An entity health check in Argentina is a mandatory annual requirement that serves as comprehensive corporate due diligence in Argentina, protecting your business from penalties, operational disruptions, and reputational damage. When you incorporate a company in Argentina, you must conduct annual Argentina entity verification (also known as ‘corporate status verification’) to ensure full compliance with local regulations. This guide explains why a proactive compliance audit is critical in Argentina’s dynamic regulatory landscape and details the primary areas of review.

Recommendation: Schedule your entity health check between March-May to avoid year-end bottlenecks and ensure timely compliance before June 30 fiscal deadlines.

Key takeaways on an entity health check in Argentina

| What is a corporate entity health check? | An entity health check is a comprehensive diagnostic of a company’s legal and financial status. |

| Why is a health check vital in Argentina’s complex regulatory environment? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks To comply with local regulations |

| What are the key areas reviewed for an Argentine company? | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Who conducts an entity health check in Argentina? | It should be done by a fully independent auditor to ensure total neutrality. The auditor should also be well aware of Argentinian company law. |

| Which authorities will be involved? | It verifies compliance with the tax authority (AFIP) and the Public Registry of Commerce (IGJ). |

| What records will be checked? | A health check ensures annual financial statements have been filed correctly. |

The Importance of a Corporate Health Check in Argentina

An entity health check is a comprehensive diagnostic of a company’s legal and financial status. Given Argentina’s complex and frequently changing regulations, a regular health check is a vital risk management tool to identify any compliance gaps before they lead to significant fines or legal challenges.

Sometimes the directors of a company cannot accurately assess the overall status of compliance or do not have the legal or financial knowledge to understand what the corporate compliance requirements are in Argentina. For this reason, they decide to work with a professional external partner to conduct this review on behalf of the company.

The entity health check in Argentina seeks to review all the fiscal, legal, and other operating activities of a company; and raise any discrepancy or problem that needs to be resolved. This generally includes:

- Assess business context and industry-specific requirements for your company’s activities

- Review corporate records, meeting minutes, and all legal documentation

- Verify director qualifications and management compliance

- Evaluate finances, social security payments, tax obligations, and accounting practices

- Conduct due diligence on business relationships and third-party arrangements

- Review corporate governance structures and decision-making processes

Main Areas of an Argentine Entity Health Check

Expert Tip: Verifying the Filing of Annual Financial Statements with IGJ

From our experience, a crucial and often complex compliance point in Argentina is the annual filing of financial statements with the Public Registry of Commerce (Inspección General de Justicia – IGJ in Buenos Aires). This is not just a tax filing; it is a separate corporate law requirement.

The process involves holding a shareholder meeting to approve the statements and then submitting them to the IGJ along with proof of payment of an annual fee. The deadlines are strict. A health check must verify not only that the tax returns were filed with AFIP, but that this separate corporate filing with the IGJ was also completed correctly.

1. Corporate Compliance with the IGJ

This audit verifies that the company’s annual financial statements and any changes to its bylaws or director appointments have been properly filed with the Public Registry of Commerce.

It is crucial to regularly review the legal corporate activity of your company in Argentina. The documentation to be included in this part of the entity health check in Argentina includes:

- Evaluation and review of contracts signed with third parties

- Corporate books and accounting books (including minutes of the Assemblies)

- Shareholders meeting

- Rental agreements or leases

- Other key legal documents for the company

When conducting legal due diligence in Argentina, special attention must be paid to:

- IGJ compliance (Inspección General de Justicia) for Buenos Aires companies

- Provincial registry requirements varying by jurisdiction

- UBO (Ultimate Beneficial Owner) declarations updated annually

- Data protection compliance under Argentine Personal Data Protection Law No. 25,326

Our entity health check includes comprehensive verification of all company directors and key management personnel. This involves confirming that directors meet Argentine legal requirements, reviewing their registration status, and ensuring all appointment documentation is properly filed with relevant authorities. We also verify that management structures comply with your company’s articles of incorporation and Argentine corporate law.

We evaluate your company’s governance framework, including board composition, shareholder meeting protocols, and decision-making processes. Our review ensures your corporate books accurately reflect all company activities and that statutory registers are maintained according to Argentine legal requirements. This includes verification of meeting minutes, resolutions, and other corporate documentation.

2. Tax and Social Security Compliance with AFIP

The company must make periodic reviews of its finances and accounting. The tax review is one of the most This involves a review of all monthly and annual tax filings (income tax, VAT) and social security contribution payments to ensure they are accurate and current with AFIP.

important and delicate parts of the compliance control of an entity in Argentina.

In Argentina, the Government Administration of Public Revenue of the Government of the Autonomous City of Buenos Aires (AGIP) continuously carries out inspection actions in shops and companies; and carries out controls on vehicles at different points of the City in order to verify the degree of compliance with tax obligations by taxpayers and/or those responsible. This makes regular Argentina compliance checks essential for avoiding surprise inspections and maintaining good standing with tax authorities.

Practical Tip: Register for AGIP’s “Domicilio Fiscal Electrónico” to receive instant notifications about inspections and avoid missed deadlines that could trigger penalties during your corporate due diligence in Argentina review.

In addition, there is AGIP Electronic Inspection. This is a scheme where inconsistencies in the fulfillment of tax obligations are exhibited, allowing the taxpayer, in this case companies, to recognize and/or clarify their tax situation and regularize it immediately.

Likewise, the Public Revenue Administration Agency (AFIP) issues the Fiscal Certificate to Hire, a document that enables companies to act as suppliers to the state only if they have complied with their tax, customs and social security obligations. A negative certification can affect a company’s credit score and result in visits from tax authorities, fines, surcharges, and other complications.

3. Financial and Accounting Records Review

This check ensures the company’s accounting books are maintained in accordance with Argentine law and that they accurately support the filed financial statements.

Beyond tax obligations, our health check includes thorough analysis of financial statements, balance sheet accuracy, and cash flow documentation. We verify compliance with Argentine accounting standards and review all social security contributions and payroll records. Our team ensures proper documentation exists for all financial transactions and that reporting meets both AFIP and provincial authority requirements.

For the review of corporate compliance in tax matters in Argentina, it is important to bear in mind that, for any legal activity such as liquidation, dissolution, and merger, the company must fully comply with its tax obligations in order to continue with its process.

4. Labor Law Compliance

This review verifies that all employees are correctly registered, that employment contracts are compliant, and that all labor obligations are being met.

Corporate compliance in Argentina

Conducting an entity health check on a regular basis is also a useful tool to confirm the status of a company before buying or merging with it. In other cases, it is a way for you to demonstrate to potential partners and clients that they are working with a company that is fully compliant with Argentine regulations. In Argentina, a company must comply with two main vital areas for the proper functioning of a company: Legal and tax compliance.

Due Diligence and Background Verification

For companies expanding operations or entering new partnerships, we provide comprehensive due diligence services. This includes verification of business partners, suppliers, and key personnel to ensure they meet regulatory standards. Our team conducts background checks on directors and shareholders, reviews third-party relationships, and assesses potential compliance risks associated with new business arrangements.

Expert Recommendations for Successful Entity Health Checks in Argentina

1. Timing Strategy

- Book your health check by March 1st for June 30 year-end companies

- Allow extra time during October-December (busy season for auditors)

- Coordinate with your external accountant’s schedule

2. Documentation Preparation

- Digitize all Libros Societarios (corporate books) using AFIP-approved formats

- Prepare F.931 forms chronologically with payment receipts attached

- Have Actas de Directorio (board minutes) translated if originally in foreign language

3. Common AFIP/AGIP Red Flags

- Discrepancies between SIFERE declarations and accounting records

- Missing Convenio Multilateral registrations for multi-provincial operations

- Unregistered “responsables sustitutos” for withholding taxes

4. Cost-Saving Recommendations

- Use AFIP’s “Programa de Cumplimiento Voluntario” for penalty reductions

- Combine with ISO certification audits when possible

- Leverage “Libro IVA Digital” to streamline tax compliance

FAQs on an entity health check in Argentina

Why should you get an entity health check?

Getting an entity health check helps executives understand how the business is managed, reduces risks of penalties and reputational harm, and minimizes transaction risks during corporate activities.

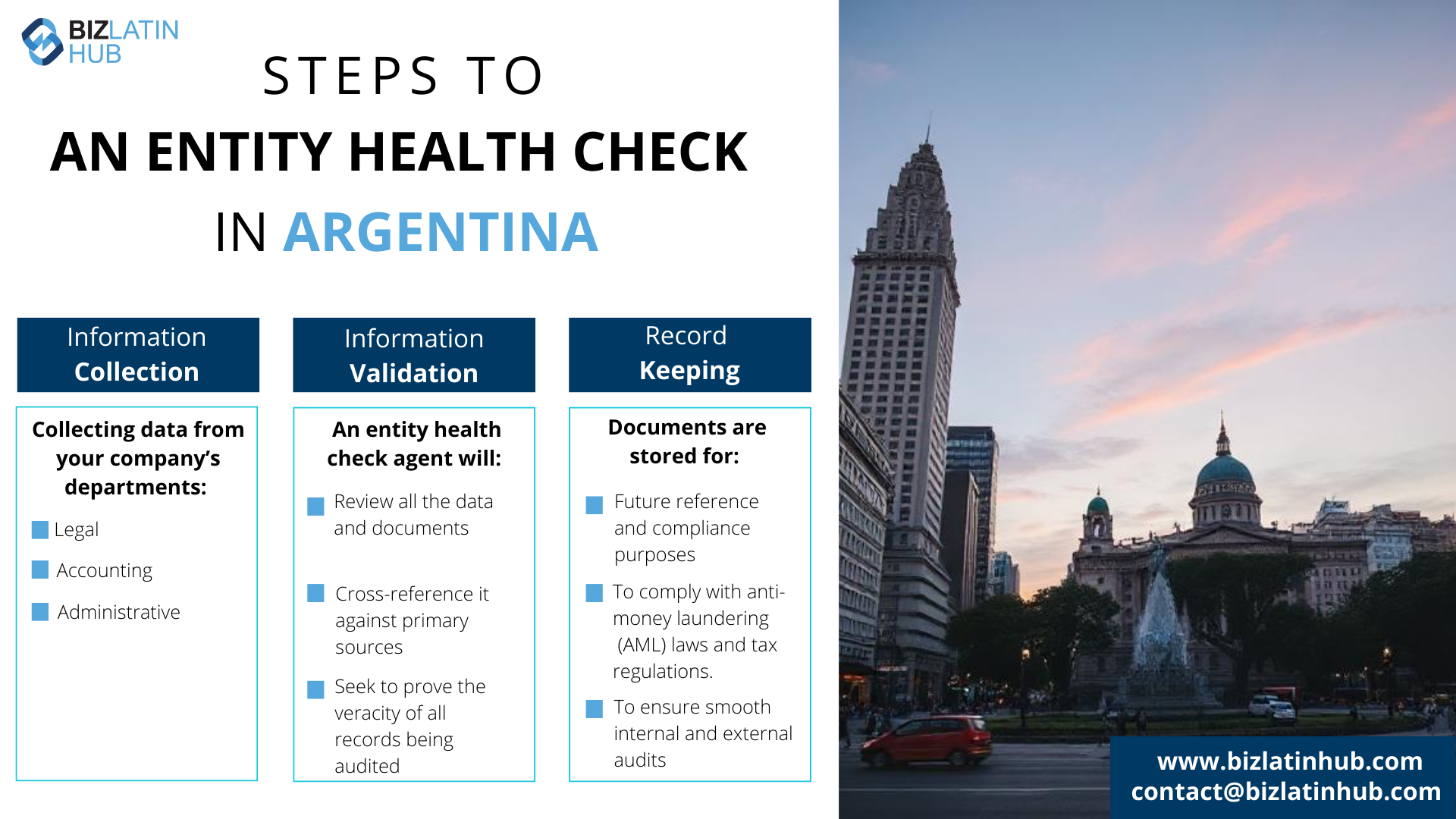

What steps are there to an entity health check?

An entity health check involves three main steps: (1) Information Collection – gathering data from legal, accounting, and operational departments; (2) Information Validation – reviewing and verifying all collected records against primary sources; and (3) Record Keeping – maintaining documentation for legal compliance and future audits.

What happens in an entity health check?

The process includes evaluating finances, reviewing third-party contracts, examining corporate and accounting books, assessing tax returns, checking upcoming certificate renewals, and preparing financial statements and balance sheets for the fiscal period.

Who can perform an entity health check in Argentina?

Entity health checks in Argentina must be conducted by fully independent auditors. This ensures impartiality and alignment with legal and regulatory expectations.

How often should companies conduct entity health checks in Argentina?

At a minimum, companies should conduct annual entity health checks. Additional reviews are recommended before major transactions, appointing directors, expanding operations, or entering new markets.

What documentation should we maintain between health checks?

Companies should maintain updated corporate books, meeting minutes, financial statements, tax filings, employment records, and correspondence with regulatory authorities. These records support future health checks and help ensure compliance.

What is AFIP?

AFIP (Administración Federal de Ingresos Públicos) is the Federal Administration of Public Revenue, Argentina’s national tax authority. It manages income tax, VAT, and social security contributions.

What is the IGJ?

The IGJ (Inspección General de Justicia) is the Public Registry of Commerce for the city of Buenos Aires. It is responsible for the registration of companies and the filing of key corporate documents, such as annual financial statements. Other provinces have their own public registries.

What happens if a company is found to be non-compliant?

Non-compliance in Argentina can lead to significant financial penalties from AFIP or IGJ, the inability to obtain tax clearance certificates (which are needed for many transactions), and potential personal liability for company directors.

What is a key labor compliance issue to check?

A key area for a labor health check is verifying that all employees are correctly registered (“en blanco”). Argentina has strict laws against unregistered employment, and penalties for violations are severe. The check ensures all employees are properly declared with AFIP.

Contact Biz Latin Hub to conduct your entity health check in Argentina

Partnering with experienced professionals for your entity health check in Argentina is crucial for navigating complex regulations. As corporate due diligence in Argentina requirements continue to evolve, having local expertise ensures your Argentina compliance check addresses all current regulatory demands while positioning your business for growth.

At Biz Latin Hub, our team of experts perform entity health checks for companies in Argentina and throughout Latin America. Our team of local and expatriate professionals offer support and advice to improve your company’s corporate compliance, increase its value and manage the risk of default.

Learn more about our team and expert authors.

Contact our team of multilingual accounting and legal experts today for personalized assistance and the support you need to successfully run your operations in Argentina.