Brazil’s employment laws are governed by the Consolidation of Labor Laws (CLT). This 2025 guide covers employment contracts, work hours, benefits, and termination rules for businesses hiring in Brazil or considering LLC formation in Brazil.

Key Takeaways

| What are the working hours mandated by employment law in Brazil? | Employment law in Brazil sets a maximum work schedule of 8 hours per day and 44 hours per week, not including overtime. |

| What is the Brazilian minimum wage? | The current minimum wage as of January 2025 is BRL$1,518 (aprox USD$245). |

| Types of Employment Contracts in Brazil | Indefinite-term. Fixed-term Temporary Employment Intermittent Employment |

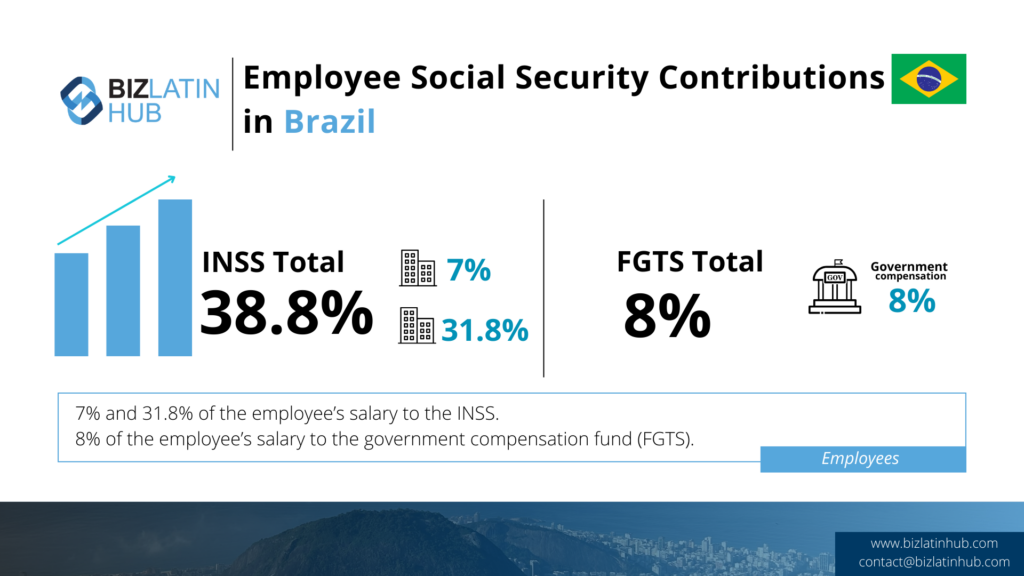

| What percentage of an employee’s salary is contributed to social security in Brazil? | 7% and 31.8% of the employee’s salary to the INSS. 8% of the employee’s salary to the government compensation fund (FGTS). |

Working Hours, Overtime, and Rest Days

According to employment law in Brazil, a standard working day is eight hours long, while a working week should be no longer than 44 hours. Overtime hours are allowed, however they should be limited to two hours per day.

There are 12 national holidays in Brazil over the course of a calendar year, while the country’s 26 states have a few of their own holidays. It pays to investigate precisely which dates are important for the state you are operating in.

Types of Employment Contracts in Brazil

There are four main types of contract that are used in Brazil, which depend on the nature of the job someone is hired for.

Indefinite contracts

This is the most common type of contract used in Brazil, under which no set period of work is established. Under the terms of such a contract, should the employer terminate the contract, the employee is entitled to receive an indemnification payment equal to one month of salary.

Fixed-term contracts

A definite-term contract can last for up to two years and is applicable under the following conditions:

The nature of the service justifies the predetermination of the period of employment

The business activity is of a temporary or transitory nature

For probation agreements (this to the maximum of 90 days, after which the agreement is converted into indefinite term)

Note that for these contracts an indemnified notice may apply, usually amounting to the equivalent to half of the remaining period.

Temporary and third-party contracts

A temporary employment contract can only be used for particular types of work or roles that warrant them. Examples include seasonal work or cover for maternity leave or other types of extended leave periods. It will usually be allowed for a maximum of 180 days and can be extended for a further 90 days.

Intermittent employment contract

Under the terms of this contract the employee is hired and paid on an hourly basis and can be called upon based on the necessities of the employer. As such, there is no fixed salary. The activities must be determined in hours, days, or months. The employee can work for other companies at the same time.

How are absences managed under employment law in Brazil?

After 12 months of working for the same company, employees are entitled to 30 days of leave over the following year. That allowance may be split into up to three separate vacation periods, which must be agreed with the employer.

According to employment law in Brazil, one of those vacation periods must last for at least 14 consecutive calendar days, while any others must last at least 5 calendar days. The employer must pay the employee’s salary plus an additional amount equivalent to one third of the salary as a benefit for the leave period.

- Sick leave

Employers are obliged to pay up to 14 days of sick leave as long as the employee has received authorization from a registered doctor. After that period, authorized sick leave will be paid by the National Institute for Social Security (INSS) agency for up to two years. - Maternity and paternity leave

In Brazil, maternity leave totals four months, or 120 days (paid by the INSS), which can be extended to 180 days, under discretion of the employer and subject to tax deductions. Paternity leave totals 5 days, but may be extended to up to 20 days (under discretion of the employer). - Bereavement

Employment law in Brazil allows for paid bereavement leave in the event of the death of an employee’s parent, sibling, spouse, or child. Bereavement leave in each case totals 2 days. - Marriage leave

Under Brazilian employment law, an employee is entitled to three days of paid leave when they get married. - Blood donation

Employees are entitled to take one day of paid leave every 12 months in order to donate blood but must provide evidence of having made the donation.

- Employee deductions: Income tax deductions vary from 0% to 27.5% based on salary. Social security deductions similarly vary from 7.5% to 14%, limited to BRL$876.97 per month.

- Employer contributions: Under employment law in Brazil, employers must make two monthly contributions:

- An amount between 26.7% and 31.8% of the employee’s salary to the INSS.

- 8% of the employee’s salary to the government compensation fund (FGTS).

Under certain circumstances, the employer is also required to provide transport and meal allowances, while for some jobs employees are entitled to have certain benefits covered, such as health and life insurance.

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Contract Type | Provide written contract and register with eSocial | Right to receive contract terms in writing |

| Working Hours | Max 44 hours/week (8/day), with overtime pay | Overtime rate of 50% or more |

| Social Security (INSS) | Contribute to pension, FGTS, and public insurance programs | Access to retirement, disability, and healthcare |

| Paid Leave | 30 days of paid annual vacation | Paid time off after 12 months of employment |

| Termination | Pay notice, unused vacation, and FGTS | Right to severance and unemployment benefits |

Termination and Severance in Brazil

Under Brazilian law, the termination must be notified in writing with at least 30 days in advance (prior notice).

When the agreement is terminated by the employer with no cause, the employer can choose whether to pay an amount equivalent to one salary for the indemnified notice or ask the employee to work during this period. If the employee resigns and does not comply with the prior notice, the amount of one salary may be deducted from the termination payments.

The employer must pay the employee any outstanding salary and holiday allowances, including vacation pay, thirteenth salary, and other payments due a proportion of their annual bonus, based on how much of the year they have worked. And a termination without cause also implies in a penalty equal to 40% of the total amounts deposited into the employees indemnity fund (FGTS) during their period of employment.

Only in the event of wrongdoing, misconduct, or a change in circumstances that make the employee unable to carry out the role they were contracted for, as laid out in Article 482 of Decree Law 5.452/43 can the employer terminate the contract with cause. In the case of termination with cause, the prior notice and penalty over FGTS deposits are is not due.

FAQs about employment law in Brazil

In our experience, these are the common questions and doubtful points of our clients.

1. What is CLT in Brazil?

CLT (Consolidação das Leis do Trabalho) is Brazil’s main labor legislation, governing employment contracts, benefits, termination, and worker protections.

2. What are the working conditions in Brazil?

Working conditions in Brazil are established by the Federal Constitution, Brazilian labor legislation, and UCBAs (Union Collective Bargain Agreements). These regulations ensure that the working day for most employees does not exceed 8 hours. Additionally, workers are entitled to overtime if they work more than 44 hours in a week, and set out any additional benefits that must be offered.

3. What is the standard workweek in Brazil?

Brazilian law sets the standard workweek at 44 hours, typically 8 hours/day across 5.5 days. Overtime is permitted with premium rates.

4. What is the minimum salary in Brazil?

The current minimum wage (Jan 2025) in Brazil is BRL$1,518 per month. The amount is usually updated on a yearly basis.

5. How is overtime paid in Brazil?

Overtime pay must be at 150% of their usual pay or 200% on holidays and weekends, and is also subject to different percentages agreed in a UCBA.

6. What are the laws regarding employment termination in Brazil?

Under Brazilian law, the termination must be notified in writing with at least 30 days in advance (prior notice).

When the agreement is terminated by the employer with no cause, the employer can choose whether to pay an amount equivalent to one salary for the indemnified notice or ask the employee to work during this period. If the employee resigns and does not comply with the prior notice, the amount of one salary may be deducted from the termination payments.

The employer must pay the employee any outstanding salary and holiday allowances, including vacation pay, thirteenth salary, and other payments due a proportion of their annual bonus, based on how much of the year they have worked. And a termination without cause also implies in a penalty equal to 40% of the total amounts deposited into the employees indemnity fund (FGTS) during their period of employment.

Only in the event of wrongdoing, misconduct, or a change in circumstances that make the employee unable to carry out the role they were contracted for, as laid out in Article 482 of Decree Law 5.452/43 can the employer terminate the contract with cause. In the case of termination with cause, the prior notice and penalty over FGTS deposits are is not due.

7. What happens if an employee is terminated without cause?

Employers must provide:

Prior notice (or pay in lieu)

40% FGTS penalty

Accrued benefits

Unemployment insurance eligibility for the employee

8. What happens when an employee quits in Brazil?

When an employee quits in Brazil, they are required to give a notice period of 30 days. Unlike in other countries, there is no additional requirement of 3 days per year of service. Upon resignation, employees are entitled to their accrued benefits, with the exception of the FGTS (there is no 40% penalty for the employer to pay) and unemployment funds.

9. Are written contracts mandatory in Brazil?

Yes. All formal employment must be documented via a written contract, and employees must be registered through Brazil’s eSocial system.

10. What social benefits must employers provide?

Employers must pay into:

INSS (pension)

FGTS (severance guarantee fund)

Transportation vouchers

Meal allowances or subsidies

11. Can a foreign company hire employees in Brazil?

Only through a local legal entity or via an Employer of Record (EOR) service that is legally established in Brazil.

Biz Latin Hub can assist you with employment law in Brazil

At Biz Latin Hub, our multilingual team of business support specialists is available to assist you launching and operating in Brazil. We have a comprehensive portfolio of back office solutions, including company formation, accounting & taxation, and hiring & PEO, meaning we can provide a tailored package of integrated services to suit every need.

Whether you need help navigating employment law in Brazil, or doing business there or in any of the other 17 markets in Latin America and the Caribbean where we provide services, contact us now to discuss how we can support you.

Or learn about our team and expert authors.