Foreign executives often choose to incorporate a company in the Dominican Republic as a gateway into the Caribbean, as the country has a steady, growing, and reliable economy. When engaging in business in any country one must also consider the need to close up shop and every solid market entry strategy must consider the possibility of an orderly exit. The most common way to withdraw investment in the Dominican Republic is by liquidating a company.

Key takeaways on how to liquidate a company in the Dominican Republic?

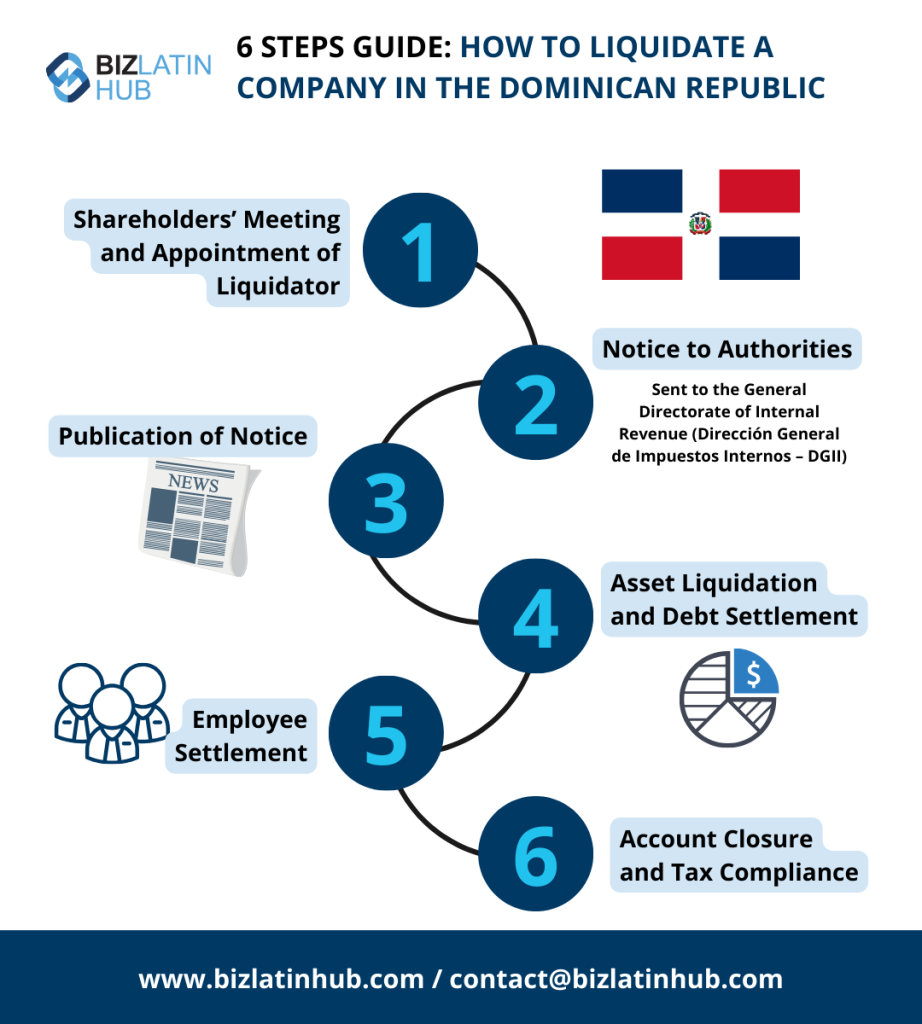

| 7 steps to liquidate a company in the Dominican Republic | Shareholders’ Meeting Appointment of Liquidator Notice to Authorities Publication of Notice Asset Liquidation and Debt Settlement Employee Settlement Account Closure and Tax Compliance |

| What is the timeframe needed to liquidate a company in the Dominican Republic? | 5–10 months is the typical timeframe, assuming the entity is compliant and documentation is in order. |

| What are the reasons to liquidate a company in the Dominican Republic? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What can cause involuntary liquidation in the Dominican Republic? | Forced liquidation is possible when companies become insolvent or fail to pay creditors. |

Liquidate a company in the Dominican Republic in just a few steps

Step 1 – Shareholders’ Meeting

Convene a General Shareholders’ Meeting to formally resolve to dissolve the company. This resolution should:

- Approve liquidation

- Discharge members of the Board of Directors

- Appoint a Liquidator and a Commissioner of Accounts

The decision must be drafted in meeting minutes, notarized, and submitted to the Chamber of Commerce. This step triggers the formal start of the process.

Step 2 – Appointment of Liquidator & Solvency Declaration

The Liquidator (a legal representative or independent third party) prepares:

- A Declaration of Solvency, confirming the company can meet its obligations

- A Liquidation Report, listing all assets, liabilities, and pending obligations

The Commissioner of Accounts must verify and sign off on these documents, which are then ratified in a second Shareholders’ Meeting.

Tip: The declaration must be notarized and submitted with financial attachments to ensure tax clearance.

Step 3 – Notification to Authorities

Notify the following entities of the company’s intention to dissolve:

- Dirección General de Impuestos Internos (DGII)

- Chamber of Commerce

- Social Security institutions (e.g., TSS)

- Ministry of Labor, if employees are involved

Provide a copy of:

- Shareholders’ resolution

- Solvency declaration

- Liquidator appointment

Each authority has its own documentation and timing. Failing to inform all required bodies may result in delayed closure or penalties.

Step 4 – Publication of Liquidation Notice

A formal announcement must be published in a national newspaper. The publication must:

- Include the company’s full legal name and registration number

- State the intention to dissolve and liquidate

- Invite creditors to submit claims within 30–60 days (based on local norms)

Why it matters: Creditors unaware of the liquidation may claim unpaid obligations later, delaying deregistration.

Tip: Retain original proof of publication—it will be required by the DGII at closure.

Step 5 – Asset Liquidation and Debt Settlement

The Liquidator will:

Compile a full inventory of all company assets and outstanding debts

Sell or auction company assets (vehicles, equipment, IP, real estate)

Prioritize payments to:

- Labor obligations (severance, salaries)

- Tax debts

- Secured and unsecured creditors

Any remaining proceeds are distributed to shareholders after all obligations are met.

Note: The Commissioner of Accounts should verify disbursements and validate payment records.

Tip: If the company owns real estate, public auction is required unless otherwise approved in the liquidation resolution.

Step 6 – Employee Settlement

All employee-related obligations must be cleared before closure, including:

- Final salaries

- Social security contributions

- Severance packages, bonuses, and paid leave (as per Labor Code)

Notify the Ministry of Labor and Social Security offices of the terminations and submit:

- Final payroll records

- Proof of social security cancellation

- Clearance certificate (Constancia de No Deuda) if applicable

Tip: Labor non-compliance is the most common reason for rejection at the DGII stage.

Step 7 – Final DGII Filings and Tax Deregistration

To officially close, submit to the DGII:

- Final income tax return

- Liquidation report and solvency declaration

- RC-02 Affidavit with attached Chamber filings

- Affidavit of Liability signed by the legal rep

Once verified, the DGII will issue a Certificate of Cessation of Fiscal Activities, confirming final deregistration and closure.

Who do you deal with when you liquidate a company in the Dominican Republic?

When liquidating a company in the Dominican Republic, you will interact with:

- Chamber of Commerce – Confirms active registration and receives the dissolution resolution and liquidator appointment. If documents are missing, a notarized statement must be submitted.

- DGII (Dirección General de Impuestos Internos) – Ensures all tax obligations are met and issues final deregistration once all forms are approved.

- Labor Ministry – Verifies employee terminations and ensures obligations are paid.

- Social Security Entities (TSS) – Cancels employee social security contributions and pension registrations.

The country’s Chamber of Commerce is the first entity you must approach when looking to liquidate a company in the Dominican Republic. This is to ensure that the Company’s registration is active and valid. In case it is inactive, the company must renew it or obtain a notarized statement indicating the register is lost.

The registration at the Chamber of Commerce includes the company’s by-laws which have a liquidation clause, and the minutes of general meetings, which need to refer to the pertinent approval to dissolve the company.

Furthermore, the company must appoint a liquidator to draft a ‘liquidation report’. Note that this report must be approved by a member of the company. Then, a formal Declaration of Solvency must be drafted, followed by the approval of the ‘liquidation report’. This is a crucial step when you liquidate a company in the Dominican Republic.

Tip: Each institution may require certified and translated documents. Using a local attorney ensures nothing is overlooked.

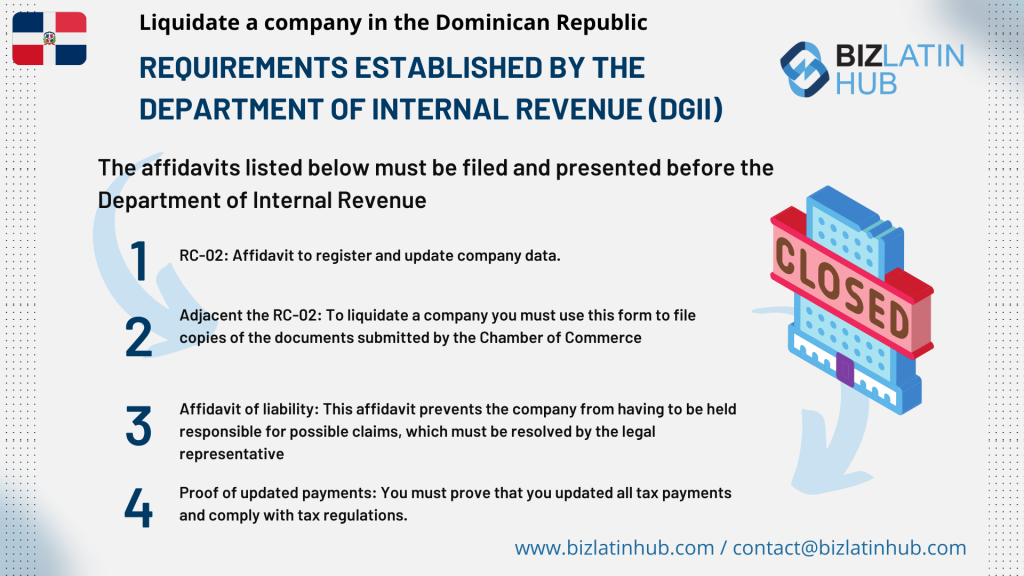

Requirements established by the Department of Internal Revenue (DGII)

To liquidate a company in the Dominican Republic, the following documents must be submitted to the DGII:

- RC-02 Affidavit: Used to update company status and submit all supporting documentation for liquidation.

- Liquidation Report: Includes full asset/liability breakdown, certified by a Commissioner of Accounts.

- Affidavit of Liability: Protects the company from future claims. Must be signed by the Liquidator, legal representative, or President.

- Declaration of Solvency: A notarized document affirming that all debts can be paid.

- Proof of Compliance: Submit:

- Final VAT and income tax returns

- Payroll summaries

- Updated payment records (RNC, ITBIS, ISR)

Important: Without tax clearance from the DGII, no final certificate will be issued—even if all other filings are complete.

FAQs for Liquidating an Entity in the Dominican Republic

Based on our extensive experience these are the common questions we receive from clients about liquidating an entity in the Dominican Republic.

1. What is the full process for liquidation in the Dominican Republic?

The process includes a formal shareholders’ meeting, appointment of a liquidator, notification to authorities, newspaper publication, asset sale and debt settlement, employee payout, and DGII deregistration. All documents must be notarized and submitted to the appropriate authorities.

2. How long does it take?

Between 5 and 10 months, depending on the complexity of the entity, whether employees are involved, and whether the company is in tax compliance. If inactive, reactivation may be needed before liquidation.

3. Why do companies liquidate?

Common reasons include:

Dormancy and cost avoidance

Market exit due to strategic realignment

Accumulated losses or low profitability

Corporate restructuring

Changes in tax or regulatory laws

4. Can the government force liquidation?

Yes. If a company fails to meet obligations (e.g. unpaid taxes or creditor claims), the DGII or a court may initiate forced liquidation. In this case, external liquidators are appointed, and the process becomes judicial.

5. Can I liquidate if I’ve lost company documents?

Yes, but you must:

Delay should be expected during this process

File a notarized statement confirming the loss

Request duplicates from the Chamber of Commerce

6. Can a foreign-owned company liquidate the same way?

Yes. The procedure is the same. However, foreign shareholders must grant Power of Attorney to a local representative to sign and file all documents.

7. What happens if I skip formal liquidation?

Risks include:

Legal action by creditors or employees

Continued tax liabilities

Blacklisting from the DGII

Inability to form or register future entities

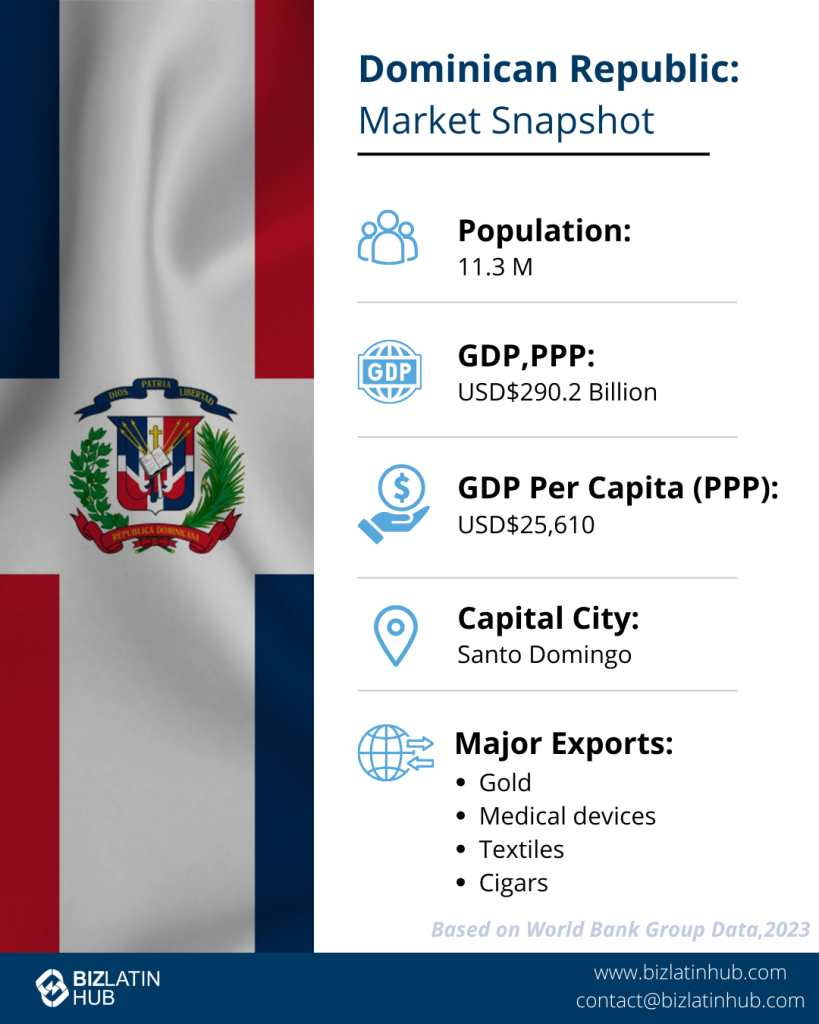

Why Engage in Business in The Dominican Republic

While the liquidation process is crucial for orderly exit, the Dominican Republic continues to offer strong reasons for doing business. The Dominican Republic presents a compelling case for businesses considering expansion or investment. When looking to liquidate a company in the Dominican Republic, the country offers a range of advantages that make it an attractive choice.

Firstly, the Dominican Republic’s robust legal framework provides clear and efficient procedures to liquidate a company in the Dominican Republic. This streamlined process minimizes bureaucratic hurdles and saves time for businesses.

Furthermore, the nation’s strategic location in the heart of the Caribbean positions companies to access a broad regional market. When seeking to liquidate a company in the Dominican Republic, businesses can take advantage of various trade agreements that facilitate international commerce.

In addition to a business-friendly environment, the Dominican Republic boasts a well-developed infrastructure, including modern ports and transportation networks. This facilitates the movement of goods and materials for companies in the process of deciding to liquidate a company in the Dominican Republic.

Moreover, the country offers an ample and skilled labor force, making it easier to find qualified professionals when it’s necessary to liquidate a company in the Dominican Republic.

In conclusion, the Dominican Republic’s business-friendly climate, strategic location, legal framework, and infrastructure make it an attractive destination for businesses, including those considering the decision to liquidate a company in the Dominican Republic, providing opportunities for growth and success in the Caribbean region.

Liquidate a company in The Dominican Republic with support from local legal experts

Although the Dominican Republic is a favorable business destination, foreign executives operating in the country might decide to undertake a liquidation process based on different circumstances. The liquidation process in the Dominican Republic can be complex and requires a sound understanding of local regulations. Therefore, it is vital to seek expert advice to liquidate a company in the Dominican Republic.

At Biz Latin Hub, our experienced team of local and expatriate legal and accounting advisors are able to guide you through a liquidation process while complying with all the local legislation. With our full suite of bilingual market entry and back-office services, we can ensure you meet all the necessary requirements and make the best decisions to liquidate your company in the Dominican Republic. Contact us now to find out how we can help you with your business.

Our bilingual legal and accounting team can guide you through every filing, from solvency declarations to DGII certification. Contact us to start your company’s formal closure today.

Learn more about our team and expert authors.