Entity health checks in Costa Rica protect businesses from potential risks during commercial operations. Companies purchasing or merging with local organizations should conduct these reviews. If you are starting a business in Costa Rica or have established commercial presence in the country, an entity health check can help you. This guide explains the value of a proactive compliance review and details the main areas that must be assessed to ensure a company in Costa Rica is in good legal and financial standing.

Key Takeaways: Entity Health Check in Costa Rica

| What is a corporate entity health check? | It is a review of your compliance measures to make sure you are not exposed to any risks by operating incorrectly. |

| What are the key compliance areas reviewed for a Costa Rican company? | Corporate and legal compliance, financial and accounting review and tax compliance. |

| A health check verifies the mandatory annual corporation tax has been paid. | |

| Why is the corporate check critical? | It ensures the Ultimate Beneficial Owner (UBO) declaration is current. |

| Why is a health check crucial for maintaining good legal standing? | It allows you to correct any errors before the authorities do and block you from being able to do business in Costa Rica. |

The Importance of a Corporate Health Check

An entity health check in Costa Rica is a preventative audit of a company’s key records. The primary goal is to identify any compliance deficiencies—such as unpaid corporate taxes or outdated shareholder information—and rectify them before they result in government penalties, legal disputes, or loss of good standing.

Key Areas of a Costa Rican Entity Health Check

An entity health check can be comprised of several elements, and an individual process may involve all or just some of them, depending on your aims and needs. A common breakdown of reviewing is to have either a legal or fiscal entity health check.

1. Corporate and Legal Compliance

An entity health check process verifies that all corporate practices comply with local regulations. This includes a review of the minutes of annual meetings to verify if such meetings have been held and logged according to rules established in the Costa Rican commercial code.

This review verifies that the company’s legal books (shareholder and board meeting minutes) are up-to-date, that the annual UBO declaration has been filed, and that all corporate information in the National Registry is correct.

Expert Tip: The Critical UBO Declaration

From our experience conducting health checks in Costa Rica, the most critical and often missed compliance point is the annual Declaration of Ultimate Beneficial Owners (UBO). This is a mandatory filing with the Central Bank of Costa Rica (BCCR) that identifies the natural persons who ultimately own or control the company.

The penalties for failing to file this declaration on time are severe, including financial fines and the inability for the company to obtain a certificate of good standing (personería jurídica). A key part of any health check must be to verify that this declaration is filed correctly and annually, as it is a major focus for the authorities.

2. Financial and Accounting Review

This involves checking that the company’s accounting records comply with local standards, that financial statements have been prepared, and that the company is maintaining proper financial controls.

3. Tax and Municipal Status

An entity health check in Costa Rica can involve the study and verification of tax returns made before the General Directorate of Taxation of Costa Rica, as well as the municipality where the entity is based. Such a process will verify compliance with the likes of valued added tax (VAT) and income tax regulations, among any other business- or sector-specific levies.

This audit confirms that the mandatory annual corporation tax has been paid, that all income and VAT tax returns have been filed correctly, and that the company is up-to-date with any required municipal permits or licenses.

What is an entity health check in Costa Rica?

An entity health check in Costa Rica includes an exhaustive legal and accounting review to determine if a company complies with all local norms and regulations, and verify that accounting records are accurate. An entity health check can include the examination of different corporate documents such as tax returns, corporate filings, or operating licenses.

By conducting an entity health check in Costa Rica when buying or doing business with a local organization, you will be able to identify — and ideally rectify — any inconsistencies to protect your business operations and avoid possible penalties imposed by local authorities.

In addition to undertaking such due diligence ahead of doing a deal in Costa Rica, you can also conduct a self-check. Such a measure is particularly useful if your company has witnessed a decrease in productivity or profits, but can simply be undertaken to verify that everything is running smoothly and identify and eliminate potential future risks that may come to affect your business operations.

Note that you can also carry out an entity health check on a subsidiary or branch operating in Costa Rica, to know if there is any type of non-compliance or bad business practice that could have repercussions for your headquarters or broader operations.

Due Diligence Costa Rica: Heath Check Types

The following types of corporate health check may be particularly useful, depending on your goals:

High-level corporate health check: This type of entity health check closely examines a company’s registration submissions, legal records, and meeting minutes to identify issues that may turn into potential violations of the law.

In-depth gap analysis: This type of entity health check analyzes the finances, accounting practices, and financial statements of a company, to identify gaps in the management of accounting records that may cause future legal sanctions.

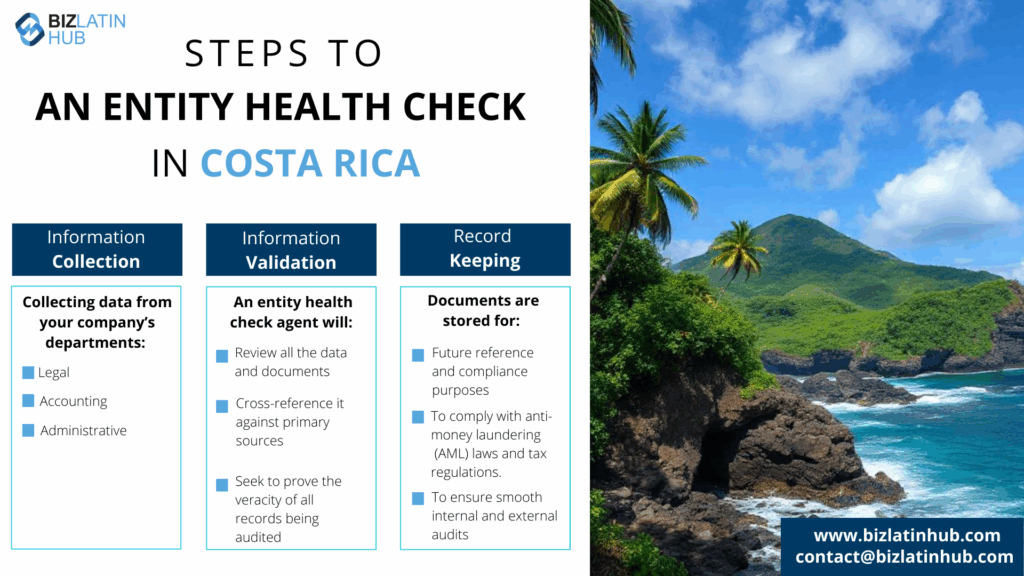

Entity Health Check Process: 3 Steps

1. Information Collection

Teams gather data from operations, legal, accounting, and administrative departments. Best practice: Companies should create a compliance department to centralize important company information.

2. Information Validation

Auditors review all documents and cross-reference data against primary sources to verify record accuracy and identify gaps.

3. Record Keeping

Companies maintain detailed documentation for tax authority inspections and future health checks. Record keeping is legally required under anti-money laundering regulations in some cases.

Legal Due Diligence Costa Rica

Legal due diligence Costa Rica verifies your company’s legal status under Costa Rican law:

Corporate Structure Check

- National Registry compliance: Corporate status, capital, and business purpose verification

- Commercial Code compliance: Corporate governance, board structure, shareholder agreements

- SUGIVAL ownership: Ultimate beneficial owner disclosure and annual updates (required since 2019)

Intellectual Property Check

- SENAPI registration: Trademark, patent, and copyright registrations

- Usage rights: IP licensing agreements and usage permissions

- Domain registration: .cr domain ownership and registration

Contract Review

- Supplier agreements: Review under Costa Rican Civil Code

- Employment contracts: Labor Code compliance

- Real estate agreements: Property ownership and lease verification

- License agreements: Professional and operational license validity

Legal Risk Assessment

- Court database search: Pending or past litigation review

- Administrative penalties: Regulatory penalties or warnings review

- Labor disputes: MTSS (Ministry of Labor) complaint verification

- Tax disputes: Ministerio de Hacienda audit results and appeals

Costa Rica Compliance Check Requirements

A full Costa Rica compliance check covers multiple regulatory areas:

Tax Compliance Review

- Income tax returns: Verification with Ministerio de Hacienda

- VAT compliance: Monthly and annual VAT return verification

- Municipal tax compliance: Business license and patent fees

- Electronic invoicing: Certified e-invoicing compliance (required for companies with revenue over ₡3 million)

Labor Compliance Review

- CCSS payments: Social security payment verification and timing

- Christmas bonus: Aguinaldo compliance and correct calculations

- Vacation time: Proper vacation calculation and payment

- Severance compliance: Correct severance calculation and fund contributions

- Work safety: INS workplace insurance compliance

- Immigration compliance: Work permit verification for foreign employees

Municipal and Local Compliance

- Business licenses: Municipal patent and operating license verification

- Construction permits: Building and renovation permit compliance

- Fire certificates: Safety compliance verification

- Health permits: SENASA health permit requirements for applicable businesses

FAQs on an entity health check in Costa Rica

Why should you get an entity health check?

An entity health check helps executives understand how the business is being managed, reduces the risk of penalties and reputational damage, and minimizes transaction risks in events like mergers or regulatory reviews.

What is the annual corporation tax?

All registered companies in Costa Rica, active or inactive, must pay an annual corporation tax (Impuesto a las Personas Jurídicas). The amount is based on the company’s gross income. Failure to pay this tax results in penalties and prevents the company from operating legally.

What government bodies are involved in compliance?

The main bodies are the National Registry (Registro Nacional) for corporate filings, the General Directorate of Taxation (Dirección General de Tributación) for tax matters, and the Central Bank (BCCR) for the UBO declaration.

What happens if a company is not in good standing?

If a company is not in good standing (e.g., due to unpaid corporation tax), the National Registry will not issue a certificate of good standing (personería jurídica). Without this certificate, a company cannot perform basic legal acts, such as selling assets, entering into contracts, or appearing in court.

How does a health check help with due diligence?

An entity health check is a form of internal due diligence. It prepares the company for scrutiny from external parties like potential buyers, investors, or banks. Having a clean health check report demonstrates good governance and can accelerate the due diligence process for a major transaction.

How long does an entity health check take in Costa Rica?

A standard entity health check takes 2–4 weeks, while a full audit can take 4–8 weeks. Urgent checks for transactions can be completed in 1–2 weeks with additional fees.

What documents are required for an entity health check?

Required documents include corporate bylaws, tax returns, employee records, financial statements, licenses, permits, and beneficial ownership filings such as those mandated by SUGIVAL.

What happens if a company fails an entity health check in Costa Rica?

Consequences of failing a health check can include fines up to ₡10 million, temporary or permanent business closure, failure in completing transactions, public reputational damage, and potential criminal liability for company directors.

How often should companies conduct entity health checks in Costa Rica?

It is recommended to conduct entity health checks annually, and additionally before transactions, after compliance issues, during ownership changes, or prior to expanding business operations.

Can companies perform health checks on Costa Rican subsidiaries remotely?

Yes, companies can conduct remote health checks on Costa Rican subsidiaries, though local expertise is essential for regulatory interpretation, database access, and communication with local authorities.

Biz Latin Hub can conduct an entity health check in Costa Rica

At Biz Latin Hub, our team of multilingual legal services specialists has deep knowledge of Costa Rica’s regulatory framework and broad experience conducting entity health checks for companies and executives doing business in the country.

With our extensive portfolio of accounting, commercial representation, and back-office services, we are equipped to deliver service with excellence and can be your single point of contact to support your commercial operations in Costa Rica or in any other of the 15 countries in Latin America and the Caribbean where we are present.

Reach out to us now for personalized assistance or a free quote.

Learn more about our team and expert authors.