Honduras’ employment relationships are governed by the Labor Code, outlining employee rights, contract types, working conditions, and termination procedures. This 2025 guide supports employers hiring in Honduras by covering essential compliance areas. This is necessary for company formation in Honduras.

Key Takeaways

| What are the working hours mandated by employment law in Honduras? | Employment law in Honduras sets a maximum work schedule of 8 hours per day and 44 hours per week, not including overtime. |

| What Is The Honduran Minimum Wage? | There are a range, depending on sector: from a minimum of 11,972 Lempiras (approximately USD$470) to a maximum of 18,036 Lempiras (approximately USD$706) in 2025. |

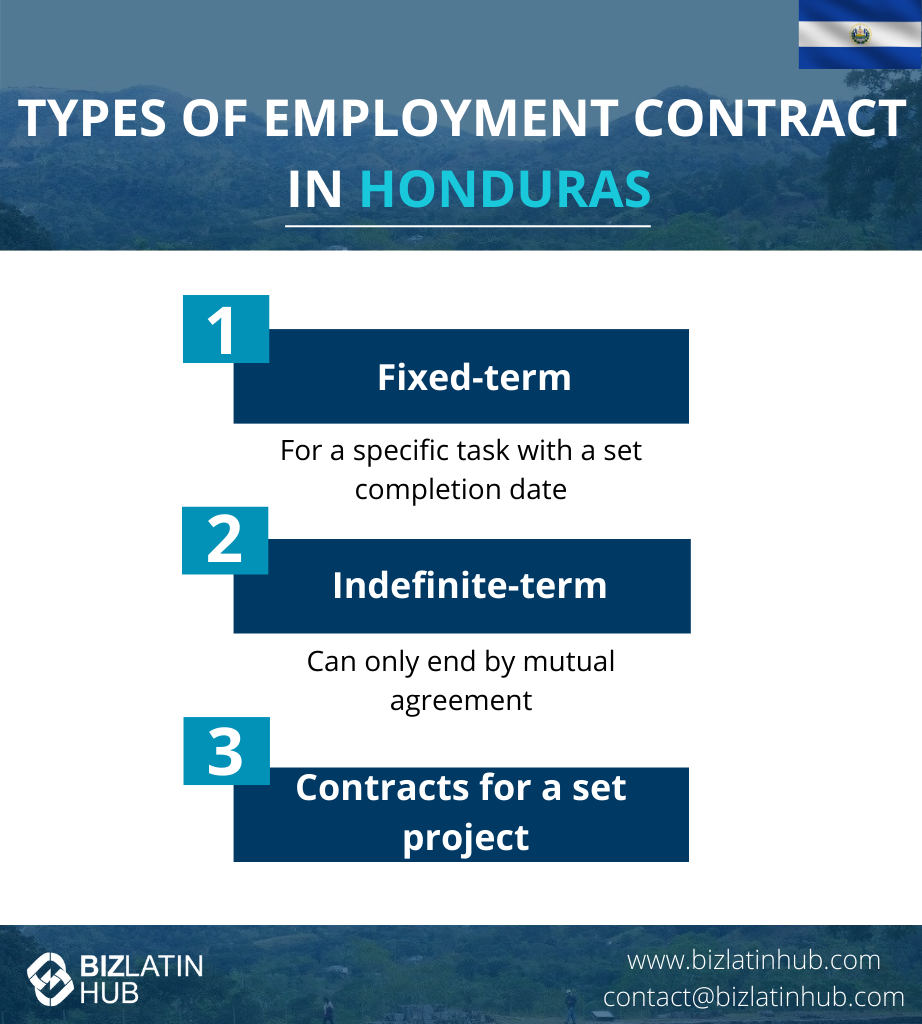

| Types of Employment Contracts in Honduras | Fixed-term. Indefinite-term. Contracts for a set project. |

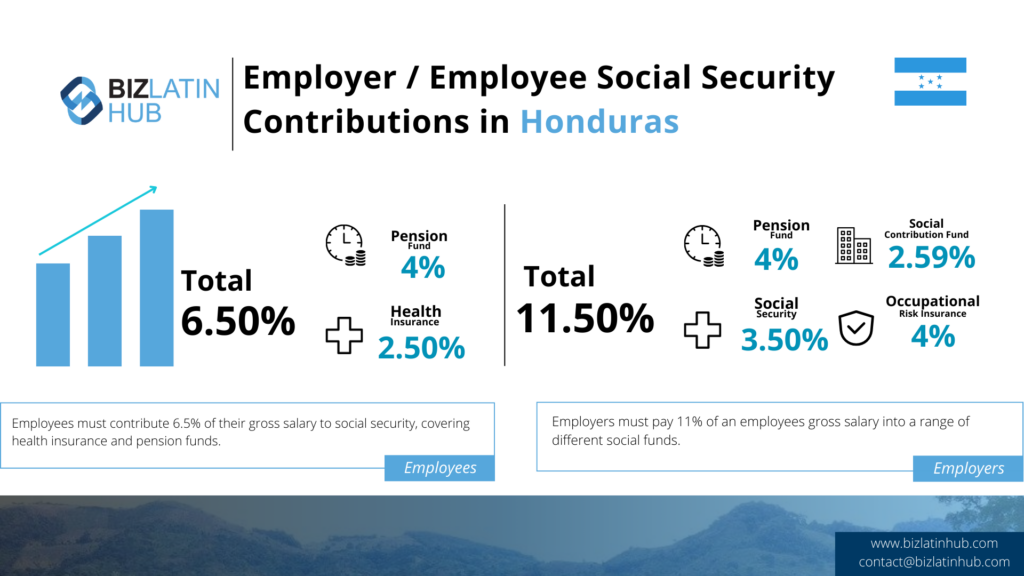

| What percentage of an employee’s salary contributed to social security in Honduras? | Employers must pay 11% of an employees gross salary into a range of different social funds. |

Overview of Labor Law in Honduras

In Honduras, the standard workweek is 44 hours, and fixed-term or indefinite employment contracts are flexible. The country sets a national minimum wage, and employees are entitled to annual paid leave. Maternity leave is granted with full pay, and social security contributions encompass health and retirement benefits. Labor laws recognize collective bargaining and the right to strike.

Working Hours, Overtime, and Leave

Working Hours: Typically, the duration of work per day should not surpass eight hours, and the cumulative weekly limit is 44 hours. For individuals working night shifts, the weekly workload must not exceed 36 hours. For those working a combination of day and night shifts, the upper limit stands at 42 hours per week.

Annual Leave in Honduras: The allocated minimum vacation duration for employees under the Honduran jurisdiction is as outlined:

- 10 days of vacation following the completion of the first year of employment

- 12 days after the second year

- 15 days following three years of service

- 20 working days for a tenure of four years or more.

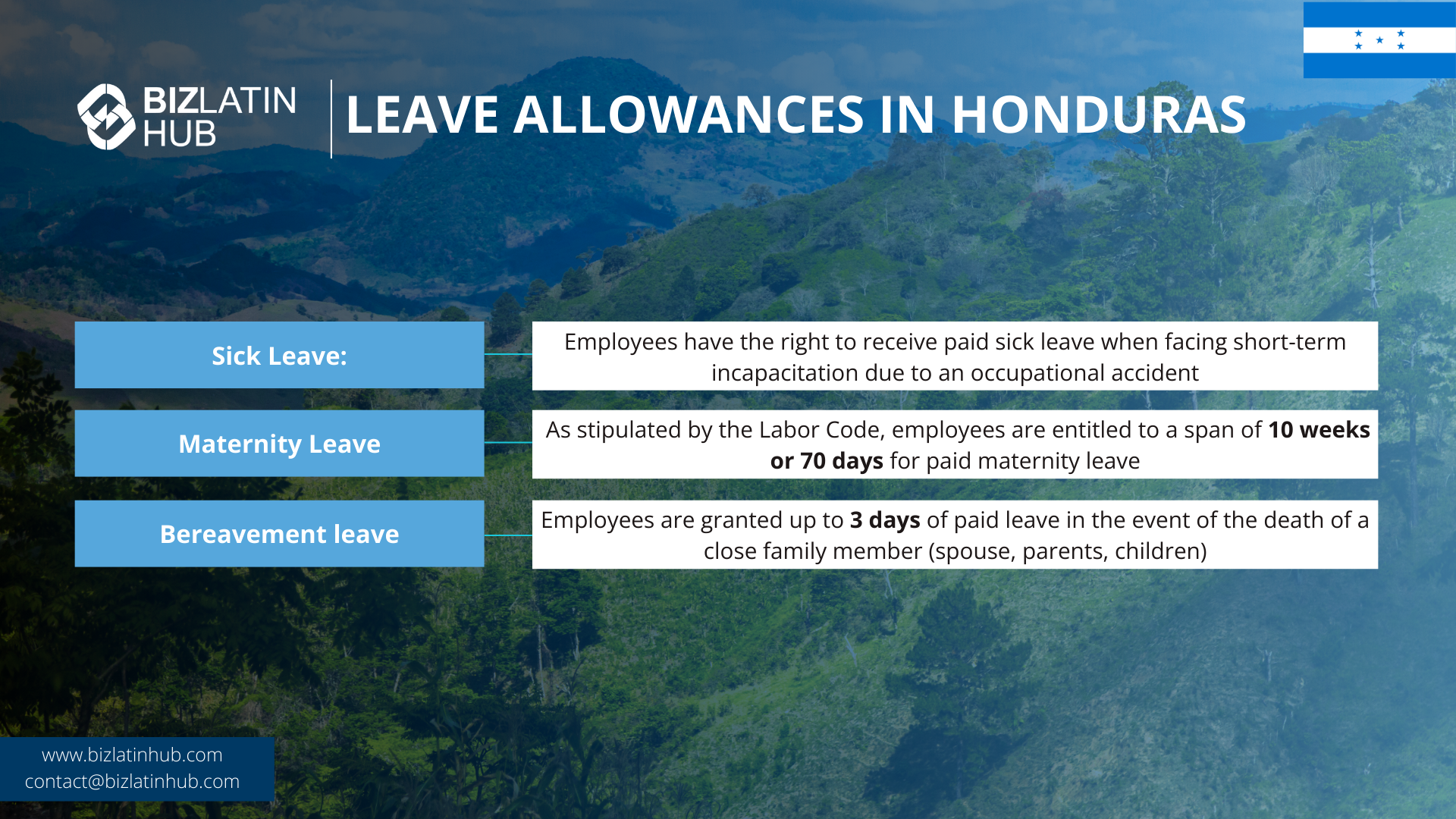

Sick Leave: Employees have the right to receive paid sick leave when facing short-term incapacitation due to an occupational accident. This compensation is granted at a rate of two paid sick days per month within the initial 12 months of employment and subsequently at a rate of four paid sick days per month. The cumulative allowance extends to a maximum of 120 paid sick days.

Maternity Leave: As stipulated by the Labor Code, employees are entitled to a span of 10 weeks or 70 days for paid maternity leave. To receive this benefit, a worker is required to provide the employer with a medical certificate detailing the pregnancy, anticipated delivery date, and the intended commencement date of the maternity leave. This period encompasses 4 weeks preceding the birth and 6 weeks succeeding it.

What is the minimum salary in Honduras?

The approved minimum wage encompasses a range: from a monthly minimum of 11,972 Lempiras (approximately USD$470) to a maximum of 18,036 Lempiras (approximately USD$706). The actual wage within this spectrum depends on factors such as the company’s activity, category, and size, as well as the number of workers employed.

Employment Contracts in Honduras

Collective bargaining agreements (CBAs) and labor unions wield significant influence within Honduras, impacting the dynamics of your relationship with employees. It is imperative to factor in these elements before proceeding to hire and offer employment in the country.

Honduran regulations mandate employers to formulate robust employment contracts encompassing crucial details like compensation, benefits, termination protocols, and more. It’s crucial to express all remuneration figures in Honduran lempira, the local currency. Additionally, your contractual documentation must align with the provisions outlined in any applicable CBA or labor union regulations.

An important legislative change occurred in April 2022 with the repeal of the law permitting hourly employment. As of June 2022, only indefinite term contracts, fixed term contracts, and project contracts remain permissible. This shift in regulation necessitates a proactive adjustment in your approach to employment contracts within the country.

7.08% to IHSS (health)

2% to RAP (housing fund)

1.5% to INFOP (training)

Employees contribute 2.5% to IHSS and 1.5% to RAP. Monthly filings must be submitted to each fund and to the SAR for tax withholdings. The minimum wage and holiday bonus (aguinaldo) must also be paid as per labor laws.

| Category | Employer Obligations | Employee Rights |

|---|---|---|

| Working Hours | Max 44 hrs/week (day), 36 hrs/week (night) | Right to rest, overtime compensation |

| Contracts | Must be written and registered | Legal protection under the Labor Code |

| Social Security | Register with IHSS and make required contributions | Access to health, pension, and maternity benefits |

| Paid Leave | 10 days vacation after 1 year + public holidays | Legal paid time off |

| Termination | Pay severance unless justified termination | Legal right to notice and compensation |

Termination and Severance Obligations

Here are the methods for concluding an employment agreement in Honduras:

Just Cause: Dismissal can occur when an employee engages in grave misconduct as stipulated in the Labor Code or the Company’s Internal Regulations.

Without Just Cause: Employers have the authority to terminate an employee’s contract at any time while adhering to the compensation outlined in labor regulations.

Fixed-Term Contract: If an employee is engaged under a fixed-term contract, termination can be initiated by asserting just cause with prior authorization from the Ministry of Labor, or upon the contract’s expiration.

In all instances, the conclusion of an employment contract must align with its terms. In most scenarios, specific procedural prerequisites must be met before termination to prevent it from being deemed unfair.

Employers possess the ability to dismiss employees without providing justification, as long as due compensation is disbursed in accordance with the law. However, there remains a potential risk wherein employees could contest the payment and seek reinstatement.

Employees generally have the prerogative to resign from their positions. Both parties can mutually agree to termination by adhering to notice periods and conditions specified in the employment contract or legal statutes. Termination due to age is possible once the employee attains the requisite retirement age, affording them the choice between retirement and continued work.

The notion of a “frustrated” contract arises in exceptional circumstances where external factors render its performance unattainable. Instances of this nature are rare and might involve the employee’s demise or complete obliteration of the workplace due to events like earthquakes.

Ultimately, the parties involved retain the liberty to agree on termination grounds, grounded in the principles of contractual freedom and good faith.

FAQs about employment law in Honduras

In our experience, these are the common questions and doubtful points of our clients.

In Honduras, the standard workweek is 44 hours, and fixed-term or indefinite employment contracts are flexible. The country sets a national minimum wage, and employees are entitled to annual paid leave. Maternity leave is granted with full pay, and social security contributions encompass health and retirement benefits. Labor laws recognize collective bargaining and the right to strike.

The maximum workday in Honduras is 8 hours. Workers are not allowed to work more than 44 hours in a week. For individuals working night shifts, the weekly workload must not exceed 36 hours. For those working a combination of day and night shifts, the upper limit stands at 42 hours per week.

Daytime shifts are limited to 44 hours/week, while night shifts are capped at 36 hours/week. Overtime is paid at 125–150% of the base rate.

The approved minimum wage encompasses a range: from a monthly minimum of 11,972 Lempiras (approximately USD$470) to a maximum of 18,036 Lempiras (approximately USD$706). The actual wage within this spectrum depends on factors such as the company’s activity, category, and size, as well as the number of workers employed.

Overtime in Honduras is paid at a rate of 125% for overtime hours worked during the day and 170% for overtime hours worked at night. The maximum number of overtime hours allowed in a week is 16 hours.

If dismissal is without just cause, employers must pay:

Severance based on seniority

Unpaid vacation and bonus

Aguinaldo (13th-month salary)

To terminate an employee in Honduras, there are specific requirements that must be met. These requirements include:

– Just Cause: Dismissal can occur when an employee engages in grave misconduct as stipulated in the Labor Code or the Company’s Internal Regulations.

– Without Just Cause: Employers have the authority to terminate an employee’s contract at any time while adhering to the compensation outlined in labor regulations.

It is important for employers to provide a written notification to the worker indicating the cause of termination. Additionally, the length of mandatory notice of termination depends on the length of service, ranging from 24 hours for employees with less than two months of service to up to two months of notice. If the employer fails to prove the alleged cause for dismissal, compensation must be paid to the employee.

When an employee quits in Honduras, they are entitled to vacation and bonus payments based on the time they worked. The Ministry of Labor provides calculations for severance payments.

If the employer does not give a notice period, they may pay full wages instead. If the employee is required to give notice, they may pay half wages. In the case of termination, the employee is entitled to vacation, bonus payments, and unemployment benefits.

Yes. All employment relationships should be governed by written contracts, registered with the Ministry of Labor.

After 1 year of continuous service, employees are entitled to 10 consecutive working days of paid annual vacation.

Employers must register employees with IHSS (Instituto Hondureño de Seguridad Social) and contribute to social security, health, and pensions.

No. You must establish a local entity or use an Employer of Record (EOR) to hire workers legally in Honduras.

Biz Latin Hub can help with employment law in Honduras

At Biz Latin Hub, we have a dedicated team of specialists ready to deliver tailored solutions that address your unique business requirements in Honduras.

With our extensive legal, accounting, and back-office services, we serve as your primary point of contact, streamlining and accelerating your entry into the Honduran market.

Talk to our team of local experts today about business opportunities in Honduras, company formation, and how to best enter this LATAM market.

If you found this article about Employment Law in Honduras helpful, explore the rest of our coverage of the region or learn more about our team and expert authors.