Business liquidation in Costa Rica is a regulated legal procedure that formally terminates a company’s legal and tax obligations. Whether driven by insolvency, restructuring, or voluntary closure, proper liquidation ensures that all debts are paid, assets are distributed, and the company is removed from the national registries. This 2025 guide outlines how to liquidate a business in Costa Rica, step by step, and includes expert insights from our experience supporting clients across multiple industries.

Key takeaways on how to liquidate your business in Costa Rica

| 6 steps to liquidate a company in Costa Rica | Step 1 – Liquidation agreed by the assembly of shareholder(s). Step 2 – Take inventory of assets and debts. Step 3 – Notify authorities of your company’s liquidation. Step 4 – Publication in the government gazette. Step 5 – Liquidation of Assets and Property. Step 6 – Registration of the dissolution agreement. |

| What is the timeframe needed to liquidate your business in Costa Rica? | It should take approximately six months to a year to liquidate a company in Costa Rica, if everything is in order. |

| What are the reasons to liquidate a business in Costa Rica? | These vary, but the key point is to stay compliant and in good standing with the authorities. |

| What causes involuntary liquidation in Costa Rica? | This type of process in Costa Rica can be initiated by a creditor or by the tax authorities if you have missed more than three corporate tax payments. |

How to Proceed to liquidate your business in Costa Rica?

Despite a growing economy, some businesses may eventually choose to exit the Costa Rican market. This can be the most suitable decision when your commercial strategy moves in a different direction.

Businesses can voluntarily enter liquidation proceedings, and close their commercial operations. This decision must be made by the governing actors in your business in Costa Rica.

There are 5 main steps involved with voluntary liquidation proceedings:

- Step 1 – Liquidation agreed by the assembly of shareholder(s).

- Step 2 – Take inventory of assets and debts.

- Step 3 – Notify authorities of your company’s liquidation.

- Step 4 – Publication in the government gazette.

- Step 5 – Liquidation of Assets and Property.

- Step 6 – Registration of the dissolution agreement.

1. Liquidation agreed by the assembly of shareholder(s)

Shareholders must formally agree to dissolve the company through a general meeting. A “dissolution act” is drafted and signed before a notary, detailing:

- The decision to dissolve the entity

- Appointment of a liquidator, who will manage the process

- Instructions for asset distribution

- Authorizations for legal representatives

Tip: In practice, this document should be carefully worded to avoid future disputes — especially in multi-partner companies. We recommend legal review prior to signing.

2. Take inventory of assets and debts

At the shareholders’ assembly, the shareholders and appointed Liquidator must make an inventory of all the company’s assets and liabilities.

The company must pay any outstanding corporation tax in order to begin liquidating the assets of the dissolved company. Once the shareholders and the liquidator have approved the inventory and balances of the corporation, the Liquidator may then begin the process to liquidate your business in Costa Rica as agreed by the shareholders and in accordance with local law (step 5).

This includes:

- Transferring the property in the personal name of the shareholders or another legal person

- Selling the corporation’s capital and distributing the proceeds to the shareholders.

- Also, the company must prepare a notice of liquidation and call for payment of all claims to creditors published in the Official Gazette and a local newspaper.

The appointed liquidator prepares a comprehensive inventory of the company’s:

- Fixed assets: property, vehicles, equipment

- Financial assets: bank balances, receivables, investments

- Liabilities: debts, leases, outstanding invoices

- Labor obligations: pending salaries, vacation, severance

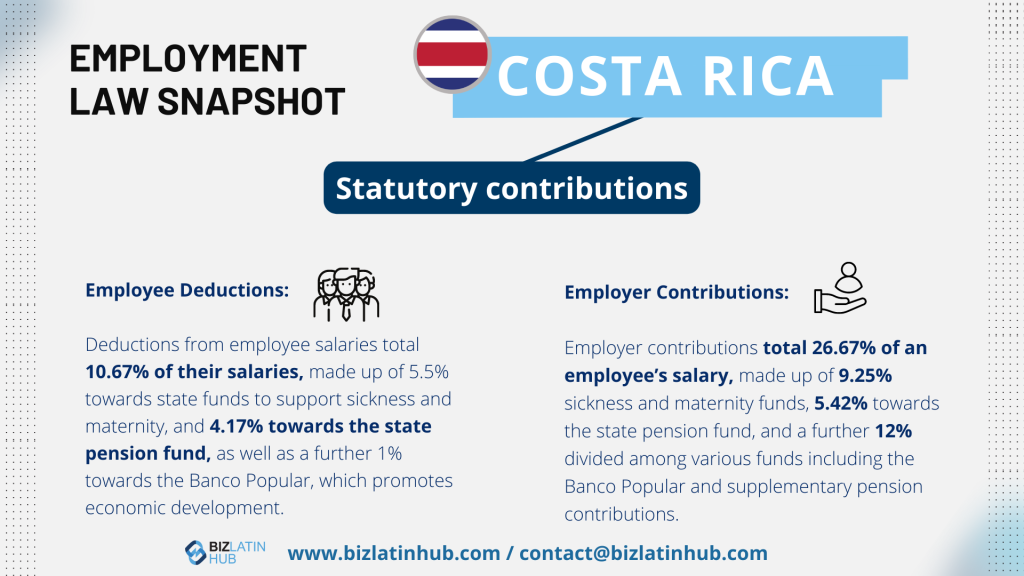

- Social security obligations: outstanding CCSS or INS contributions

- Tax liabilities: VAT, income tax, municipal dues

This inventory becomes the legal foundation for the liquidation balance sheet.

Professional insight: We often see clients underestimate social security or municipal tax obligations. These must be reconciled before any deregistration can proceed. Always request account statements from CCSS and municipal offices.

3. Notify authorities of your company’s liquidation

Once a Public Notary has approved the dissolution agreement, the transaction must be submitted to the Trade and Companies Register. This will revoke your company’s name from this register and confirm that you are no longer in business.

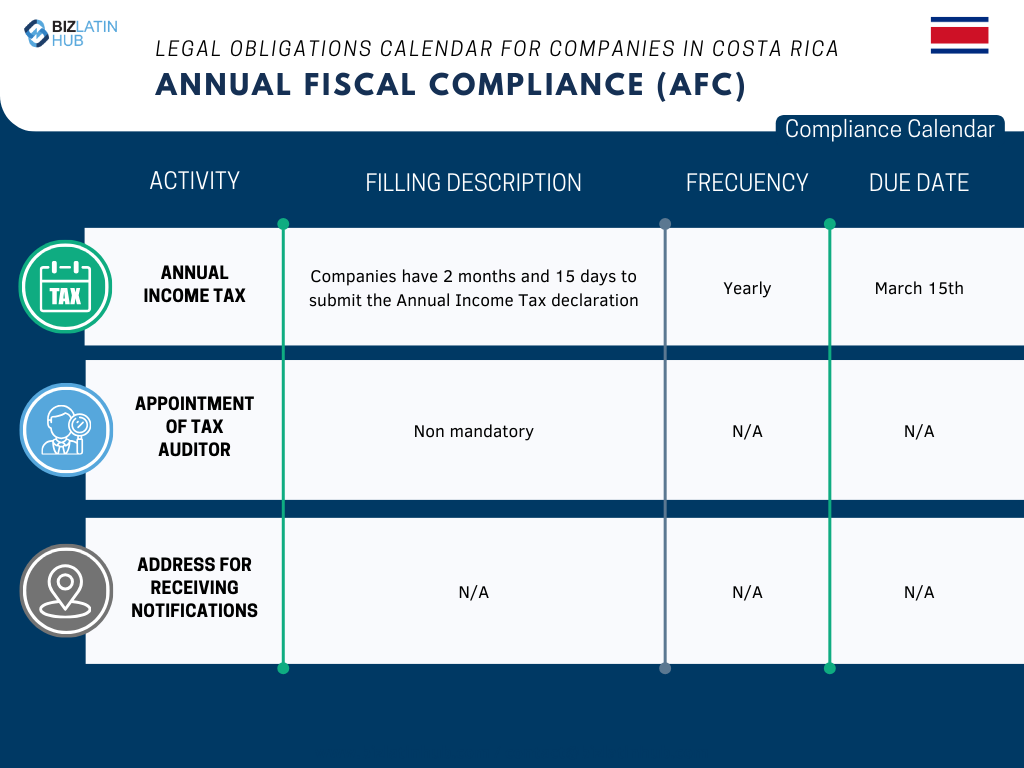

You must then terminate your registration with Costa Rica’s tax authority, Hacienda. In order to do this, you must first provide any outstanding income tax declarations (these are filed annually).

Note: you only need to cancel your tax registration if your company is registered with the Revenue Service, and you have recorded income. The cost to terminate your tax registration is US$150.

The notarized dissolution act is submitted to:

- Registro Nacional (National Registry), for public record update

- Dirección General de Tributación, which updates the company’s tax status

The liquidator must also update the RUT (Registro Único Tributario) and file all pending returns. Authorities may request tax or compliance certificates before accepting the company’s closure.

Tip: Use this phase to clean up any past due filings or reporting issues. We’ve helped several clients avoid penalties by reconciling inconsistencies with DIAN early.

4. Publication in the government gazette

Once the previous steps have been completed, the company’s shareholders must publish a notice in the government publication, La Gaceta (‘The Gazette’). To do this, you’ll need assistance with producing a formal publication about your company in Spanish. The purpose of this step is to alert creditors of the company about your liquidation so they can make claims to recuperate any bills the company owes them.

If there are no creditors, and there are no assets of the company, the liquidation process becomes void. Nevertheless, it’s mandatory to publish this notice in the government’s Gazette. The cost of posting the notice is US$100.

The company must publish a liquidation notice in La Gaceta, Costa Rica’s official government bulletin. The notice must include:

- Legal name and tax ID (cédula jurídica)

- Appointment of the liquidator

- Deadline (minimum 30 days) for creditors to submit claims

Professional insight: This step often causes unnecessary delays if proof of publication is lost or improperly formatted. Keep the original publication copy and submit it as part of the final deregistration request.

5. Liquidation of Assets and Property

For this step, the business’ Liquidator will formally liquidate all identified company assets. The business’ holdings, such as real estate, vehicles, or any other property are considered to be assets. The liquidator must first ensure all receivables and debts contracted by the company are paid out to its creditors. Then, the company’s shareholders can be paid.

If the company has no debt, it is recommended to dispose of the assets before entering into the shareholders’ agreement to have a more straightforward and less costly liquidation process.

Once the 30-day window has passed, the liquidator proceeds to:

- Sell or transfer company assets

- Collect receivables

- Pay debts, following legal priority:

- Taxes

- CCSS and labor obligations

- Secured creditors

- Unsecured creditors

All transactions must be documented and aligned with the original inventory. Any remaining balance is distributed to shareholders according to their ownership percentages.

Tip: Keep careful accounting records for asset sales and creditor payments. Missing documentation can lead to delays at the final registration stage.

6. Registration of the dissolution agreement

Once any claims and debts have been repaid, it is up to the shareholders to file the dissolution agreement to complete the liquidation of their business in Costa Rica. The terms of the dissolution must outline paid creditors, asset sharing, and all aspects of the liquidation process.

You must file the dissolution agreement – signed by all the shareholders, the liquidator, and a Public Notary – in the national register. It takes about 2-3 weeks for the registry to review the shareholder agreement and liquidate the business in Costa Rica. The cost of the government fees for this step is US$100.

After completing payments and distributions, the liquidator drafts the final liquidation report, which includes:

- List of settled debts

- Proof of CCSS and DIAN compliance

- Distribution of remaining assets

- Tax and labor clearance certificates

This report, along with a second notarized act confirming liquidation completion, is filed with the Registro Nacional to officially cancel the legal existence of the entity.

Key note: The company’s cédula jurídica is deactivated only after both DIAN and Registro Nacional accept the liquidation and issue their final confirmations.

What does it mean to liquidate your business in Costa Rica?

Liquidation is the formal process of dissolving a Costa Rican company. It involves ceasing business operations, selling off assets, paying creditors and employees, and deregistering the entity from public and tax registries. The goal is to close the business legally and ensure it carries no future liabilities.

There are two types of liquidation in Costa Rica:

- Voluntary liquidation, initiated by shareholders when the company is solvent and wishes to close

- Judicial liquidation, triggered when the company cannot meet its obligations and must be dissolved through court proceedings

Both processes require coordination with the Registro Nacional, Dirección General de Tributación, Caja Costarricense de Seguro Social (CCSS), and publication in La Gaceta.

Insolvency procedure in Costa Rica

Companies that cannot meet their obligations must enter judicial liquidation, governed by Costa Rica’s Ley Concursal. This process is initiated in the commercial courts and involves:

- Court-appointed judicial administrator to oversee liquidation

- Submission of creditor claims

- Judicial auction or transfer of assets

- Proportional payment of creditors

- Legal deregistration by court order

Biz Latin Hub Insight: Judicial liquidation can be significantly more expensive and lengthy than voluntary procedures. Whenever possible, we assist clients in settling obligations to proceed with voluntary closure.

FAQs on how to liquidate your business in Costa Rica

Based on our extensive experience these are the common questions and doubts of our clients when liquidating a local entity

1. What is the process of liquidation in Costa Rica?

- Step 1 – Liquidation agreed by the assembly of shareholder(s).

- Step 2 – Take inventory of assets and debts.

- Step 3 – Notify authorities of your company’s liquidation.

- Step 4 – Publication in the government gazette.

- Step 5 – Liquidation of Assets and Property.

- Step 6 – Registration of the dissolution agreement.

2. How long does it take to liquidate a company in Costa Rica?

The liquidation process will normally take between (6) and (12) months, assuming the entity is in good standing and no rectification work is required.

3. What are the reasons to liquidate a company in Costa Rica?

There are a number of reasons you may do so, such as the venture becoming unworkable, a change in laws or simple failure in the relevant markets. You may wish to close one business in order to start another or you may want to leave the country for other reasons. For whatever reason you eventually decide to liquidate a company in Costa Rica, it is best to do so in accordance with the law.

4. Can you be forced to liquidate a company in Costa Rica?

Yes, under certain circumstances. This type of process in Costa Rica can be initiated by a creditor or by the tax authorities if you have missed more than three corporate tax payments.

5. Can I keep operating during the liquidation process?

Yes, but only for activities necessary to conclude business operations — such as asset liquidation or debt recovery. New commercial activity is prohibited.

6. Do I need an accountant during liquidation?

Yes. A certified accountant must prepare final tax returns, financial statements, and assist with CCSS and municipal reconciliations.

7. Is a liquidation balance sheet required?

Yes. The liquidation balance sheet is essential and must reflect real asset values, debt settlements, and cash distribution. It is submitted with the final dissolution report.

8. What if my company has no assets or income?

You must still complete the liquidation process and notify authorities. A zero-balance liquidation is possible but still requires formal closure through the Registro Nacional and DIAN.

9. Can I skip liquidation if the company was inactive?

No. Even inactive companies remain liable for tax filings, CCSS reporting, and may accrue fines. Formal liquidation is the only legal way to dissolve the company.

Biz Latin Hub can help you liquidate your business in Costa Rica

Expert Legal and Accounting Support for Liquidation in Costa Rica

At Biz Latin Hub, we help clients across Costa Rica legally dissolve their businesses while avoiding delays and regulatory pitfalls. With deep experience in corporate compliance, we provide:

- Drafting and notarization of dissolution acts

- Inventory compilation and balance sheet assistance

- Full tax and CCSS reconciliation

- Coordination with Registro Nacional and DIAN

- Public notice publication in La Gaceta

- Final liquidation report and legal deregistration

Whether you operate a micro-enterprise or a large regional subsidiary, we ensure your liquidation is compliant, smooth, and efficient.

Contact us today to begin the process with bilingual legal and accounting experts by your side.