Discover why doing business in the Dominican Republic is gaining attention in 2025, with insights into company formation, foreign investment incentives, and strategic advantages.

Doing business in the Dominican Republic in 2025 offers a range of advantages for international companies, from free trade zones and tax incentives to growing consumer demand and regional logistics access. Read on to learn more about the benefits of doing business in the Dominican Republic, and why you should consider expanding to this Caribbean country. Biz Latin Hub can help you to incorporate a company in the Dominican Republic or elsewhere in the region. Businesses looking to do business in the Dominican Republic must understand local regulations, the benefits of the free zone system, and the practical steps required to incorporate a company.

Key takeaways on doing business in the Dominican Republic

| Is foreign ownership allowed in the Dominican Republic? | Yes, 100% foreign ownership is fully legal. |

| Most important sectors in the Dominican Republic | The country has a strong manufacturing and industrial sector, with services such as tourism and media also booming. Tech is also developing rapidly, thanks to investment in education. |

| Are there Free Trade Zones in the Dominican Republic? | There are 92 Free Trade Zones for doing business in the Dominican Republic |

| Are there incentives for Foreign Direct Investment in the Dominican Republic? | The country offers specific tax incentives for businesses operating in: – Renewable energy. – The industrial sector. – Tourism. – Film production. – Haiti-Dominican Republic border development. |

| What international links does the country have? | The Dominican Republic benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA. |

Why invest in the Dominican Republic?

Located on the crossroads between the Eastern and Western Caribbean, the Dominican Republic is a trade link between the large markets of Central, South, and North America for trade and transport.

The country shares a border with Haiti, is close to the US hub Miami and other developing Central American economies, offering wide trade opportunities.

The Dominican Republic also benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA. The CARICOM is made up of 15 member countries and an additional five associate members based in the region, and aims to develop regional economic integration and deepen trade ties.

The CAFTA comprises the United States, Costa Rica, El Salvador, Guatemala, Honduras, and Nicaragua, and is the United States’ third-largest export market in Latin America.

Businesses setting up in the Dominican Republic can explore their trade opportunities with minimal barriers to trade among fellow members of these groups. They may also explore their prospects further afield in the developing, highly accessible Southern American markets.

What is the workforce like in the DR?

Education is affordable in the Dominican Republic compared to other countries in Latin America and the Caribbean. The high level of education of Dominican people is one of the benefits of doing business in the Dominican Republic.

The country’s labor market holds a healthy population of talented programmers, webmasters, and designers from well-known tech institutions. English levels are generally high for the region, taking advantage of longstanding ties to the United States. This also means that there are many cultural similarities in terms of doing business in the country.

Doing business in the Dominican Republic: favorable business environment

The Dominican Republic is the second-largest economy in the Caribbean by GDP, reporting a GDP of US$120 billion in 2023. Its local market has a strong appetite for imported goods and technology. For companies doing business in the Dominican Republic, top growth industries include tourism, renewable energy, logistics, free trade zone manufacturing, and real estate development.

The country works to promote foreign direct investment and business through its legal framework and promotion initiatives such as ProDominica, launched in 2017. Foreign business and investment is allowed in almost all sectors, with few exceptions.

The country also offers specific tax incentives for businesses operating in:

- renewable energy.

- the industrial sector.

- tourism.

- film production.

- Haiti-Dominican Republic border development.

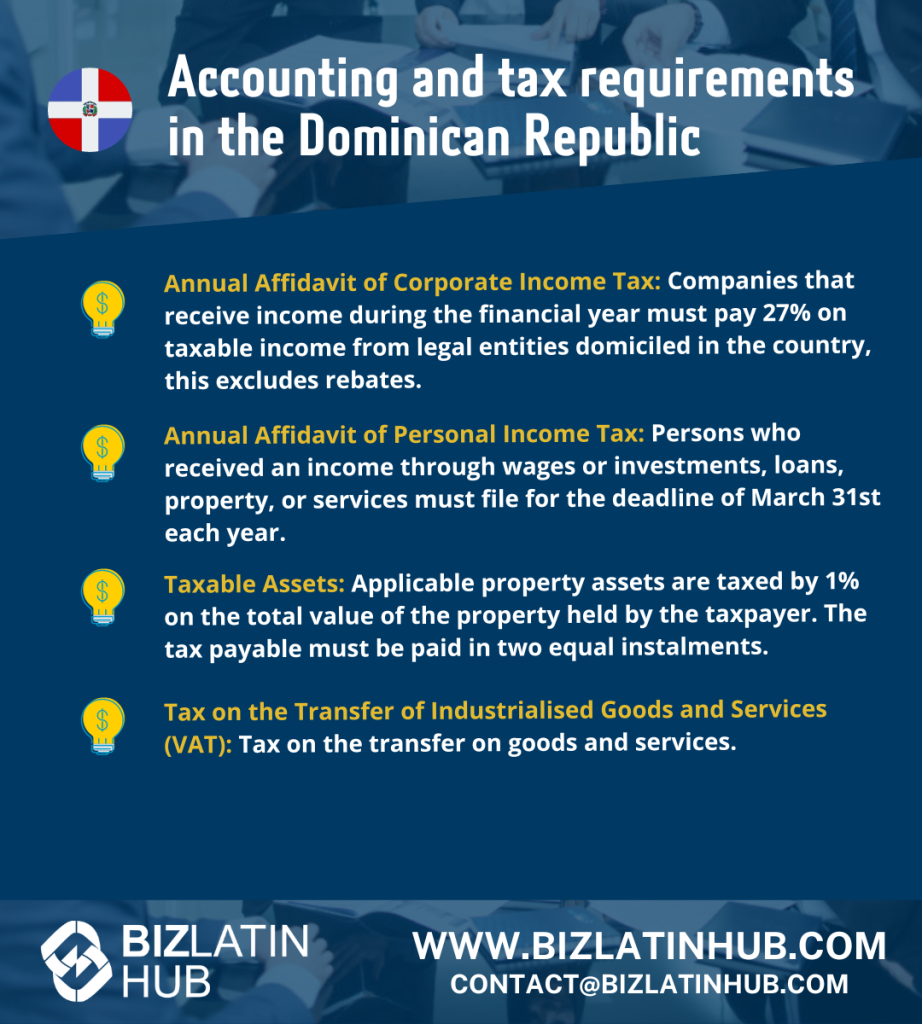

The tax rate is about 42.2% which is slightly lower than the continent’s average (45.3%). Additionally, opening a business in the Dominican Republic takes only 14.5 days, significantly less than the Latin American average of 30 days.

Public institutions such as the National Council of Free Trade Zones for Export, and the Export and Investment Center of the Dominican Republic, also provide support to foreign executives and investors doing business in the Dominican Republic.

In a number of key sectors, foreign executives may be provided with incentives to do business in the Dominican Republic. They may also have access to one of the many available free trade zones. This minimizes costs for exporters and other businesses, and can facilitate long-term success.

Why the Dominican Republic Is a Rising Investment Hub in 2025

The Dominican Republic is one of the fastest-growing economies in the Caribbean, with a government that actively supports foreign direct investment. In 2025, international businesses are increasingly attracted to its combination of cost-effective operations, trade connectivity, and political stability.

Key investment advantages include:

- Free Trade Zones (FTZs) – Companies operating within FTZs benefit from 100% exemption on import duties, corporate tax, VAT, and export taxes.

- Strong logistics infrastructure – With major seaports, airports, and FTAs including DR-CAFTA, the country serves as a natural bridge to both North and Latin America.

- Tourism and real estate growth – Ongoing tourism expansion is creating spillover demand in hospitality, construction, and real estate services.

- Renewable energy focus – The country is targeting 25% renewable energy by 2025, opening opportunities in solar, wind, and waste-to-energy projects.

- Skilled, affordable labor – The DR offers a large, young, and trainable workforce, ideal for manufacturing, BPO, and regional service centers.

Local Tip:

Santo Domingo and Santiago offer the most established legal and financial infrastructure for foreign companies seeking to incorporate or establish representative offices.

What is the local market like?

Doing business in the Dominican Republic implies expanding to a market of over 10 million consumers.

Additionally, there is a thriving export market for products made in the Dominican Republic. Thanks to relatively low operating and labor costs, companies from the Dominican Republic can achieve economies of scale. This gives them a significant competitive advantage over CARICOM counterparts.

Company formation in the Dominican Republic

Doing business in the Dominican Republic is particularly attractive due to its pro-investment policies, simplified incorporation process, and strong legal protections for foreign-owned entities.

Foreign investors looking to incorporate a company in the Dominican Republic must register with the Mercantile Registry, obtain a RNC tax ID, and open a corporate bank account. With legal assistance, the process typically takes 2–4 weeks. Investors can choose from various legal structures, including SRL (similar to LLC) and SA. FTZ businesses require an additional approval process with the National Free Zones Council.

Local Insight for 2025:

Companies in the Dominican Republic’s Free Trade Zones enjoy some of the most aggressive tax exemptions in the region — including full exemptions on corporate tax, import duties, and repatriation taxes.

Doing business in the Dominican Republic: competitive prices

Doing business in the Dominican Republic allows your company to expand into the national market, and reach over 11 million consumers.

Additionally, there is a thriving export market for products made in the Dominican Republic. Thanks to relatively low operating and labor costs, companies from the Dominican Republic can achieve economies of scale. This gives them a significant competitive advantage over CARICOM counterparts.

FAQs on doing business in the Dominican Republic

Answers to some of the most common questions we get asked by our clients.

1. Can a foreigner own a business in Dominican Republic?

Yes, a business can be 100% foreign-owned by either legal persons (legal entities) or natural persons (individuals).

2. Are there Free Trade Zones in Dominican Republic?

| Yes there are, 92 of them and public institutions such as the National Council of Free Trade Zones for Export, and the Export and Investment Center of the Dominican Republic, also provide support to foreign executives and investors doing business in the Dominican Republic. |

3. How long does it take to register a company in Dominican Republic?

It takes 10-14 weeks if all your paperwork is in order.

4. Which sectors are important in Dominican Republic?

The country has a strong manufacturing and industrial sector, with services such as tourism and media also booming. Tech is also developing rapidly, thanks to investment in education.

5. Does Dominican Republic have trade agreements with other countries?

Yes, the nation has signed an agreement with CAFTA to unlock the Central American market, has numerous agreements with the USA and is a prominent member of CARICOM, the association of Caribbean economies. The Dominican Republic benefits from a free flow of goods and services as a member of CARICOM and DR-CAFTA.

6. What entity types offer Limited Liability in Dominican Republic?

The S.R.L, S.A and S.A.S company structures all offer limited liability in the Dominican Republic.

7. Why is the Dominican Republic attractive for doing business?

The country offers stable economic growth, government incentives, low labor costs, and an ideal geographic position for trade within the Americas.

8. Can foreign investors fully own a company in the Dominican Republic?

Yes. There are no restrictions on foreign ownership. Foreign companies can fully own local entities and repatriate profits without limitations.

9. How long does it take to incorporate a company in the Dominican Republic?

With the right support, company formation can take 2–4 weeks, including tax registration and bank setup.

Biz Latin Hub can help you with doing business in the Dominican Republic

The Dominican Republic offers a lot of benefits for entrepreneurs and investors looking to do business in the Caribbean and Central America. While the country’s business potential is still largely undiscovered, now is the perfect time to expand your business in a growing market. If you’re considering doing business in the Dominican Republic in 2025, Biz Latin Hub can support your market entry, from legal incorporation to ongoing back-office compliance.

At Biz Latin Hub, we provide expert corporate legal and accounting advice to foreign businesses expanding into Central and South America, and the South Pacific. Our multilingual team of local and ex-pat professionals provides in-depth guidance and comprehensive business solutions for all market entry and back-office needs. This includes company formation, corporate compliance, due diligence, hiring and PEO services, and visa processing.

Contact us now, or visit our website at bizlatinhub.com to find out how we can be your single point of contact for doing business in the Dominican Republic.

Learn more about our team and expert authors.