It is important to understand how to liquidate a company in Australia if your business operations aren’t playing out as planned. Not every business project works out after company formation in Australia. There are multiple ways to liquidate, cancel and dissolve established companies or branches in Australia. For each of these processes, it’s wise to seek out a trusted legal services specialist in the country who can support your liquidation proceedings.

Key takeaways on how to liquidate a company in Australia

| Steps to liquidate a company in Australia | Step 1: Directors Make a Declaration of Solvency Step 2: Shareholders Pass a Special Resolution Step 3: Appoint a Registered Liquidator Step 4: The Liquidator Winds Up the Company’s Affairs Step 5: Final Filings and Deregistration |

| What is the timeframe to liquidate a company in Australia? | It should take approximately a year to liquidate a company in Australia, if everything is in order. |

| What are the reasons to liquidate a company in Australia? | Liquidation is the right choice for your company if the firm: Cannot pay its creditors Is too small Has no assets Is trading at a loss |

| What causes involuntary liquidation in Australia? | This can be triggered by not complying with legal responsibilities under the law such as it cannot pay its creditors or its obligations to the Australian Taxation Office (ATO). |

| What is a Declaration of Solvency? | This is a formal written statement signed by the company’s directors declaring that they have investigated the company’s affairs and have formed the opinion that the company will be able to pay its debts in full within 12 months. |

| Do the shareholders play a role in the process? | A special resolution of the shareholders is required to start the liquidation. |

The 5-Step Process for a Members’ Voluntary Liquidation

Expert Tip: The Registered Liquidator Requirement

From our experience, the most critical legal requirement in any formal liquidation in Australia is the appointment of a Registered Liquidator. Unlike in some other countries, a company director or their regular accountant cannot act as the liquidator. The liquidator must be an individual who is officially registered as such with ASIC. This is a non-negotiable requirement. We advise clients that the first practical step is to engage a Registered Liquidator, who will then guide them through the formal steps of making the solvency declaration and calling the shareholder meeting.

Step 1: Directors Make a Declaration of Solvency

The directors must investigate the company’s finances and sign a formal declaration that the company is solvent.

Step 2: Shareholders Pass a Special Resolution

The members (shareholders) hold a meeting and pass a special resolution (requiring a 75% majority) to wind up the company voluntarily.

Step 3: Appoint a Registered Liquidator

In the same meeting, the shareholders appoint an ASIC-Registered Liquidator to take control of the company and manage the process.

Step 4: The Liquidator Winds Up the Company’s Affairs

The liquidator sells the company’s assets, pays all creditors, settles any outstanding tax obligations with the ATO, and distributes any surplus funds to the shareholders.

Step 5: Final Filings and Deregistration

Once the process is complete, the liquidator holds a final meeting and lodges a final return with ASIC. ASIC will then formally deregister the company.

Key Regulatory Bodies

Two main government bodies oversee the liquidation process. The Australian Securities and Investments Commission (ASIC) is the corporate regulator where all notices and reports are filed. The Australian Taxation Office (ATO) is the tax authority, and the liquidator must ensure all tax liabilities are settled and file a final tax return.

When would you choose to liquidate your company in Australia?

Liquidation is the right choice for your company if the firm:

- Cannot pay its creditors or its obligations to the Australian Taxation Office (ATO)

- Is too small (To save a small company, Voluntary Administration is too expensive)

- Has no assets, or not enough assets to keep doing business

- Is trading at a loss, cannot recover from losses accumulated, in the past, or has stopped trading altogether.

Liquidation can be a desirable option for directors who want to eliminate their obligations and liability for company activities and formally close operations.

Different types of liquidation

There are four basic types to liquidate your company in Australia:

- Creditors Voluntary Liquidation: This is the most common method of liquidating a company. Directors and shareholders declare the company insolvent and appoint a liquidator to carry out liquidation proceedings.

- Members Voluntary Liquidation: This method is used to voluntarily finalize the affairs of a solvent business.

- Official Liquidation: The Court appoints a liquidator on application by a creditor.

- Provisional Liquidation: The court appoints a liquidator for a period of assessment mostly in a director’s dispute.

If you choose to liquidate your firm, then you must establish if the company is solvent or insolvent. You will choose the CVL process if your company is insolvent. If your company is solvent, you will need to undertake MVL proceedings.

Creditors Voluntary Liquidation (CVL)

This method to liquidate your company in Australia is agreed upon by the directors and shareholders.

- Directors agree to liquidate and declare insolvency

- Appoint liquidator

- Call an Extraordinary General Meeting for the shareholders

- Approve a Special Resolution

- Wind up the firm.

Members Voluntary Liquidation (MVL)

This method is only available to solvent companies and is primarily used to return capital to shareholders and finalize the company’s affairs.

Members Voluntary Liquidation appointments are commonly made as part of the simplification of a group of companies, to save on administration costs or to utilize tax advantages when distributing past profits to shareholders.

The conduct of an MVL is procedural, and includes:

- Formal meetings

- Forms to be lodged with ASIC

- Notifications to government authorities

- Advertisements in ASIC’s Insolvency Website.

In a practical sense, the affairs of the company must be ‘wound up,’ including the removal of all assets, and payment of all liabilities.

Appoint a liquidator

To appoint a liquidator in a Creditors Voluntary Liquidation and a Members Voluntary Liquidation, you have to:

- Sign a document of the directors’ resolution

- Sign a resolution by the shareholders

- Contact an experienced liquidation services provider

- The liquidator provides the draft minutes of a meeting

- The liquidator receives a consent to act as liquidator.

The process of liquidation in Australia

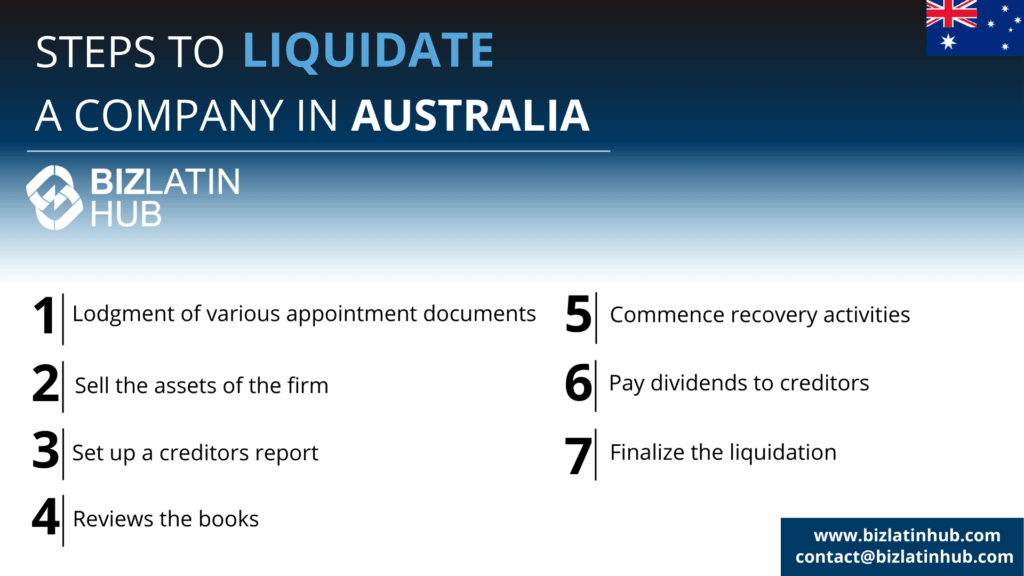

The process of liquidation varies on the different types of liquidation. Generally speaking, the duties of the liquidator include:

- Lodgment of various appointment documents at the Australian Securities & investments Commission (ASIC)

- Recommend different government organizations, for instance, the Australian Tax Office and state government revenue offices, of the appointment

- Ask if the director(s) can complete a questionnaire and deliver the books and records of the company to the Liquidator

- Gathers and sells the assets of the firm

- Set up a creditors report and hold a creditors’ meeting

- Reviews the books and records and reports findings to ASIC

- Possibly commence recovery activities if there were “hidden assets” or assets that should be recovered

- If resources are available, pay a dividend to creditors

- Finalize the liquidation by formulating a final report for creditors, lodge different documents with ASIC and request that ASIC deregisters the firm. In order to let the government know that the company is formally closed.

FAQs for liquidating an entity in Australia

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in Australia.

1. What is the process of liquidation in Australia?

- Lodgment of various appointment documents at the Australian Securities & investments Commission (ASIC)

- Recommend different government organizations, for instance, the Australian Tax Office and state government revenue offices, of the appointment

- Ask if the director(s) can complete a questionnaire and deliver the books and records of the company to the Liquidator

- Gathers and sells the assets of the firm

- Set up a creditors report and hold a creditors’ meeting

- Reviews the books and records and reports findings to ASIC

- Possibly commence recovery activities if there were “hidden assets” or assets that should be recovered

- If resources are available, pay a dividend to creditors

- Finalize the liquidation by formulating a final report for creditors, lodge different documents with ASIC and request that ASIC deregisters the firm. In order to let the government know that the company is formally closed.

2. How long does it take to liquidate a company in Australia?

The liquidation process will normally take between (10) and (14) months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in Australia?

| Liquidation is the right choice for your company if the firm: Cannot pay its creditors or its obligations to the Australian Taxation Office (ATO) Is too small (To save a small company, Voluntary Administration is too expensive) Has no assets, or not enough assets to keep doing business Is trading at a loss, cannot recover from losses accumulated, in the past, or has stopped trading altogether. |

4. Can you be forced to liquidate a company in Australia?

Yes, under certain circumstances such as not being able to pay creditors. It is worth noting that small businesses often do this as voluntary liquidation is too expensive.

5. What is a Declaration of Solvency?

This is a formal written statement signed by the company’s directors declaring that they have investigated the company’s affairs and have formed the opinion that the company will be able to pay its debts in full within 12 months. This is a critical legal document.

6. What is a Members’ Voluntary Liquidation?

This is the formal legal process for winding up a solvent company. It is initiated by the members (shareholders) and managed by a registered liquidator.

7. What is the difference between liquidation and deregistration?

| Liquidation is the formal process of winding up a company’s affairs, paying creditors, and distributing surplus assets. Deregistration is the final step where ASIC removes the company from the corporate register. A simple administrative deregistration is only available for companies with minimal assets and liabilities; otherwise, a formal liquidation is required first. |

8. Who is ASIC?

| ASIC is the Australian Securities and Investments Commission, the country’s main corporate regulator. The liquidator has a statutory duty to file various reports and notices with ASIC throughout the liquidation process. |

Work with Biz Latin Hub to liquidate your company in Australia

Liquidating a business is never an easy thing to do, regardless of the country in which it takes place. Australia is no exception to the rule, and the country’s liquidation procedure must be duly followed.

Liquidation is an extensive legal procedure, and it is essential to use a knowledgeable lawyer in Australia who can guide you through voluntary or court liquidation proceedings and offer advice on the next steps to exit the market.

At Biz Latin Hub, our team of local lawyers and professionals have significant experience with liquidation procedures and building comprehensive market exit strategies in Australia.

Reach out to our team of local experts for advice and comprehensive support to liquidate your business in Australia. Contact us now for personalized assistance.

Learn more about our team and expert authors.