The process to open a corporate bank account in the Dominican Republic, with all the documentation and approvals that are required, is very similar to the process of incorporating a business in the country. For that reason, many business entities plan things in such a way to register a business in the Dominican Republic and activate a business bank account at the same time. The Dominican Republic is a growing hub for international business and nearshoring. The banking sector offers full services to foreign entities, with bilingual staff and flexible account management options.

Key takeaways on how to open a corporate bank account in the Dominican Republic

| Which banks are best to open a corporate bank account in the Dominican Republic? | BanReservas Banco Popular Dominicano Banco Multiple BHD Leon Banco BDI Banco Vimenca Banco Unión Scotiabank República Dominicana Citi Dominican Republic |

| The four step process to open a corporate bank account in the Dominican Republic: | Step 1: Choose a Corporate Bank Provider. Step 2: Prepare all the Required Documentation. Step 3: Make an Initial Deposit. Step 4: Activate your account. |

| Do all banks have the same process? | This is a general guide: you will need to check individual banks’ rules or contact one of our expert advisors for more detailed rules. |

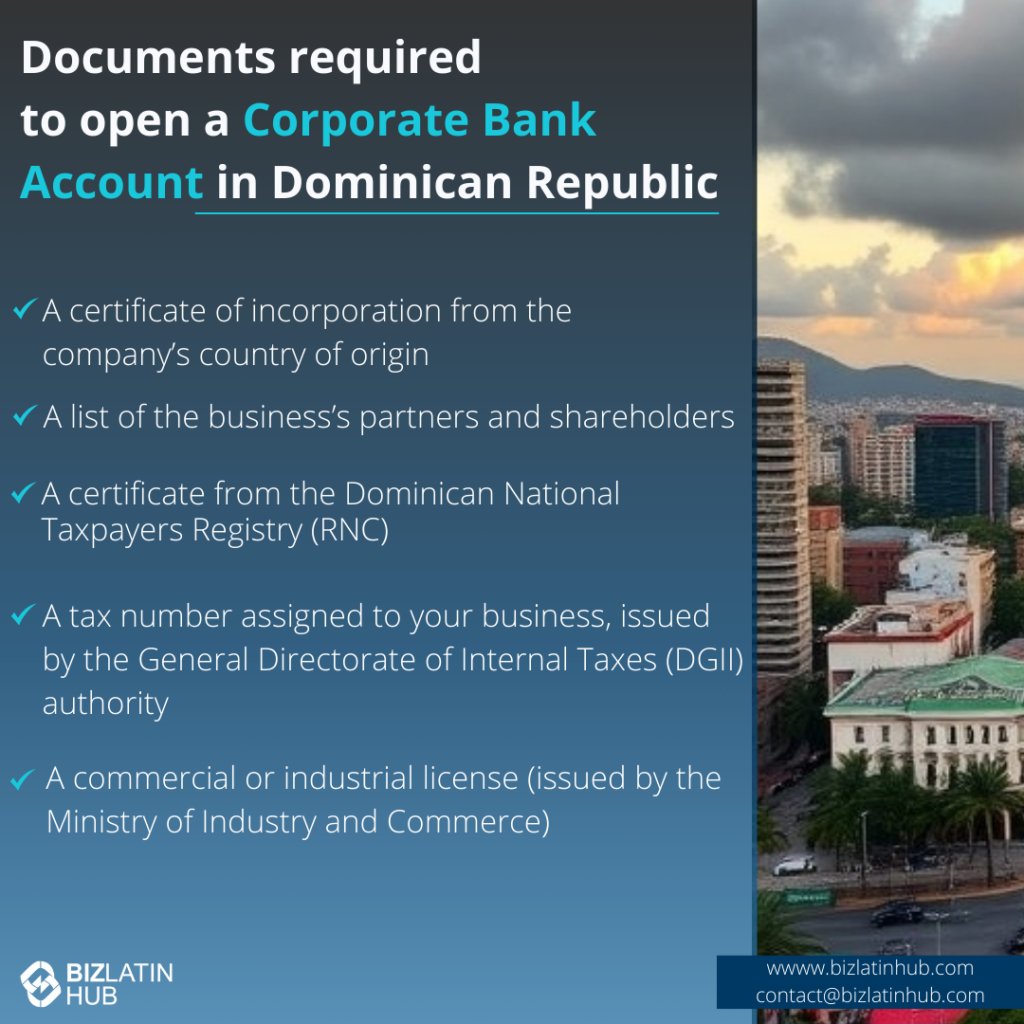

| What are the necessary documents when opening a corporate bank account in the Dominican Republic? | A certificate of incorporation from the company’s country of origin. A list of the business’s partners and shareholders. A certificate from the Dominican National Taxpayers Registry (RNC). A tax number assigned to your business, issued by the General Directorate of Internal Taxes (DGII) authority. A commercial or industrial license (issued by the Ministry of Industry and Commerce). |

Step-by-Step Corporate Account Setup

To open a corporate bank account in the Dominican Republic:

- Step 1: Choose a Corporate Bank Provider.

- Step 2: Prepare all the Required Documentation.

- Step 3: Make an Initial Deposit.

- Step 4: Activate your account.

1. Choose a Corporate Bank Provider

The first step in opening a corporate bank account in the Dominican Republic is selecting the right banking provider and account type to meet your company’s specific needs. Each bank has its own set of corporate services, fees, and account features, so it is crucial to compare them thoroughly. Consider factors such as transaction limits, the availability of online and international banking services, foreign currency options, and any specialized services your business might require, such as trade finance or payroll management.

We have found visiting a local branch is often a helpful way to understand the specific options available. Many banks have relationship managers who can provide detailed information about their corporate offerings and suggest the most appropriate account type based on the nature of your business. Whether you run a small enterprise or a large corporation, choosing a provider that aligns with your operational needs can save you both time and money.

2. Prepare all the Required Documentation

Preparing all necessary documentation is a critical step in the account-opening process. Banks require detailed paperwork to verify your business’s identity and ensure compliance with legal and regulatory requirements. Start by gathering your company’s Articles of Incorporation and RNC (Registro Nacional de Contribuyentes), as these documents serve as proof of your business’s legitimacy and tax registration in the Dominican Republic. You will also need a board resolution authorizing the account opening and designating the account signatories, as well as a copy of your company’s by-laws, which outline its governance structure and operational policies.

In addition to organizational documents, banks will require identification for all authorized representatives and major shareholders, such as passports or national IDs, along with proof of their addresses. If any documents are not in Spanish, they must be translated by a certified translator and authenticated with an apostille. After assembling all documents, complete the bank’s application form, which will ask for detailed information about your company, its operations, and its expected transaction patterns.

Some banks may require an in-person interview as part of their Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance procedures. During this interview, a bank officer will review your documents, ask questions about your business, and confirm your eligibility for an account. Ensuring that your documentation is complete and accurate will help streamline the process and minimize delays.

3. Make an Initial Deposit

Once your application has been approved and you have been accepted as a customer, you will likely be required to make an initial deposit to activate your account. The amount varies depending on the bank and the type of account you have chosen. Some banks may set a minimum deposit amount for corporate accounts to ensure that they are used actively and appropriately.

Some banks may also request that the deposit is made in a specific currency, especially if you are opening a multi-currency account. Planning this step in advance and having a clear understanding of the bank’s requirements will ensure a smooth transition to the next phase.

4. Activate Your Account

After making the initial deposit, your corporate account will be activated, allowing you to start managing your comany’s financial transactions. Activation often includes receiving account details such as your account number and IBAN (if applicable), as well as access credentials for online banking services. Some banks may provide training or tutorials on how to use their platforms effectively, particularly if you are new to their systems.

With your account now active, you can begin conducting essential business activities such as receiving payments, making transactions, and managing payroll. Most banks also offer additional services for corporate clients, such as credit facilities, trade finance options, or dedicated account managers to support your financial needs. Regularly monitoring your account and maintaining compliance with the bank’s policies will ensure a positive and productive banking relationship.

Required Documents to Open a Business Account

The most complicated part of opening a corporate bank account in the Dominican Republic is providing all the required documentation.

This may include RNC (tax ID), incorporation certificate, shareholder and director IDs, notarized board resolution authorizing the account, proof of address, and business activity summary.

Any documents in a language other than Spanish need to be translated by a certified translator and documents issued outside the Dominican Republic (i.e., from the business’s country of origin) must be apostilled.

Internal policies at each bank determine the exact list of documents that are required when opening a corporate account. What follows is a general list that most banks require:

- A certificate of incorporation from the company’s country of origin.

- A list of the business’s partners and shareholders.

- A certificate from the Dominican National Taxpayers Registry (RNC).

- A tax number assigned to your business, issued by the General Directorate of Internal Taxes (DGII) authority.

- A commercial or industrial license (issued by the Ministry of Industry and Commerce).

In cases where a company’s on-the-ground legal representative holds 10 percent or more of the company’s shares, additional documentation could be required. Such documents may include:

- Board meeting minutes where the representative was appointed to the position.

- A copy of the business entity’s bylaws.

- Identity documents of all partners, shareholders, and managers.

- Banking records from the business’s country of origin

- In some cases, depending on the bank, commercial references from the company’s clients and/or suppliers.

The above is a general overview of what is needed to open a corporate bank account in the Dominican Republic, but it should not be considered an exhaustive list. Some banks may require additional documentation depending on the structure of the business entity, its size, and the type of business it intends to conduct in the country.

Top Banks for Foreign-Owned Companies

It is important to choose a bank that is most aligned with your business objectives in the country. Also, it’s crucial to know whether a bank imposes restrictions on foreign transactions if, for example, the company has foreign shareholders. This may be due to the tax and accounting requirements in the Dominican Republic.

Such things must be carefully considered by an organization’s upper-level management, so they don’t end up opening an account with a bank that doesn’t have their best interests in mind. Many require in-person document submission and due diligence reviews. Banks are regulated by the Superintendencia de Bancos and subject to AML/CFT controls. UBO identification, economic activity validation, and document authentication are typically required.

What follows are some of the most established banks in the island nation:

- BanReservas – This is the largest bank in the Dominican Republic in terms of assets under management, and it has the most branches/ATM locations across the island.

- Banco Popular Dominicano – This bank offers a full range of personal and corporate banking services. It even offers personal accident and life insurance plans.

- Banco Multiple BHD Leon – This is another large bank in the Dominican Republic, holding 19 percent of the retail banking market share on the island.

- Banco BDI – This bank was instrumental in the development of the agri-business and industrial sectors in the late 20th century. It now offers a full range of personal banking services.

- Banco Vimenca – Like all banks in the Dominican Republic, this one offers personal banking services, but it’s the smallest bank in the country in terms of locations and market share.

- Banco Unión – This niche bank focuses on making it easy for accountholders to receive remittances from abroad. It operates through a network of correspondents in the US, Latin America, Spain, and other European countries.

- Scotiabank República Dominicana – This bank is a subsidiary of the Canadian banking giant Scotiabank Group and is one of only two foreign banks operating in the country. Its focus is providing personal and corporate services to small- and medium-sized enterprises (SMEs), as well as large corporations.

- Citi Dominican Republic – Citigroup has had a presence in the country for more than 50 years. Citi Dominican Republic offers a wide range of banking products and services to individuals and large corporations.

Based on our experience, we often recommend Banco Popular Dominicano or Scotiabank or foreign companies. This is based on the ease of doing business as a foreigner in the Dominican Republic.

Comparison Table:

| Feature | Dominican Republic | Costa Rica | Panama |

| Minimum Deposit | $500–$2,000 | $500–$1,000 | $1,000 |

| Account Opening Time | 2–3 weeks | 2–4 weeks | 2–3 weeks |

| Foreign Ownership Allowed | Yes | Yes | Yes |

| Remote Opening | Rare | Limited | Common |

Additional FAQs About Dominican Business Banking

Based on our extensive experience, these are the common questions and doubts of our clients on opening a company bank account in the Dominican Republic:

1. Can I open a corporate bank account online in Dominican Republic?

No. However, you can open a bank account from abroad with the support of a local attorney empowered through a power of attorney (POA). However, the original bank application forms will need to be sent to the Dominican Republic.

2. What documents do I need for banking in the Dominican Republic?

The following documents are required to open the company bank account:

- Copy of the articles of incorporation of the company.

- An up-to-date copy of the company’s bylaws.

- Banking reference letter.

- Certificate of good standing of the company.

- An up-to-date financial statement for the company.

- Passport copy of all shareholders and members of the company.

- US$500 initial deposit for US$ accounts or RD$500 for accounts in local currency.

3. Who can have access to a company bank account in the Dominican Republic?

Any member of the company that is authorized by company shareholders can have access to the bank account.

4. What is the best bank in the Dominican Republic for foreign companies?

We recommend the following banks for foreign companies: Banco Popular Dominicano, Banco BHD León, Banesco, and Scotiabank.

5. Why do companies open bank accounts in the Dominican Republic?

Companies choose to open bank accounts in the Dominican Republic due to the economic and political stability, the ability to hold currency in US Dollars, the national taxation system, and banking privacy.

6. Does the Dominican Republic have bank secrecy?

Yes. The Monetary and Financial Act, Article 56, Section b, states that the information obtained by a financial entity must be kept strictly confidential and may only be provided to third parties by order of the competent judicial or governmental authority.

7. Can a foreign business open a bank account in the Dominican Republic?

Yes. Foreign companies must present incorporation documents, RNC, and notarized ID documentation. An in-country representative may be needed.

8. What compliance checks are required?

Banks must verify UBOs, source of funds, and business legitimacy. This may include economic activity reports and tax declarations.

9 How long does onboarding take?

Between 2 and 3 weeks depending on the bank and completeness of submitted documents.

10. Are multi-currency accounts available?

Yes. Banks offer USD and DOP accounts with online banking capabilities.

Why Open a Corporate Bank Account in the Dominican Republic?

Opening a bank account in the Dominican Republic is an essential step for investors looking to engage with one of the Caribbean’s fastest-growing economies. It facilitates transactions in Dominican pesos, reduces international transfer costs, and ensures compliance with local financial regulations, making it easier to invest in key sectors like tourism, real estate, and agriculture.

A local account also enhances credibility with Dominican businesses and authorities while offering access to financial products designed for the country’s vibrant market. It allows investors to navigate the regulatory environment effectively, adapt to local market dynamics, and leverage opportunities in the Dominican Republic’s thriving economy, ensuring a solid foundation for investment success.

Biz Latin Hub can Help You Open a Corporate Bank Account in the Dominican Republic

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in Bogota and Cartagena, as well as over a dozen other major cities in the region. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about how to open a corporate bank account in the Dominican Republic, our portfolio of services includes hiring & PEO accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent or otherwise doing business in Latin America and the Caribbean.