Selecting the right legal structure is an essential step for registering a company in Costa Rica. The country offers various company types — including SRL, SA, and foreign branches — each with distinct compliance obligations and benefits. Whether you’re a local entrepreneur or a foreign investor, this guide details the administrative and governance differences between the S.A. and S.R.L. to help you select the appropriate vehicle.

Key Takeaways

| What are the common legal entity types in Costa Rica? | Corporation (Sociedad Anónima – S.A). Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L). Branch Office. |

| What is the most common Costa Rican business entity? | The Limited Liability Corporation (LLC), or Sociedad de Responsabilidad Limitada, is the most common business entity in Costa Rica. Its popularity stems from its speed of formation and internal organization, which suit foreign businesses looking to enter the market. |

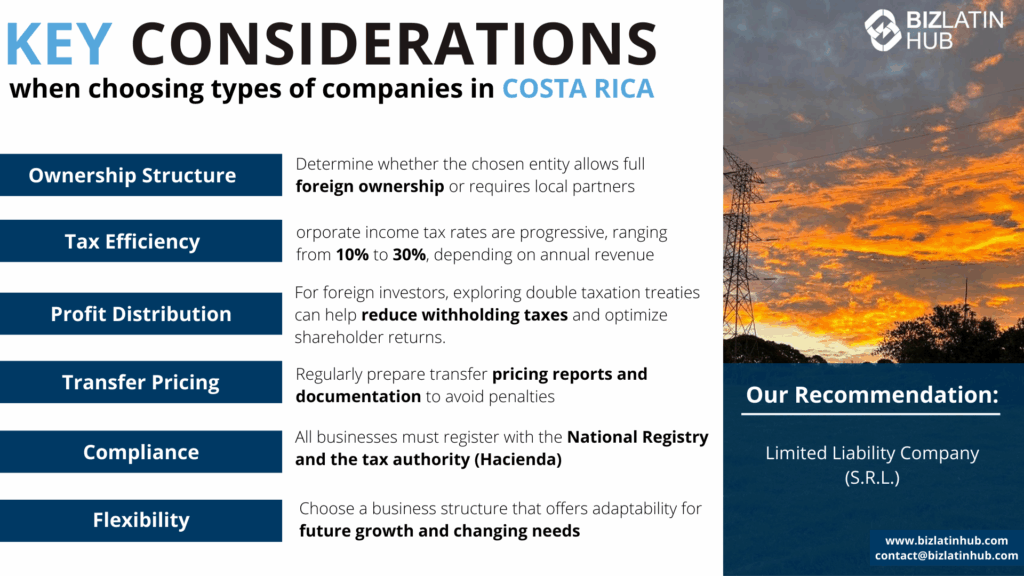

| What are the primary considerations when choosing a business entity in Costa Rica? | Ownership Structure. Tax Efficiency. Profit distribution. Transfer Pricing. Compliance. Flexibility. |

Key Types of Legal Entities in Costa Rica

The two most common legal entities in Costa Rica are:

- Corporation (Sociedad Anónima – S.A)

- Limited Liability Company (Sociedad de Responsabilidad Limitada – S.R.L)

Comparison Table: Key Legal Entity Types in Costa Rica

| Entity Type | Best For | Shareholders | Liability | Legal Personality | Tax Status |

|---|---|---|---|---|---|

| SRL (Sociedad de Responsabilidad Limitada) | SMEs and partnerships | 2–30 | Limited to contributions | Yes | Corporate tax applies |

| SA (Sociedad Anónima) | Larger companies or raising capital | 2+ | Limited to contributions | Yes | Corporate tax applies |

| Branch | Foreign multinationals | 1 (foreign HQ) | Parent company liable | Yes | Taxed as a local entity |

Below are the key characteristics of each company type:

1. Limited Liability Company (SRL)

Who should choose this: Best for small-to-medium enterprises and partnerships. Offers limited liability and operational flexibility.

The Limited Liability Company has the same requirements as the S.A., with the only exception being the administration; shareholders are required to appoint at least one General Manager. Shares are called quotas and there is no minimum required capital. However, the amount subscribed must be divisible by 100. The company name availability must also be checked on the National Registry database.

Expert Tip: S.R.L. for US Investors

From our experience, US-based clients often prefer the S.R.L. structure because it can be classified as a “Check-the-Box” entity for US tax purposes (treated as a pass-through partnership). This avoids the double taxation issues that can arise with a “Corporation” (S.A.). If you are a US taxpayer, we strongly advise consulting your tax advisor about the S.R.L. option before incorporating.

2. Corporation (SA)

Who should choose this: Ideal for large businesses or those seeking investment. Suitable for companies that plan to issue shares or go public.

The S.A. is the most common legal entity structure in Costa Rica. See below some of its key characteristics:

- A Public Document must be drafted with the bylaws and signed by the public notary and company shareholders.

- A minimum of two shareholders are required.

- There is no established minimum capital.

- A board needs to be appointed, consisting of three board members and a controlling agent.

The availability for the company name needs to be checked with the National Registry Database.

3. Branch of a Foreign Company

Who should choose this: Recommended for international businesses seeking to operate in Costa Rica while maintaining centralized control under a parent entity.

Branches of foreign companies are incorporated with a public deed signed by the Public Notary and the power of attorney of the foreign company. Due to the complexities of drafting and signing all agreements, this legal structure is not recommended for SMEs. Apart from the requisites asked by the National Registry, it is also considered more expensive than other legal entities in Costa Rica.

How to Choose the Right Legal Structure in Costa Rica

Ownership Structure

Evaluate whether the chosen business structure allows full foreign ownership, as Costa Rica generally permits 100% foreign ownership across most industries. However, specific sectors like maritime concessions and certain natural resource activities may require local participation or have restrictions. Ensuring compliance with these regulations will help align your business with local laws and facilitate long-term success.

Tax Efficiency

Understand how Costa Rica’s tax system will impact your business operations. Corporate income tax rates are progressive, ranging from 10% to 30%, depending on annual revenue. Additionally, Costa Rica imposes a 13% VAT on goods and services. Businesses may qualify for tax benefits under the Free Trade Zone (FTZ) regime, which offers significant exemptions on income tax, import duties, and VAT for export-oriented companies or those in strategic sectors like technology and manufacturing. Proper tax planning is essential to optimize costs while ensuring compliance with local regulations.

Profit Distribution

Consider the tax implications of profit distribution in Costa Rica. Dividends distributed to non-residents are subject to a 15% withholding tax. For foreign investors, exploring double taxation treaties—such as those Costa Rica has with Spain, Germany, and Mexico—can help reduce withholding taxes and optimize shareholder returns. Clear profit repatriation strategies are critical for efficient fund transfers while minimizing tax burdens.

Transfer Pricing

Ensure compliance with Costa Rica’s transfer pricing regulations for cross-border transactions between related entities. Businesses are required to document and justify intercompany transactions to reflect arm’s-length pricing. This is particularly relevant for companies involved in import/export activities, intellectual property licensing, or intercompany loans. Preparing thorough transfer pricing documentation and annual reports will help avoid penalties and reduce the risk of audits.

Compliance

Prepare for Costa Rica’s regulatory and compliance requirements. All businesses must register with the National Registry and the tax authority (Hacienda). Companies are required to submit annual financial statements and file monthly tax declarations for VAT and income tax. Adopting International Financial Reporting Standards (IFRS) is mandatory for larger entities. Additionally, labor and social security compliance, including contributions to the Costa Rican Social Security Fund (CCSS), is critical to avoid legal issues.

Flexibility

Choose a business structure that offers adaptability for your future growth and operational needs. In Costa Rica, the two most common legal entities are:

- Sociedad Anónima (S.A.): Suitable for larger businesses and those requiring greater capital-raising options. The S.A. allows shares to be traded and has a more formal governance structure, including a board of directors.

- Sociedad de Responsabilidad Limitada (SRL): Ideal for smaller businesses or those requiring fewer partners. The SRL offers simplicity, limited liability, and direct management by its partners.

Both structures provide limited liability, but the choice depends on your specific operational and ownership goals. Flexibility in adapting to Costa Rica’s evolving regulatory and business environment is crucial.

Note: We reccomend clients to choose the Limited Liability Company (S.R.L.) structure because it provides a balance of limited liability protection for its members and flexibility in management and ownership. Additionally, the S.R.L structure is well-suited for small to medium-sized enterprises seeking to establish a presence in Costa Rica.

Steps to Incorporate a Company in Costa Rica

Registering a company in Costa Rica is easy compared to many other countries. You can handle it remotely with the help of a Power of Attorney and an incorporation agent.

- Step 1 – Pay agency fees when forming your Costa Rican company.

- Step 2 – Choose the company structure.

- Step 3 – Search for homonyms of the company name.

- Step 4 – Sign off on proper documentation.

- Step 5 – Register an incorporation charter.

- Step 6 – Open a corporate bank account in Costa Rica.

- Step 7 – Register as a taxpayer in Costa Rica.

- Step 8 – Apply for insurance.

- Step 9 – Register with Costa Rican Social Security.

- Step 10 – Receive your Costa Rica Company Kit.

Compliance Tip

All companies in Costa Rica must register with the National Registry, obtain a corporate ID (Cédula Jurídica), and enroll with the Dirección General de Tributación for tax purposes. Social security registration with the CCSS is mandatory when hiring staff.

Common Pitfalls When Choosing a Legal Entity in Costa Rica

- Selecting an SA when flexibility and fewer corporate formalities are needed

- Assuming an SRL allows free share transfer (it does not)

- Misunderstanding tax residency of a foreign branch

- Not appointing a resident legal representative

- Overlooking annual corporate reporting obligations

Partnering with Biz Latin Hub for Company Formation in Costa Rica

Choosing the type of company depends on which structure is best suited to your business needs. Much consideration needs to be taken before launching your operations in Costa Rica.

Given the favorable conditions in the country and the region as well as the economic growth, Biz Latin Hub through its company offers the experience and support necessary for investors to have a successful market entry in Costa Rica. Feel free to contact us now.

FAQs: Legal Entities in Costa Rica

1. Can a foreigner register a company in Costa Rica?

Absolutely, foreigners can register a company in Costa Rica. However, certain restrictions or requirements may apply depending on the chosen legal entity structure.

2. What type of legal entity is an S.R.L (Sociedad de Responsabilidad Limitada) in Costa Rica?

The S.R.L is similar to an LLC type of company in other jurisdictions.

3. How do I create a company in Costa Rica?

To establish a company in Costa Rica, you need to follow specific legal procedures and fulfill regulatory requirements. It’s advisable to seek assistance from legal professionals to ensure compliance.

4. What is an LLC in Costa Rica?

An LLC, or Limited Liability Company, in Costa Rica is a hybrid legal structure that combines the flexibility of partnerships with the limited liability protection of corporations. It offers advantages such as pass-through taxation and simplified management structures.

5. What is the business structure of a Sociedad de Responsabilidad Limitada (S.R.L) in Costa Rica?

Shareholders are required to appoint at least one general manager. Shares are called quotas and there is no minimum required capital. However, the amount subscribed must be divisible by 100.

6. What is the most popular legal structure in Costa Rica?

The SRL is most commonly used due to its simplicity and minimal corporate requirements.

7. Can a foreigner fully own a company in Costa Rica?

Yes. Foreigners can own 100% of Costa Rican companies, including SRLs and SAs.

8. How long does incorporation take?

Generally, 4–6 weeks from document submission to final registration.

9. Can I change the structure later?

Yes, but restructuring requires legal formalities. It’s best to select the right structure from the outset.

10. What tax responsibilities does a company have?

Companies must file corporate income tax returns, pay VAT (where applicable), and meet payroll tax obligations.

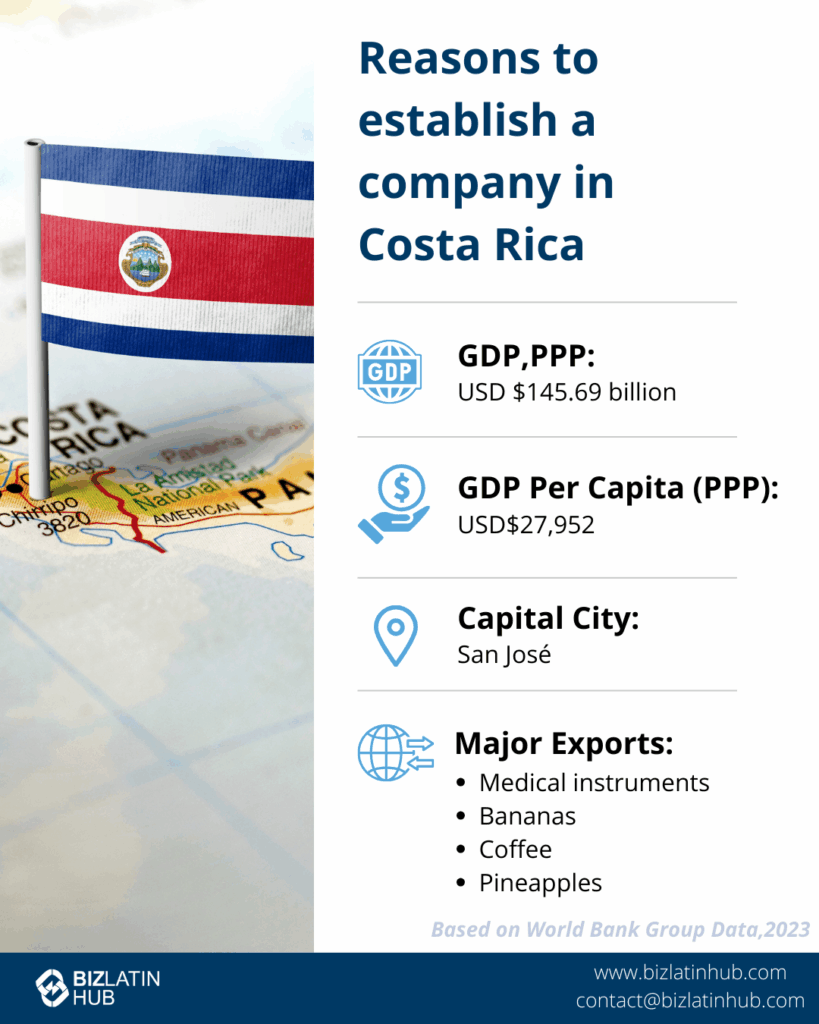

Why Choose to Invest in Costa Rica?

Costa Rica offers a stable political climate and a business-friendly environment, making it an attractive destination for investors. The country has enjoyed uninterrupted democracy for over a century, providing a secure setting for foreign investments.

The Costa Rican government also provides a competitive Free Trade Zone Regime that grants tax exemptions to companies investing in the country.

This regime complies with OECD and WTO standards, offering benefits such as corporate income tax exemption, customs duties exemptions on imports and exports, and VAT exemptions for local purchases.

In tandem, Costa Rica’s commitment to sustainability is evident, with 98% of its electricity sourced from renewable energies like hydropower, wind, geothermal, and solar power.

This dedication to green energy attracts multinational companies seeking environmentally responsible investment opportunities.