An entity health check in Uruguay provides comprehensive verification of your company’s compliance status with local corporate laws. This corporate due diligence process protects you after business formation in Uruguay from penalties and maintains your standing with the regulatory authorities. An entity health check ensures your business meets all requirements before authorities arrive. This guide explains the value of a proactive compliance audit and details the main areas that must be assessed to ensure a company in Uruguay is in good legal and financial standing.

Key Takeaways on Entity Health Check in Uruguay

| What is a entity health check? | An entity health check is a preventative review of a company’s key statutory records. |

| What critical deadlines are there? | Annual tax filings, monthly BPS payments, timely corporate book updates per legal requirements |

| What are the key areas reviewed for a Uruguayan company? | It verifies compliance with the DGI, BPS, AIN, and the Central Bank (BCU). |

| Does a health check check UBO? | A health check ensures the UBO declaration to the Central Bank is current. |

| Why is a health check crucial before an investment or sale? | It is part of due diligence. |

The Importance of a Corporate Health Check

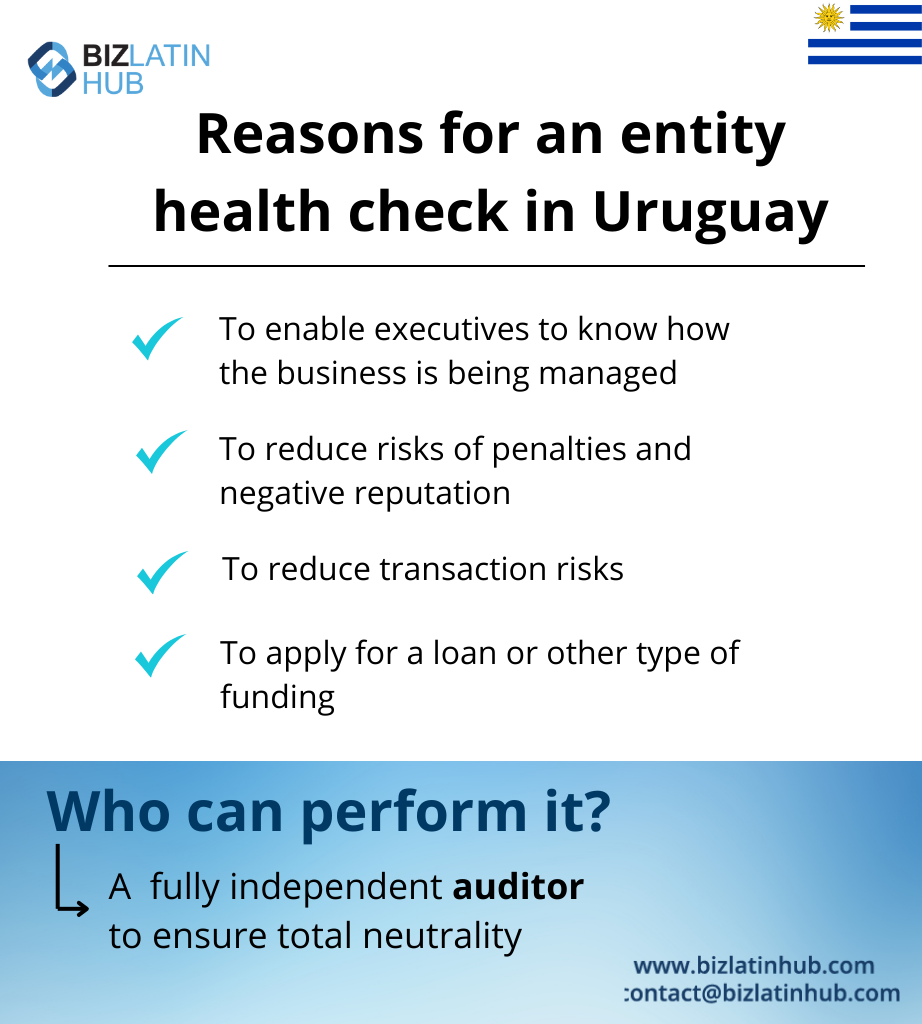

An entity health check is a preventative review of a company’s key statutory records. The primary goal is to identify any compliance failures—such as an out-of-date UBO declaration or unpaid social security contributions—and correct them before they can result in government penalties.

Key Areas of a Uruguayan Entity Health Check

Expert Tip: Verifying the Central Bank UBO Declaration

From our experience, the single most critical compliance point in Uruguay is the declaration of Ultimate Beneficial Owners (UBO) to the Central Bank of Uruguay (BCU). This is not a one-time filing; it must be updated annually. The penalties for non-compliance are severe, including substantial fines and the inability to obtain a tax clearance certificate from the DGI, which can halt business operations. A health check must prioritize verifying that this annual declaration has been filed correctly and on time, as it is a major focus for Uruguayan regulators.

1. Corporate and Legal Records Review

This audit verifies that the company’s bylaws are correctly registered, that shareholder meeting minutes are properly maintained, and that the company’s legal books are up-to-date.

2. Tax Compliance with the DGI

This involves a review of all monthly and annual tax filings to confirm they were submitted correctly and on time, and that the company has a valid tax clearance certificate.

3. Social Security Compliance with the BPS

This check verifies that the company is correctly registered as an employer and that all required monthly social security contributions for its staff have been paid.

4. Central Bank (BCU) Declaration Status

This is a critical verification that the company’s annual declaration of its Ultimate Beneficial Owners has been correctly filed with the Central Bank of Uruguay.

What Is an Entity Health Check in Uruguay?

An entity health check examines your company’s legal, fiscal, and operational compliance in Uruguay. This Uruguay compliance check covers registrations with government bodies, tax filings, labor documentation, and corporate governance requirements.

Legal due diligence in Uruguay focuses on corporate book maintenance including Libro de Actas and Libro de Registro de Acciones, shareholder meeting documentation and resolutions, power of attorney validity and registration, commercial contracts and third-party agreements, and labor contracts with union agreement compliance. Each element requires specific attention to Uruguay’s unique legal framework and documentation standards.

Corporate due diligence in Uruguay includes comprehensive review of DGI tax registration and monthly filings, BPS social security contributions and declarations, IRAE corporate tax compliance, VAT declarations and payment schedules, and transfer pricing documentation for international transactions. These fiscal elements form the foundation of Uruguay compliance verification and directly impact your company’s operational continuity.

5 Essential Steps for Entity Health Check in Uruguay

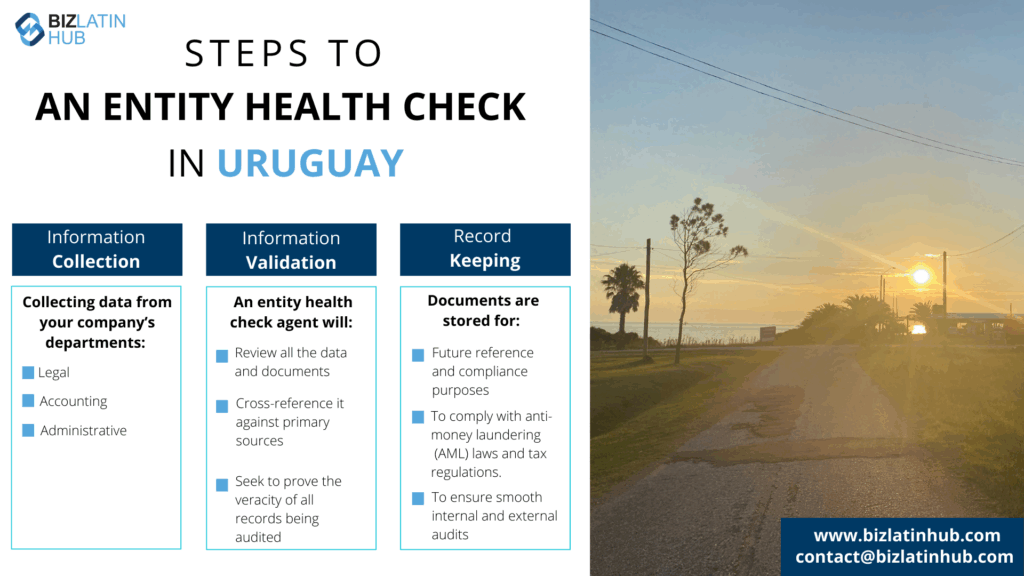

1. Pre-Audit Document Collection

The first step requires gathering Uruguay-specific documents that prove your company’s legal existence and operational compliance:

- RUT (Registro Único Tributario) certification

- Complete BPS registration and payment history

- Corporate books certified by a notary

- Labor contracts registered with MTSS

- Financial statements approved by a licensed CPA

Document collection typically takes 5-10 business days depending on your internal organization and record-keeping practices.

2. Uruguay Compliance Verification

Compliance verification examines your adherence to Uruguay’s regulatory framework. This includes corporate transparency requirements, beneficial ownership registry regulations, personal data protection laws, and anti-money laundering (AML) requirements. Each regulation carries specific documentation requirements and reporting obligations that affect different aspects of your business operations.

3. Tax Compliance Review

Uruguay’s tax system requires careful review of multiple obligations. Your entity health check must examine IRAE payments and advance payments, IVA (VAT) monthly declarations, IRNR obligations for foreign shareholders, wealth tax for qualifying entities, and municipal taxes specific to Montevideo or other departments. Tax compliance forms the largest component of most entity health checks due to the complexity of Uruguay’s fiscal regulations and the severity of penalties for non-compliance.

4. Labor Law Compliance Check

Labor compliance in Uruguay involves verifying adherence to salary council (Consejo de Salarios) minimum wages, calculating vacation bonus (salario vacacional) correctly, ensuring proper year-end bonus (aguinaldo) provisions, maintaining work accident insurance (BSE) coverage, and respecting union rights and collective bargaining requirements. Uruguay’s strong labor protections mean that employment-related compliance often reveals the most violations during entity health checks.

5. Documentation and Reporting

The final step produces comprehensive compliance reports that include an executive summary in Spanish for local authorities, detailed action plans for identified gaps, realistic timelines for corrections typically ranging from 30 to 90 days, and cost estimates for compliance improvements. Professional reports provide clear roadmaps for achieving and maintaining compliance with Uruguay regulations.

Uruguay Entity Verification: Industry-Specific Requirements

Free Zone Companies

Free zone entities in Uruguay operate under special regulations that require annual audits by law, specific reporting to Free Zone authorities, verification of foreign revenue requirements, and documentation of substance requirements. These companies benefit from tax exemptions but face stricter compliance monitoring to ensure they meet operational requirements. The Free Zone regime requires maintaining detailed records of all international transactions and demonstrating that local sales remain within permitted limits.

Financial Services

Financial institutions face enhanced scrutiny from BCU (Central Bank) with specific reporting requirements, quarterly compliance certificates, regular AML/KYC documentation updates, and capital adequacy verification. The financial sector in Uruguay must demonstrate robust internal controls and maintain higher standards of documentation than other industries. Regular entity health checks help financial services companies prepare for BCU inspections and maintain their operating licenses.

Agricultural Businesses

Agricultural operations require specialized compliance including MGAP (Ministry of Agriculture) registrations, environmental compliance certificates, rural property tax (Contribución Inmobiliaria Rural) payments, and export permit validations. Uruguay’s agricultural sector faces unique challenges related to land ownership documentation, environmental impact assessments, and traceability requirements for exports. Entity health checks for agricultural businesses often reveal gaps in environmental compliance and export documentation.

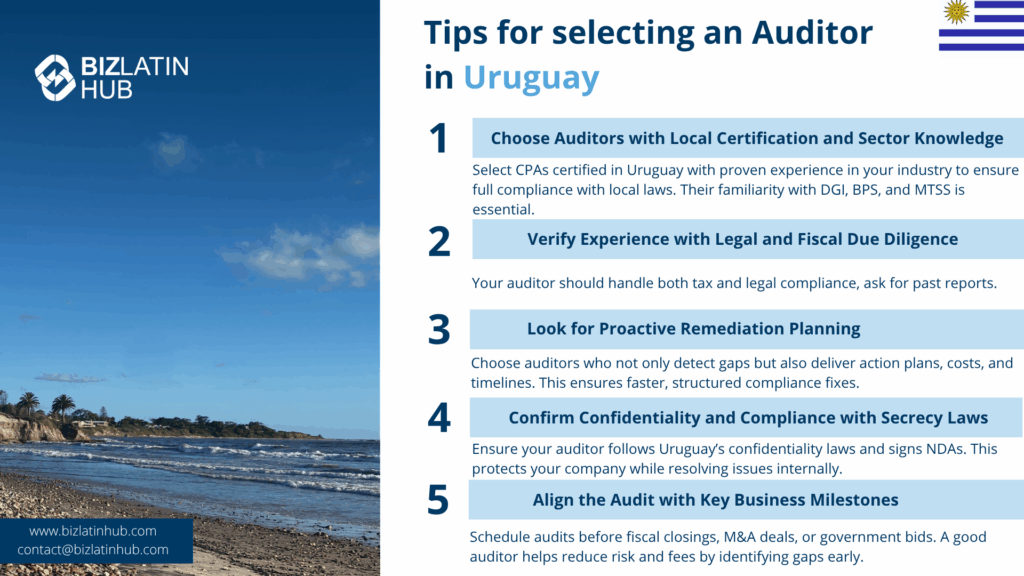

Tips and Recommendations from Local Experts

Timing Your Health Check

Best practice suggests scheduling entity health checks well before fiscal year-end deadlines. This timing allows correction of issues before annual tax filings and reduces rush fees charged by professional service providers. Companies that conduct health checks with adequate lead time typically save significantly on professional fees compared to those requesting urgent reviews. Early detection of compliance issues also provides more time for remediation without facing penalty deadlines.

Documentation Management

Uruguay requires physical corporate books stamped by notaries, and digital copies alone don’t satisfy legal requirements. Maintain books at your registered office address and ensure they’re updated within 90 days of any corporate action. Many companies face penalties simply because their corporate books aren’t physically available during inspections. Create a documentation protocol that ensures all required stamps and certifications are obtained promptly.

BPS Compliance Strategy

Expert recommendation includes setting automatic BPS payments for the 5th of each month to avoid late payment penalties. Late payments trigger immediate penalties plus 3% monthly interest, and early payment avoids system delays common during peak processing periods. Establish a dedicated bank account for BPS payments to ensure funds are always available and payment records remain clear.

DGI Relationship Management

Respond to DGI information requests within 10 business days as extensions are rarely granted. Designate a tax representative (representante fiscal) for faster communication with authorities. Building positive relationships with DGI officials through prompt responses and professional communication can significantly ease future interactions. Maintain organized files specifically for DGI requests to enable quick response times.

Labor Documentation

MTSS inspections focus heavily on overtime records and safety documentation. Keep daily attendance logs and signed overtime authorizations for 5 years minimum. Create standardized forms for all labor-related documentation and train supervisors on proper completion. Many labor violations result from incomplete documentation rather than actual non-compliance with regulations.

Cost Considerations for Uruguay Due Diligence

Entity health check costs in Uruguay vary significantly based on company size and complexity. As a general guide, small companies with 1-10 employees might expect costs starting from USD 2,000, while medium companies with 11-50 employees typically see higher fees. Large companies with over 50 employees should budget accordingly for comprehensive reviews, with free zone entities often requiring additional specialized compliance review.

Cost factors include:

- Number of employees and contractors

- Transaction volume and complexity

- Presence of international operations

- Previous compliance history

- Urgency of the review

Companies with clean compliance histories and organized documentation typically pay lower fees due to reduced auditor time requirements. Establishing good documentation practices can reduce future health check costs significantly. For accurate pricing, consult with local professionals who can assess your specific needs.

When to Conduct Uruguay Compliance Checks

Mandatory Triggers

Certain business events mandate immediate entity health checks in Uruguay:

- Preparation for M&A transactions

- Receipt of foreign investment

- Applications for free zone status

- Banking facility applications

- Government contract bids

Each situation requires specific documentation and compliance verification to satisfy counterparty due diligence requirements. Failing to conduct proper health checks before these events can result in deal delays or failures.

Recommended Schedule

Regular health checks prevent compliance deterioration and reduce remediation costs. All active companies should conduct annual reviews, while companies with 50 or more employees benefit from semi-annual checks. Financial institutions and free zone companies require quarterly reviews due to regulatory requirements, and high-risk sectors including gaming and cryptocurrency operations need monthly compliance monitoring. Establishing regular review schedules helps identify issues before they become critical violations.

Common Compliance Failures in Uruguay

BPS declaration errors affect approximately 35% of companies during health checks. These errors include incorrect employee categorization, missing contractor declarations, and calculation errors in contributions. Many companies misclassify employees as contractors or fail to update employee categories when roles change, leading to significant underpayment of social security contributions.

Corporate book delays impact 28% of companies reviewed. Meeting minutes not transcribed within 90 days, missing notary certifications, and incomplete shareholder registries create legal vulnerabilities. Uruguay law requires timely documentation of all corporate actions, and delays can invalidate important business decisions.

DGI filing issues affect 22% of companies, primarily through late monthly IVA submissions, incorrect IRAE advance payments, and missing supporting documentation. Tax filing errors often compound over time, creating larger liabilities when eventually discovered. Electronic filing systems help reduce errors but require proper setup and maintenance.

Labor law violations found in 15% of companies typically involve overtime payment calculations, vacation record maintenance, and safety training documentation. Uruguay’s complex labor laws create numerous compliance traps for employers, particularly regarding overtime calculations and benefit accruals.

FAQs on Entity Health Check in Uruguay

How long does an entity health check take in Uruguay?

Standard reviews require 15-30 business days for completion. Complex multinational companies may need 45-60 days due to additional documentation requirements and international verification needs. Urgent reviews are available within 7 days at premium rates, typically 50% higher than standard fees. Timeline depends primarily on document availability and company cooperation during the review process.

What is the DGI?

The DGI (Dirección General Impositiva) is the General Tax Directorate, Uruguay’s main tax authority. A health check verifies that all corporate tax (IRAE) and VAT filings are current.

What is the BPS?

The BPS (Banco de Previsión Social) is the Social Security Bank. The health check confirms that the company has paid all mandatory monthly social security contributions for its employees to the BPS.

What is the AIN?

The AIN (Auditoría Interna de la Nación) is the National Audit Office. Companies are required to file their annual financial statements with the AIN.

Why is the UBO declaration so important?

The UBO (Ultimate Beneficial Owner) declaration is a key part of Uruguay’s commitment to international anti-money laundering and tax transparency standards. Failure to comply can lead to significant domestic penalties and can flag the company to international authorities.

Which Uruguay authorities might request entity verification?

Several Uruguay authorities may require entity verification:

- DGI – Conducts tax audits focusing on income tax and VAT compliance

- BPS – Performs social security inspections examining contribution calculations and payment histories

- MTSS – Reviews labor compliance including contracts, overtime, and safety standards

- BCU – Monitors financial institutions for regulatory compliance and systemic risk

- AIN (Auditoría Interna de la Nación) – Audits government contractors for public fund usage

Each authority has specific documentation requirements and inspection procedures.

Entity Health Check Types in Uruguay

Legal Due Diligence Uruguay

Legal entity verification in Uruguay encompasses comprehensive review of registry filings with RNC (Registro Nacional de Comercio), ensuring all corporate changes are properly recorded. Corporate governance compliance includes verification of board and shareholder meeting minutes, resolutions, and proper notification procedures. Statutory registers including share registry and director registry must be maintained according to legal requirements with proper notarization. Contract review covers all commercial agreements, leases, licenses, and employment contracts to ensure legal validity and compliance. Litigation checks search court records in Montevideo and relevant departments to identify potential legal risks or ongoing disputes that could affect business operations.

Fiscal Due Diligence Uruguay

Fiscal compliance verification requires examining all DGI filings for the past 5 years to ensure consistency and accuracy. BPS compliance history reveals patterns of payment timing and calculation methods that may require correction. Municipal taxes vary by location, with Montevideo having different requirements than other departments. Customs duties documentation becomes critical for import/export businesses to demonstrate proper valuations and classifications. Transfer pricing documentation must support all international transactions between related parties, following OECD guidelines adapted to Uruguay requirements.

Next Steps for Your Uruguay Entity Health Check

Professional entity health checks protect your Uruguay operations from costly penalties and reputational damage. Schedule your review with adequate time before regulatory deadlines to ensure thorough assessment and remediation opportunities. Early action provides time for comprehensive review and measured correction of any identified issues.

Important Note: This guide provides general information about entity health checks in Uruguay. Specific requirements, deadlines, and penalties vary based on your company’s structure, industry, and circumstances. Always consult with qualified local professionals for current regulations and requirements applicable to your situation.

Contact Biz Latin Hub for Uruguay Due Diligence Services

At Biz Latin Hub, our Uruguay team provides comprehensive entity health checks and due diligence services. Our local experts understand DGI requirements, BPS regulations, and MTSS compliance standards. We deliver actionable reports that protect your business interests.

Our Uruguay entity verification services include complete legal due diligence Uruguay, corporate due diligence Uruguay, Uruguay compliance check services, Uruguay entity verification and audits, and remediation support with implementation guidance. We work with your team to ensure sustainable compliance practices that prevent future violations.

Reach out to us now for your Uruguay entity health check consultation.

Learn more about our team and expert authors.