An Employer of Record (EOR) in Brazil is an excellent tool for testing market entry and setting your business up for success. By handling essential HR tasks, an EOR arrangement enables you to focus on growth while navigating the legal and operational nuances of the country. Partnering with a trusted local expert is key, and Biz Latin Hub offers unparalleled support with its extensive experience across Latin America. From market entry to company formation in Brazil, we provide the services you need to thrive in Brazil and beyond.

Key Takeaways

| Is it legal to hire through an EOR in Brazil? | Yes, hiring through EOR in Brazil is legal. It ensures compliance with labor laws and simplifies employment without needing a local entity. |

| What are the benefits of hiring through an EOR in Brazil? | Hiring through an EOR in Brazil offers quick market entry without a local entity, managing payroll and taxes with reduces legal risks, allowing you to focus on core business operations seamlessly. |

| Steps to hire through an EOR in Brazil | 1. Sign an agreement with the third party (EOR). 2. Confirm the employment offer for the candidate. 3. Send the employment offer to the candidate. 4. EOR will prepare an employment contract. 5. The candidate approves and signs the employment contract. 6. The EOR then completes all mandatory registrations for a new employee in Brazil. 7. Employee starts work and reports to the hiring foreign company. |

| Why employ Brazilian workers? | Hiring through an Employer of Record (EOR) in Brazil simplifies market entry by managing HR, payroll, and compliance, allowing you to onboard local talent quickly and focus on business growth without establishing a local entity. |

What is an Employer of Record (EOR) in Brazil?

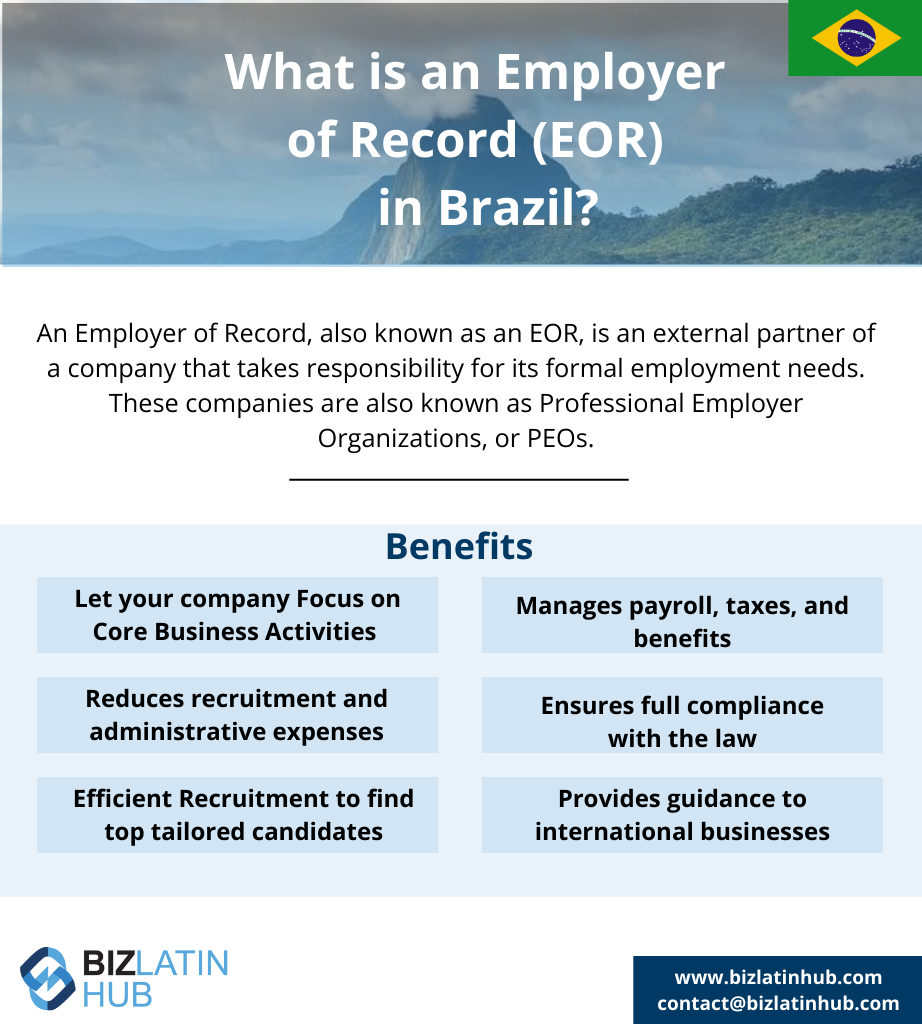

An Employer of Record, also known as an EOR, is an external partner of a company that takes responsibility for its formal employment needs. These companies are also known as Professional Employer Organizations, or PEOs.

Through a co-employment model, an employer of record in Brazil can manage your recruiting, hiring, and payroll needs in full compliance with local law. They support companies that need to hire and manage staff in the country, but which aren’t fully aware of their employment obligations in Brazil.

Some of the responsibilities an employer of record may assume include:

- Organizing all visas and work permits for the employees, with the purpose of avoiding delays or refusals;

- Advising on and ensuring compliance with labor laws in Brazil concerning local employee contracts and worker protections;

- Informing the hiring company of required notice periods, rules of termination and compensation pay;

- Processing, paying, and managing benefits for your employees.

Companies looking to hire staff will engage with an employer of record when they need to hire in a country in which they aren’t yet fully incorporated. If an expanding company wants to take a small-scale approach to enter the Brazilian market, then hiring sales executives through an employer of record in Brazil is an attractive option.

How to Partner With an Employer of Record to Hire in Brazil?

To partner with an EOR, the hiring company will sign a contract with a third-party organization agreeing to list them as the employer of record for the staff members they wish to hire in Brazil. This designation means that, on official documentation in Brazil, the third-party company (the PEO/EOR) is considered responsible for meeting all employment regulations for that staff member.

The foreign company is therefore free from the burden of understanding and complying with employment law in Brazil on its own. As a result, the foreign company is at a reduced risk of non-compliance, and can let its executives focus on business development and growth in their new market.

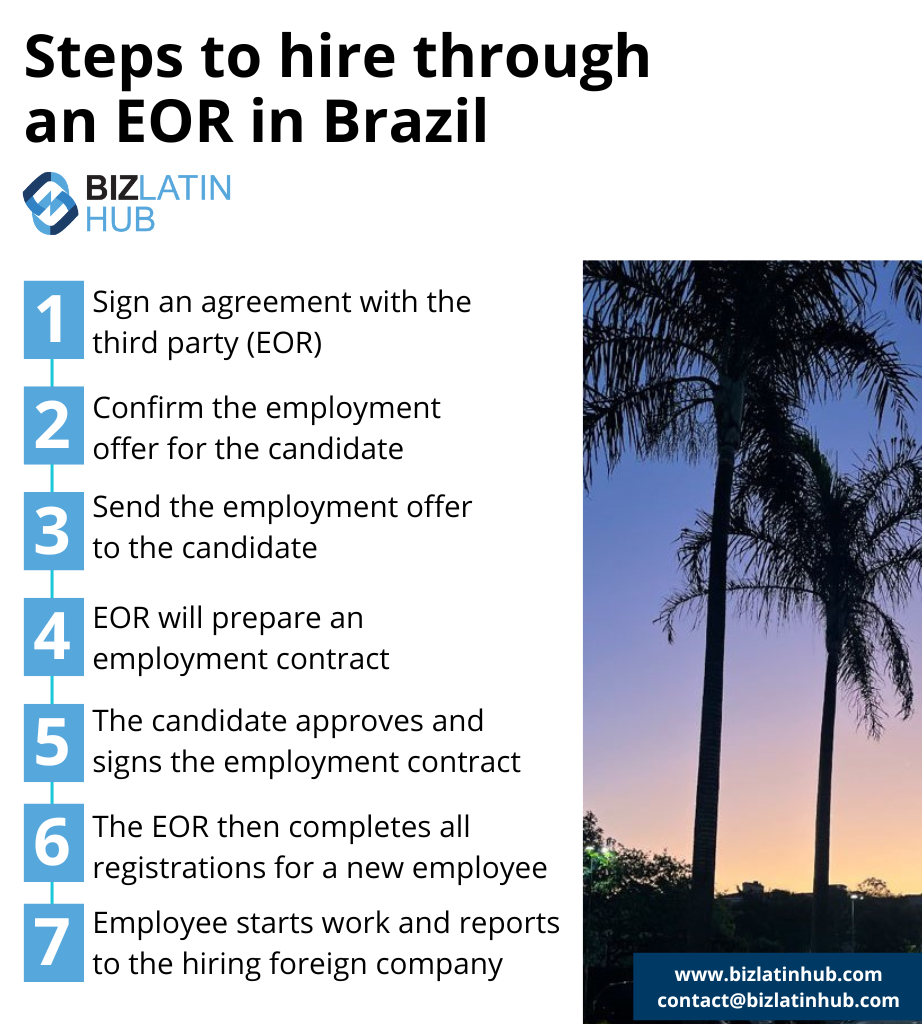

The process of hiring an employee through an employer of record is very simple. What follows is an outline of the steps to complete when hiring an employee through an employer of record (EOR) in Brazil:

- Sign an agreement with the third party (EOR)

- Confirm the employment offer for the candidate

- Send the employment offer to the candidate

- Once the candidate accepts the employment offer, the EOR will prepare an employment contract, for which the EOR will act as the employer of record

- The candidate approves and signs the employment contract

- As the employer of record, the EOR then completes all mandatory registrations for a new employee in Brazil

- Employee starts work and reports to the hiring foreign company.

Why use an Employer of Record (EOR) in Brazil?

Using an employer of record provides many benefits to companies doing business in Brazil.

Due to the employer of record’s expert management of bureaucratic processes, optimized hiring practices, and negation of the need for the lengthy procedure of company formation, using an EOR can be time-saving. It allows foreign companies to begin operating in Brazil far quicker than they may otherwise be able.

Aside from saving a foreign company time, an employer of record – EOR in Brazil can also help with legal advice and representation, mitigating the risk of non-compliance. Any changes to relevant laws and regulations in Brazil will be noticed by the EOR, allowing you to stay compliant. A EOR can also deal with and resolve many claims made against your employees.

Another advantage of using large employment services providers is that they can offer attractive employee benefits. This is an added bonus for smaller companies working through an employer of record, as they may not necessarily have been able to offer those benefits themselves. Additionally, a EOR pays and processes the benefits for a foreign company’s employees, saving time that can be spent elsewhere.

An employer of record can inform its partner’s hiring decisions in light of more extensive knowledge about the region. The EOR can use its experience to hire the most qualified and best-suited candidates. If necessary, your employer of record can even acquire business visas or residency permits for any foreign employees.

If you opt for an employer of record specialized in Latin America, you can expect it to be familiar with the local language/s. All documents and contracts will be drawn up in both Portuguese and English, or even Spanish if necessary. Your EOR can offer additional assistance in translating as well.

Lastly, using an employer of record can help you gain familiarity with the Brazilian market without having to make a large investment. Working with an employer of record – EOR in Brazil is a good way to begin to form your own impression of the market, informing your decision to invest further. Making a reduced initial investment compared to the larger investment required for company formation in Brazil lets foreign companies test the waters before fully committing.

In summary, a EOR can release foreign companies from the obligation of learning all the nuances of laws and regulations in Brazil, while also dramatically speeding up the hiring process, and bypassing the need for company formation.

There are many advantages to employing an EOR. However, although an EOR can help guide you through the nuances of laws and regulations in Brazil, it may still prove useful for you to learn more about Brazilian labor and employment law. This is further discussed below.

EOR vs. PEO in Brazil – What’s the Difference?

When expanding into Brazil, businesses often choose between an Employer of Record (EOR) or a Professional Employer Organization (PEO) to hire and manage employees.

- EOR (Employer of Record): A third-party provider that legally hires employees for companies, handling payroll, taxes, and compliance. It enables quick market entry without a local entity but may have limitations for long-term operations. EORs are completely legal in Brazil and are commonly used for market entry strategies.

- PEO (Professional Employer Organization): A service provider that supports companies with a local entity establishment and then managing payroll, benefits, and HR compliance. While entity setup requires initial time and investment, it offers greater stability, talent attraction, ability to build a long company culture and reduced permanent establishment risks.

Note that EOR and PEO are often used interchangeably in Brazil, and, in some cases, may even mean the same thing, as their meanings can vary depending on context, local legal frameworks, and business local norms.

Important Tip: While an EOR provides a quick-entry solution for the Brazilian market, establishing a legal entity and working with a PEO typically offers greater control, long-term cost efficiency, reduced permanent establishment risk, stronger legal standing, and better talent attraction in Brazil. Biz Latin Hub offers both EOR and PEO solutions, helping businesses navigate Brazil’s complex labor regulations, establish entities, and ensure full HR compliance. Whether you need a fast market entry or a stable long-term presence in Brazil, we can guide you through the process.

Overview of Employment Contracts in Brazil

If you are considering using an employer of record – EOR in Brazil, it may be useful to learn more about the various types of business contracts used when hiring staff in Brazil. Usually, employment contracts in Brazil exist for an unlimited term. However, contracts are not always indefinite. Brazilian law allows for three types of contracts: fixed-term, open-ended, and intermittent.

- Fixed-term contracts: In fixed-term contracts, the business activities are temporary. They depend upon the completion of a specified service. They last only up to 2 years. The employment agreement requires a written statement clarifying the terms of employment.

- Open-ended contract: A fixed-term contract becomes indefinite-term employment if the reasons for a definite term contract are not sufficient, the information is incomplete, or the contract has been extended more than once. These contracts have no set end date, but may end when the employee decides to leave or the employer decides to terminate, in which case the employee is entitled to their rights under Brazilian law.

- Intermittent contracts: Intermittent contracts apply only during specified periods of time. During these periods, the employee may be called upon to work. Outside of these, the employee remains inactive.

Employers of record in Brazil will advise you on the best type of contract for the type of employees you want and the length of time you will need them.

15 Key Employee Benefits and Rights in Brazil

Brazil’s employment law environment sets a number of benefits and rights for employees. These are written into Brazilian law primarily by the 1943 Consolidation of Labor Laws. What follows are the most important points outlined in this law.

- Minimum wage: In 2024, the minimum wage in Brazil amounts to R$1,412 per month. Brazilian states may maintain their own minimum wage higher than the national.

- Paid vacations: Employees can legally take 30 days off for every year they work. The employer may decide when the employee takes their vacation. At least one of these vacations must be at least 14 days, and the rest must be at least 5. Employees may sell up to 10 of their vacation days for double pay. Vacation pay is equivalent to the normal monthly salary plus an additional ⅓ of the normal monthly salary. Depending on the employees’ unexcused absences, they may have fewer vacation days.

- Holidays: Holidays occur on New Year’s Day (January 1), Good Friday, Tiradentes Day (April 21), Labor Day (May 1), Independence Day (September 7), Our Lady of Aparecida (October 12), All Souls’ Day (November 2), Republic Proclamation Day (November 15), Christmas Day (December 25)

- Social security: Employers are expected to pay between 8 to 26.7% of an employee’s annual salary to the Nation Institute of Social Security.

- Bonuses: Like in other Latin American countries, employees in Brazil must a receive an annual bonus, which is one month’s salary paid in two installments – usually in November and December.

- Maternity leave: Women giving birth can take maternity leave of up to 120 days. Fathers are permitted to take 5 days off for the birth of their children. This cost will be reimbursed by the National Institute of Social Security. Pregnant women may take an additional 2 months off uncompensated if they choose.

- Sick leave: An employee that is sick gets paid for the first 15 days of sick leave, provided they show a certification from the doctor of their illness. After 15 days, the National Institute of Social Security pays any further day of sickness if properly documented.

- Overtime: Overtime is paid at a minimum rate of 150% of the regular salary. Overtime is limited to only 2 hours per day.

- Working hours: The federal constitution states that working hours shouldn’t surpass 44 hours a week, and in most businesses, 8 hours a day.

- Breaks: Employees are entitled to 1 hour breaks overwork periods longer than 6 hours and to 15 minutes break during work periods between 4 and 6 hours long.

- Probation period: Probation periods are not to exceed 90 days. However, they may be renewed.

- Termination notice: For termination of employment without cause, the employer must notify the employee of termination at least 30 days prior (or 8 days if working hourly), plus 3 days for each year the employee has worked with the employer (for a maximum of 90 days). If terminated with cause, no notice is required, however, an employee may dispute and sue in labor court.

- Termination payment: For termination without cause, the employee must additionally be paid severance fund pay equal to 8% of the employee’s compensation, and an additional fine of 40% of the employee’s severance pay fund. Employees must also be paid for all unused vacation days and an annual bonus based on how many days the employee worked that year.

- Termination special cases: An employee may not be terminated if the employee is a union representative (including those who have applied, and those who have been a union representative in the past 12 months), a pregnant woman (until 5 months after birth), or has suffered a work-related accident (and has yet to return, or has returned less than 12 months ago).

- Collective bargaining agreements: Employees will be ensured rights or wages by collective bargaining agreements additional to those written into law. Make sure that you are aware of any such relevant agreements.

For many foreign business owners, it can be difficult to understand and fully comply with the local employment laws in Brazil. To save time and avoid issues when hiring employees, it is advised to contact an external employer of record to help you with these issues.

How to Use a Payroll Calculator

If you want to get an idea of the possible costs involved in payroll outsourcing in Brazil, using a payroll calculator is one way to get a good estimate.

Although a payroll calculator won’t be completely accurate, it will give you the opportunity to look at costs while varying the salary, the number of employees, the country you want to enter, and the currency you wish to work in. As such, you will be able to understand your likely costs across a range of salaries, while also being able to compare other countries as potential alternative destinations.

You can find the BLH payroll calculator at the bottom of our PEO & Recruitment Services page. The calculator will allow you to make good estimations of the costs involved in hiring in Latin America and the Caribbean based on country, currency, and salary, with the calculator factoring in local statutory deductions.

To use the BLH payroll calculator, you will need to undertake the following steps:

Step 1: Select the country

Choose the country where you are doing business, or planning to launch. This feature will be useful when it comes to comparing potential alternative markets.

Step 2: Select the currency you wish to deal in

You can choose between US dollars (USD), British Sterling (GBP) and Euros, as well as the local currency for the country you are looking at, compared to what is most convenient for you. Note that for Ecuador, El Salvador, and Panama, the local currency is also USD, as they have dollarized economies.

Step 3: Indicate an employees monthly income

Here you can indicate the expected salary you will be paying an employee, in the currency of your choice.

Step 4: Calculate your estimated costs

Based on all of the information you have provided, you will receive results indicating your estimated costs, including a breakdown for estimated statutory benefits you will be liable for.

Step 5: Compare your costs to other options

With a good estimate at hand of how much your staff in Brazil would be, if you are flexible about your expansion into Latin America and the Caribbean, you can use the BLH payroll calculator to compare those costs to other jurisdictions.

FAQs on hiring through an employer of record (EOR) in Brazil

Based on our extensive experience, these are the common questions and doubts of our clients on hiring through and EOR in Brazil:

1. How does one hire employees in Brazil?

You can hire an employee by incorporating your own legal entity in Brazil, and then using your own entity to hire employees or you can hire through an Employer of Record (EOR), which is a third party organization that allows you to hire employees in Brazil by acting as the legal employer. With an EOR you do not need a Brazilian legal entity to hire local employees.

2. What is in a standard employment contract in Brazil?

Find below the suggested clauses since in Brazil a written contract is not obligatory but always recommended:

- Qualification of the parties (Employer and Employee)

- Location of Work

- Work hours

- Remuneration and form of payment

- Benefits (if applicable)

- Job description

- Impediments and obligations

- A start date and duration of the contract

- Experience/probation period (if applicable)

- Other Specific agreements or pacts

3. What are the mandatory employment benefits in Brazil?

The mandatory employment benefits in Brazil are the following:

- Paid vacations

- 13th salary – Christmas bonus

- Transportation vouchers

- Other benefits can be obligatory according to the UBCA (Union Collective Bargain Agreement) of the professional category such as meal vouchers, food vouchers, health insurance, and life insurance, among others.

4. What is the total cost to hire an employee in Brazil?

The total cost for an employer to hire an employee in Brazil can vary according to the salary of the employee. For an estimate of the monthly cost of an employee, we must add a percentage of at least 54.7% to the gross salary.

Please use our Payroll Calculator to calculate employment costs.

5. What is the difference between hiring through an EOR and forming a legal entity?

Forming a legal entity differs from hiring through a EOR in the following ways:

- It is slower to establish.

- Creates a permanent presence in the country.

- All costs are deductible through a local entity.

- Provides the ability to sign contracts and agreements locally.

- Provides ability to invoice through local entity.

- Legal entity compliance support is required.

- Company hires employees directly.

6. What is the difference between an EOR and a PEO?

An EOR offers a wider range of services, particularly legal services, whereas a PEO might only offer administrative services.

Why Invest in Brazil?

Brazil’s large domestic market, strong economy, and geographical advantage offer prime conditions for doing business in Latin America. The country has the ninth-largest economy in the world based on nominal GDP, meaning an increasing number of people are searching for an employer of record – EOR in Brazil.

Business and investment in Brazil are poised to increase as the government works to develop its economy and attract foreign business activities. However, navigating your business’s expansion into a new country is a complex process.

Knowing the business requirements to hire employees is difficult, so it may be wise to engage with and seek guidance from a knowledgeable third party such as an employer of record – EOR in Brazil.

Biz Latin Hub can help as an Employer of Record (EOR) in Brazil

At Biz Latin Hub, our team of experienced HR agents in Brazil can support your expansion into the country. We are dedicated to making the hiring process as quick and easy for you as possible.

For entry-level positions, we can hire a candidate as little as a week after we’re assigned as your EOR. With our complete portfolio of back-office solutions, including legal and accounting services, we can be your employer of record in Brazil.

Contact us now to discuss your business options.

Or read about our team of expert authors.