doing business in New Zealand

The country has a wide-ranging agreement with neighboring Australia that allows the two to function as a common market. On top of that, there is the Trans Pacific Partnership, the ASEAN agreement and a range of other free trade agreements with countries around the world.

If you’re considering expanding a business into Oceania, then the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can also be beneficial, as it allows companies in New Zealand and Australia to trade with Canada, Brunei, Chile, Japan, Malaysia, Mexico, Peru, Singapore, and Vietnam.

The CPTPP went into force in December 2018, creating a trade bloc that represents 495 million consumers and 13.5% of global GDP, offering significant opportunities for companies in each of the eleven countries involved.

Four key sectors in New Zealand

The agriculture sector is the bread and butter of its local and export economy, attracting a high degree of foreign investment in New Zealand. In spite of its size, the Pacific Island nation is the largest dairy exporter in the world. This is centralized by the country’s dairy-dealing kingpin, the Fonterra Co-operative Group. Additionally, the country’s red meat exports are growing fast.

Construction is responding to a population boom in New Zealand’s urban areas. People movement and immigration to New Zealand’s business and lifestyle hotspots has put a strain on housing availability. In particular, Auckland city is experiencing a housing crisis that the government is scrambling to address. Industry experts forecast that an additional 15,000 houses will need to be built per year to keep up with growth.

An up-and-comer on the list of New Zealand’s economic success stories is the nation’s fast-developing service sector. This sector makes up around 70% of the country’s GDP, with transport and logistics the largest industry. Local businesses are said to be spending, on average, around 40% more on services than wages and salaries.

New Zealand supports an immense tourism sector by touting its picturesque landscapes and diverse adventure experiences. It is the country’s largest export industry with regard to foreign exchange earnings. Tourism revenue made up 6.1% of national GDP, totaling $15.9 billion. The sector employs 8% of the New Zealand population. This record growth is largely attributed to the increasing influx of affluent Chinese tourists.

FAQs on doing business in New Zealand

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in New Zealand?

| Yes, a business can be 100% foreign-owned in New Zealand. |

2. Are there Free Trade Zones in New Zealand?

| No, there are no free trade zones or special economic areas. However, there is the common market with Australia. |

3. How long does it take to register a company in New Zealand?

It takes 4 weeks to register an operating company in New Zealand

4. Which sectors are important in New Zealand?

Key sectors in New Zealand include:

Agriculture and Agritech

Construction

Services

Tourism

5. Does New Zealand have trade agreements with other countries?

The country has a wide-ranging agreement with neighboring Australia that allows the two to function as a common market. On top of that, there is the Trans Pacific Partnership, the ASEAN agreement and a range of other free trade agreements with countries around the world.

If you’re considering expanding a business into Oceania, then the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) can also be beneficial, as it allows companies in New Zealand and Australia to trade with Canada, Brunei, Chile, Japan, Malaysia, Mexico, Peru, Singapore, and Vietnam.

6. What entity types offer Limited Liability in New Zealand?

The LLC, PLC and Limited Partnership are all types of companies in New Zealand whereby the owners are not personally liable for the company’s debts or liabilities.

Biz Latin Hub can help you with doing business in New Zealand

Legal compliance is more than a requirement—it’s a foundation for success. Businesses that proactively address legal challenges minimize risks and position themselves for growth. From selecting the right legal structure to adhering to employment laws, understanding legal obligations is essential for sustainable operations.

At Biz Latin Hub, we specialize in helping businesses navigate complex regulatory environments in Latin America and the Caribbean. Whether you’re entering a new market, managing payroll, or ensuring compliance with tax laws, our expert team is here to guide you.

Don’t let legal pitfalls hinder your progress. Connect with Biz Latin Hub to explore tailored solutions for your business and gain the peace of mind that comes with professional support. Let’s work together to build a strong, compliant, and thriving business.

Contact us today to learn more!