If you are looking at company formation in the Dominican Republic, you should have an entity health check done. An entity health check in the Dominican Republic will involve a full examination of that company’s compliance with local regulations, as well identifying structural or operational inefficiencies in order to maximize your profitability. You may also opt for an entity health check in the Dominican Republic if you already run a business there and simply wish to audit your existing operations to identify potential options to improve your bottom line.

Key takeaways on an entity health check in the Dominican Republic

| Due Diligence Aspect | Dominican Republic Requirements |

|---|---|

| Legal due diligence Dominican Republic | Commercial registry verification, employment law compliance (Labor Code 16-92), intellectual property validation, industry-specific licensing |

| Corporate due diligence Dominican Republic | Corporate Law 479-08 compliance, beneficial ownership disclosure (UIF requirements), anti-money laundering verification (Law 155-17) |

| Dominican Republic compliance check timeline | Information collection (1-2 weeks), validation and cross-reference (1-2 weeks), final report preparation (3-5 days) |

| Dominican Republic entity verification | DGII tax status confirmation, IDSS social security validation, Central Bank foreign investment registration (if applicable) |

| Cost of non-compliance | Tax penalties: 10-200% of owed amounts, Labor violations: up to RD$50,000, Social security penalties: up to 200% of contributions |

| Recommended frequency | Annual self-audits recommended, Highly-recommended for M&A transactions, quarterly for high-risk industries |

What is an entity health check?

An entity health check is an in-depth analysis carried out by legal and financial auditors to discover if any non-compliance issues or major inefficiencies can be identified in a company’s operations. When this is carried out on a company you are planning to purchase or partner up with, it forms a crucial aspect of the due diligence you must undertake to ensure the money you are investing is going to be safe.

Hiring an external provider to carry out an entity health check is the best way to guarantee that it is undertaken comprehensively and impartially, and that the conclusions drawn are reliable. The external provider will have to be authorized by the owner of the business you are doing business with to access current and historic financial, accounting, and legal records.

In the event a company you are doing business with or planning to do business with shows reluctance to submit to such a process, or proves resistant in offering up its records, that should act as a red flag that something is likely not right and offer you good cause to reconsider your venture.

Due Diligence Dominican Republic: Corporate Verification Process

Legal due diligence Dominican Republic examines your entity’s compliance with local corporate governance requirements. This process verifies commercial registry filings with the Chamber of Commerce, validates employment contracts under Dominican Labor Code 16-92, and confirms industry-specific licensing requirements.

Corporate due diligence Dominican Republic processes follow the country’s Corporate Law 479-08 and recent amendments affecting foreign investment structures. This approach ensures compliance with beneficial ownership disclosure requirements mandated by the Financial Intelligence Unit (UIF) and anti-money laundering regulations under Law 155-17.

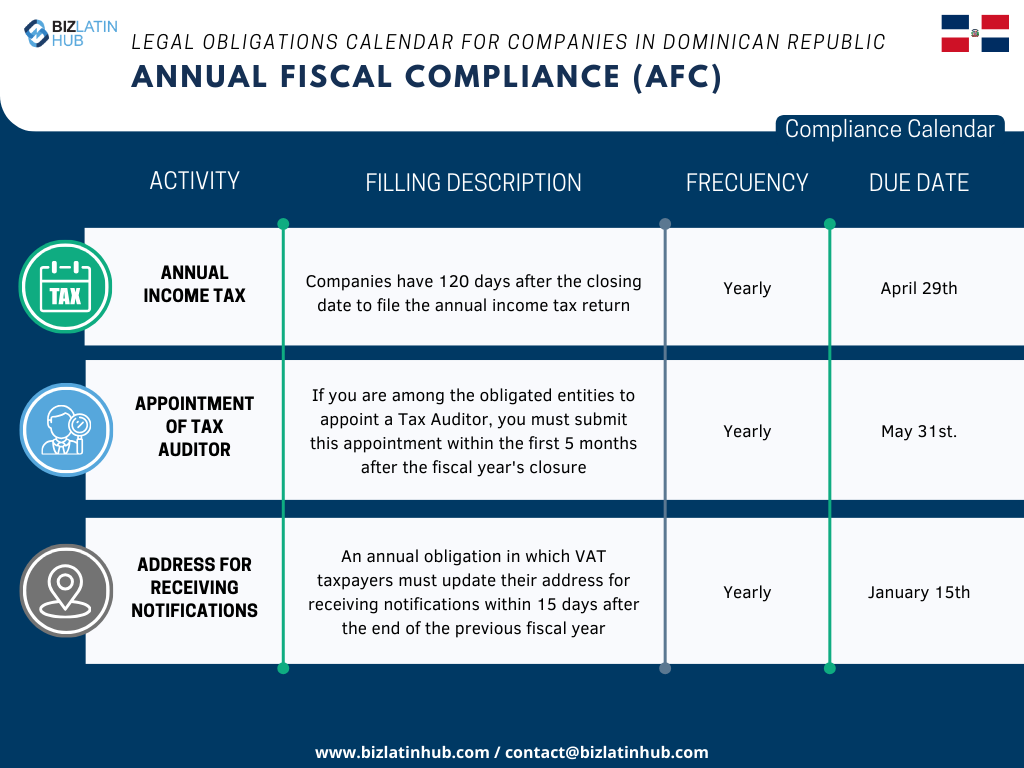

A Dominican Republic compliance check verifies:

- DGII (tax authority) filing status and payment history

- IDSS (social security) contribution compliance

- Ministry of Labor regulatory adherence

- Central Bank foreign investment registration (if applicable)

- Free zone compliance through CNZFE (if operating in designated zones)

Dominican Republic entity verification services validate legal standing, corporate structure integrity, and ongoing regulatory compliance across all operational jurisdictions within the country.

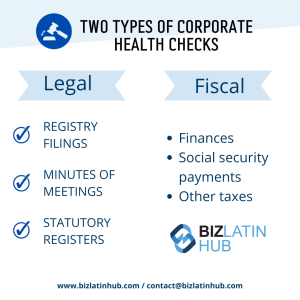

Entity health check types

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Legal health checks

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in the Dominican Republic.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

Fiscal health checks

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

When to Conduct Dominican Republic Entity Health Checks

Mandatory Scenarios

- M&A transactions: Required for all merger and acquisition due diligence

- Foreign investment entry: Central Bank registration compliance verification

- Free zone operations: Annual CNZFE compliance audits

- High-risk industry operations: Quarterly checks for financial services, mining, telecommunications

Recommended Self-Audits

- Annual compliance reviews: Identify potential issues before tax authority inspections

- Declining profitability: Uncover hidden inefficiencies or compliance costs

- Regulatory changes: Ensure adaptation to new Dominican laws and regulations

- Pre-transaction preparation: Maintain investment-ready status

Timing Considerations

Best practice: Schedule entity health checks during Q1 or Q3 to avoid DGII tax season delays and ensure faster processing of verification requests.

FAQs on an entity health check in the Dominican Republic

Why should you get an entity health check in the Dominican Republic?

Conducting an entity health check helps businesses understand their compliance status, reduce risks of tax penalties and reputational harm, prepare for mergers or acquisitions, and ensure they meet evolving Dominican regulations.

What Dominican Republic regulations require special attention during entity health checks?

Key regulations include DGII tax filings, IDSS social security contributions, compliance with Dominican labor laws, anti-money laundering laws such as Law 155-17, and free zone operational rules under CNZFE.

What happens during a Dominican Republic compliance check?

The process involves reviewing financial records, legal documents, regulatory compliance certificates, corporate governance practices, and internal operational controls to ensure full legal and tax compliance.

How long does Dominican Republic entity verification take?

Entity verification typically takes 2–4 weeks for standard businesses and up to 6 weeks for complex operations, depending on document availability and government response times.

Who can perform an entity health check in the Dominican Republic?

Qualified professionals include licensed auditors from ICPARD, attorneys registered with the Dominican Bar, and firms experienced in Dominican tax and corporate compliance with government liaison capabilities.

What are the penalties for non-compliance discovered during entity health checks?

Penalties may include significant tax fines (10–200% of unpaid amounts), social security penalties, labor law fines, business license suspension, or loss of investment incentives for foreign-owned companies.

How often should Dominican Republic compliance checks be conducted?

Annual self-audits are recommended for all entities, with quarterly reviews for high-risk industries and additional checks during major transactions or regulatory changes.

Biz Latin Hub can help you do an entity health check in the Dominican Republic

At Biz Latin Hub, our team of due diligence experts has deep knowledge of the regulatory framework in the Dominican Republic and is experienced in carrying out entity health checks in support of foreign investment into the country.

With our comprehensive portfolio of back-office services, including legal, accounting, and recruitment, we can be your single point of contact to support your market entry and ongoing operations in the Dominican Republic, or any of the other 15 countries around Latin America and the Caribbean where we have a local team in place.

Reach out to us today for a quote or free consultation.

Or learn more about our team of expert authors.