The Dominican Republic offers a strategic location and a pro-business environment for investors expanding into the Caribbean. Choosing the correct legal entity when you incorporate a company in the Dominican Republic is critical to ensure legal compliance, tax efficiency, and operational flexibility. This guide explores the key company types available (SRL, SA, SAS, and branch offices) to help you make the right decision.

Key Takeaways

| Common legal entity types in the Dominican Republic | Limited Liability Company. Simplified Limited Company. Limited Company. |

| What is the most common Dominican Republican business entity? | The entity type we most commonly reccomend is the Sociedad de Responsabilidad Limitada (S.R.L.) that is very similar to an LLC in the US. |

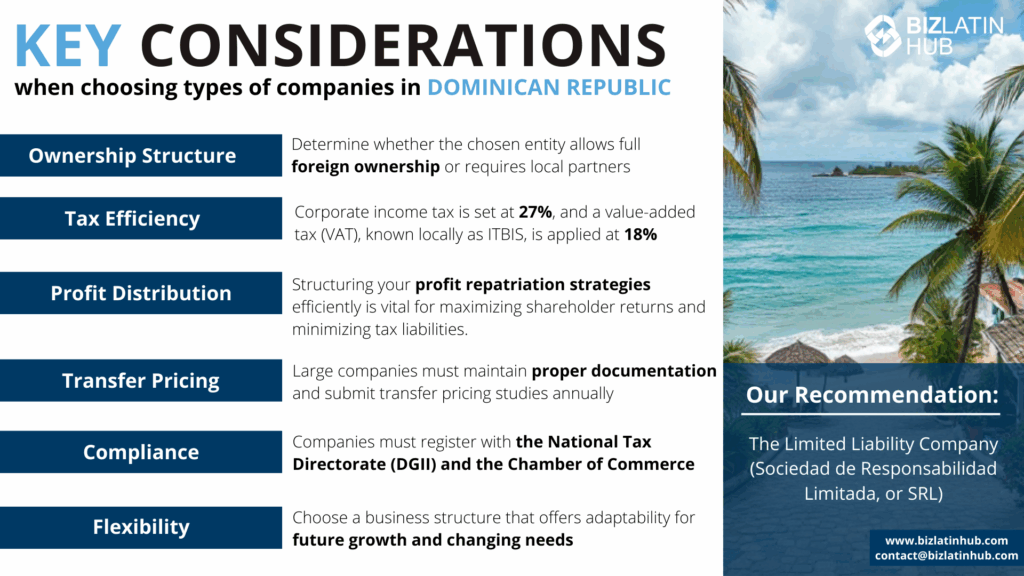

| What are the primary considerations when choosing a business entity in the Dominican Republic? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Main Company Types in the Dominican Republic

When looking to enter the Dominican Republic, foreign investors are confronted with a choice in terms of what sort of commercial presence they want to have. Expanding multinationals must incorporate a company in the Dominican Republic as a formal corporate vessel for business.

Branches and representative offices are viable options for multinational companies. However, choosing the best type of company must be done on a case-by-case basis.

- Limited Liability Company.

- Simplified Limited Company.

- Limited Company.

Below we review the different types of companies in the Dominican Republic for incorporation.

Comparison Table: Key Legal Entity Types in Dominican Republic

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SRL | Small to mid-size partnerships | 2–50 | Limited to capital | Yes | Corporate tax applies |

| SA | Large or public corporations | 2+ | Limited to capital | Yes | Corporate tax applies |

| SAS | Startups and foreign investors | 1+ | Limited to capital | Yes | Corporate tax applies |

| Branch | Multinationals operating in-country | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a local entity |

1. Sociedad de Responsabilidad Limitada (SRL)

The Limited Liability Company (Sociedad de Responsabilidad Limitada, or SRL in Spanish) is historically the popular choice for typically small businesses. It is quite appealing in the sense that the social capital required to incorporate the company in the Dominican Republic is quite reasonable and low.

This type of company requires a minimum of 2 shareholders which can be either individual persons or other legal entities. The shareholders can have a local or a foreign domicile. In terms of administration, at least 1 director is required to manage the SRL legal entity.

Regarding tax compliance, it is necessary for this type of company to file annual financial statements to tax authorities. Furthermore, the company’s account needs to undergo an annual audit.

2. Sociedad Anónima Simplificada (SAS)

The Simplified Limited Company is also known as Sociedad Anónima Simplificada or SAS in Spanish. It is the preferred legal entity for company incorporation in the Dominican Republic when one is looking to raise capital. It is easier to do so than for example in the previously explained SRL. In other words, this type of company in the Dominican Republic is quite appealing as well for entrepreneurs looking to be that next unicorn.

This type of company requires a minimum of 2 shareholders which can be both individuals or legal entities. The shareholders can have a local or a foreign domicile.

In terms of administration, at least 1 director is needed to manage the SAS legal entity.

All SAS companies require a higher initial company capital – approximately 3 times the amount – than that needed to incorporate an SRL.

3. Sociedad Anónima (SA)

The Limited Company is also known as the Sociedad Anónima or SA in Spanish. Typically, this corporate structure is best suited for larger-sized companies that will likely participate in the stock market, publicly offering their shares to investors.

This legal entity requires a minimum of two shareholders which can be both individuals and legal entities. The shareholders may have a local or a foreign domicile.

The Limited Company legal entity requires a minimum of three directors to take care of the administration and governance of the company.

Our recommendation: The Limited Liability Company. It is well-suited for small to medium-sized enterprises and foreign businesses seeking to establish a presence in the country. It is a commonly chosen legal entity type for businesses operating in the Dominican Republic due to its simplicity and effectiveness.

4. Branch of a Foreign Company

As is the case with Limited Companies in the Dominican Republic, Branches are an excellent option for larger foreign multinational companies. This option has benefits in terms of reputation, banking, and engaging with third parties. It is also a preferable choice if the intent is to engage with local public entities directly or via tenders.

A branch office in the Dominican Republic needs to have in place at least one individual (national or foreign) to act as its representative in the country.

Who Should Choose Which Type of Entity in the Dominican Republic?

SRL – Sociedad de Responsabilidad Limitada

Who should choose this: Private, smaller businesses where direct partner involvement and control is essential.

SA – Sociedad Anónima

Who should choose this: Public companies or those looking to raise funds and issue shares, with more regulatory oversight.

SAS – Sociedad Anónima Simplificada

Who should choose this: Ideal for startups, SMEs, and foreign investors who want flexibility, reduced formalities, and fast setup.

Branch

Who should choose this: Foreign companies operating directly in the Dominican Republic without incorporating a new legal entity.

Choosing the Right Legal Structure in the Dominican Republic

Ownership Structure

Understand whether your chosen business entity allows full foreign ownership. The Dominican Republic generally permits 100% foreign ownership in most industries. However, certain sectors, such as aviation, media, and mining, may have specific restrictions or require additional permits. Evaluating these regulations ensures compliance with local laws and facilitates smooth business operations.

Tax Efficiency

Analyze the implications of the Dominican Republic’s tax system on your business. Corporate income tax (Impuesto Sobre la Renta, ISR) is set at 27%, and a value-added tax (VAT), known locally as ITBIS, is applied at 18% on most goods and services. Businesses may benefit from incentives under the Free Zones Law (Law 8-90), which provides significant tax exemptions for export-oriented companies or those operating in specific industries like tourism and renewable energy. Proper tax planning, including leveraging these incentives, is essential to reduce costs while ensuring compliance.

Profit Distribution

Consider the tax implications of distributing profits. Dividends paid to non-resident shareholders are subject to a 10% withholding tax. Double taxation treaties with countries like Spain and Canada can help reduce withholding tax rates. Structuring your profit repatriation strategies efficiently is vital for maximizing shareholder returns and minimizing tax liabilities.

Transfer Pricing

Comply with the Dominican Republic’s transfer pricing regulations, which require cross-border transactions between related entities to reflect arm’s-length pricing. This is particularly relevant for businesses engaged in imports, exports, or intercompany loans. Companies must maintain proper documentation and submit transfer pricing studies annually if they meet certain revenue thresholds. Non-compliance can result in penalties and increased scrutiny from tax authorities.

Compliance

Prepare to meet the Dominican Republic’s compliance requirements. Companies must register with the National Tax Directorate (DGII) and the Chamber of Commerce. Financial reporting must follow local accounting standards, aligned with IFRS for certain businesses. Monthly tax filings for VAT, payroll, and withholding taxes are mandatory, alongside annual income tax declarations. Labor compliance, including employee benefits and contributions to the social security system (TSS), is essential to avoid penalties. Ensuring adherence to these regulations maintains your company’s legal standing.

Flexibility

Select a business structure that aligns with your operational and strategic needs. The most common types of legal entities in the Dominican Republic are:

- Sociedad de Responsabilidad Limitada (S.R.L.): A popular structure for small and medium-sized businesses, offering limited liability and simplicity in governance.

- Sociedad Anónima (S.A.): Suitable for larger businesses or those planning to raise capital through share issuance. It requires at least two shareholders and a board of directors.

- Sociedad Anónima Simplificada (S.A.S.): A newer, flexible option designed for businesses of all sizes. It allows for fewer corporate formalities and greater adaptability in ownership and capital changes.

Choosing a flexible structure ensures that your business can adapt to changing regulations and opportunities in the Dominican Republic.

Our recommendation: From experience we recommend clients the S.R.L, as it offers limited liability protection to shareholders, flexibility in shareholding structure, management and capital contributions.

Steps to Incorporate a Company in the Dominican Republic

Here are the 6 steps to help you incorporate an entity in the Dominican Republic:

- Step 1 – Check Company Name Availability.

- Step 2 – Agree on the constitution and create the bylaws.

- Step 3 – Sign the Constitution Act.

- Step 4 – Payment of Duties, Stamps, and Taxes.

- Step 5 – Register the company with the tax authority and other institutions.

- Step 6 – Open a corporate bank account.

Compliance Tip:

Companies must register with the Cámara de Comercio y Producción, obtain a RNC (tax ID), and comply with labor registration (TSS), tax (DGII), and annual filings with the local authorities.

Common Pitfalls When Choosing a Legal Entity in the Dominican Republic

- Assuming SAS and SA are interchangeable (they differ in setup and governance)

- Choosing SRL for a business intending to raise capital or expand rapidly

- Forgetting to appoint a local legal representative

- Delays in obtaining a RNC (tax ID) due to incomplete documentation

- Missing mandatory compliance deadlines for corporate filings and taxes

Partnering with Biz Latin Hub for Company Formation in the Dominican Republic

Understanding the differences between the types of businesses in the Dominican Republic can provide many advantages. However, finding the right legal entity in another country can be very challenging.

Our multilingual team from Biz Latin Hub has vast experience in Latin America and the Caribbean. Our local lawyers and professional accountants provide you with tailor-made business solutions. We offer a wide range of market entry and back-office services, such as company incorporation and other legal services, due diligence, visa procedures, PEO and hiring support, payroll management, accounting and taxation, and more.

Get in touch with our specialists to start your business in the Dominican Republic soon!

Learn more about our team and expert authors.

FAQs: Legal Entities in the Dominican Republic

1. Can a foreigner register a company in the Dominican Republic?

Foreigners can register all types of companies in the Dominican Republic. The process involves fulfilling certain requirements and complying with local regulations. Legal assistance and consultation with experts can streamline the registration process for foreign entrepreneurs.

2. What type of legal entity is recommended in the Dominican Republic?

The recommended legal entity in the Dominican Republic depends on various factors such as liability protection, taxation, and operational flexibility. One commonly recommended type is the Limited Liability Company (LLC), which offers a balance of liability protection and tax advantages.

3. How do I create a legal entity in the Dominican Republic?

To create a legal entity in the Dominican Republic, businesses need to follow a series of steps, including choosing a business name, preparing incorporation documents, and obtaining necessary permits and licenses.

4. What is an LLC in the Dominican Republic?

In the Dominican Republic, an LLC, or Limited Liability Company, is a business structure that combines the benefits of both partnerships and corporations. It provides limited liability protection to its members while allowing for pass-through taxation and flexibility in management.

5. What is the business structure of a Simplified Shares Company (S.A.S) in the Dominican Republic?

The Simplified Shares Company (S.A.S) offers a combination of speed, flexibility, and investor-friendly features that make it a suitable choice for businesses looking to establish a presence in the Dominican Republic.

6. What is the most common business entity in the Dominican Republic?

The SRL is most commonly used due to its ease of management, partner control, and suitability for small to medium-sized operations.

7. Can a foreigner incorporate a company in the Dominican Republic?

Yes. Foreigners can own 100% of a Dominican company, including SAS, SRL, and SA structures. A legal representative is required locally.

8. What’s the main benefit of using a SAS?

A SAS allows you to incorporate quickly with just one shareholder, offers reduced compliance requirements, and is ideal for early-stage or international ventures.

9. What’s the difference between SRL and SA?

SRLs are better for closely held businesses with limited growth, while SAs are ideal for public companies or those seeking outside investment.

10. How long does it take to register a company?

The process typically takes 2–4 weeks, depending on documentation readiness, registration speed with the Chamber of Commerce, and issuance of the tax ID (RNC).

11. Do branches have the same obligations as local companies?

Yes. Branches are treated as resident entities and must comply with local tax, labor, and reporting obligations — but the parent company retains liability.

12. What tax rates apply?

The standard corporate income tax rate is 27%. Additional taxes include VAT (18%) and payroll-related taxes, depending on employee count and salary base.

Why Invest in the Dominican Republic?

The island nation has a great deal to offer for business owners looking to enter the region. According to the World Bank, the country has the second-highest GDP figures in the Caribbean.

This means that all of the types of companies in the Dominican Republic are catering to a strong internal market.

In recent years, we have seen an important increase in foreign direct investment into the Dominican Republic.

This takes place specifically in the manufacturing, real estate, export, and tourism sectors.

This region has also made a name for itself as an appealing hub for foreign businesses through its tax and migration offerings.