Luckily, legal compliance in New Zealand is relatively straightforward. Migration steps are easy to comply with and the process of establishing, owning and operating your business can be completed through government applications such as online portals. Find out what you need to know in terms of your responsibilities if you want to form a company in New Zealand. This guide details the essential statutory duties for companies, directors, and shareholders under the Companies Act 1993.

Key Takeaways On Corporate Legal Compliance in New Zealand

| Is a physical address in New Zealand necessary for doing business? | Yes, a registered office address or local fiscal address is required for all entities in New Zealand for the receipt of legal correspondence and governmental visits. |

| What are the annual entity fiscal compliance requirements? | Annual Financial Statements Filing Annual Returns Income Tax Returns Certain companies are also required to undergo an audit. |

| What are the annual Entity Legal Compliance Requirements? | An annual general meeting of the board must be held and publically recorded. |

| What common statutory appointments do companies make in New Zealand? | More than one local director can be appointed. However at least one of them should be an NZ national or a foreigner with the right to live/work in New Zealand or Australia |

| Why Choose to Invest in New Zealand? | New Zealand is a small country that packs a powerful punch compared to its size. The strong economic and regulatory environment allows the country to provide entrepreneurs and investors, including foreigners, a great opportunity to start their commercial journey. |

| What information is required in the annual return filing? | Companies must prepare financial statements that comply with the New Zealand equivalents to International Financial Reporting Standards (NZ IFRS), depending on their size and type. Smaller companies may qualify for simplified reporting standards. |

| What are the main duties and responsibilities of a company director? | A local director will be personally liable, both legally and financially for the good operation and standing of the company. |

| What is a New Zealand Business Number (NZBN)? | This identifies the business with the authorities. |

Key Compliance Requirements for NZ Companies

1. File an Annual Return

Every year, the company must file an annual return with the Companies Office. This confirms that the company’s registered details, such as its address, directors, and shareholders, are correct. A small fee is payable with the filing.

Expert Tip: The Filing Month

From our experience, the Annual Return system in NZ is unique because you are assigned a specific “filing month” based on your incorporation date. It is not the same for everyone. You will receive a reminder email from the Companies Office.

If you ignore this and fail to file within your designated month, the Registrar will initiate steps to remove your company from the register. We advise checking your specific filing month on the Companies Office register immediately upon formation.

2. Maintain Company Records

Companies must keep their corporate records up-to-date and available for inspection at their registered office. This includes maintaining a share register that details all shareholders and their holdings.

3. Fulfill Director Obligations

Directors have a legal duty to act in good faith and in the best interests of the company. They are responsible for managing the company and ensuring it complies with all relevant laws, including health and safety and employment regulations.

Expert Tip: The Resident Director Requirement

From our experience, the most critical compliance point for foreign investors is the resident director rule. The Companies Act 1993 mandates that every New Zealand company must have at least one director who either lives in New Zealand or lives in Australia and is also a director of a company incorporated in Australia. This cannot be a “nominee” in name only; the director must be actively involved. We advise clients to secure a qualified resident director early in the formation process, as failure to maintain one at all times can lead to the company being struck off the register.

4. Meet Shareholder Requirements

Shareholders must approve major transactions, such as the sale of a significant portion of the company’s assets. While shareholders are not involved in daily management, their approval is required for fundamental changes to the company.

5. Comply with Tax Obligations

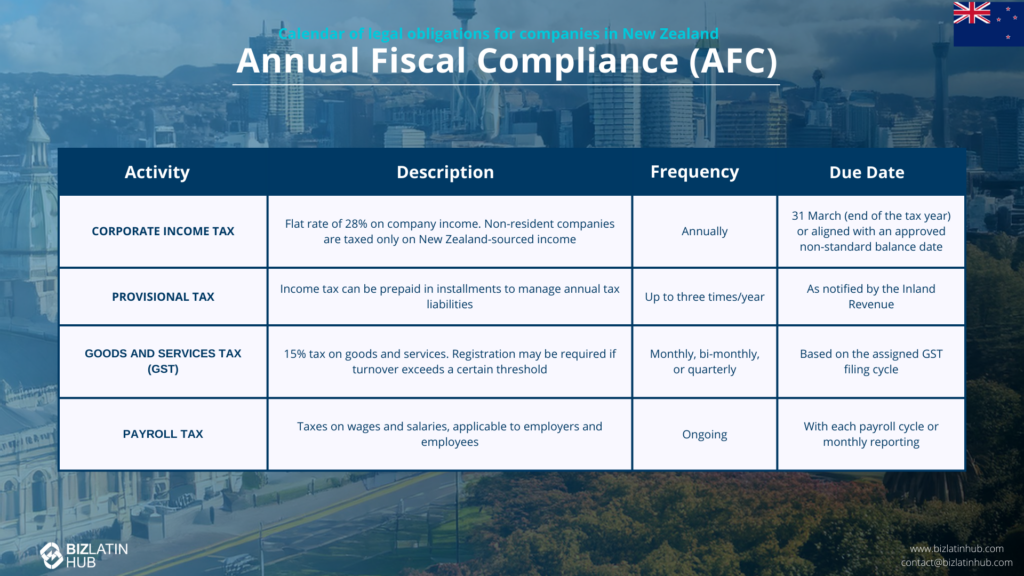

Companies must register with Inland Revenue, file annual income tax returns, and file regular Goods and Services Tax (GST) returns if their annual turnover exceeds NZD $60,000.

How does taxation compliance work in New Zealand?

Tax is compulsory in New Zealand, therefore, anyone that earns money in the country has to pay income tax. This includes businesses, contractors and those who are self-employed.

Income tax can be pre-paid. This is known as provisional tax and contributes to annual tax paid in several installments. However, the Inland Revenue, the local department that handles tax for the government, notifies the company or the person to do this.

Annual fiscal compliance in New Zealand involves the folllowing:

Annual Financial Statements

Companies must prepare financial statements that comply with the New Zealand equivalents to International Financial Reporting Standards (NZ IFRS), depending on their size and type. Smaller companies may qualify for simplified reporting standards.

Filing Annual Returns

All registered companies must file an annual return with the Companies Office, providing updated company details, including director and shareholder information. This filing is required every 12 months from the company’s incorporation date.

Income Tax Returns

Companies must file an annual income tax return (IR4) with Inland Revenue. This includes declaring income, expenses, and tax calculations for the financial year ending March 31.

Audit and Assurance Requirements

Large companies, Public Interest Entities (PIEs), and certain subsidiaries of overseas entities may require annual audits. Small and medium-sized entities are generally exempt unless shareholders or the constitution mandate it.

The Role of the Companies Office and Inland Revenue

Corporate compliance in New Zealand is primarily managed by two government agencies. The Companies Office maintains the public register of companies and handles the filing of annual returns. Inland Revenue (IRD) is responsible for all tax-related matters, including the administration of income tax, Goods and Services Tax (GST), and employee taxes.

Incorporating a company in New Zealand

When incorporating a company into New Zealand, the company must reserve a company name. The New Zealand Companies Act expresses that a company must have an official registered office address in New Zealand. Therefore, a registered office must be provided however if the new business has not yet got a physical presence in the country. There are solicitors and accountants available to provide the service needed for the growing company.

There must be at least one shareholder with a nominal share capital of NZ$1. In addition, all companies must have a minimum of one director who is a resident in New Zealand or Australia. The Companies Office in New Zealand should be informed of who the company director is with certain accompanying details. Both directors and shareholders must sign a consent form for registration alongside disclosing their date and place of birth which is confidential.

Although adopting a constitution is not compulsory, this is strongly suggested and can be done during the incorporation process or another date.

What compliance requirements exist for company administration in New Zealand?

After registering the new company, the subsidiary must hold annual meetings for shareholders within 18 months, and no later than 6 months following its balance date.

If the company is registered as overseas then a subsidiary will be needed to file an annual return and register it with the Companies Office.

Companies that exceed NZ$60 million, or if the company’s total revenue and their subsidiaries exceed NZ$30 million for the previous two accounting periods, are classed as large companies and must disclose their financial statements publicly.

Additionally, companies exceeding more than 10 shareholders who fail to opt-out in relation to the accounting period, or those companies with less than 10 shareholders who opt-in must declare their financial statements publicly.

Using a legal representative

Legal representatives are highly recommended in New Zealand to help a new foreign business or entrepreneur aware of the responsibilities and liabilities that come with having a business in this country.

A legal representative can work externally to or within the business and can help with registration and incorporation, and all further and ongoing compliance requirements for commercial activity in New Zealand.

Corporate Tax

Corporate income tax in New Zealand rate rests on a flat rate of 28%.

Non-residence companies are simply taxed on their New Zealand sourced income. However, a company that is resident in the country has to have the head office, or main management or company director in New Zealand. You’ll also need to file an income tax return for your company.

Payroll Tax

Payroll taxes are taxes imposed on employers or employees, a percentage of the salaries that employers pay their staff is calculated.

A business entrepreneur should consider the payroll tax that is correlated with hiring employees. This would also depend on whether the company employs foreign nationals or local New Zealand employees. The foreign company will need to register a branch, apply for an IRD or tax number and then register as an employer with the Inland Revenue. One option for a non-resident company to payroll its employees in New Zealand is to use a fully outsourced service which will employ and payroll the staff on their behalf.

Your employees: Personal Income Tax

A personal tax return applies to income based on wages. If a person is receiving income from overseas or has arrived midway through the tax year which runs from the start of April and promptly runs through to the 31 March, then filing a return is compulsory. A company may be eligible to apply for a non-standard balance date through Inland Revenue to align the tax and accountancy end year.

Income over NZ$60,000 is taxed at 33% where income up to NZ$14,000 income would be taxed at the rate of 10.5%.

Goods and service tax

Goods and Services Tax (GST) is a value-added tax or consumption tax for goods and services consumed in New Zealand. 15% tax is applied to the final price of the product or service being purchased.

Non-resident companies may have to register for goods and service tax. Where a company that is carrying on their business can register for goods and service tax at their discretion if there are content with the turnover threshold

Double taxation

Innocently being double taxed in New Zealand and another country as a foreign investor can be a possibility due to defaults in the system. However, this mistake is easy to avoid if you can provide evidence of credit for tax paid overseas on an income that is also subject to the New Zealand taxation regime. There are agreements in place with 39 trading and investing partners of New Zealand to avoid double taxation incidents occurring.

Financial Reporting for Overseas Companies

While small local companies are exempt from filing accounts, “Large” overseas companies (or NZ subsidiaries of large overseas companies) must file audited financial statements with the Companies Office. A company is “large” if assets exceed NZD $20m or revenue exceeds NZD $10m (approx. thresholds). This ensures transparency for significant foreign entities operating in NZ.

FAQs on legal compliance in New Zealand

Based on our extensive experience these are the common questions and doubts of our clients when looking to operate within the country.

The following are the most common statutory appointments for legal entities in New Zealand:

– A local director who will be personally liable, both legally and financially for the good operation and standing of the company. More than one local director can be appointed. However at least one of them should be an NZ national or a foreigner with the right to live/work in New Zealand or Australia

Yes, a registered office address or local fiscal address is required for all entities in New Zealand for the receipt of legal correspondence and governmental visits.

Some responsibilities of the legal representative of a company in New Zealand include the following:

– Sign employment, sales, and lease contracts

– Open corporate bank accounts with the permission of the beneficiary of the company

– Represent the company in application processes for local permits

– Provide guidance on current and changing regulations in the country

The key points to know about legal compliance in New Zealand are the following:

– Corporate income tax in New Zealand rests on a flat rate of 28%

– Payroll taxes are taxes imposed on employers or employees

– There are agreements with 39 jurisdictions to avoid double taxation

– Legal representatives are highly recommended

The Goods and Services Tax (GST) is a value-added tax or consumption tax for goods and services consumed in New Zealand. 15% tax is applied to the final price of the product or service being purchased.

Non-resident companies may have to register for goods and service tax. Where a company that is carrying on their business can register for goods and service tax at their discretion if there are content with the turnover threshold.

The annual return must be filed with the Companies Office within 20 working days of the anniversary of the company’s incorporation date. The Companies Office will send an email reminder when the return is due.

A company must maintain several key records at its registered office. These include the company’s constitution, minutes of all meetings of shareholders and directors, a share register, and financial statements for the last seven years.

The corporate income tax rate in New Zealand is a flat 28% on the company’s net profit.

While not legally mandatory for all operations, it is practically essential. A New Zealand bank account is required to register for Goods and Services Tax (GST) with Inland Revenue and is necessary for most day-to-day business transactions within the country.

Why Invest in New Zealand?

New Zealand stands out as a prime investment destination, renowned for its political stability, transparent regulatory environment, and strong economy. As a global leader in agriculture, technology, and renewable energy, it offers lucrative opportunities in key sectors such as agribusiness, tech innovation, tourism, and green industries.

Its free trade agreements and strategic location in the Asia-Pacific region make it a gateway to some of the world’s fastest-growing markets. With an efficient infrastructure and a business-friendly government, New Zealand ensures a seamless environment for foreign investment.

The country’s unique strengths lie in its highly skilled workforce, emphasis on sustainability, and reputation for high-quality products, including dairy, meat, wine, and honey. Additionally, its thriving tourism industry is fueled by stunning natural landscapes and eco-tourism initiatives.

New Zealand’s commitment to clean energy, technology, and innovation further strengthens its economic future, offering investors the chance to partner with a progressive and globally connected economy.

Biz Latin Hub can help you with legal compliance in New Zealand

At Biz Latin Hub, we provide integrated market entry and back-office services throughout Latin America and the Caribbean, with offices in over a dozen other major cities. We also have trusted partners in many other markets.

Our unrivaled reach means we are ideally placed to support multi-jurisdiction market entries and cross border operations.

As well as knowledge about hiring and recruitment outsourcing in Peru, our portfolio of services includes hiring & PEO, accounting & taxation, company formation, bank account opening, and corporate legal services.

Contact us today to find out more about how we can assist you in finding top talent, or otherwise do business in New Zealand. If this article on Law and Tax in New Zealand was of interest to you, check out the rest of our coverage of the region. Or read about our team and expert authors