Before incorporating your company in New Zealand, you may want a trusted local provider to look at your business. An entity health check in New Zealand is a vital tool for understanding a company’s status in the eyes of the government. Mitigate risk and ensure full corporate compliance for your company through an entity health check in New Zealand, whether that’s fiscal or legal. This guide explains why a proactive compliance audit is a critical part of good governance and details the primary areas of review for any New Zealand company.

Key takeaways on an entity health check in New Zealand

| What are the key areas reviewed for a New Zealand company? | There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company. |

| Why have an entity health check in New Zealand? | To enable executives to know how the business is being managed To reduce risks of penalties and negative reputation To reduce transaction risks |

| What is a corporate entity health check? | An entity health check is a detailed diagnostic of a company’s statutory records and filings. |

| Which authorities will a health check look at? | It verifies compliance with the Companies Office and Inland Revenue (IRD). |

| What corporate rules are checked? | A health check ensures the annual return has been filed and the resident director rule is met. |

| Why is a health check vital for maintaining a company’s legal status? | It makes sure that you stay above board before the authorities intervene. |

The Importance of a Corporate Health Check in New Zealand

An entity health check is a comprehensive review of a company’s statutory records and filings. Its purpose is to identify any compliance breaches, such as an out-of-date director register or unfiled tax returns, and provide a clear path to resolve them before they can lead to penalties or deregistration.

An entity health check is a review of a company’s overall fiscal and legal condition. Usually, an independent auditor will carry out an entity health check on a company. These can also often be referred to as ‘corporate health checks.’

The auditor’s goal is to get an overall picture of the company’s corporate compliance status in New Zealand. This means examining legal documents and financial transactions, plus payroll and other employment records, and any applicable licensing documents the company uses to operate. These records are checked against New Zealand corporate regulations and the requirements of the individual agencies responsible for administering them.

The purpose of checking the legal and fiscal conditions of a company is to understand whether there are any non-compliance issues that prospective investors should be aware of before incorporating that company.

Main Areas of a New Zealand Entity Health Check

There are two main types of entity health checks. They typically focus on either the fiscal or legal condition of the company.

Expert Tip: Confirming the Resident Director’s Status

From our experience, the most critical compliance risk for a foreign-owned New Zealand company is the resident director requirement. The law mandates that at least one director must live in New Zealand (or be a director of an Australian company who lives in Australia). A health check must not only verify that a resident director is listed but also confirm their current residency status.

We have seen cases where a resident director has moved overseas, unknowingly putting the company in breach of the Companies Act. The Companies Office can remove a company from the register for failing to meet this requirement, so ongoing verification is essential.

1. Corporate Compliance with the Companies Office

This audit verifies that the company’s annual returns have been filed on time and that all information on the public register, such as the registered office address, is current and correct.

The legal health check focuses on reviews of commercial contracts, employment contracts, industry-specific regulations, and intellectual property protection. The industry your business operates within is also an important element for auditors to consider when conducting a legal entity health check in New Zealand.

Particular industries carry additional and strict regulations that businesses must comply with; it’s important to know that your business is adhering to any additional industry-specific regulations.

2. Director and Shareholder Register Review

This check ensures the company’s internal share register and register of directors are accurately maintained. Crucially, it verifies that the company continues to meet the mandatory resident director requirement.

3. Tax Compliance with Inland Revenue (IRD)

This involves reviewing the company’s filing status for income tax and Goods and Services Tax (GST) to ensure all returns have been submitted as required.

4. Financial Records and Statements

This review confirms that the company is keeping proper financial records for at least the last seven years, as required by the Companies Act.

A fiscal entity health check will ensure that your accounts, social security payments, and taxes are consistent with regulations and give you information that will be valuable for your future choices and strategies.

Why is it important?

It’s important to get an entity health check in New Zealand, as it means giving yourself peace of mind before investing in a company. Get a picture of the company’s ‘health’ in the eyes of the government, so you know if you need to take action to ensure it meets all local corporate compliance requirements. Once you’ve achieved this, you can operate commercially in New Zealand with confidence and certainty that everything is above board.

If you incorporate a company before undertaking an entity health check in New Zealand, you put yourself at risk of financial penalty and reputational fallout. You won’t necessarily know about the company’s status according to agencies like the Inland Revenue Department, New Zealand’s local tax authorities. Running a company that is not compliant with corporate legal and tax requirements could result in costly fines, and loss of credibility to your consumers.

Save yourself from any future mishaps or penalties by knowing the exact status or ‘health’ of a company, and work with a professional to ensure you meet all corporate compliance requirements in New Zealand before operating.

When should I get an entity health check?

Ideally, you’ll want to get an entity health check in New Zealand before you begin the process of incorporating the company. You shouldn’t wait until you are already operational and carrying out commercial activities to do this step; you don’t want to risk finding out about a potential entity health issue too late.

Knowing status of a company after an entity health check in New Zealand empowers you to make the right decisions for your company, and start off on the right foot in the country’s thriving business climate.

How does this check fit in with corporate compliance in New Zealand?

New Zealand’s government sets a number of legislative requirements to do business in the country. Though getting an entity health check in New Zealand is highly recommended, it’s not compulsory.

However, there are several specific corporate legal and accounting compliance requisites in New Zealand that you must ensure your company adheres to. You can use the entity health check as a tool to protect your company from any gaps in your overall compliance with local law.

This includes:

- having a registered office in the country

- a minimum of one shareholder with a share capital of NZ$1, and one director residing in either Australia or New Zealand

- holding annual meetings for shareholders

- public disclosure of financial statements if income exceeds NZ$60 million, or NZ$30 million over two consecutive accounting periods

- paying corporate, payroll, goods and services, and other taxes.

Frequently Asked Questions: Entity Health Check in New Zealand

1. Why should you get an entity health check?

The main advantages of conducting an entity health check include:

To enable executives to know how the business is being managed

To reduce risks of penalties and negative reputation

To reduce transaction risks

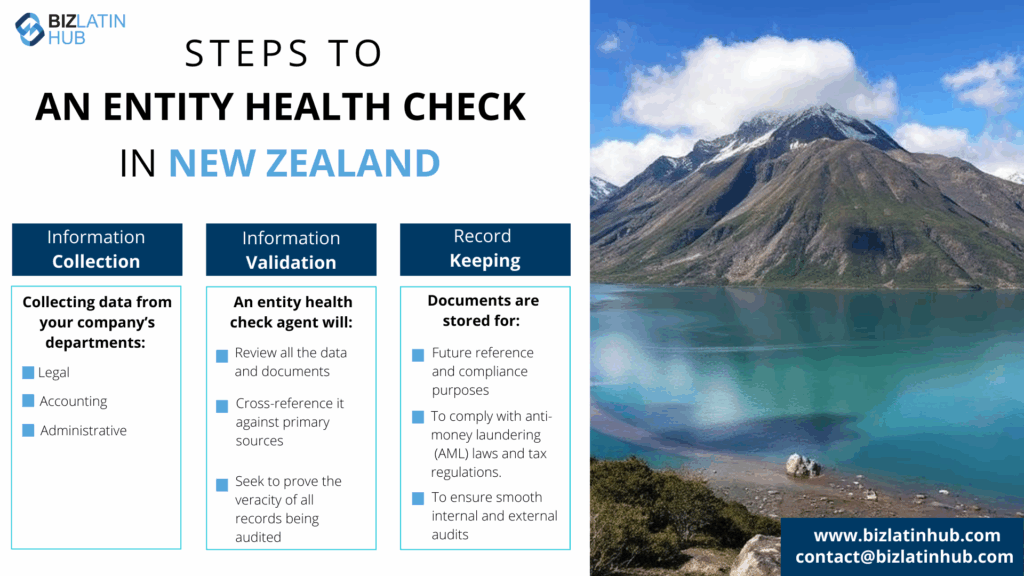

2. What steps are there to an entity health check?

Carrying out a successful entity health check involves the following 3 key steps:

1. Information collection

When carrying out an entity health check, a large amount of information will have to be gathered. This will include collecting data from your company’s operations, legal, accounting, and administrative departments.

Note that a best practice many companies are adopting is the creation of a compliance or audit department, in charge of centralizing important company information, which eases this first step.

2. Information validation

Once gathered, the information goes through a validation process. In this step, an entity health check agent will review all the data and documents obtained, cross-reference it against primary sources where necessary, and otherwise seek to prove the veracity of all records being audited.

3. Record Keeping

Records of all the documents and evaluations made during your entity health check will not only be valuable for presenting to tax authorities in case of an inspection, but also during future entity health checks. In some cases, keeping such records is a legal obligation, due to laws desiged to prevent money laundering.

3. What happens in an entity health check?

Generally, an entity health check includes:

Evaluation of finances, social security payments, and other fiscal obligations

Examination and review of contracts signed with third parties

Review of corporate and accounting books

Review of monthly tax returns and tax statements

Review of upcoming renewals of certificates and policies

Preparation of financial statements

Review of balance sheets submitted at the closure of the fiscal period

4. Who can perform an entity health check in New Zealand?

It should be done by a fully independent auditor to ensure total neutrality and make sure everything is in accordance with the authorities.

5. What happens if a company is struck off the register?

If a company is struck off (or “removed”) from the Companies Register, it ceases to be a legal entity. It cannot trade, its assets legally pass to the Crown, and its bank account may be frozen.

6. What is an annual return?

The annual return is a mandatory filing with the Companies Office that confirms the company’s details (address, directors, etc.) are correct. Failure to file the annual return can lead to the company being struck off the register.

7. What is Inland Revenue (IRD)?

Inland Revenue is New Zealand’s tax authority. A health check reviews the company’s registration status with the IRD and confirms that all income tax and GST returns have been filed.

8. What is the Companies Office?

The New Zealand Companies Office is the government agency responsible for the registration and administration of all companies. A health check verifies the company’s information and filing history on the Companies Register.

Be confident doing business in New Zealand

New Zealand is renowned for its status as the easiest place to do business in the world, besting 189 other countries on the World Bank Group’s Doing Business Rankings.

New Zealand offers short wait times to start your business, straightforward company formation and corporate compliance requirements and ample institutional support to ensure your business has what it needs to succeed locally.

Start off on the right foot, and protect yourself financially by first investing in an entity health check in New Zealand for your company. This will bring you certainty and crucial information on how to proceed with your business expansion into the country.

Get an entity health check in New Zealand with Biz Latin Hub

Getting an entity health check in New Zealand means protecting yourself and mitigating risk when incorporating a business. Take the time to start your expansion the right way. Engage with trusted local professionals who will ensure you can make informed decisions about your new company and your corporate compliance obligations.

At Biz Latin Hub, our team of local and expatriate professionals offers a range of legal, accounting and human resource services. We are a single point of contact for ensuring your successful company incorporation and market entry in New Zealand.

Reach out to us today for personalized support and information about entity health checks in New Zealand.

Learn more about our team and expert authors.